Medical Device Security Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

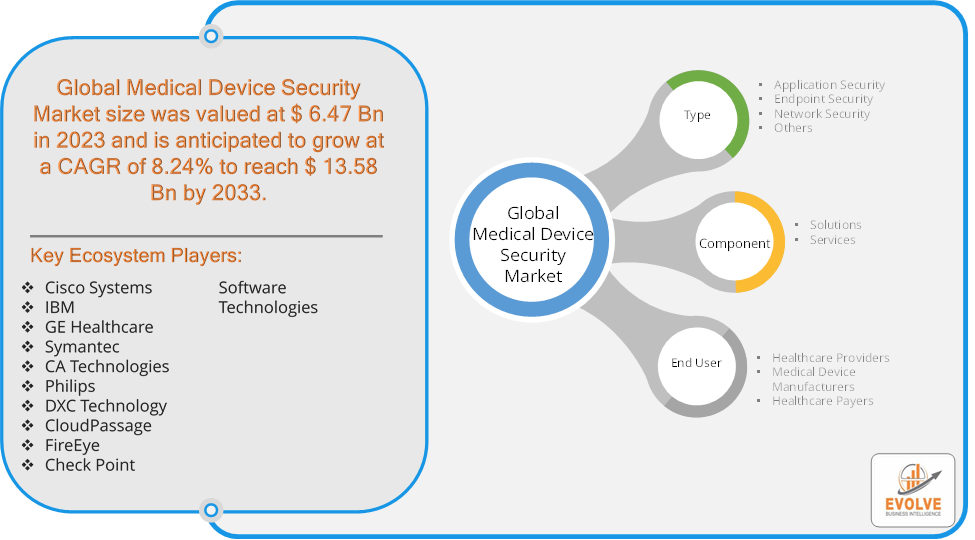

Medical Device Security Market Research Report: Information By Type (Application Security, Endpoint Security, Network Security, Others), By Component (Solutions, Services), By End User (Healthcare Providers, Medical Device Manufacturers, Healthcare Payers), and by Region — Forecast till 2033

Page: 163

Medical Device Security Market Overview

The Medical Device Security Market Size is expected to reach USD 13.58 Billion by 2033. The Medical Device Security Market industry size accounted for USD 6.47 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.24% from 2023 to 2033. The Medical Device Security Market refers to the sector focused on protecting medical devices from cybersecurity threats. This market encompasses a range of products, services, and solutions designed to safeguard medical devices from unauthorized access, cyberattacks, and other security breaches.

The primary drivers of this market include the increasing prevalence of connected medical devices (Internet of Medical Things or IoMT), the rising number of cyberattacks in the healthcare sector, stringent regulatory requirements, and growing awareness about the importance of medical device security. Key stakeholders in this market include medical device manufacturers, healthcare providers, cybersecurity firms, and regulatory bodies.

Global Medical Device Security Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic has significantly impacted the Medical Device Security Market. The pandemic accelerated the adoption of telemedicine and remote patient monitoring, leading to a surge in the use of connected medical devices. This increase highlighted the need for robust security measures to protect these devices from cyber threats. The healthcare sector saw a rise in cyberattacks during the pandemic. Hospitals and healthcare providers became prime targets for ransomware and other cyber threats, emphasizing the critical need for enhanced security solutions for medical devices. The heightened awareness of cybersecurity risks has led to increased investments in medical device security solutions. Healthcare providers and medical device manufacturers are allocating more resources to ensure their devices are secure. The pandemic has spurred innovation in the medical device security market. Companies are developing advanced security solutions, including AI-driven cybersecurity, encryption technologies, and secure communication protocols, to protect medical devices.

Medical Device Security Market Dynamics

The major factors that have impacted the growth of Medical Device Security Market are as follows:

Drivers:

Ø Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks targeting healthcare systems and medical devices are a major driver. The need to protect sensitive patient data and ensure the functionality of life-saving devices has heightened the focus on security. The growing adoption of the Internet of Medical Things (IoMT), which connects medical devices to networks and the internet, increases the attack surface for potential cyber threats, driving the demand for robust security solutions. The shift towards telemedicine and remote patient monitoring, accelerated by the COVID-19 pandemic, has led to a surge in the use of connected medical devices. This trend necessitates enhanced security measures to protect data and device integrity.

Restraint:

- Perception of High Implementation Costs

Implementing robust security solutions for medical devices can be expensive. The costs associated with developing, deploying, and maintaining these solutions can be a significant barrier for smaller healthcare providers and medical device manufacturers. The absence of universal standards for medical device security can create challenges for manufacturers and healthcare providers. Inconsistent regulatory requirements across different regions can complicate compliance and hinder market growth.

Opportunity:

⮚ Advancements in AI and Machine Learning

Leveraging artificial intelligence (AI) and machine learning (ML) technologies can enhance the detection and prevention of cyber threats. These technologies can be used to develop advanced security solutions that can identify and mitigate threats in real-time. The expansion of telemedicine and remote patient monitoring, accelerated by the COVID-19 pandemic, creates a need for secure communication and data protection solutions. This trend offers opportunities to develop specialized security solutions for remote healthcare services.

Medical Device Security Market Segment Overview

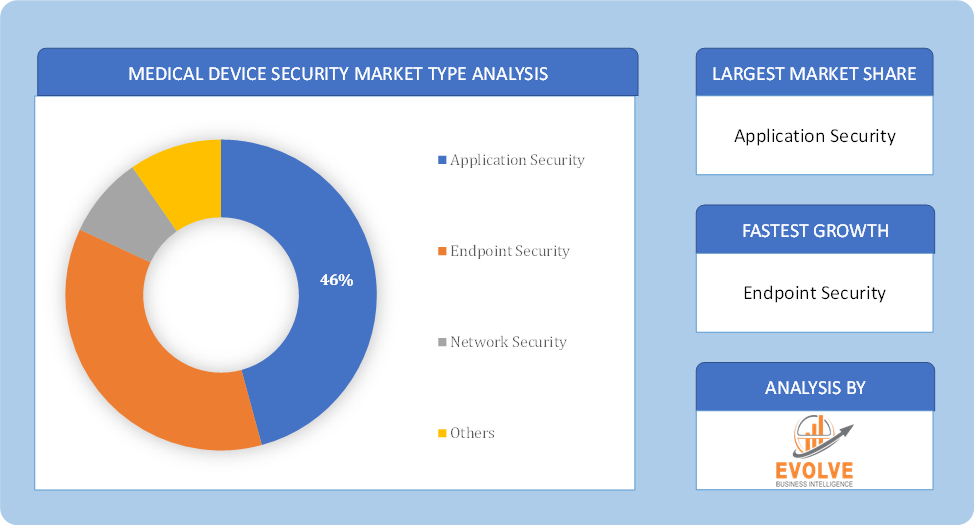

By Type

Based on Type, the market is segmented based on Application Security, Endpoint Security, Network Security and Others. The endpoint security category is predicted to dominate the market. The substantial share of this segment is due to factors such as the increasing number of connected medical equipment, as well as networks becoming more vulnerable to new and sophisticated attacks such as zero-day malware, trojans, and APIs. Furthermore, the trend of BYOD, social media usage and cloud-synchronizing technologies is driving the market growth.

By Component

Based on Component, the market segment has been divided into the Solutions and Services. Solution is designed to protect medical devices and the data they handle from cybersecurity threats. There are many uses of medical device security market solutions, such as to secure medical devices, network, and data. Encryption solutions help protect patient confidentiality and integrity. In line with this, they assist in minimizing the risk of data breaches and unauthorized interception.

By End User

Based on End Users, the market segment has been divided into the Healthcare Providers, Medical Device Manufacturers and Healthcare Payers. The Healthcare providers segment is predicted to hold the highest share of the medical device security market. The high demand for connected networked medical devices among healthcare professionals, as a result of the multiple benefits offered by these devices, has contributed to the segment’s rise.

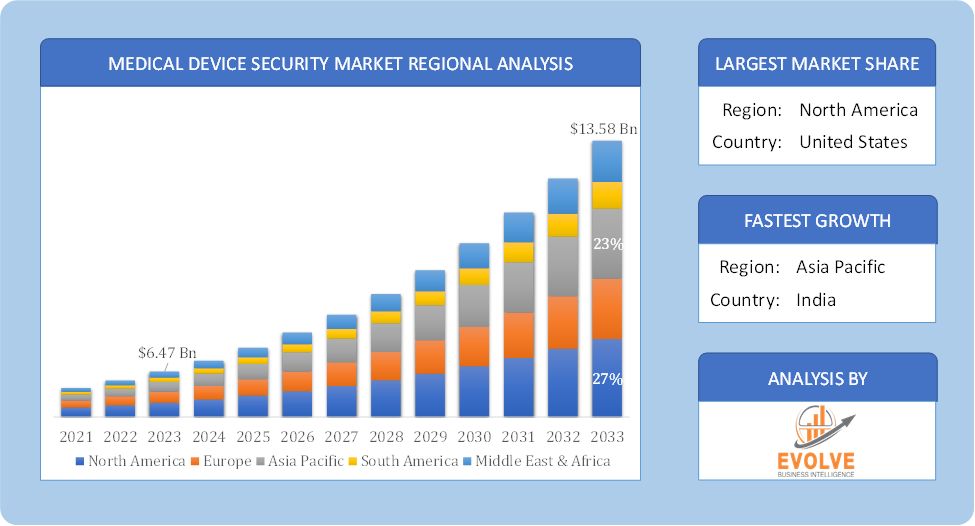

Global Medical Device Security Market Regional Analysis

Based on region, the global Medical Device Security Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Medical Device Security Market followed by the Asia-Pacific and Europe regions.

Medical Device Security North America Market

North America holds a dominant position in the Medical Device Security Market. North America, particularly the United States, holds a significant share of the Medical Device Security Market. The region’s advanced healthcare infrastructure and high adoption rate of connected medical devices drive market growth. Stringent regulations by bodies such as the FDA mandate robust cybersecurity measures for medical devices, propelling market demand. High levels of investment in healthcare IT and the presence of key cybersecurity firms enhance the development and implementation of advanced security solutions.

Medical Device Security Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Medical Device Security Market industry. The Asia-Pacific region is experiencing rapid growth due to increasing healthcare expenditure, rising adoption of connected medical devices, and expanding healthcare infrastructure in countries like China, India, and Japan. Emerging regulatory frameworks in the region are starting to address medical device cybersecurity, though they are less mature compared to North America and Europe. The region is seeing significant investments in healthcare IT, fostering the development of security solutions.

Competitive Landscape

The global Medical Device Security Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as End User launches, and strategic alliances.

Prominent Players:

- Cisco Systems

- IBM

- GE Healthcare

- Symantec

- CA Technologies

- Philips

- DXC Technology

- CloudPassage

- FireEye

- Check Point Software Technologies

Key Development

In August 2023, Medcrypt Inc., the proactive cybersecurity solution provider for medical device manufacturers (MDMs), partnered with NetRise, the company providing granular visibility into the world’s XIoT security problem. This partnership will provide MDMs with a Software Bill of Materials (SBOM) lifecycle management solution that will empower device makers to proactively identify and address potential security risks while ensuring the safety and integrity of their medical devices.

Scope of the Report

Global Medical Device Security Market, by Type

- Application Security

- Endpoint Security

- Network Security

- Others

Global Medical Device Security Market, by Component

- Solutions

- Services

Global Medical Device Security Market, by End User

- Healthcare Providers

- Medical Device Manufacturers

- Healthcare Payers

Global Medical Device Security Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 13.58 Billion |

| CAGR (2023-2033) | 8.24% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Component, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Cisco Systems, IBM, GE Healthcare, Symantec, CA Technologies, Philips, DXC Technology, CloudPassage, FireEye and Check Point Software Technologies. |

| Key Market Opportunities | · Advancements in AI and Machine Learning · Telemedicine and Remote Patient Monitoring |

| Key Market Drivers | · Rising Cybersecurity Threats · Increase in Telemedicine and Remote Patient Monitoring |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Medical Device Security Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Medical Device Security Market historical market size for the year 2021, and forecast from 2023 to 2033

- Medical Device Security Market share analysis at each End User level

- Competitor analysis with detailed insight into its End User segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including End User launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Medical Device Security Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, End User offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Medical Device Security Market is 2021- 2033

What is the growth rate of the global Medical Device Security Market?

The global Medical Device Security Market is growing at a CAGR of 8.24% over the next 10 years

Which region has the highest growth rate in the market of Medical Device Security Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Medical Device Security Market?

North America holds the largest share in 2022

Who are the key players in the global Medical Device Security Market?

Cisco Systems, IBM, GE Healthcare, Symantec, CA Technologies, Philips, DXC Technology, CloudPassage, FireEye and Check Point Software Technologies. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Component Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Application 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Medical Device Security Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Medical Device Security Market, By Type 7.1. Introduction 7.1.1. Application Security 7.1.2. Endpoint Security 7.1.3. Network Security 7.1.4. Others CHAPTER 8 Medical Device Security Market, By Component 8.1. Introduction 8.1.1. Solutions 8.1.2. Services CHAPTER 9. Medical Device Security Market, By End User 9.1. Introduction 9.1.1. Healthcare Providers 9.1.2 Medical Device Manufacturers 9.1.3 Healthcare Payers CHAPTER 10. Medical Device Security Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Typess, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Cisco Systems 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. End User Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. IBM 13.3. GE Healthcare 13.4. Symantec 13.5. CA Technologies 13.6. Philips 13.7. DXC Technology 13.8. CloudPassage 13.9 FireEye 13.10 Check Point Software Technologies

Connect to Analyst

Research Methodology