Mobile Biometric Security and Service Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

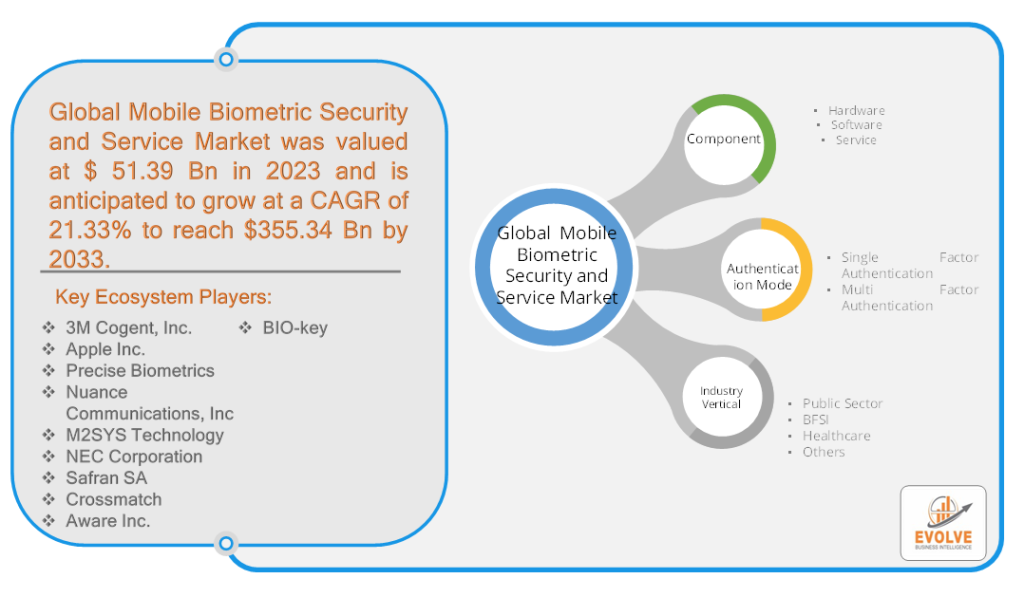

Mobile Biometric Security and Service Market Research Report: Information By Component (Hardware, Software, and Service), By Authentication Mode (Single Factor Authentication, Multi Factor Authentication), By Industry Vertical (Public Sector, BFSI, Healthcare, and Others) and By Region — Forecast till 2033

Mobile Biometric Security and Service Market Overview

The global Mobile Biometric Security & Service Market Analysis is expected to reach USD 355.34 Billion by 2033. The global Mobile Biometric Security and Service industry size accounted for USD 51.39 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 21.33% from 2023 to 2033. The advancements in technology have revolutionized the way we secure and access our devices and applications. Mobile biometric security and services have emerged as a robust solution to enhance security and streamline authentication processes. Biometric security refers to the use of unique biological characteristics, such as fingerprints, facial recognition, iris scans, and voice recognition, to verify the identity of individuals. This technology has found extensive applications in various sectors, including finance, healthcare, public sector, and more.

Mobile biometric security and service find applications across a wide range of industries. In the finance sector, it is used for secure mobile banking transactions and identity verification for digital payments. In healthcare, it ensures patient privacy and secure access to electronic medical records. In the public sector, biometric identification helps law enforcement agencies in criminal investigations and border control. Moreover, the technology is also utilized for secure access to personal devices, apps, and online accounts, reducing the risk of unauthorized access.

Global Mobile Biometric Security and Service Market Synopsis

The COVID-19 pandemic has accelerated the adoption of mobile biometric security and services. The fear of virus transmission through physical contact has led to a surge in touchless biometric solutions. As a result, facial recognition and iris scans have gained significant prominence. The market has witnessed a growing demand for mobile biometric security solutions to enable contactless transactions, access control, and identity verification. Post-COVID, this trend is expected to continue as organizations prioritize hygiene and safety measures.

Mobile Biometric Security and Service Market Dynamics

The major factors that have impacted the growth of Mobile Biometric Security and Service are as follows:

Drivers:

Increasing Cybersecurity Concerns and Identity Theft

One of the driving factors behind the growth of the mobile biometric security and service market is the increasing cybersecurity concerns and identity theft incidents. Traditional authentication methods, such as passwords and PINs, are becoming less secure due to hacking techniques and phishing attacks. Mobile biometric security offers a more secure and convenient alternative, ensuring that only authorized individuals can access sensitive information and perform transactions. Biometric data is unique to each individual, making it extremely difficult for cybercriminals to replicate or manipulate.

Restraint:

- Privacy Concerns and Regulatory Challenges

While mobile biometric security and service offer enhanced security, there are concerns regarding privacy and regulatory compliance. Biometric data is highly personal and requires strict protection to prevent unauthorized access or misuse. Additionally, there are legal and regulatory challenges associated with the collection, storage, and sharing of biometric information. Organizations need to ensure compliance with data protection laws and establish transparent policies to address privacy concerns, thereby fostering trust among users.

Opportunity:

⮚ Growing Adoption of Mobile Payments and E-commerce

The rapid growth of mobile payments and e-commerce presents a significant opportunity for the mobile biometric security and service market. As more consumers shift towards digital transactions, the need for secure and convenient authentication methods becomes crucial. Mobile biometric security offers a seamless and secure way to verify identities and authorize transactions, reducing the risk of fraudulent activities. By integrating biometric authentication into mobile payment apps and e-commerce platforms, businesses can enhance user experience and build trust among customers.

Mobile Biometric Security and Service Segment Overview

By Component

Based on the Component, the market is segmented based on Hardware, Software and Services. the Software segment holds the largest share of the Mobile Biometric Security and Service market. Software solutions provide the necessary algorithms and protocols to capture, analyze, and match biometric data, ensuring accurate and efficient identification. Additionally, software components encompass data encryption and storage mechanisms to safeguard sensitive information.

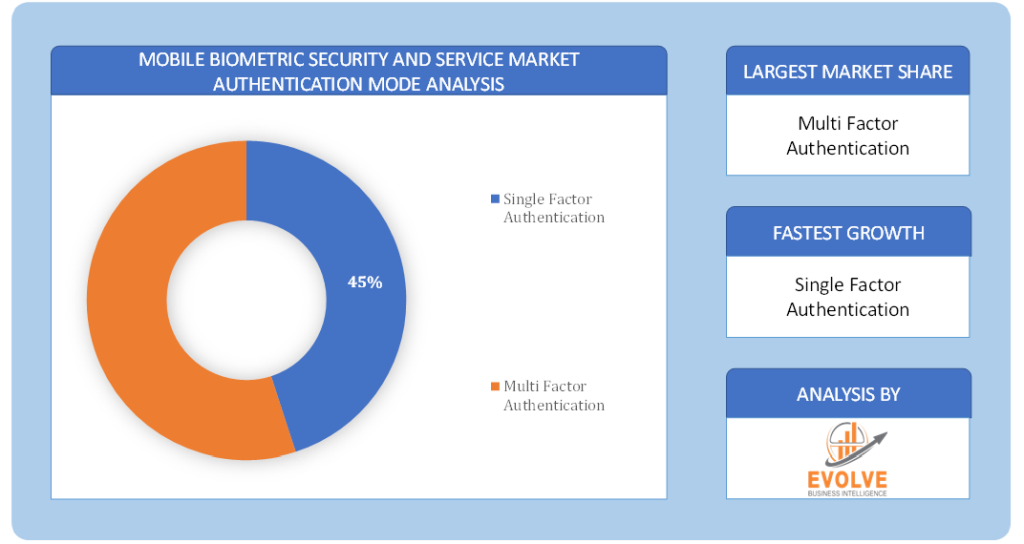

By Authentication Mode

Based on Authentication Mode, the market has been divided into Single Factor Authentication, and Multi Factor Authentication. The multi-factor authentication (MFA) holds the largest share in the mobile biometric security and service market. MFA combines two or more authentication factors, such as fingerprint recognition and facial verification, to enhance security. By implementing MFA, organizations can establish a layered approach to identity verification, significantly reducing the risk of unauthorized access and identity theft. MFA provides an additional layer of security beyond single-factor authentication methods like passwords or PINs, making it a preferred choice for sensitive applications and transactions.

Based on Authentication Mode, the market has been divided into Single Factor Authentication, and Multi Factor Authentication. The multi-factor authentication (MFA) holds the largest share in the mobile biometric security and service market. MFA combines two or more authentication factors, such as fingerprint recognition and facial verification, to enhance security. By implementing MFA, organizations can establish a layered approach to identity verification, significantly reducing the risk of unauthorized access and identity theft. MFA provides an additional layer of security beyond single-factor authentication methods like passwords or PINs, making it a preferred choice for sensitive applications and transactions.

Based on Industry Vertical, the market has been divided into Public Sector, BFSI, Healthcare, and Others. the public sector holds the largest share in the mobile biometric security and service market. Government agencies and organizations in the public sector rely on biometric solutions to ensure secure access control, border management, law enforcement, and citizen services. Biometric authentication offers enhanced security and accuracy compared to traditional methods, enabling efficient identification of individuals in various public sector applications.

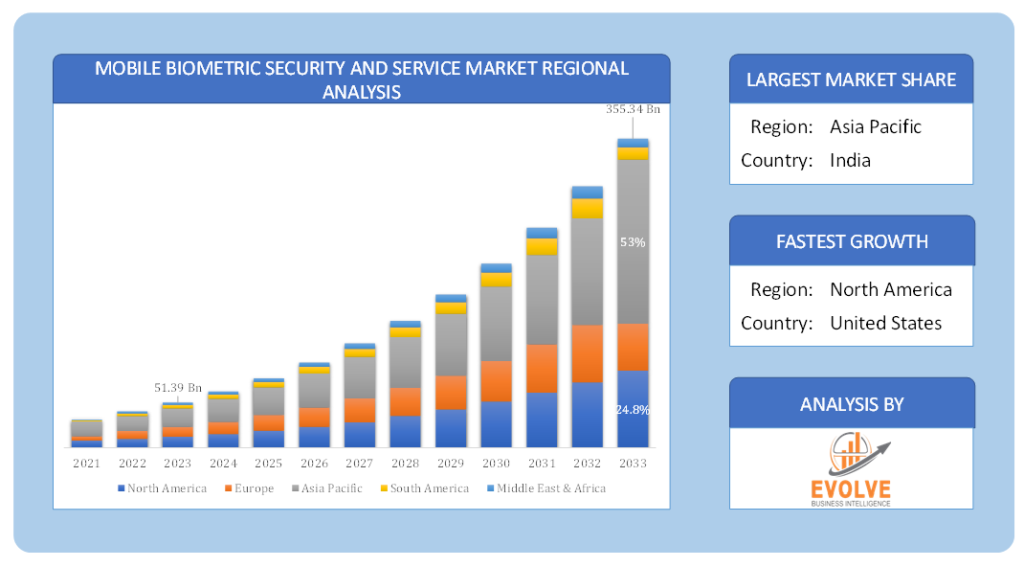

Global Mobile Biometric Security and Service Market Regional Analysis

Based on region, the global Logistics Intelligence Software market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. Asia Pacific is projected to dominate the use of the market followed by the Europe and North America regions.

North America Market

North America Market

North America holds a prominent position in the mobile biometric security and service market. The region is characterized by the presence of leading technology companies and a high level of awareness and adoption of advanced security solutions. The United States, in particular, dominates the North American market due to its strong technological infrastructure and high investment in research and development.

The adoption of mobile biometric security solutions in North America is driven by the increasing emphasis on data security, the growing prevalence of cyber threats, and the need for secure authentication methods. The region has witnessed a surge in the use of mobile payments, online banking, and e-commerce, creating a favorable environment for mobile biometric security solutions.

Asia Pacific Market

The Asia-Pacific region is expected to experience significant growth in the mobile biometric security and service market. Rapid economic growth, expanding population, and increasing smartphone penetration are contributing factors to the adoption of mobile biometric solutions in this region. Countries such as China, India, and Japan are the key contributors to the market growth.

China, in particular, is witnessing a rapid adoption of mobile biometric security and service solutions due to government initiatives promoting digital transformation and the use of biometric authentication for various applications. India is also emerging as a lucrative market for mobile biometric security, driven by the government’s efforts to promote digital identity verification and financial inclusion.

Competitive Landscape

The global Mobile Biometric Security and Service market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- 3M Cogent, Inc.

- Apple Inc.

- Precise Biometrics

- Nuance Communications, Inc.

- M2SYS Technology

- NEC Corporation

- Safran SA

- Crossmatch

- Aware Inc.

- BIO-key

Key Development:

April 2023: NEC Corporation, one of the key players in the mobile biometric security and service market, made a significant development in recent months. NEC Corporation announced the launch of its advanced mobile biometric authentication solution, called NeoFace Mobile Suite.

Scope of the Report

Global Mobile Biometric Security and Service Market, by Component

- Hardware

- Software

- Service]

Global Mobile Biometric Security and Service Market, by Authentication Mode

- Single Factor Authentication

- Multi Factor Authentication

Global Mobile Biometric Security and Service Market, by Industry Vertical

- Public Sector

- BFSI

- Healthcare

- Others

Global Mobile Biometric Security and Service Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $355.34 Billion |

| CAGR | 21.33% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component,Authentication Mode, Industry Vertical |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | 3M Cogent, Inc, Apple Inc., Precise Biometrics, Nuance Communications, Inc., M2SYS Technology, NEC Corporation, Safran SA, Crossmatch, Aware Inc., and BIO-key |

| Key Market Opportunities | Growing Adoption of Mobile Payments and E-commerce |

| Key Market Drivers | Increasing Cybersecurity Concerns and Identity Theft |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Mobile Biometric Security and Service market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Mobile Biometric Security and Service market historical market size for the year 2021, and forecast from 2023 to 2033

- Mobile Biometric Security and Service market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Multi Factor Authentication strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among Healthcare.

- To identify and understand the various factors involved in the global Mobile Biometric Security and Service market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Multi Factor Authentication health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Mobile Biometric Security and Service market is 2021- 2033

What is the growth rate of the global Mobile Biometric Security and Service market?

The global Mobile Biometric Security and Service market is growing at a CAGR of 21.33% over the next 10 years

Which region has the highest growth rate in the market of Mobile Biometric Security and Service?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Mobile Biometric Security and Service market?

North America holds the largest share in 2022

Who are the key players in the global Mobile Biometric Security and Service market?

3M Cogent, Inc, Apple Inc., Precise Biometrics, Nuance Communications, Inc., M2SYS Technology, NEC Corporation, Safran SA, Crossmatch, Aware Inc., and BIO-key are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Authentication Mode Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/BFSIers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Hardware Of Buyers 4.2.3. Bargaining Hardware Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Mobile Biometric Security and Service Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Component Overview 4.5. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Mobile Biometric Security and Service Market 4.8.Import Analysis of the Mobile Biometric Security and Service Market 4.9.Export Analysis of the Mobile Biometric Security and Service Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Mobile Biometric Security and Service Market, By Component 6.1. Introduction 6.2. Hardware 6.3. Software Chapter 7. Global Mobile Biometric Security and Service Market, By Authentication Mode 7.1. Introduction 7.2. Single Factor Authentication 7.3. Multi Factor Authentication Chapter 8. Global Mobile Biometric Security and Service Market, By Industry Vertical 8.1. Introduction 8.2. Public Sector 8.3. BFSI Chapter 9. Global Mobile Biometric Security and Service Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.3. Market Size and Forecast, By Country, 2023-2033 9.2.4. Market Size and Forecast, By Component, 2023-2033 9.2.5. Market Size and Forecast, By Authentication Mode, 2023-2033 9.2.6. Market Size and Forecast, By Industry Vertical, 2023-2033 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.3. Market Size and Forecast, By Component, 2023-2033 8.2.7.4. Market Size and Forecast, By Authentication Mode, 2023-2033 8.2.7.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.8.4. Market Size and Forecast, By Component, 2023-2033 9.2.8.5. Market Size and Forecast, By Authentication Mode, 2023-2033 9.2.8.6. Market Size and Forecast, By Industry Vertical, 2023-2033 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.3. Market Size and Forecast, By Country, 2023-2033 9.3.4. Market Size and Forecast, By Component, 2023-2033 9.3.5. Market Size and Forecast, By Authentication Mode, 2023-2033 9.3.6. Market Size and Forecast, By Industry Vertical, 2023-2033 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.7.3. Market Size and Forecast, By Component, 2023-2033 9.3.7.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.3.7.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.8.3. Market Size and Forecast, By Component, 2023-2033 9.3.8.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.3.8.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.9.3. Market Size and Forecast, By Component, 2023-2033 9.3.9.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.3.9.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.10.3. Market Size and Forecast, By Component, 2023-2033 9.3.10.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.3.10.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.4.11. Rest Of Europe 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.11.3. Market Size and Forecast, By Component, 2023-2033 9.4.11.4. Market Size and Forecast, By Industry Vertical, 2023-2033 9.5. Asia-Pacific 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.3. Market Size and Forecast, By Country, 2023-2033 9.5.4. Market Size and Forecast, By Component, 2023-2033 9.5.5. Market Size and Forecast, By Authentication Mode, 2023-2033 9.5.6. Market Size and Forecast, By Industry Vertical, 2023-2033 9.5.7. China 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.7.3. Market Size and Forecast, By Component, 2023-2033 9.5.7.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.5.7.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.5.8. India 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.8.3. Market Size and Forecast, By Component, 2023-2033 9.5.8.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.5.8.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.5.9. Japan 9.5.9.1. Introduction 9.5.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.9.3. Market Size and Forecast, By Component, 2023-2033 9.5.9.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.5.9.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.5.10. South Korea 9.5.10.1. Introduction 9.5.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.10.3. Market Size and Forecast, By Component, 2023-2033 9.5.10.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.5.10.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.5.11. Rest Of Asia-Pacific 9.5.11.1. Introduction 9.5.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.11.3. Market Size and Forecast, By Component, 2023-2033 9.5.11.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.5.11.5. Market Size and Forecast, By Industry Vertical, 2023-2033 9.6. Rest Of The World (RoW) 9.6.1. Introduction 9.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.6.3. Market Size and Forecast, By Component, 2023-2033 9.6.4. Market Size and Forecast, By Authentication Mode, 2023-2033 9.6.5. Market Size and Forecast, By Industry Vertical, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. 3M Cogent, Inc.. 10.1.1. Business Overview 10.1.2. Multi Factor Authentication Analysis 10.1.2.1. Multi Factor Authentication – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Apple Inc. 10.2.1. Business Overview 10.2.2. Multi Factor Authentication Analysis 10.2.2.1. Multi Factor Authentication – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Precise Biometrics 10.3.1. Business Overview 10.3.2. Multi Factor Authentication Analysis 10.3.2.1. Multi Factor Authentication – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Nuance Communications, Inc. 10.4.1. Business Overview 10.4.2. Multi Factor Authentication Analysis 10.4.2.1. Multi Factor Authentication – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. M2SYS Technology 10.5.1. Business Overview 10.5.2. Multi Factor Authentication Analysis 10.5.2.1. Multi Factor Authentication – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. NEC Corporation 10.6.1. Business Overview 10.6.2. Multi Factor Authentication Analysis 10.6.2.1. Multi Factor Authentication – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Safran SA. 10.7.1. Business Overview 10.7.2. Multi Factor Authentication Analysis 10.7.2.1. Multi Factor Authentication – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Crossmatch 10.8.1. Business Overview 10.8.2. Multi Factor Authentication Analysis 10.8.2.1. Multi Factor Authentication – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Aware Inc. 10.9.1. Business Overview 10.9.2. Multi Factor Authentication Analysis 10.9.2.1. Multi Factor Authentication – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. BIO-key. 10.10.1. Business Overview 10.10.2. Multi Factor Authentication Analysis 10.10.2.1. Multi Factor Authentication – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysiss

Connect to Analyst

Research Methodology