Open Banking Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

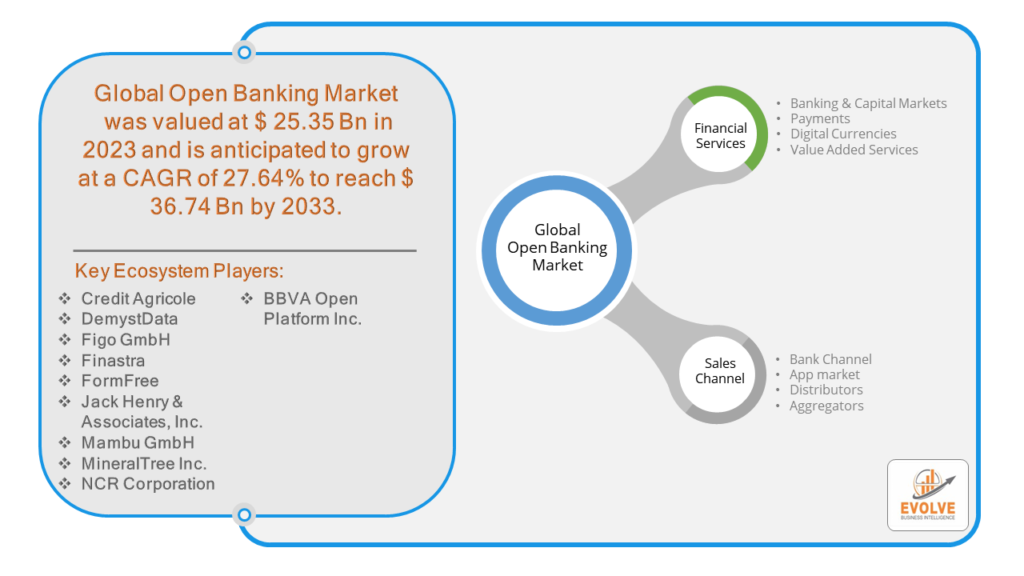

Open Banking Market Research Report: Information By Financial Services (Banking & Capital Markets, Payments, Digital Currencies, Value Added Services), By Sales Channel (Bank Channel, App market, Distributors, Aggregators), and by Region — Forecast till 2033

Page: 161

Open Banking Market Overview

The Open Banking Market Size is expected to reach USD 36.74 Billion by 2033. The Open Banking Market industry size accounted for USD 25.35 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 27.64% from 2023 to 2033. The Open Banking Market refers to the ecosystem of financial services that arises from the use of open banking standards and practices. Open banking involves the use of open APIs (Application Programming Interfaces) that allow third-party developers to build applications and services around the financial institution. This practice encourages greater financial transparency and competition in the financial services industry by enabling consumers to securely share their banking data with third-party providers.

The Open Banking Market aims to foster innovation, enhance customer experiences, and promote competition in the financial industry by allowing more players to participate and offer diverse financial services.

Global Open Banking Market Synopsis

The COVID-19 pandemic has significantly impacted the Open Banking Market. The pandemic has expedited the shift towards digital banking services as physical branches were inaccessible during lockdowns. This increased the adoption of open banking technologies as both consumers and businesses sought more digital solutions for their financial needs. With a greater need for contactless transactions, consumers turned to online and mobile banking. Open banking facilitated the development and integration of various contactless payment and banking services, enhancing the customer experience. The economic uncertainty brought by the pandemic spurred innovation in financial services. Open banking enabled fintech companies to rapidly develop and deploy new products such as budgeting tools, loan management systems, and financial wellness apps tailored to the changing needs of consumers. The pandemic changed consumer behavior, making people more comfortable with using digital services for their banking needs. This shift is likely to have a lasting impact, sustaining the growth of the open banking market even post-pandemic.

Open Banking Market Dynamics

The major factors that have impacted the growth of Open Banking Market are as follows:

Drivers:

Ø Technological Advancements

Consumers are increasingly seeking more personalized and convenient financial services. Open banking allows for the development of tailored financial products and services, such as budgeting apps, personalized lending offers, and integrated financial dashboards, which enhance the customer experience. Advances in technology, particularly in APIs, cloud computing, and data analytics, have made it easier to implement and scale open banking solutions. These technologies enable secure data sharing and seamless integration between banks and third-party providers. Open banking can help promote financial inclusion by providing access to financial services for underserved populations. By enabling new entrants to offer niche or low-cost financial products, open banking helps reach consumers who might not have access to traditional banking services.

Restraint:

- Perception of Consumer Awareness and Trust

Many consumers are still unaware of what open banking is and how it can benefit them. A lack of understanding and trust in new technologies can slow down adoption rates. Effective communication and education are required to build consumer confidence in open banking. Integrating open banking APIs with existing legacy systems can be challenging for traditional financial institutions. The technical complexity and costs associated with upgrading infrastructure to support open banking can act as a barrier to implementation. The rapid growth of fintech companies leveraging open banking can lead to market saturation and increased competition. This environment can make it difficult for new entrants to differentiate themselves and achieve profitability.

Opportunity:

⮚ Growing demand for Innovation and New Business Models

Open banking allows for the creation of innovative financial products and services. Fintech companies can develop new business models that provide personalized financial solutions, such as budgeting tools, investment platforms, and tailored lending options, driving market growth. By leveraging open banking APIs, financial institutions can offer more personalized and integrated services. This leads to improved customer satisfaction and loyalty as consumers enjoy a seamless, user-friendly banking experience. Open banking can help underserved populations access financial services. By lowering barriers to entry for fintech companies, open banking enables the development of affordable and accessible financial products for individuals and small businesses that traditional banks might overlook.

Open Banking Market Segment Overview

By Financial Services

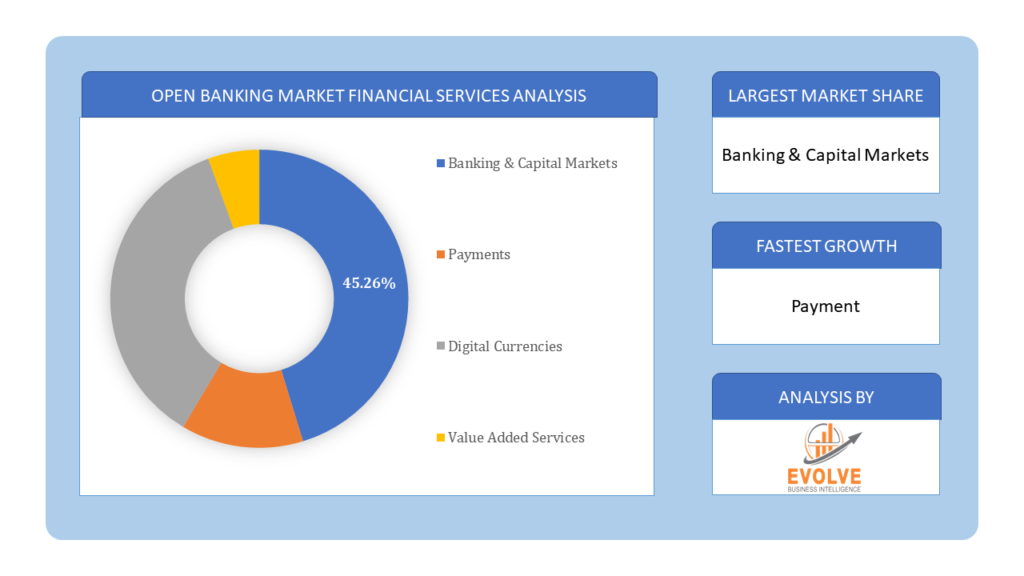

Based on Financial Services, the market is segmented based on Banking & Capital Markets, Payments, Digital Currencies and Value Added Services. Bank and capital segment dominant the market, owing to the growing demand to maintain finances effectively among Gen Z. With modernization, payment options have replaced traditional methods, and consumer adoption of more AI-based platforms that meet customer needs is expected to create opportunities in the segment.

Based on Financial Services, the market is segmented based on Banking & Capital Markets, Payments, Digital Currencies and Value Added Services. Bank and capital segment dominant the market, owing to the growing demand to maintain finances effectively among Gen Z. With modernization, payment options have replaced traditional methods, and consumer adoption of more AI-based platforms that meet customer needs is expected to create opportunities in the segment.

By Sales Channel

Based on Sales Channel, the market segment has been divided into the Bank Channel, App market, Distributors and Aggregators. The app market is supposed to be dominating the industry as the consumer is more aware of online transactions and the ease of availability of smartphones worldwide. Moreover, the availability of various apps for transactions has been developing, such as PayPal, google pay, Zelle, and many more, which have made buying and selling easier with just one click, is expected to drive the segment.

Global Open Banking Market Regional Analysis

Based on region, the global Open Banking Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Open Banking Market followed by the Asia-Pacific and Europe regions.

Open Banking North America Market

Open Banking North America Market

North America holds a dominant position in the Open Banking Market. Open Banking is gaining traction, driven by initiatives like the Open Financial Data (OFD) standard in the US and APIs offered by major financial institutions in Canada. Growth is concentrated in areas like account aggregation and payments. Security and data privacy remain a major concern for regulators and consumers.

Open Banking Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Open Banking Market industry. Rapidly growing market, fueled by government initiatives like India’s Open Banking Framework and China’s plans for an open banking infrastructure. Strong presence of tech giants like Alibaba and Tencent offering financial services through Open Banking. Focus on areas like mobile payments and wealth management.

Competitive Landscape

The global Open Banking Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Credit Agricole

- DemystData

- Figo GmbH

- Finastra

- FormFree

- Jack Henry & Associates, Inc.

- Mambu GmbH

- MineralTree Inc.

- NCR Corporation

- BBVA Open Platform Inc.

Key Development

In July 2022, Finastra and HSBC collaborated together and would be working on API-driven connectivity to offer banking as a service FX capability for mid-sized banks.

In September 2022, Jack Henry & Associates, Inc. collaborated with google cloud to advance a multi-year next-generation technology which focuses to help community and financial institutions to innovate quickly and respond to changing needs of account holders.

Scope of the Report

Global Open Banking Market, by Financial Services

- Banking & Capital Markets

- Payments

- Digital Currencies

- Value Added Services

Global Open Banking Market, by Sales Channel

- Bank Channel

- App market

- Distributors

- Aggregators

Global Open Banking Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $36.74 Billion |

| CAGR | 27.64% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Financial Services, Sales Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Credit Agricole, DemystData, Figo GmbH, Finastra, FormFree, Jack Henry & Associates Inc., Mambu GmbH, MineralTree Inc., NCR Corporation and BBVA Open Platform Inc |

| Key Market Opportunities | • The growing demand for Innovation and New Business Models • Financial Inclusion |

| Key Market Drivers | • Technological Advancements • Consumer Demand for Better Services |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Open Banking Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Open Banking Market historical market size for the year 2021, and forecast from 2023 to 2033

- Open Banking Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Open Banking Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Open Banking Market?

The study period for the Open Banking Market is from 2023 to 2033.

What is the growth rate of the Open Banking Market?

The Open Banking Market is expected to grow at a compound annual growth rate (CAGR) of 27.64% from 2023 to 2033.

Which region has the highest growth rate in the Open Banking Market?

North America is projected to dominate the Open Banking Market, followed by the Asia-Pacific and Europe regions

Which region has the largest share of the Open Banking Market?

North America holds the largest share of the Open Banking Market.

Who are the key players in the Open Banking Market?

Key players in the Open Banking Market include Credit Agricole, DemystData, Figo GmbH, Finastra, and Jack Henry & Associates, Inc.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Open Banking Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Open Banking Market 4.8. Import Analysis of the Open Banking Market 4.9. Export Analysis of the Open Banking Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Open Banking Market, By Financial Services 6.1. Introduction 6.2. Banking & Capital Markets 6.3. Payments 6.4. Digital Currencies 6.5. Value Added Services Chapter 7. Global Open Banking Market, By Sales Channel 7.1. Introduction 7.2. Bank Channel 7.3. App market 7.4 Distributors 7.5 Aggregators Chapter 8. Global Open Banking Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Credit Agricole 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. DemystData 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Figo GmbH 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Finastra 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. FormFree 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Jack Henry & Associates Inc. 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Mambu GmbH 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 MineralTree Inc. 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 NCR Corporation 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. BBVA Open Platform Inc. 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology