Media & Entertainment Storage Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

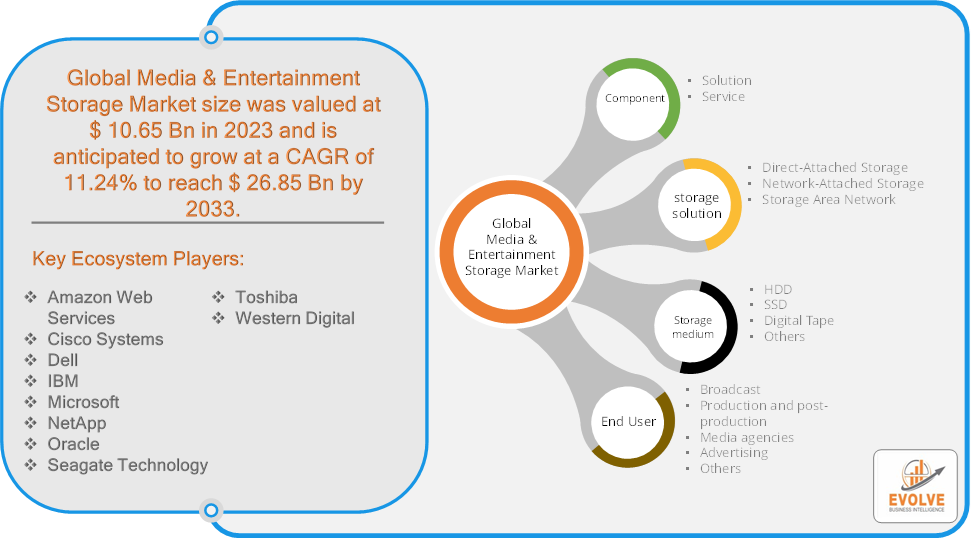

Media & Entertainment Storage Market Research Report: Information By Component (Solution, Services), By Storage Solution (Direct-Attached Storage, Network-Attached Storage, Storage Area Network), By Storage Medium (HDD, SSD, Digital Tape, Others), By End-User (Broadcast, Production and post-production, Media agencies, Advertising, Others), and by Region — Forecast till 2033

Page: 171

Media & Entertainment Storage Market Overview

The Media & Entertainment Storage Market Size is expected to reach USD 26.85 Billion by 2033. The Media & Entertainment Storage Market industry size accounted for USD 10.65 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.24% from 2023 to 2033. The Media & Entertainment Storage Market refers to the industry segment that focuses on providing storage solutions tailored to the needs of media and entertainment companies. These solutions include hardware, software, and cloud-based systems designed to store, manage, and retrieve large volumes of digital content such as videos, music, graphics, and other multimedia files.

The market is driven by the exponential growth in digital content creation and consumption, requiring more sophisticated storage solutions to manage the increasing volume, diversity, and quality of media files.

Global Media & Entertainment Storage Market Synopsis

The COVID-19 pandemic had a significant impact on the Media & Entertainment Storage Market. With global lockdowns and social distancing measures, there was a sharp increase in the consumption of digital content, especially through streaming platforms like Netflix, Disney+, and Amazon Prime. This led to a surge in demand for storage solutions capable of handling large volumes of high-definition (HD) and ultra-high-definition (UHD) video content. The gaming industry saw a significant boost as people turned to video games for entertainment during lockdowns. This created a need for enhanced storage solutions to support game development, distribution, and the management of large gaming files. The pandemic accelerated the adoption of cloud storage and hybrid cloud solutions, enabling seamless access, management, and storage of media assets across distributed teams. This shift was essential for maintaining productivity and meeting content delivery timelines. Even as restrictions eased, many companies continued with hybrid work models, maintaining the reliance on cloud-based storage solutions. This trend is likely to persist, influencing future investments in media storage infrastructure. The habits formed during the pandemic, such as increased streaming and gaming, have continued post-pandemic, sustaining the demand for advanced storage solutions in the media and entertainment sector.

Media & Entertainment Storage Market Dynamics

The major factors that have impacted the growth of Media & Entertainment Storage Market are as follows:

Drivers:

Ø Exponential Growth in Digital Content Creation

The shift to 4K, 8K, and even higher resolutions in video content is driving the need for more storage capacity. Higher resolutions generate larger file sizes, requiring storage solutions that can handle vast amounts of data efficiently. The rise of virtual reality (VR), augmented reality (AR), and 360-degree video content has further increased the demand for storage that can accommodate these complex and data-intensive formats. Increasing internet access, especially in developing regions, is driving the consumption of digital media, thereby boosting the demand for media storage solutions globally. To reach diverse audiences, media companies are creating localized content in multiple languages, further increasing storage requirements.

Restraint:

- Perception of Data Security and Privacy Concerns

As digital content becomes more valuable, the risk of cyberattacks targeting media storage systems increases. High-profile breaches can result in the loss of sensitive or unreleased content, leading to financial and reputational damage. Media companies must navigate complex data protection regulations, such as GDPR in Europe or CCPA in California, which impose strict requirements on how data is stored, accessed, and managed. Non-compliance can result in heavy fines and legal challenges.

Opportunity:

⮚ Expansion of Cloud Storage Solutions

The growing adoption of cloud storage solutions offers media companies scalable and flexible options to manage their expanding content libraries. Providers can capitalize on this trend by offering tailored cloud solutions that address specific needs in media and entertainment. Developing hybrid cloud solutions that integrate on-premises storage with cloud-based storage can appeal to media companies looking for a balance between local control and cloud scalability. There is a growing need for advanced data security solutions to protect valuable media assets. Providers can offer storage systems with integrated encryption, access controls, and threat detection to address security concerns.

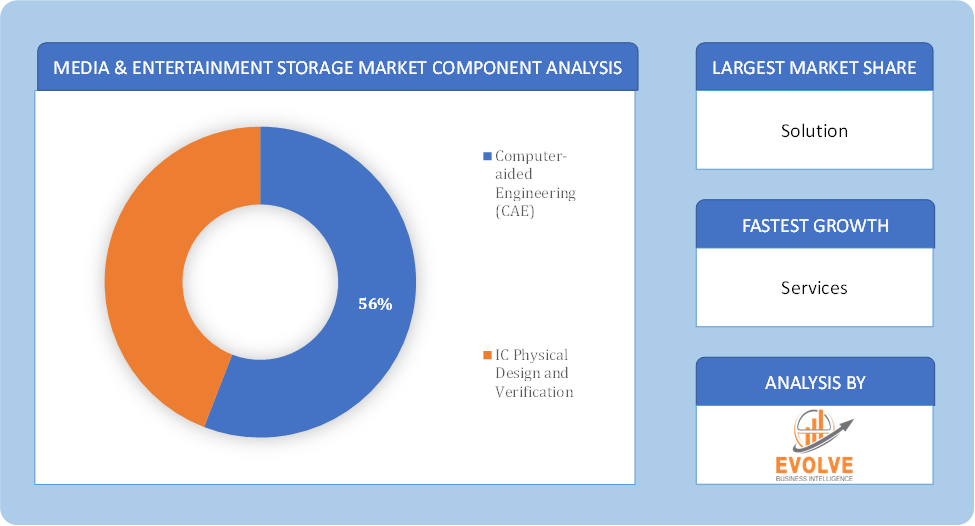

Media & Entertainment Storage Market Segment Overview

Based on Component, the market is segmented based on Solution and Services. The Solution segment dominant the market.

By Storage Solution

Based on Storage Solution, the market segment has been divided into Direct-Attached Storage, Network-Attached Storage and Storage Area Network. The direct-attached storage segment dominant the market. The growing demand for direct-attached storage (DAS) is contributing to the market growth as it offers low-latency performance, which is essential for real-time media editing and processing tasks. Besides this, the direct connection to the host system allows for high-speed data transfers, making it highly effective for time-sensitive operations, which increases its appeal.

By Storage Medium

Based on Storage Medium, the market segment has been divided into HDD, SSD, Digital Tape and Others. The HDD segment dominant the market. Hard disk drives (HDDs) offer a high storage capacity at a relatively lower cost per gigabyte compared to other storage mediums like Solid-State Drives (SSDs). This cost-effectiveness is crucial for industries handling vast amounts of data, such as high-definition videos and complex graphics. In line with this, HDDs have matured as a technology, making them a reliable and well-understood storage medium, instilling confidence in their deployment for large-scale storage needs.

By End User

Based on End User, the market segment has been divided into Broadcast, Production and post-production, Media agencies, Advertising and Others. The production and post-production segment dominant the market. Production and post-production segments are driving the growth of the media & entertainment storage market primarily due to the data-intensive nature of their operations. These stages involve the capture, editing, and rendering of high-resolution digital content, processes that require immense storage capabilities. Besides this, the shift towards higher resolution formats, such as 4K and 8K, has further exacerbated the need for efficient and robust storage systems, creating a positive outlook for market growth.

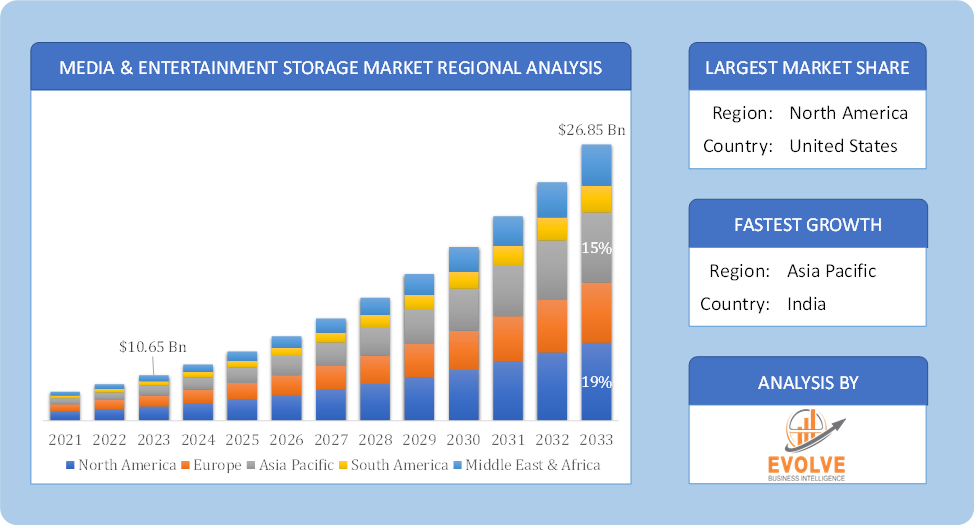

Global Media & Entertainment Storage Market Regional Analysis

Based on region, the global Media & Entertainment Storage Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Media & Entertainment Storage Market followed by the Asia-Pacific and Europe regions.

Media & Entertainment Storage North America Market

Media & Entertainment Storage North America Market

North America holds a dominant position in the Media & Entertainment Storage Market. North America, particularly the United States, is a major player in the Media & Entertainment Storage Market due to its well-established media and entertainment industry, including Hollywood studios, streaming services, and content creators. There is significant adoption of cloud-based storage solutions and advanced technologies such as AI and machine learning for media asset management and there is high demand for seamless streaming services has led to substantial investment in CDNs and high-performance storage solutions to support large-scale content delivery.

Media & Entertainment Storage Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Media & Entertainment Storage Market industry. The Asia-Pacific region is experiencing rapid growth in the Media & Entertainment Storage Market due to increasing internet penetration, rising digital content consumption, and the expansion of media industries in countries like China, India, and Japan. Emerging markets in Southeast Asia and South Asia are witnessing growing demand for storage solutions as local media companies and streaming platforms expand their operations and there is high mobile internet usage and the popularity of over-the-top (OTT) platforms drive the need for scalable and flexible storage solutions.

Competitive Landscape

The global Media & Entertainment Storage Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Amazon Web Services

- Cisco Systems

- Dell

- IBM

- Microsoft

- NetApp

- Oracle

- Seagate Technology

- Toshiba

- Western Digital

Key Development

In September 2023, AWS for Media & Entertainment announced the launch of a new Monetization solution, allowing customers to simplify and modernize their advertising, licensing, subscription, and marketing technology strategies.

In May 2020, Dell Technologies and Google Cloud launched Dell Technologies Cloud OneFS for Google Cloud to allow organizations to control exponential data and application growth and ease the flow of files across their private clouds and Google Cloud.

Scope of the Report

Global Media & Entertainment Storage Market, by Component

- Solution

- Services

Global Media & Entertainment Storage Market, by storage solution

- Direct-Attached Storage

- Network-Attached Storage

- Storage Area Network

Global Media & Entertainment Storage Market, by Storage medium

- HDD

- SSD

- Digital Tape

- Others

Global Media & Entertainment Storage Market, by End User

- Broadcast

- Production and post-production

- Media agencies

- Advertising

- Others

Global Media & Entertainment Storage Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 26.85 Billion |

| CAGR (2023-2033) | 11.24% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Storage Solution, Storage Medium, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Amazon Web Services, Cisco Systems, Dell, IBM, Microsoft, NetApp, Oracle, Seagate Technology, Toshiba and Western Digital |

| Key Market Opportunities | · Expansion of Cloud Storage Solutions · Enhanced Data Security Solutions |

| Key Market Drivers | · Exponential Growth in Digital Content Creation · Global Expansion of Digital Media |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Media & Entertainment Storage Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Media & Entertainment Storage Market historical market size for the year 2021, and forecast from 2023 to 2033

- Media & Entertainment Storage Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Media & Entertainment Storage Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Media & Entertainment Storage Market is 2021- 2033

What is the growth rate of the global Media & Entertainment Storage Market?

The global Media & Entertainment Storage Market is growing at a CAGR of 11.24% over the next 10 years

Which region has the highest growth rate in the market of Media & Entertainment Storage Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Media & Entertainment Storage Market?

North America holds the largest share in 2022

Who are the key players in the global Media & Entertainment Storage Market?

Amazon Web Services, Cisco Systems, Dell, IBM, Microsoft, NetApp, Oracle, Seagate Technology, Toshiba and Western Digital are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Component Segement – Market Opportunity Score 4.1.2. Storage Solution Segment – Market Opportunity Score 4.1.3. Storage Medium Segment – Market Opportunity Score 4.1.4. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Media & Entertainment Storage Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Media & Entertainment Storage Market, By Component 7.1. Introduction 7.1.1. Solution 7.1.2. Services CHAPTER 8. Media & Entertainment Storage Market, By Storage Solution 8.1. Introduction 8.1.1. Direct-Attached Storage 8.1.2. Network-Attached Storage 8.1.3. Storage Area Network CHAPTER 9. Media & Entertainment Storage Market, By Storage Medium 9.1. Introduction 9.1.1. HDD 9.1.2. SSD 9.1.3. Digital Tape 9.1.4. Others CHAPTER 10. Media & Entertainment Storage Market, By End User 10.1.Introduction 10.1.1. Broadcast 10.1.2. Production and post-production 10.1.3. Media agencies 10.1.4. Advertising 10.1.5. Others CHAPTER 11. Media & Entertainment Storage Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Storage Solution, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Storage Medium, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Alcatel-Lucent Enterprise 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Avaya Inc. 13.3. Cisco Systems Inc. 13.4. Huawei Technologies Co. Ltd. 13.5. Microsoft Corporation 13.6. Mitel Corporation 13.7. NEC Corporation 13.8. Nice Systems Ltd. 13.9. Oracle Corporation 13.10. Genesys

Connect to Analyst

Research Methodology