Online Food Delivery Service Market Overview

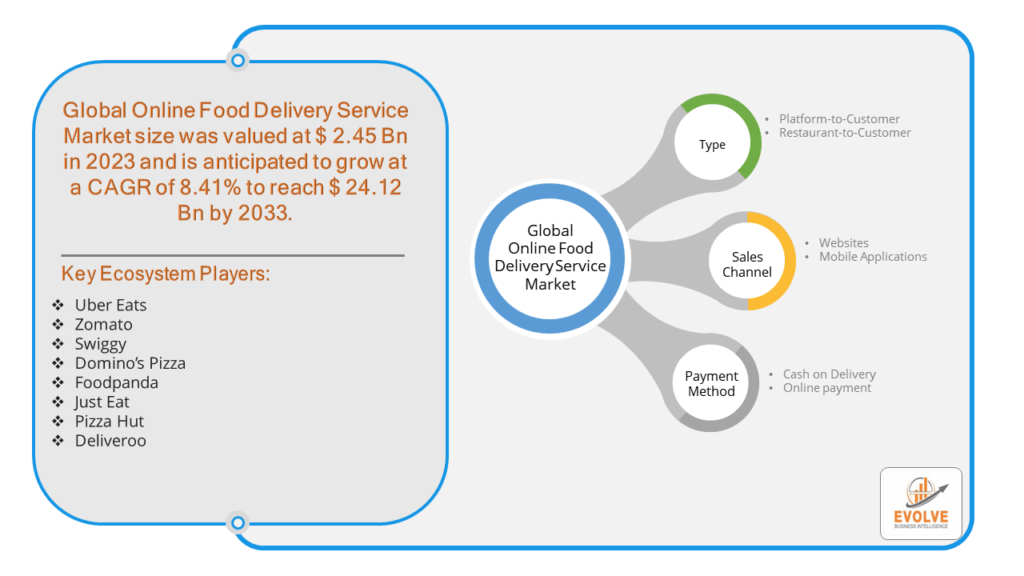

The Online Food Delivery Service Market Size is expected to reach USD 24.12 Billion by 2033. The Online Food Delivery Service Market industry size accounted for USD 2.45 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.41% from 2023 to 2033. The online food delivery service market is a sector of the economy focused on businesses that deliver prepared food and drinks to customers who place orders through websites or mobile apps. It allows you to browse menus, choose dishes from various restaurants, and have them conveniently delivered to your doorstep.

The online food delivery service market is experiencing significant growth due to factors like More people have access to the internet, making online ordering easier. Busy schedules make convenient meal options more appealing. Mobile apps allow for easy on-the-go ordering. More people living in urban areas tend to order food online.

Global Online Food Delivery Service Market Synopsis

The COVID-19 pandemic had a significant impact on the Online Food Delivery Service Market. With lockdowns, social distancing measures, and restaurant closures, consumers turned to online food delivery services as a safer and more convenient alternative. This led to a surge in demand for these services. Many consumers who had never used online food delivery services before began doing so during the pandemic. This expanded the customer base and introduced new demographics to these platforms. The market saw innovations such as contactless delivery, improved hygiene protocols, and enhanced digital payment options to address safety concerns. Restaurants and delivery platforms also adapted by expanding delivery menus and offering meal kits or grocery delivery. The market became more competitive as new players entered and existing platforms intensified their efforts to capture market share. This led to aggressive marketing and pricing strategies.

Online Food Delivery Service Market Dynamics

The major factors that have impacted the growth of Online Food Delivery Service Market are as follows:

Drivers:

Ø Technological Advancements

User-friendly platforms that facilitate browsing, ordering, and payment enhance the overall customer experience. Seamless integration with various digital payment methods, including credit cards, mobile wallets, and even cryptocurrencies, make transactions convenient. Increasing reliance on digital services in daily life has extended to food ordering and delivery. Improved delivery logistics, including real-time tracking and optimized routing, enhance service efficiency. Extending delivery coverage areas to reach more customers, even in less densely populated regions. Growing consumer preference for sustainable and environmentally friendly packaging solutions boosts market attractiveness.

Restraint:

- Perception of High Operational Costs

Managing a large network of delivery personnel, ensuring timely deliveries, and maintaining vehicles can be expensive. Developing and maintaining user-friendly apps and websites, along with the necessary backend infrastructure, requires significant investment. Concerns about the freshness and safety of delivered food can deter potential customers. Protecting customer data from breaches and misuse is critical to maintaining trust.

Opportunity:

⮚ Technology Integration

Leveraging AI for personalized recommendations, efficient delivery routing, and demand forecasting. Integrating with smart home devices to enable voice-activated food ordering. Using augmented reality (AR) and virtual reality (VR) for interactive menu displays and immersive experiences. Expanding menus to include organic, gluten-free, vegan, and other health-conscious options. Providing detailed nutritional information and health benefits of menu items to attract health-focused customers. Exploring the use of drones and autonomous vehicles to reduce delivery times and costs. Establishing localized fulfillment centers to speed up delivery processes and reduce logistical challenges.

Online Food Delivery Service Market Segment Overview

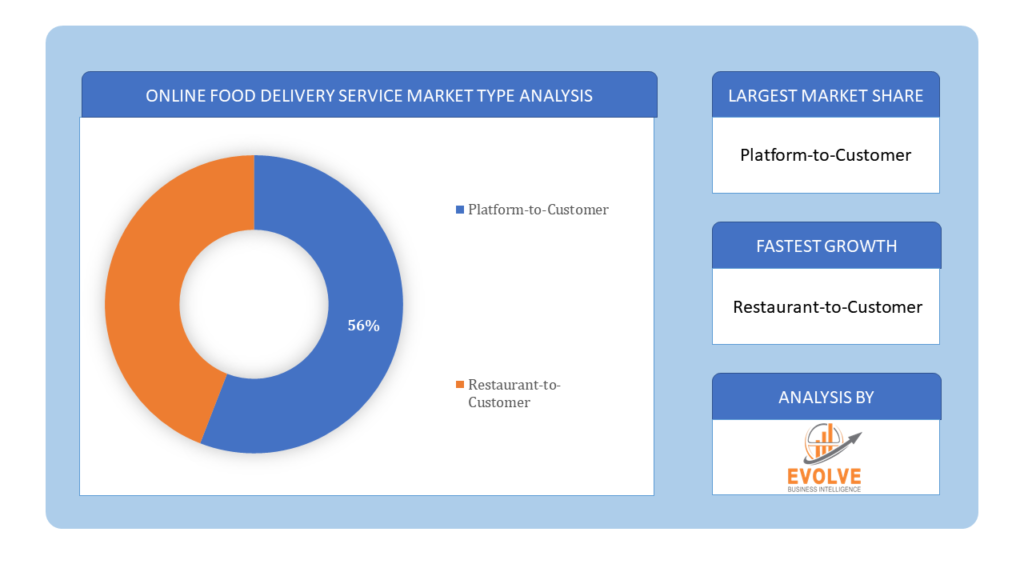

By Type

Based on Type, the market is segmented based on Platform-to-Customer and Restaurant-to-Customer. The platform-to-consumer segment dominant the market. The “Platform to Consumer” segment in the online food delivery market is experiencing rapid growth for several compelling reasons. Firstly, it offers consumers unparalleled convenience by aggregating a wide range of restaurant choices in one app or website, simplifying the ordering process.

Based on Type, the market is segmented based on Platform-to-Customer and Restaurant-to-Customer. The platform-to-consumer segment dominant the market. The “Platform to Consumer” segment in the online food delivery market is experiencing rapid growth for several compelling reasons. Firstly, it offers consumers unparalleled convenience by aggregating a wide range of restaurant choices in one app or website, simplifying the ordering process.

By Sales Channel

Based on Sales Channel, the market segment has been divided into the Websites and Mobile Applications. The mobile applications segment is anticipated to dominant the market. The “Mobile Applications” segment in the online food delivery market pertains to the channel type through which customers access food delivery services via dedicated mobile applications on their smartphones or tablets.

By Payment Method

Based on Payment Method, the market segment has been divided into the Cash on Delivery and Online payment. The online segment hold the largest market. The demand for the “online” payment segment in the online food delivery market is on the rise due to several compelling reasons. Firstly, it offers a convenient and contactless payment option, which has gained significance in light of health and safety concerns, such as the COVID-19 pandemic. Secondly, online payments provide users with a seamless, cashless experience, reducing the need for physical currency.

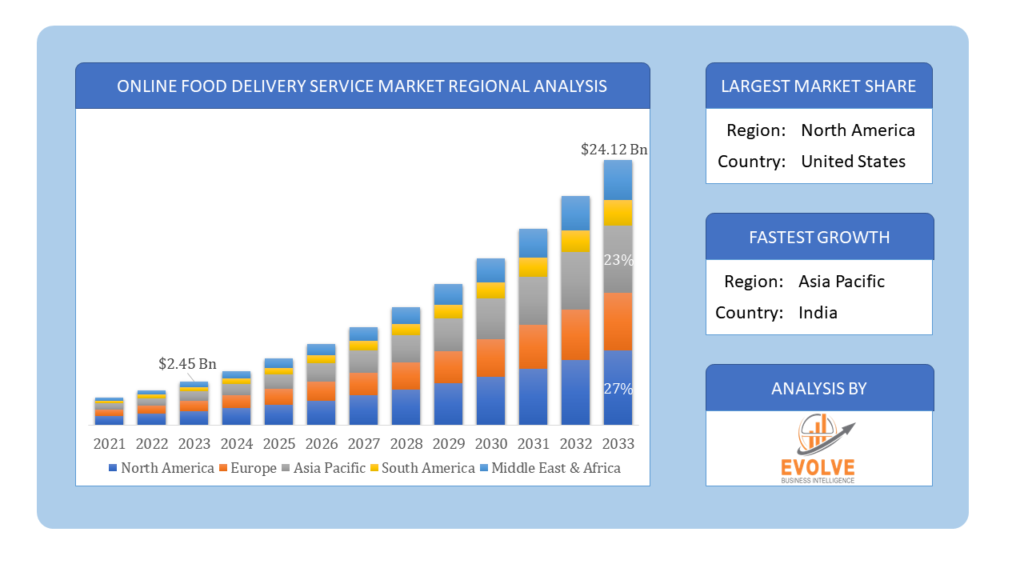

Global Online Food Delivery Service Market Regional Analysis

Based on region, the global Online Food Delivery Service Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Online Food Delivery Service Market followed by the Asia-Pacific and Europe regions.

Online Food Delivery Service North America Market

Online Food Delivery Service North America Market

North America holds a dominant position in the Online Food Delivery Service Market. North America has high demand for convenience and variety, with a strong preference for on-demand services. Increasing adoption of subscription models and partnerships with local and niche restaurants. High smartphone penetration and a culture of convenience drive market growth.

Online Food Delivery Service Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Online Food Delivery Service Market industry. Asia-Pacific is rapidly growing market with high mobile penetration and a preference for digital services. Increasing adoption of innovative technologies like AI for personalized recommendations and drone deliveries.

Competitive Landscape

The global Online Food Delivery Service Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Uber Eats

- Zomato

- Swiggy

- Domino’s Pizza

- Foodpanda

- Just Eat

- Pizza Hut

- Deliveroo

Key Development

In August 2023, Zomato Launched a quick commerce grocery delivery service in India, competing with established players like Swiggy.

In March 2023, Doordash Expanded its grocery delivery service through a partnership with national grocery store chain Albertsons

Scope of the Report

Global Online Food Delivery Service Market, by Type

- Platform-to-Customer

- Restaurant-to-Customer

Global Online Food Delivery Service Market, by Sales Channel

- Websites

- Mobile Applications

Global Online Food Delivery Service Market, by Payment Method

- Cash on Delivery

- Online payment

Global Online Food Delivery Service Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $24.12 Billion |

| CAGR | 8.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Sales Channel, Payment Method |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Uber Eats, Zomato, Swiggy, Domino’s Pizza, Foodpanda, Just Eat, Pizza Hut and Deliveroo |

| Key Market Opportunities | • Technology Integration • Health and Wellness Focus |

| Key Market Drivers | • Technological Advancements • Improved Logistics and Infrastructure |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Online Food Delivery Service Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Online Food Delivery Service Market historical market size for the year 2021, and forecast from 2023 to 2033

- Online Food Delivery Service Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Online Food Delivery Service Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.