Medical Plastics Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

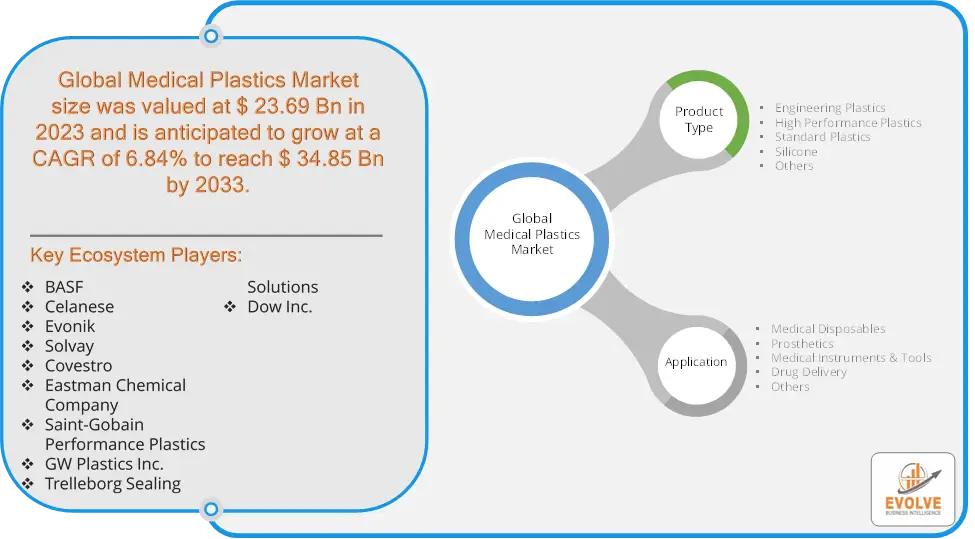

Medical Plastics Market Research Report: Information By Product Type (Engineering Plastics, High Performance Plastics, Standard Plastics, Silicone, Others), By Application (Medical Disposables, Prosthetics, Medical Instruments & Tools, Drug Delivery, Othvers), and by Region — Forecast till 2033

Page: 165

Medical Plastics Market Overview

The Medical Plastics Market Size is expected to reach USD 34.85 Billion by 2033. The Medical Plastics Market industry size accounted for USD 23.69 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.84% from 2023 to 2033. The Medical Plastics Market refers to the sector of the plastics industry that focuses on the production, distribution, and use of plastic materials specifically designed for medical applications. These plastics are used in a wide range of healthcare products due to their favourable properties, such as durability, chemical resistance, and biocompatibility.

The market is influenced by factors like advancements in medical technology, healthcare regulations, and the growing need for cost-effective healthcare solutions. The medical plastics market plays a vital role in modern healthcare, providing essential materials for a wide range of medical products.

Global Medical Plastics Market Synopsis

The COVID-19 pandemic had significantly impacted the Medical Plastics Market. The pandemic led to a surge in demand for medical plastics used in personal protective equipment (PPE), such as face shields, gloves, and masks, as well as medical devices like ventilators and testing kits. The pandemic caused disruptions in global supply chains, affecting the availability of raw materials and the distribution of finished products. The pandemic highlighted the need for more sustainable practices in the production and disposal of medical plastics. Companies are likely to invest more in building resilient supply chains and improving their capacity to handle future crises.

Medical Plastics Market Dynamics

The major factors that have impacted the growth of Medical Plastics Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in plastic materials and manufacturing processes enhance product performance, leading to greater adoption of medical plastics in advanced medical devices and implants. Rising health awareness, the prevalence of chronic diseases, and the expansion of healthcare infrastructure drive demand for a wide range of medical plastics. The preference for disposable medical products due to hygiene and infection control measures promotes the use of medical plastics. Advances in diagnostic and therapeutic technologies require specialized plastics, driving market growth. Medical plastics often provide a cost-effective alternative to metal and glass in various medical applications due to their light weight, durability, and ease of processing.

Restraint

- Perception of High Raw Material Costs and Complex Manufacturing Processes

Fluctuations in the prices of raw materials used in medical plastics can lead to increased production costs, affecting profit margins and product pricing. The production of high-performance medical plastics often involves complex and specialized manufacturing processes, which can be challenging and expensive to scale. Economic downturns and fluctuations can affect healthcare budgets and spending, potentially leading to reduced demand for certain medical plastic products.

Opportunity:

- Increased Demand for Disposable Products

The ongoing emphasis on hygiene and infection control boosts the demand for disposable medical products made from plastics, such as masks, gloves, and syringes. Innovations in manufacturing processes can enhance production efficiency, reduce costs, and improve product quality. Development of advanced polymer composites with enhanced properties can expand the range of medical applications. Developing environmentally friendly and recyclable plastic alternatives can address sustainability concerns and meet regulatory pressures. Implementing recycling and reuse strategies for medical plastics can reduce environmental impact and enhance market appeal.

Medical Plastics Market Segment Overview

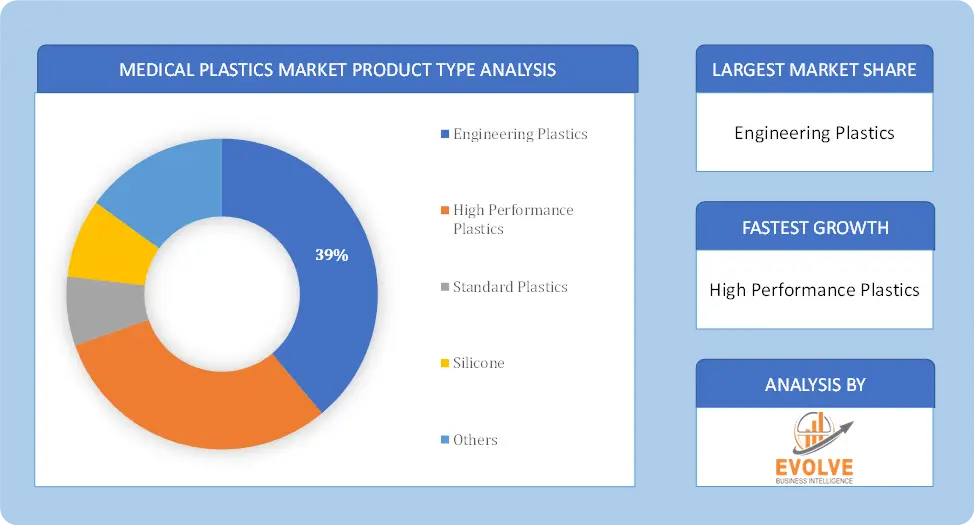

By Product Type

Based on Product Type, the market is segmented based on Engineering Plastics, High Performance Plastics, Standard Plastics, Silicone and Others. The Engineering plastics segment dominant the market. Engineering plastics offer many advantages over standard plastics, such as good ductility, faster production times, low weight, high impact, resistance to fire, impact, and chemicals, and reduced friction. Improved standards and regulations requiring high-quality plastics used in medical applications are responsible for the large market size in this segment. In addition, the increasing use of engineering plastics in robotic aids, AI-driven processes, 3D printing of implants and prostheses, and more, is driving the use of engineering plastics.

Based on Product Type, the market is segmented based on Engineering Plastics, High Performance Plastics, Standard Plastics, Silicone and Others. The Engineering plastics segment dominant the market. Engineering plastics offer many advantages over standard plastics, such as good ductility, faster production times, low weight, high impact, resistance to fire, impact, and chemicals, and reduced friction. Improved standards and regulations requiring high-quality plastics used in medical applications are responsible for the large market size in this segment. In addition, the increasing use of engineering plastics in robotic aids, AI-driven processes, 3D printing of implants and prostheses, and more, is driving the use of engineering plastics.

By Application

Based on Application, the market segment has been divided into the Medical Disposables, Prosthetics, Medical Instruments & Tools, Drug Delivery and Others. The disposable medical segment dominant the market. The usage of medical plastics is rising owing to their versatility. Disposable medical items can be defined as single-use products used in surgical and procedural applications. The use of these medical products in general health check-ups and procedural applications is increasing. The rising prevalence of chronic diseases, changing lifestyles of middle-income groups, demand for better healthcare facilities, and increasing aging population are the main drivers of the market.

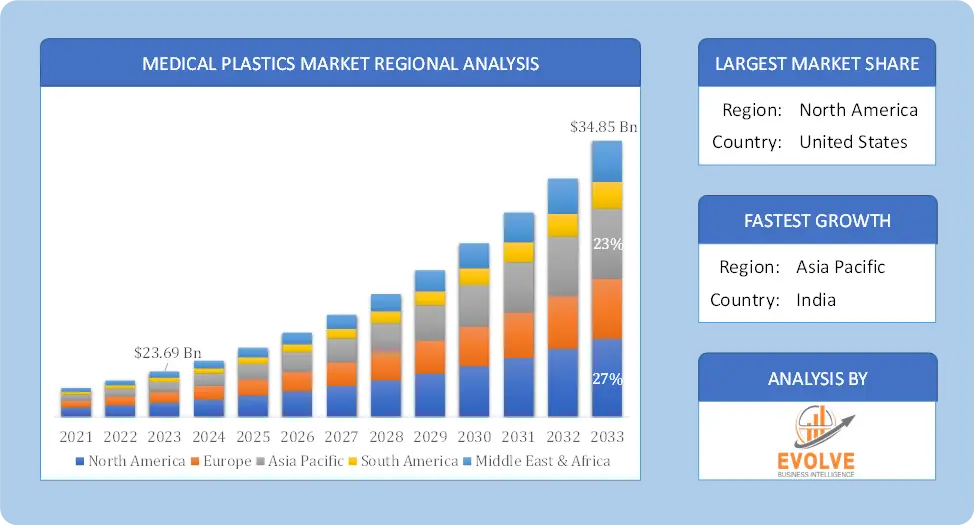

Global Medical Plastics Market Regional Analysis

Based on region, the global Medical Plastics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Medical Plastics Market followed by the Asia-Pacific and Europe regions.

Global Medical Plastics North America Market

Global Medical Plastics North America Market

North America holds a dominant position in the Medical Plastics Market. A mature market with established healthcare systems and a strong focus on medical innovation. The United States is the largest consumer of medical plastics due to a large elderly population and advanced medical technology and Canada is also a significant market with a growing healthcare sector.

Global Medical Plastics Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Medical Plastics Market industry. China and India are major manufacturing hubs due to low labor costs and increasing domestic demand. Other countries like Japan, South Korea, and Singapore are also significant contributors due to advanced healthcare infrastructure and technological advancements and rapid urbanization and growing middle class are driving market growth.

Competitive Landscape

The global Medical Plastics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BASF

- Celanese

- Evonik

- Solvay

- Covestro

- Eastman Chemical Company

- Saint-Gobain Performance Plastics

- GW Plastics Inc.

- Trelleborg Sealing Solutions

- Dow Inc.

Key Development

In April 2022: Solvay, a leading global polymer supplier, has unveiled a novel medical grade of Ixef PARA for single-use surgical tools and biopharma processing components with moving blades.

In December 2021: SABIC unveiled a novel portfolio of bio-based ULTEM resins that can provide environmental advantages while preserving the same superior efficiency and processability as original ULTEM materials.

Scope of the Report

Global Medical Plastics Market, by Product Type

- Engineering Plastics

- High Performance Plastics

- Standard Plastics

- Silicone

- Others

Global Medical Plastics Market, by Application

- Medical Disposables

- Prosthetics

- Medical Instruments & Tools

- Drug Delivery

- Others

Global Medical Plastics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $34.85 Billion |

| CAGR | 6.84% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF, Celanese, Evonik, Solvay, Covestro, Eastman Chemical Company, Saint-Gobain Performance Plastics, GW Plastics Inc., Trelleborg Sealing Solutions and Dow Inc. |

| Key Market Opportunities | • Increased Demand for Disposable Products • Sustainable Plastics Development |

| Key Market Drivers | • Technological Advancements • Rising Demand for Diagnostic and Therapeutic Devices: |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Medical Plastics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Medical Plastics Market historical market size for the year 2021, and forecast from 2023 to 2033

- Medical Plastics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Medical Plastics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Medical Plastics Market is 2021- 2033

What is the growth rate of the global Medical Plastics Market?

The global Medical Plastics Market is growing at a CAGR of 6.84% over the next 10 years

Which region has the highest growth rate in the market of Medical Plastics Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Medical Plastics Market?

North America holds the largest share in 2022

Who are the key players in the global Medical Plastics Market?

BASF, Celanese, Evonik, Solvay, Covestro, Eastman Chemical Company, Saint-Gobain Performance Plastics, GW Plastics Inc., Trelleborg Sealing Solutions and Dow Inc. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Medical Plastics Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Medical Plastics Market, By Product Type 6.1. Introduction 6.2. Engineering plastics 6.3. High performance plastics 6.3. Standard plastics 6.4. Silicone Chapter 7. Global Medical Plastics Market, By Application 7.1. Introduction 7.2. Medical disposables 7.3. Prosthetics 7.4. Medical instruments & tools 7.5. Drug delivery Chapter 8. Global Medical Plastics Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2026 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2026 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. BASF 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Celanese 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Evonik 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Solvay 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Covestro 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Eastman Chemical Company 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Saint-Gobain Performance Plastics 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. GW Plastics, Inc. 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Trelleborg Sealing Solutions 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Dow Inc. 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology