Mining Drilling Services Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Mining Drilling Services Market by Mining Type (Metal, Coal, Mineral, Quarry, Others, ),and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Page: 119

Mining Drilling Services Market Overview

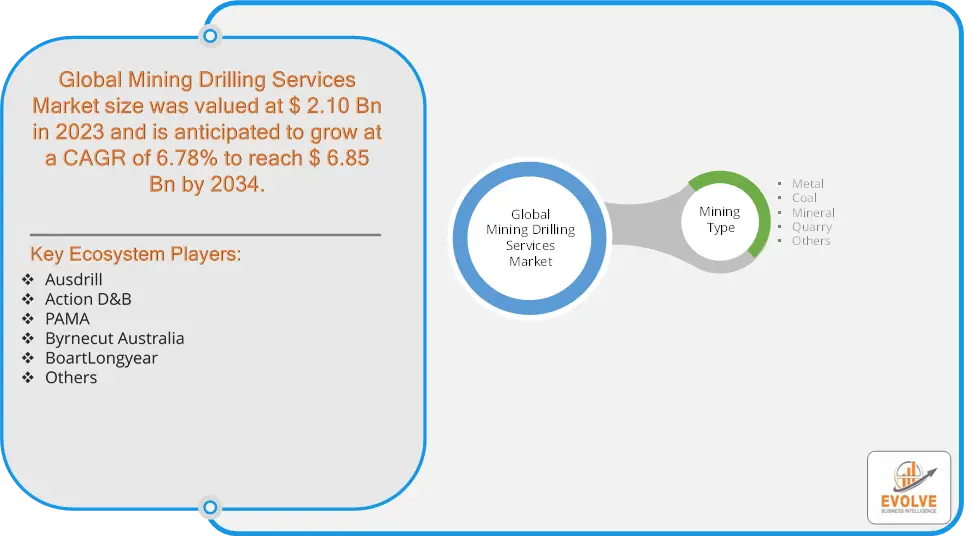

The Mining Drilling Services Market size accounted for USD 2.10 Billion in 2023 and is estimated to account for 3.46 Billion in 2024. The Market is expected to reach USD 6.85 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.78% from 2024 to 2034. The mining drilling services market refers to the industry that provides specialized equipment and expertise for penetrating and extracting rocks, mines, and minerals from various depths beneath the surface. These services are essential for the successful operation of the mining sector, as they assist in identifying mineral resources and extracting them efficiently.

The mining drilling services market is a vital component of the global mining industry, providing essential services for the extraction of valuable resources. The market is influenced by various factors, including demand for minerals, technological advancements, and environmental regulations.

Global Mining Drilling Services Market Synopsis

Mining Drilling Services Market Dynamics

Mining Drilling Services Market Dynamics

The major factors that have impacted the growth of Mining Drilling Services Market are as follows:

Drivers:

Ø Technological Advancements in Drilling

Innovations in drilling technologies, such as automation, remote-operated drill rigs, and precision drilling, improve efficiency, safety, and cost-effectiveness. This encourages mining companies to adopt advanced drilling services. There is a growing need to explore new mineral reserves due to the depletion of existing resources. Exploration drilling is crucial for discovering new deposits, increasing the demand for drilling services. The need for sustainable mining practices has led to the adoption of eco-friendly drilling technologies, such as waterless drilling and minimized environmental impact solutions, driving the demand for advanced drilling services.

Restraint:

- Perception of High Capital Costs and Skilled Labor Shortage

Mining drilling requires significant capital investment in equipment, technology, and skilled labor. For smaller companies or new market entrants, these high upfront costs can act as a barrier, limiting market growth. Mining drilling services require specialized labor, and a shortage of trained personnel can hinder the market’s ability to meet growing demand. Recruiting and retaining skilled workers is a challenge in some regions, especially in remote areas. While advancements in drilling technology drive the market forward, adapting to these technologies can also pose a challenge. Not all companies are able to afford or implement the latest innovations, potentially limiting their competitiveness.

Opportunity:

⮚ Focus on Sustainable Mining Practices

As the mining industry shifts towards sustainability, there is a growing demand for eco-friendly drilling solutions, such as low-impact drilling technologies and waterless methods. Companies that can innovate in this space will find significant market opportunities. The use of data analytics in drilling operations can optimize drilling performance, reduce downtime, and improve decision-making. Companies that leverage big data and machine learning can enhance their service offerings. Many mining companies are looking to expand their operations through mergers and acquisitions. This can lead to new contracts and increased demand for drilling services as companies integrate their operations.

Mining Drilling Services Market Segment Overview

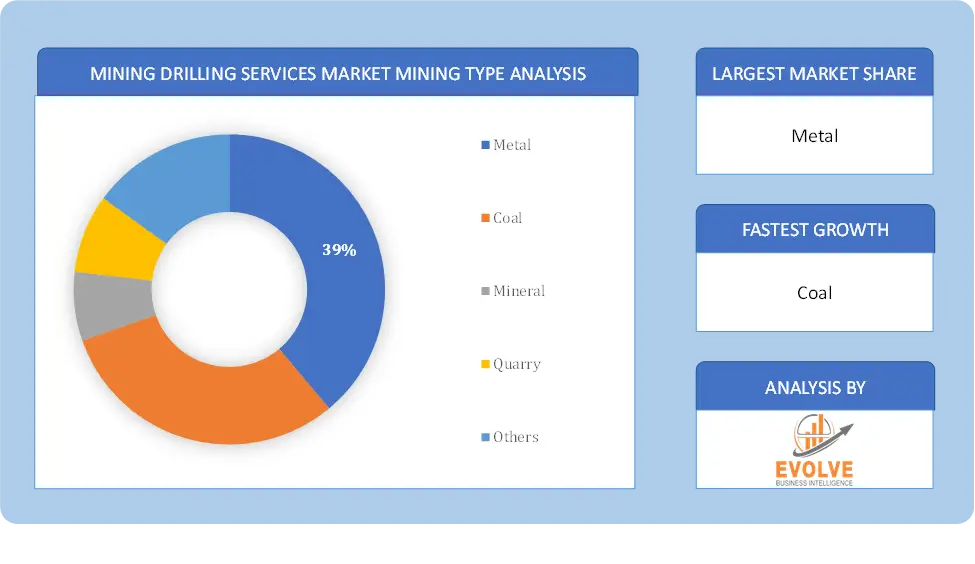

By Mining Type

Based on Mining Type, the market is segmented based on Metal, Coal, Mineral, Quarry and Others. The mineral segment dominant the market due to the substantial demand for various minerals essential for numerous industries, including technology, construction, and manufacturing. The continuous need for metals like copper, gold, and iron drives extensive drilling activities to locate and extract these valuable resources. Recent product launches catering to this segment underline its significance.

Based on Mining Type, the market is segmented based on Metal, Coal, Mineral, Quarry and Others. The mineral segment dominant the market due to the substantial demand for various minerals essential for numerous industries, including technology, construction, and manufacturing. The continuous need for metals like copper, gold, and iron drives extensive drilling activities to locate and extract these valuable resources. Recent product launches catering to this segment underline its significance.

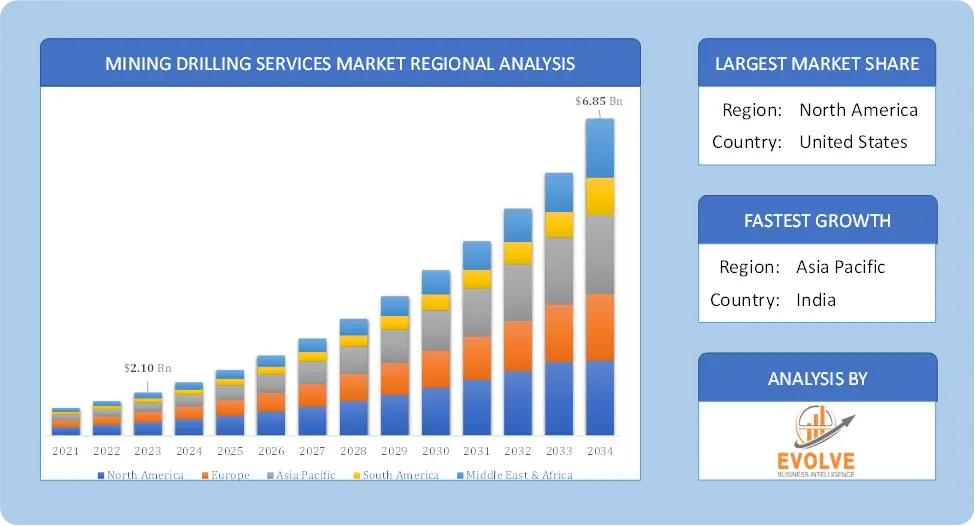

Global Mining Drilling Services Market Regional Analysis

Based on region, the global Mining Drilling Services Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Mining Drilling Services Market followed by the Asia-Pacific and Europe regions.

Mining Drilling Services North America Market

Mining Drilling Services North America Market

North America holds a dominant position in the Mining Drilling Services Market. North America is a significant player in the mining drilling services market due to its rich mineral resources, including gold, copper, and coal. The region benefits from advanced technologies and infrastructure, along with strict regulatory standards that promote sustainable practices. The U.S. shale oil and gas boom has also increased drilling activities.

Mining Drilling Services Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Mining Drilling Services Market industry. The Asia-Pacific region is one of the largest markets for mining drilling services due to high demand for minerals and metals. China is a significant consumer and producer of various minerals, while Australia is a major exporter of coal and iron ore. India’s growing economy also boosts demand for mining activities. However, regulatory complexities and environmental concerns can pose challenges.

Competitive Landscape

The global Mining Drilling Services Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Ausdrill

- Action D&B

- PAMA

- Byrnecut Australia

- BoartLongyear

- Others

Key Development

In June 2024, Central China’s Hunan Province introduced the world’s first electric, intelligent, and deep-sea heavy-duty mining vehicle platform for deep-sea mineral resource exploration.

In June 2024, Giant Mining Corp. announced its engagement with Boart Longyear Limited for reverse circulation (RC) mining drilling services at the Majuba Hill Porphyry Copper Deposit in Pershing County, Nevada.

Scope of the Report

Global Mining Drilling Services Market, by Mining Type

- Metal

- Coal

- Mineral

- Quarry

- Others

Global Mining Drilling Services Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $6.85 Billion |

| CAGR | 6.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Mining Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Ausdrill, Action D&B, PAMA, Byrnecut Australia, BoartLongyear and Others |

| Key Market Opportunities | • Focus on Sustainable Mining Practices • Integration of Data Analytics |

| Key Market Drivers | • Technological Advancements in Drilling • Rising Exploration Activities |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Mining Drilling Services Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Mining Drilling Services Market historical market size for the year 2021, and forecast from 2023 to 2033

- Mining Drilling Services Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Mining Drilling Services Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Mining Drilling Services Market is 2021- 2033

What is the growth rate of the global Mining Drilling Services Market?

The global Mining Drilling Services Market is growing at a CAGR of 6.78% over the next 10 years

Which region has the highest growth rate in the market of Mining Drilling Services Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Mining Drilling Services Market?

North America holds the largest share in 2022

Who are the key players in the global Mining Drilling Services Market?

Ausdrill, Action D&B, PAMA, Byrnecut Australia, BoartLongyear and Others. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Mining Drilling Services Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Mining Drilling Services Market, By Mining Type 6.1. Introduction 6.2. Metal 6.3. Coal 6.4. Mineral 6.5. Quarry 6.6. Others Chapter 8. Global Mining Drilling Services Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Mining Type, 2020 - 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Mining Type, 2020 - 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.3.10. Rest of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Mining Type, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.4.10. Rest of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.5. Rest of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Mining Type, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Mining Type, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Ausdrill 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Mining Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Action D&B 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Mining Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. PAMA 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Mining Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Byrnecut Australia 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Mining Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. BoartLongyear 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Mining Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology