Military Embedded Systems Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

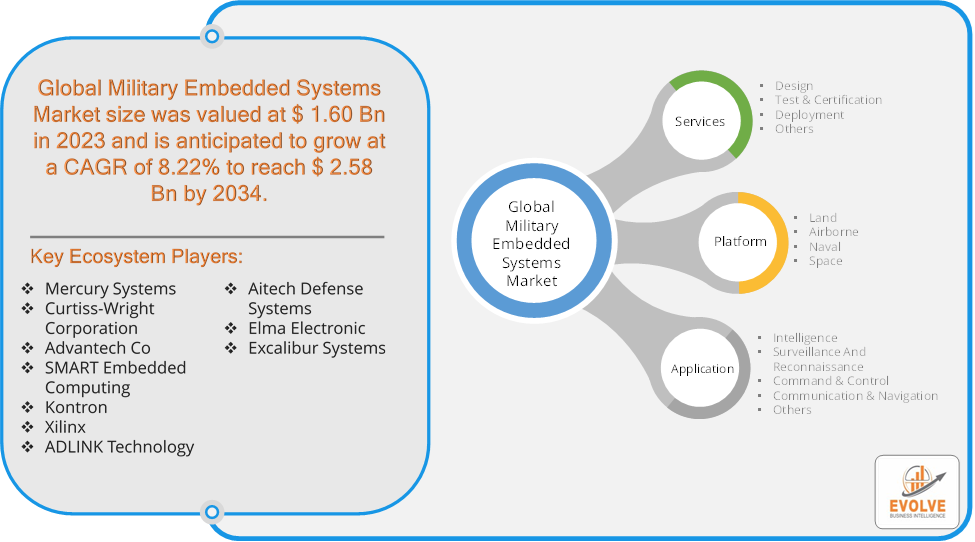

Military Embedded Systems Market Research Report: Information by Services (Design, Test & Certification, Deployment, Others), By Application (Intelligence, Surveillance, And Reconnaissance, Command & Control, Communication & Navigation, Others), By Platform (Land, Airborne, Naval, Space), and by Region — Forecast till 2033

Page: 115

Military Embedded Systems Market Overview

The Military Embedded Systems Market Size is expected to reach USD 2.58 Billion by 2034. The Military Embedded Systems Market industry size accounted for USD 1.60 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.22% from 2023 to 2033. The Military Embedded Systems Market refers to the segment of the technology market focused on embedded systems designed specifically for military applications. Embedded systems are specialized computing systems integrated into larger devices to perform dedicated functions.

The market includes hardware Systems (like processors and sensors), software, and integrated solutions, all tailored to meet the stringent requirements of military environments. The growth of this market is driven by advancements in technology, increasing defense budgets, and the need for modernized and sophisticated military capabilities.

Global Military Embedded Systems Market Synopsis

Military Embedded Systems Market Dynamics

Military Embedded Systems Market Dynamics

The major factors that have impacted the growth of Military Embedded Systems Market are as follows:

Drivers:

Ø Technological Advancements

Continuous innovation in semiconductor technology, miniaturization, and integration of advanced features drive the development of more capable and efficient embedded systems. There is a growing need for advanced and precision weapon systems, which require sophisticated embedded systems for control, guidance, and operation. The need for improved situational awareness in military operations drives the demand for embedded systems used in surveillance, reconnaissance, and communication. The development of new military applications, such as unmanned systems (drones) and advanced robotics, requires specialized embedded systems.

Restraint:

- Perception of High Development Costs and Rapid Technological Changes

The development of advanced military embedded systems requires significant investment in research and development, which can be a barrier for some companies and countries. The fast pace of technological advancements can lead to obsolescence of current systems, requiring frequent updates and upgrades that can be costly and challenging. Embedded systems are potential targets for cyberattacks. Ensuring the security and resilience of these systems against hacking and other threats is a significant challenge.

Opportunity:

⮚ Rising Demand for Modernization Programs

Ongoing military modernization programs globally provide opportunities for companies to supply new and upgraded embedded systems that enhance the performance and capabilities of existing platforms. The concept of smart warfare, which involves the use of connected and intelligent systems for combat and strategic operations, creates a demand for innovative embedded solutions. Developing cost-effective and reliable embedded systems that meet military requirements can attract interest from defense organizations looking to optimize their spending while upgrading their technology.

Military Embedded Systems Market Segment Overview

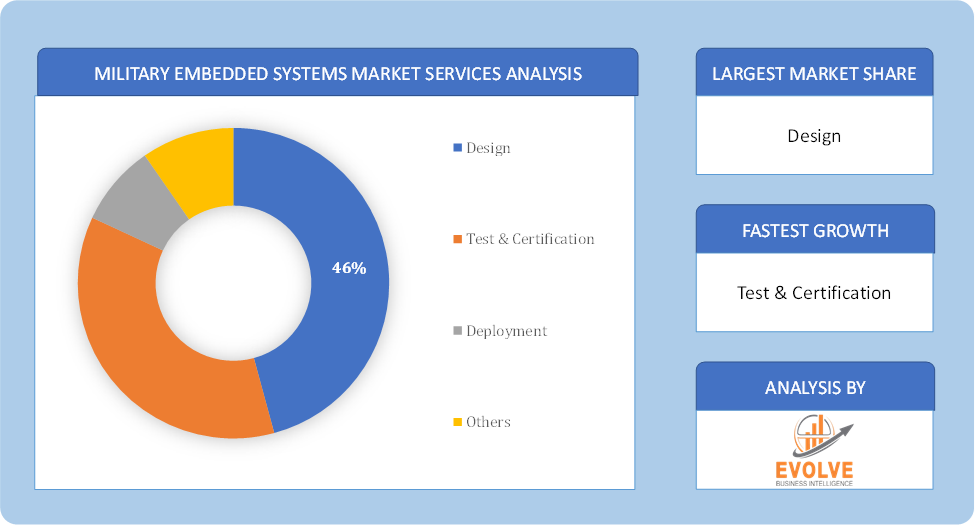

Based on Services, the market is segmented based on Design, Test & Certification, Deployment and Others. The Deployment segment dominant the market. Embedded systems used in portable military equipment such as handheld devices, communication gear, and wearable technology. Systems deployed in mobile command units or tactical operations centers for on-the-go strategic management and communication

By Application

Based on Application, the market has been divided into Intelligence, Surveillance, And Reconnaissance, Command & Control, Communication & Navigation and Others. The into Intelligence, Surveillance, And Reconnaissance segment dominant the market. The Intelligence, surveillance, and reconnaissance (ISR) in military embedded systems involve the integration of advanced hardware and software to enhance information-gathering capabilities. These systems play a pivotal role in military operations, providing real-time data for decision-making. Embedded electronics, with heightened reliability and security, support ISR applications, ensuring effective communication, navigation, and reconnaissance.

By Platform

Based on Platform, the market has been divided into Land, Airborne, Naval and Space. The Land segment dominant the market. The Land segment dominate the market. In terms of platform, land refers to the segment that encompasses embedded technologies deployed on ground-based military vehicles and systems. This includes the integration of advanced electronic systems such as communication devices, sensors, navigation systems, and real-time data processing capabilities into land-based military platforms. Land platforms serve as the foundation for a wide range of military embedded system applications, encompassing diverse technological solutions crucial for modern warfare. hosting a diverse array of technological solutions crucial for modern warfare.

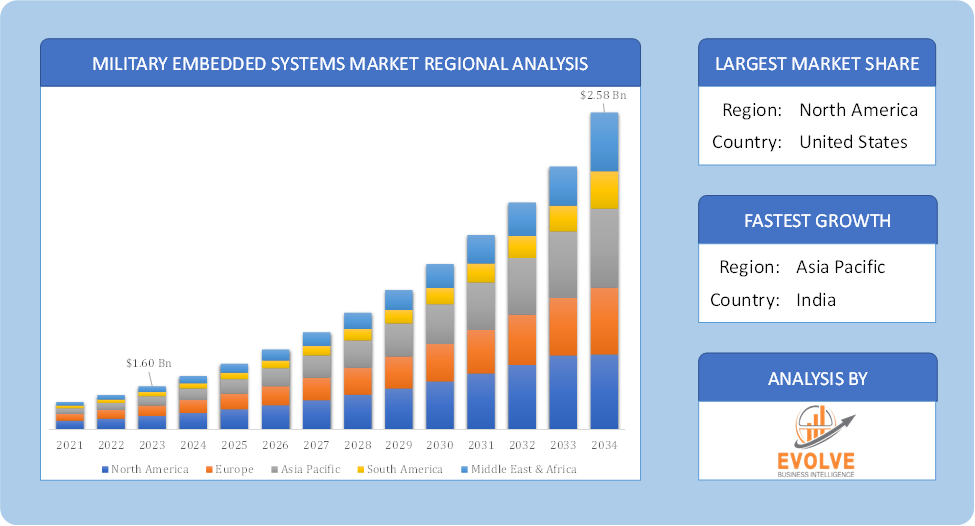

Global Military Embedded Systems Market Regional Analysis

Based on region, the global Military Embedded Systems Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Military Embedded Systems Market followed by the Asia-Pacific and Europe regions.

Military Embedded Systems North America Market

Military Embedded Systems North America Market

North America holds a dominant position in the Military Embedded Systems Market. North America is the largest and most mature market for military embedded systems, driven by the significant investments made by the US and Canadian governments in defense technologies. The region’s strong defense industry, advanced technological capabilities, and the presence of major defense contractors contribute to its dominance and the United States and Canada are significant players in this market due to substantial defense budgets and ongoing modernization programs.

Military Embedded Systems Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Military Embedded Systems Market industry. The Asia-Pacific region is the fastest-growing market for military embedded systems, driven by the increasing defense spending of countries like China, India, and Japan. The rising geopolitical tensions in the region, the modernization of military forces, and the increasing demand for advanced technologies are fueling the market growth.

Competitive Landscape

The global Military Embedded Systems Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To

Prominent Players:

- Mercury Systems

- Curtiss-Wright Corporation

- Advantech Co

- SMART Embedded Computing

- Kontron

- Xilinx

- ADLINK Technology

- Aitech Defense Systems

- Elma Electronic

- Excalibur Systems

Key Development

In September 2022 – Curtiss-Wright’s Defense Solutions division, a leading supplier of Modular Open Systems Approach (MOSA)-based solutions engineered for success, announced that it has again been selected by a leading defense system integrator to provide its embedded Security IP module technology. Under the contract, Curtiss-Wright will supply its XMC-528 Mezzanine Card to add state-of-the-art security protection to an existing system within a DoD end-state application.

Scope of the Report

Global Military Embedded Systems Market, by Services

- Design

- Test & Certification

- Deployment

- Others

Global Military Embedded Systems Market, by Application

- Intelligence

- Surveillance And Reconnaissance

- Command & Control

- Communication & Navigation

- Others

Global Military Embedded Systems Market, by Platform

- Land

- Airborne

- Naval

- Space

Global Military Embedded Systems Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 2.58 Billion |

| CAGR (2023-2033) | 8.22% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Services, Application, Platform |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Mercury Systems, Curtiss-Wright Corporation, Advantech Co, SMART Embedded Computing, Kontron, Xilinx, ADLINK Technology, Aitech Defense Systems, Elma Electronic and Excalibur Systems |

| Key Market Opportunities | · Rising Demand for Modernization Programs · Smart Warfare Solutions |

| Key Market Drivers | · Technological Advancements · Demand for Enhanced Situational Awareness |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Military Embedded Systems Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Military Embedded Systems Market historical market size for the year 2021, and forecast from 2023 to 2033

- Military Embedded Systems Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Military Embedded Systems Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Military Embedded Systems Market is 2021- 2033

What is the growth rate of the global Military Embedded Systems Market?

The global Military Embedded Systems Market is growing at a CAGR of 8.22% over the next 10 years

Which region has the highest growth rate in the market of Military Embedded Systems Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Military Embedded Systems Market?

North America holds the largest share in 2022

Who are the key players in the global Military Embedded Systems Market?

Mercury Systems, Curtiss-Wright Corporation, Advantech Co, SMART Embedded Computing, Kontron, Xilinx, ADLINK Technology, Aitech Defense Systems, Elma Electronic and Excalibur Systems are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Service Segement – Market Opportunity Score 4.1.2. Platform Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Military Embedded Systems Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Military Embedded Systems Market, By Services 7.1. Introduction 7.1.1. Design 7.1.2. Test & Certification 7.1.3. Deployment 7.1.4. Others CHAPTER 8 Military Embedded Systems Market, By Application 8.1. Introduction 8.1.1. Intelligence 8.1.2. Surveillance, And Reconnaissance 8.1.3. Command & Control 8.1.4. Communication & Navigation 8.1.5. Others CHAPTER 9. Military Embedded Systems Market, By Platform 9.1. Introduction 9.1.1. Land 9.1.2 Airborne 9.1.3 Naval 9.1.4 Space CHAPTER 10. Military Embedded Systems Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.2.2. North America: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.2.3. North America: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.2.4. North America: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.2.5.2. US: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.3. Europe: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.7.2. France: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.5.2. China: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.7.2. India: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.5.2. South America: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.5.3. South America: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.5.4. South America: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Platform, 2021 – 2034 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By System, 2021 – 2034 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Mercury Systems 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Curtiss-Wright Corporation 13.3. Advantech Co 13.4. SMART Embedded Computing 13.5. Kontron 13.6. Xilinx 13.7. ADLINK Technology 13.8. Aitech Defense Systems 13.9 Elma Electronic 13.10 Excalibur Systems

Connect to Analyst

Research Methodology