Military RADAR Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

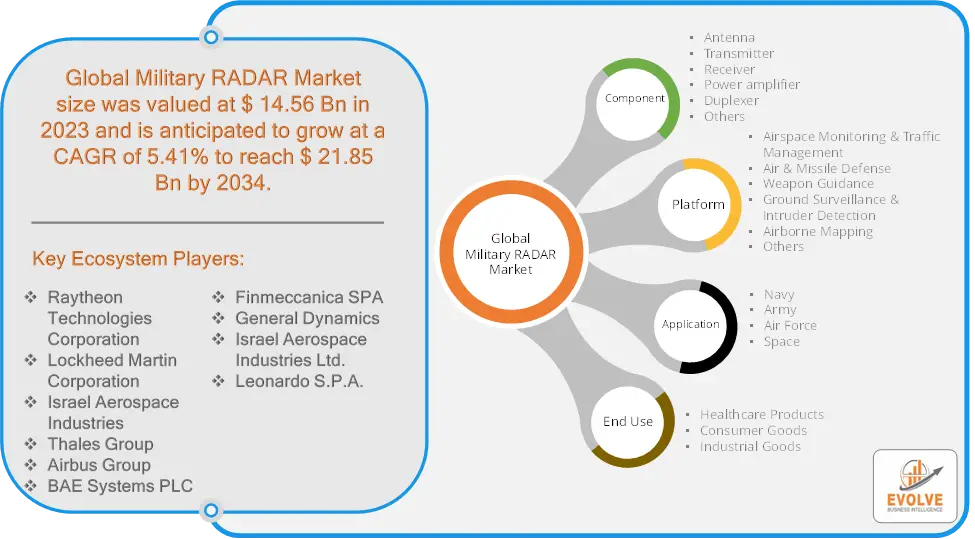

Military RADAR Market Research Report: By component (Antenna, Transmitter, Receiver, Power amplifier, Duplexer, Others), By Platform (Land Radar, Naval Radar, Airborne Radar market, Space-Based Radar), By Application (Airspace Monitoring & Traffic Management, Air & Missile Defense, Weapon Guidance, Ground Surveillance & Intruder Detection, Airborne Mapping, OthersBy End Use (Navy, Army, Air Force, Space), and by Region — Forecast till 2034

Page: 115

Military RADAR Market Overview

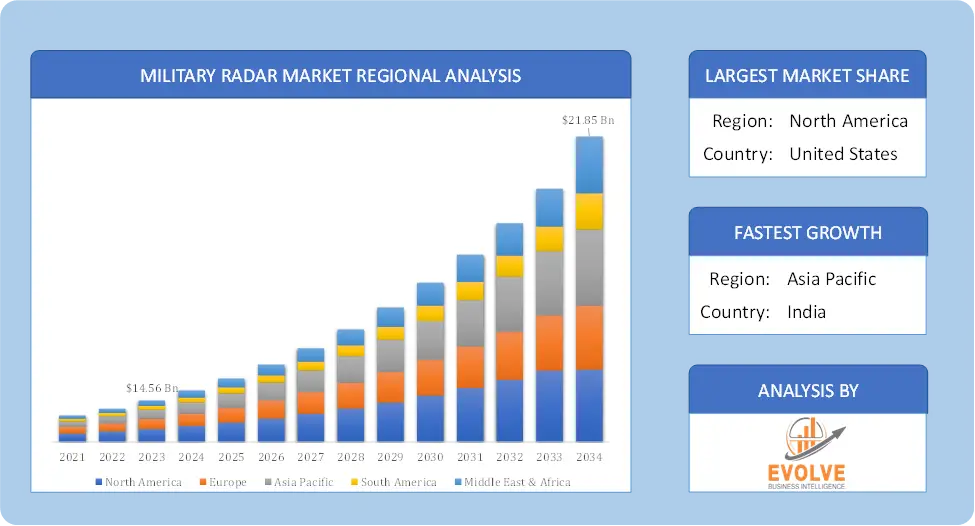

The Military RADAR Market Size is expected to reach USD 21.85 Billion by 2034. The Military RADAR Market industry size accounted for USD 14.56 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.41% from 2021 to 2034. The military radar market involves systems used for detecting, tracking, and identifying objects, such as aircraft, missiles, and ships, in defense and security applications. Key segments include air defense radars, ground surveillance radars, and naval radars. Technological advancements focus on improving range, resolution, and resistance to electronic warfare. Market growth is driven by increasing defense budgets, the need for advanced surveillance capabilities, and rising geopolitical tensions. The market is competitive, with major players investing in research and development to enhance radar performance and integrate with other defense systems. Trends include the adoption of phased array radars and multi-function radar systems. The market is influenced by global defense policies, technological innovations, and the ongoing modernization of military forces.

Global Military RADAR Market Synopsis

Global Military RADAR Market Dynamics

Global Military RADAR Market Dynamics

The major factors that have impacted the growth of Military RADAR are as follows:

Drivers:

⮚ Technological Advancements

Innovations in radar technology, such as phased array radars, synthetic aperture radars (SAR), and multi-function radars, are enhancing performance and capabilities. These advancements improve detection range, resolution, and accuracy, making radar systems more effective in various military applications.

Restraint:

- Technological Complexity

The sophistication of modern radar systems involves intricate technology, which can lead to challenges in development, integration, and maintenance. The complexity of these systems requires specialized skills and knowledge, which can constrain their deployment and effectiveness.

Opportunity:

⮚ Advancements in Radar Technology

Innovations such as phased array radars, synthetic aperture radars (SAR), and multifunction radars offer opportunities to enhance detection capabilities and operational flexibility. These technologies enable improved range, resolution, and resistance to electronic countermeasures, providing enhanced situational awareness and targeting accuracy.

Military RADAR Market Segment Overview

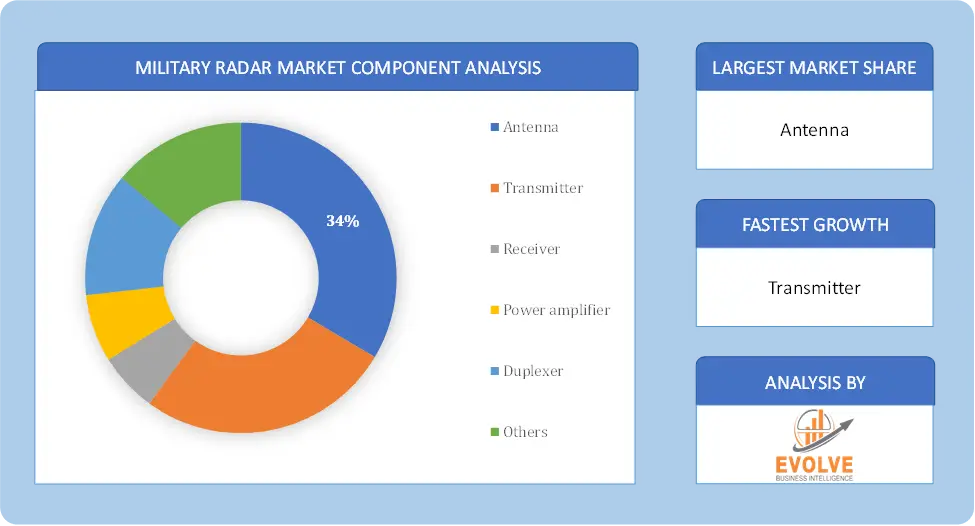

By Component

Based on the Component, the market is segmented based on Antenna, Transmitter, Receiver, Power amplifier, Duplexer, Others. the Antenna segment typically dominates due to its fundamental role in signal transmission and reception, which is crucial for the performance and effectiveness of radar systems.

Based on the Component, the market is segmented based on Antenna, Transmitter, Receiver, Power amplifier, Duplexer, Others. the Antenna segment typically dominates due to its fundamental role in signal transmission and reception, which is crucial for the performance and effectiveness of radar systems.

By Platform

Based on Platform, the market has been divided into Land Radar, Naval Radar, Airborne Radar market, Space-Based Radar. the Airborne Radar segment generally dominates due to its critical role in providing real-time surveillance, target tracking, and threat detection from airborne platforms, which are essential for modern air defense operations.

By Application

Based on the Application, the market has been divided into Airspace Monitoring & Traffic Management, Air & Missile Defense, Weapon Guidance, Ground Surveillance & Intruder Detection, Airborne Mapping, Others. the Air & Missile Defense segment usually dominates due to its crucial role in detecting and intercepting airborne and missile threats, which are central to national defense strategies.

By End Use

Based on End Use, the market has been divided into Navy, Army, Air Force, Space. the Air Force segment typically dominates due to its extensive use of radar for air surveillance, missile detection, and control of airspace, reflecting the critical role of radar in modern air defense operations.

Global Military RADAR Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Military RADAR, followed by those in Asia-Pacific and Europe.

Military RADAR North America Market

Military RADAR North America Market

The North American region holds a dominant position in the Military RADAR market. Due to the governments in the region making large investments in national security, aerospace and military, among other fields, the North American Military Navigation market area will dominate this industry. Following Canada and Mexico in terms of market share, the United States holds the largest share in the area.

Military RADAR Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Military RADAR industry. From 2023 to 2032, the Asia-Pacific Military Navigation Market is anticipated to develop at the quickest compound annual growth rate (CAGR). As a result, nations like Japan, India, and others in the Asia-Pacific region are spending more on their armed forces. Furthermore, in the Asia-Pacific area, the Indian Military Navigation market was expanding at the fastest rate, while China’s Military Navigation market maintained the biggest market share.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Raytheon Technologies Corporation, Lockheed Martin Corporation, Israel Aerospace Industries, Thales Group, and Airbus Group are some of the leading players in the global Military RADAR Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Israel Aerospace Industries

- Thales Group

- Airbus Group

- BAE Systems PLC

- Finmeccanica SPA

- General Dynamics

- Israel Aerospace Industries Ltd.

- Leonardo S.P.A.

Key Development:

In September 2022, Raytheon Technologies Corporation advanced its military radar capabilities by unveiling the new AN/APG-79(V)4 AESA radar, enhancing the surveillance and targeting capabilities of its airborne systems.

Scope of the Report

Global Military RADAR Market, by Component

- Antenna

- Transmitter

- Receiver

- Power amplifier

- Duplexer

- Others

Global Military RADAR Market, by Platform

- Airspace Monitoring & Traffic Management

- Air & Missile Defense

- Weapon Guidance

- Ground Surveillance & Intruder Detection

- Airborne Mapping

- Others

Global Military RADAR Market, by Application

- Navy

- Army

- Air Force

- Space

Global Military RADAR Market, by End Use

- Healthcare Products

- Consumer Goods

- Industrial Goods

Global Military RADAR Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $21.85 Billion |

| CAGR | 5.41% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Platform, Application, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Raytheon Technologies Corporation, Lockheed Martin Corporation, Israel Aerospace Industries, Thales Group, Airbus Group, BAE Systems PLC, Finmeccanica SPA, General Dynamics, Israel Aerospace Industries Ltd., Leonardo S.P.A. |

| Key Market Opportunities | Changing nature of warfare Increasing demand for new-generation air and missile defense systems |

| Key Market Drivers | Rising use of UAVs by the defense forces |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Military RADAR market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Military RADAR market historical market size for the year 2022, and forecast from 2021 to 2034

- Military RADAR market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Military RADAR market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Military RADAR market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Military RADAR market?

The global Military RADAR market is growing at a CAGR of ~5.41% over the next 10 years

Which region has the highest growth rate in the market of Military RADAR?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Military RADAR?

North America holds the largest share in 2023

Major Key Players in the Market of Military RADAR?

Raytheon Technologies Corporation, Lockheed Martin Corporation, Israel Aerospace Industries, Thales Group, Airbus Group, BAE Systems PLC, Finmeccanica SPA, General Dynamics, Israel Aerospace Industries Ltd., and Leonardo S.P.A. are the major companies operating in the Military RADAR Industry

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Military RADAR Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Military RADAR Market, By component 6.1. Introduction 6.2. Antenna 6.3. Transmitter 6.4. Receiver 6.5. Power amplifier 6.6. Duplexer 6.7. Others Chapter 7. Global Military RADAR Market, By Platform 7.1. Introduction 7.2. Land Radar 7.3. Naval Radar 7.4. Airborne Radar market 7.5. Space-Based Radar Chapter 8. Global Military RADAR Market, By Application 8.1. Introduction 8.2. Airspace Monitoring & Traffic Management 8.3. Air & Missile Defense 8.4. Weapon Guidance 8.5. Ground Surveillance & Intruder Detection 8.6. Airborne Mapping 8.7. Others Chapter 9. Global Military RADAR Market, By End Use 9.1. Introduction 9.2. Navy 9.3. Army 9.4. Air Force 9.5. Space Chapter 10. Global Military RADAR Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By component, 2020 - 2028 10.2.5. Market Size and Forecast, By Platform, 2020 - 2028 10.2.6. Market Size and Forecast, By Application, 2020 – 2028 10.2.7. Market Size and Forecast, By End User, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By component, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Platform, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.8.6. Market Size and Forecast, By End User, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By component, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Platform, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.9.6. Market Size and Forecast, By End User, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By component, 2020 - 2028 10.3.5. Market Size and Forecast, By Platform, 2020 - 2028 10.3.6. Market Size and Forecast, By Application, 2020 – 2028 10.3.7. Market Size and Forecast, By End User, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By component, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Platform, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.8.6. Market Size and Forecast, By End User, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By component, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Platform, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.9.6. Market Size and Forecast, By End User, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By component, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Platform, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.10.6. Market Size and Forecast, By End User, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By component, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Platform, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.11.6. Market Size and Forecast, By End User, 2020 - 2028 10.3.12. Rest of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By component, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Platform, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.12.6. Market Size and Forecast, By End User, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By component, 2020 - 2028 10.4.5. Market Size and Forecast, By Platform, 2020 - 2028 10.4.6. Market Size and Forecast, By Application, 2020 – 2028 10.4.7. Market Size and Forecast, By End User, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By component, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Platform, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.8.6. Market Size and Forecast, By End User, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By component, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Platform, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.9.6. Market Size and Forecast, By End User, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By component, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Platform, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.10.6. Market Size and Forecast, By End User, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By component, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Platform, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.11.6. Market Size and Forecast, By End User, 2020 - 2028 10.4.12. Rest of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By component, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Platform, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.12.6. Market Size and Forecast, By End User, 2020 - 2028 10.5. Rest of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By component, 2020 - 2028 10.5.4. Market Size and Forecast, By Platform, 2020 - 2028 10.5.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.6. Market Size and Forecast, By End User, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By component, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Platform, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.8.6. Market Size and Forecast, By End User, 2020 - 2028 10.5.9. Middle East & Africa 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By component, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Platform, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.9.6. Market Size and Forecast, By End User, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Raytheon Technologies Corporation 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Lockheed Martin Corporation 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. Israel Aerospace Industries 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. Thales Group 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. Airbus Group 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. BAE Systems PLC 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. Finmeccanica SPA 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. General Dynamics 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Israel Aerospace Industries Ltd. 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Leonardo S.P.A. 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology