Millimeter Wave Technology Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

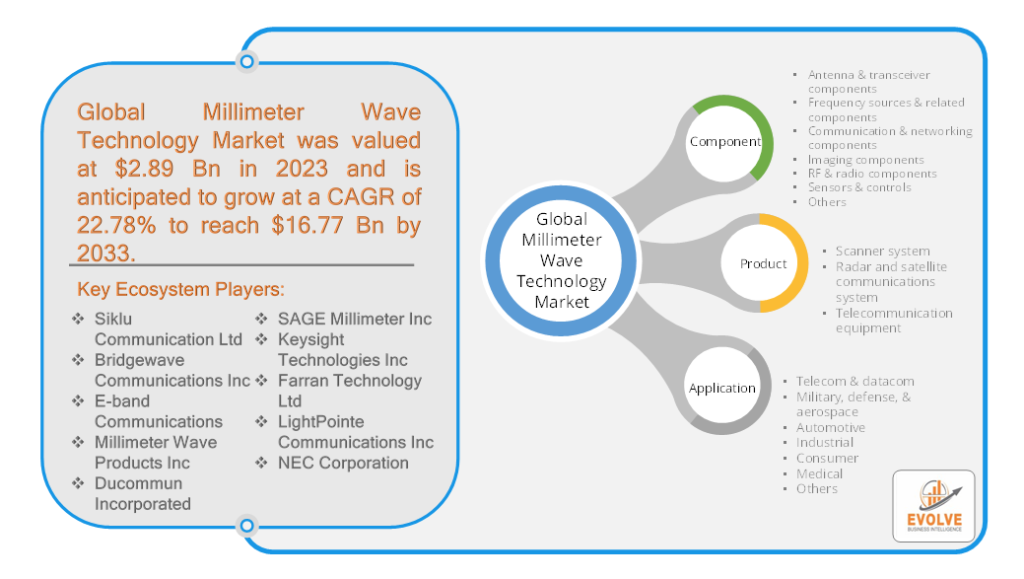

Millimeter Wave Technology Market Research Report: By Component (Antenna & transceiver components, Frequency sources & related components, Communication & networking components, Imaging components, RF & Radio Components, Sensors & Controls, Others), By Product (Scanner Systems, Radar And Satellite Communications System, Telecommunication Equipment), By Application (Telecom & Datacom, Military, Defense, & Aerospace, Automotive, Industrial, Consumer, Medical, Others), and by Region — Forecast till 2033

Millimeter Wave Technology Market Overview

Millimeter Wave Technology Market Size is expected to reach USD 16.77 Billion by 2033. The Millimeter Wave Technology industry size accounted for USD 2.89 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 22.78% from 2023 to 2033. Millimeter Wave Technology refers to the use of electromagnetic waves in the millimeter wave frequency range for various applications. It utilizes radio waves within the frequency range of approximately 30 gigahertz (GHz) to 300 gigahertz (GHz), corresponding to wavelengths between 1 millimeter and 10 millimeters. This technology enables high-frequency wireless communication and data transfer, offering advantages such as large bandwidth capacity, high data transmission rates, and support for a large number of connected devices simultaneously. Millimeter wave technology is commonly employed in telecommunications, particularly in the development of advanced wireless communication systems like 5G networks, where it facilitates faster and more efficient connectivity. Due to their shorter wavelengths, millimeter waves have specific characteristics, including high directionality and susceptibility to signal attenuation over longer distances or when obstructed by obstacles. To overcome these challenges, advanced beamforming techniques and dense network infrastructure, such as small cells and relay stations, are often employed in millimeter wave technology applications.

Global Millimeter Wave Technology Market Synopsis

COVID-19 Impact Analysis

The Millimeter Wave Technology (AAL) market experienced a significant impact as a result of the COVID-19 pandemic. The implementation of physical distancing measures and the surge in demand for remote healthcare services led to an increased reliance on millimeter wave technology in the Ambient Assisted Living (AAL) sector. The pandemic necessitated a greater emphasis on telehealth and remote monitoring solutions to ensure the safety and well-being of individuals, particularly those who were elderly or had underlying health conditions. In this context, millimeter wave technology played a crucial role by enabling high-speed and reliable wireless communication, facilitating the delivery of remote healthcare services, and supporting the implementation of AAL solutions. Furthermore, the pandemic underscored the significance of robust and resilient communication networks to meet the escalating demand for telehealth and remote care services. Millimeter wave technology, with its capability to deliver high bandwidth and low latency connectivity, played a crucial role in bridging the digital divide and ensuring seamless communication between healthcare providers and individuals in need of care.

Global Millimeter Wave Technology Market Dynamics

The major factors that have impacted the growth of Millimeter Wave Technology are as follows:

Drivers:

Demand for High-Speed Wireless Communication

The increasing demand for high-speed wireless communication is a significant driver for the Millimeter Wave Technology market. With the growing adoption of data-intensive applications, such as streaming video, virtual reality, and Internet of Things (IoT) devices, there is a need for faster and more efficient wireless connectivity. Millimeter wave technology provides large bandwidth capacity, enabling the transmission of massive amounts of data at ultra-high speeds. This driver is particularly relevant in sectors such as telecommunications, autonomous vehicles, and smart cities.

Restraint:

- Signal Attenuation and Range Limitations

One of the primary restraints in the Millimeter Wave Technology market is the challenge posed by signal attenuation and limited range. Millimeter waves have shorter wavelengths, making them more susceptible to signal degradation when obstructed by obstacles or affected by atmospheric conditions. The shorter range of millimeter waves necessitates the deployment of dense network infrastructure with smaller cell sizes to maintain consistent signal coverage. Overcoming these limitations and ensuring reliable connectivity over larger areas can be technically challenging and costly.

Opportunity:

5G Network Deployment and Expansion

The ongoing deployment and expansion of 5G networks present a significant opportunity for the Millimeter Wave Technology market. Millimeter waves are a key component of 5G networks, as they offer the necessary bandwidth to support the high data rates and low latency requirements of 5G applications. With the rollout of 5G networks worldwide, there is an increasing demand for millimeter wave technology in the development of base stations, small cells, and other infrastructure elements. This presents a growth opportunity for companies involved in millimeter wave technology, including equipment manufacturers, semiconductor providers, and network operators.

Millimeter Wave Technology Market Segment Overview

By Component

Based on the Component, the market is segmented based on Antenna & transceiver components, Frequency sources & related components, Communication & networking components, Imaging components, RF & radio components, Sensors & controls, and Others. The largest market share is anticipated to go to the RF & radio components segment. RF (Radio Frequency) and radio components are essential elements in millimeter wave systems, as they enable the generation, transmission, and reception of millimeter wave signals. These components include amplifiers, transceivers, antennas, frequency converters, and other RF devices. The anticipated dominance of the RF & radio components segment can be attributed to the critical role these components play in facilitating efficient and reliable millimeter wave communication. They are integral to various applications, including wireless telecommunications, satellite communications, automotive radar, and industrial automation, among others.

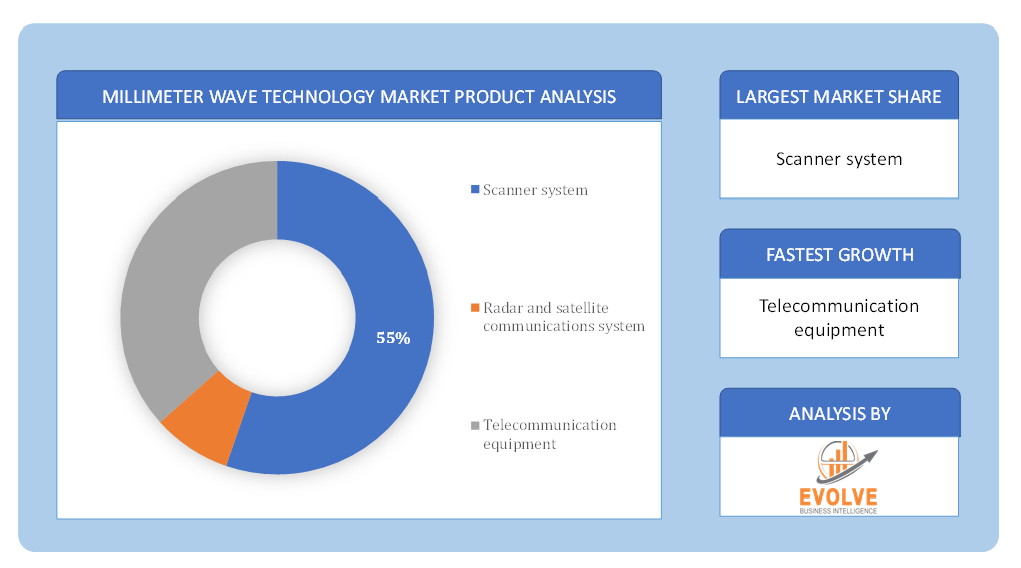

By Product

Based on Product, the market has been divided into Scanner systems, Radar and satellite communications systems, and Telecommunication equipment. The dominance of the Scanner systems segment. Scanner systems play a crucial role in various applications, including security screening, imaging, and radar systems. These systems utilize millimeter waves to capture detailed images or scans of objects or environments for analysis and detection purposes. The dominance of the Scanner systems segment can be attributed to the growing demand for advanced security solutions and imaging technologies. With increasing security concerns in public places, such as airports, seaports, and critical infrastructure facilities, the need for effective and efficient scanning systems has risen. Millimeter wave-based scanners provide enhanced capabilities for detecting concealed objects or weapons, thereby enhancing security measures.

Based on Product, the market has been divided into Scanner systems, Radar and satellite communications systems, and Telecommunication equipment. The dominance of the Scanner systems segment. Scanner systems play a crucial role in various applications, including security screening, imaging, and radar systems. These systems utilize millimeter waves to capture detailed images or scans of objects or environments for analysis and detection purposes. The dominance of the Scanner systems segment can be attributed to the growing demand for advanced security solutions and imaging technologies. With increasing security concerns in public places, such as airports, seaports, and critical infrastructure facilities, the need for effective and efficient scanning systems has risen. Millimeter wave-based scanners provide enhanced capabilities for detecting concealed objects or weapons, thereby enhancing security measures.

By Application

Based on Application, the market has been divided into Telecom & datacom, Military, defense, & aerospace, Automotive, Industrial, Consumer, Medical, and Others. The market is projected to see significant growth in the Military, defense, & aerospace. The increasing importance of millimeter wave technology in addressing the evolving needs and challenges in these industries. The adoption of millimeter wave technology in military operations, defense systems, and aerospace applications is expected to drive innovation and create opportunities for technology providers and solution developers in this market segment.

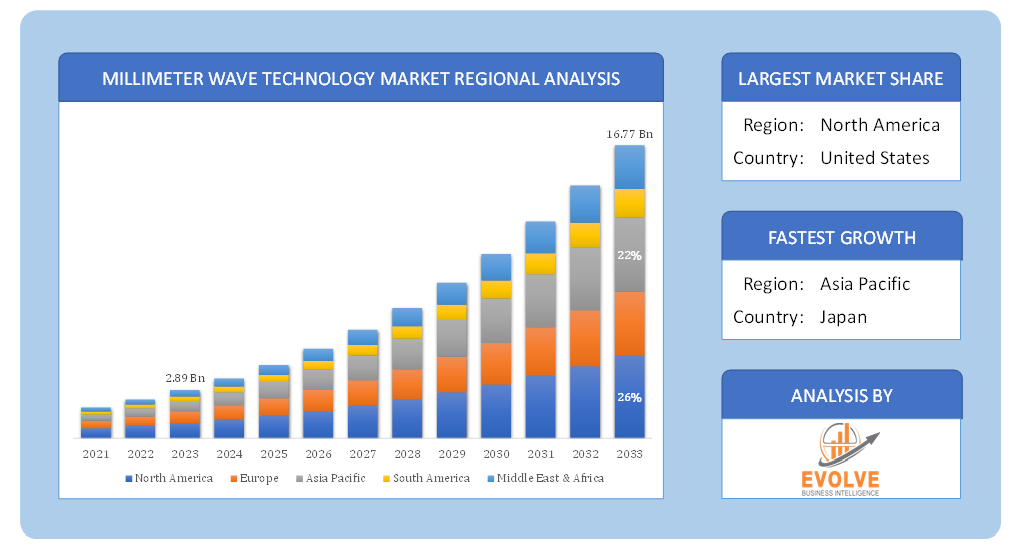

Global Millimeter Wave Technology Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Millimeter Wave Technology, followed by those in Asia-Pacific and Europe.

North America Market

The North American region holds a dominant position in the Millimeter Wave Technology market. North America has been at the forefront of technological advancements and innovation, particularly in the field of telecommunications and wireless communication. The region is home to several major players and industry leaders in millimeter wave technology, including equipment manufacturers, semiconductor companies, and network operators. The presence of these key stakeholders contributes to the development and adoption of millimeter-wave technology solutions. The North American market benefits from a robust infrastructure for the deployment of millimeter wave technology. The region has well-established telecommunications networks and a high level of digital connectivity, which provides a favorable environment for the implementation of millimeter wave-based applications. This infrastructure supports the seamless integration of millimeter wave technology into various sectors, including telecommunications, healthcare, aerospace, and defense.

Asia Pacific Market

The Asia-Pacific region is emerging as a significant and rapidly growing market. The Asia-Pacific region has a large and diverse population, along with rapid urbanization and increasing technological adoption. This creates a favorable environment for the deployment and adoption of millimeter wave technology. The region’s growing middle class and rising disposable incomes drive the demand for advanced communication systems, high-speed internet connectivity, and innovative applications that leverage millimeter-wave technology. Also, governments and industry players in the Asia-Pacific region are actively investing in the development of 5G networks and infrastructure. Millimeter wave technology plays a crucial role in delivering the high-speed, low-latency, and capacity requirements of 5G networks. As countries in the region strive to establish themselves as leaders in the 5G ecosystem, the demand for millimeter wave technology is expected to rise significantly.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as SMK Electronics Corporation, Ducommun Incorporated, SAGE Millimeter Inc, and Keysight Technologies Inc are some of the leading players in the global Millimeter Wave Technology Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Siklu Communication Ltd

- Bridgewave Communications Inc

- E-band Communications

- SMK Electronics Corporation

- Ducommun Incorporated

- SAGE Millimeter Inc

- Movandi

- Keysight Technologies Inc

- Farran Technology Ltd

- LightPointe Communications Inc

- NEC Corporation

Key Development:

In January 2023, SMK Electronics Corporation introduced a cutting-edge millimeter wave sensor technology and solution known as MilwebTM. This advanced sensor utilizes proprietary algorithms to accurately identify objects, surfaces, terrain, and even an individual’s heart rate and respiration at close range. The versatility of this sensor technology opens up various applications across sectors such as home automation, automotive manufacturing, healthcare, and safety products.

In October 2022, Movandi collaborated with Rakuten Mobile to enhance the availability and bandwidth of 5G outdoor and indoor millimeter wave networks in Japan. This partnership involved the implementation of Movandi’s intelligent repeater and BeamXR Open-RAN technology. These solutions aim to improve network coverage and performance, enabling a seamless and efficient 5G experience for users in Japan.

Scope of the Report

Global Millimeter Wave Technology Market, by Component

- Antenna & transceiver components

- Frequency sources & related components

- Communication & networking components

- Imaging components

- RF & radio components

- Sensors & controls

- Others

Global Millimeter Wave Technology Market, by Product

- Scanner system

- Radar and satellite communications system

- Telecommunication equipment

Global Millimeter Wave Technology Market, by Application

- Telecom & datacom

- Military, defense, & aerospace

- Automotive

- Industrial

- Consumer

- Medical

- Others

Global Millimeter Wave Technology Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $16.77 Billion |

| CAGR | 22.78% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Product, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Siklu Communication Ltd, Bridgewave Communications Inc, E-band Communications, SMK Electronics Corporation, Ducommun Incorporated, SAGE Millimeter Inc, Keysight Technologies Inc, Farran Technology Ltd, LightPointe Communications Inc, NEC Corporation |

| Key Market Opportunities | • Technological Advancements |

| Key Market Drivers | • Demand for High-Speed Wireless Communication |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Millimeter Wave Technology Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Millimeter Wave Technology market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Millimeter Wave Technology market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Millimeter Wave Technology Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Millimeter Wave Technology market is 2022- 2033

What are the 10 Years CAGR (2023 to 2033) of the global Millimeter Wave Technology market?

The global Millimeter Wave Technology market is growing at a CAGR of ~78% over the next 10 years

Which region has the highest growth rate in the market of Millimeter Wave Technology?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region accounted for the largest share of the market of Millimeter Wave Technology?

North America holds the largest share in 2022

Major Key Players in the Market of Millimeter Wave Technology?

Siklu Communication Ltd, Bridgewave Communications Inc, E-band Communications, SMK Electronics Corporation, Ducommun Incorporated, SAGE Millimeter Inc, Keysight Technologies Inc, Farran Technology Ltd, LightPointe Communications Inc, NEC Corporation are the major companies operating in the Millimeter Wave Technology

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Material Type Segement – Market Opportunity Score 4.1.2. End User Segment – Market Opportunity Score 4.1.3. Distribution Channel Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Millimeter Wave Technology Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Millimeter Wave Technology Market, By Product 7.1. Introduction 7.1.1. Antenna & transceiver components 7.1.2. Frequency sources & related components 7.1.3. Communication & networking components 7.1.4. Imaging components 7.1.5. RF & radio components 7.1.6. Sensors & controls 7.1.7. Others CHAPTER 8. Global Millimeter Wave Technology Market, By Product 8.1. Introduction 8.1.1. Scanner system 8.1.2. Radar and satellite communications system 8.1.3. Telecommunication equipment CHAPTER 9. Global Millimeter Wave Technology Market, By Application 9.1. Introduction 9.1.1. Telecom & datacom 9.1.2. Military, defense, & aerospace 9.1.3. Automotive 9.1.4. Industrial 9.1.5. Consumer 9.1.6. Medical 9.1.7. Others CHAPTER 10. Global Millimeter Wave Technology Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13. REST of ASIA PACIFIC 10.4.13.1. Rest of Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.13.2. Rest of Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.13.3. Rest of Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Siklu Communication Ltd 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Bridgewave Communications Inc 13.3. E-band Communications 13.4. SMK Electronics Corporation 13.5. Ducommun Incorporated 13.6. SAGE Millimeter Inc 13.7. Keysight Technologies Inc 13.8. Farran Technology Ltd 13.9. LightPointe Communications Inc 13.10. NEC Corporation

Connect to Analyst

Research Methodology