Low Calorie Drinks Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Low Calorie Drinks Market Research Report: Information By Product (Artificial Sweetener, Natural Sweetener), By Distribution Channel (Supermarkets/Hypermarkets, Departmental Stores, Online Retail Stores, and Others), and By Region — Forecast till 2033

Page: 208

Press Release: https://evolvebi.com/low-calorie-drinks-market-2021-2033-trends-and-predictions/Low Calorie Drinks Market Overview

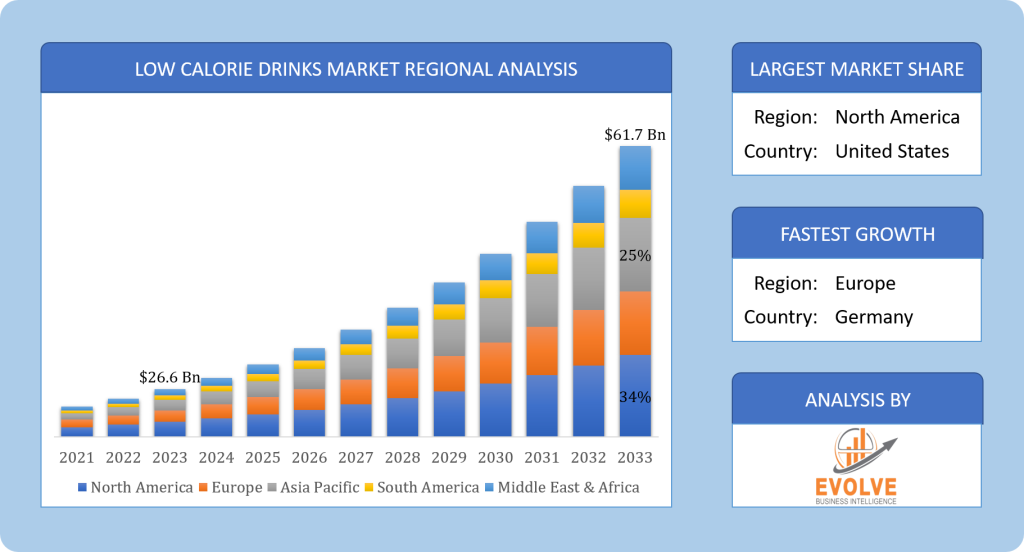

The global Low Calorie Drinks Market Size is expected to reach USD 61.7 Billion by 2033. The global Low Calorie Drinks industry size accounted for USD 26.6 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2033. In today’s fast-paced world, where health and wellness have become paramount, the low-calorie drinks market has emerged as a beacon for those seeking healthier beverage options. Low-calorie drinks, also known as reduced-calorie or light beverages, are specially formulated to provide a refreshing and flavorful experience while containing fewer calories compared to their regular counterparts. These drinks have gained popularity among health-conscious individuals who are keen on reducing their calorie intake without compromising on taste and enjoyment. With a wide range of low-calorie drinks available in the market, consumers now have an array of options to choose from. From carbonated soft drinks and fruit juices to teas and flavored water, low-calorie beverages have found applications across various segments, including retail, foodservice, and online channels. These drinks cater to a diverse consumer base, ranging from fitness enthusiasts and weight-conscious individuals to those managing health conditions such as diabetes.

Global Low-Calorie Drinks Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic has significantly impacted the global beverage industry, including the low-calorie drinks market. As the world grappled with the health crisis, there was an increased focus on personal health and well-being. This shift in consumer mindset led to a surge in demand for low-calorie beverages as people sought out healthier options to boost their immunity and maintain a balanced lifestyle.

During the pandemic, with restrictions on dining out and increased time spent at home, consumers turned to retail channels to purchase low-calorie drinks. The convenience and safety offered by online platforms and home delivery services further fueled the growth of this market segment. Post-COVID, as economies gradually recover and restrictions ease, the demand for low-calorie drinks is expected to remain strong, driven by the growing health consciousness among consumers.

Low Calorie Drinks Market Dynamics

The major factors that have impacted the growth of Low Calorie Drinks are as follows:

Drivers:

- Rising Health Consciousness Fuels the Low Calorie Drinks Market

The growing emphasis on health consciousness among consumers has been a significant driver for the low-calorie drinks market. In an era where obesity rates are rising, and lifestyle diseases are becoming increasingly prevalent, individuals are becoming more aware of the importance of making healthier choices, including their beverage options. This has created a shift in consumer preferences, leading to an increased demand for low-calorie drinks.

Consumers today are actively seeking out beverages that align with their health goals. They are increasingly aware of the impact of excessive sugar consumption on their well-being and are choosing low-calorie drinks as a healthier alternative. These beverages allow them to indulge in flavorful options while keeping their calorie intake in check. Moreover, low-calorie drinks often incorporate natural and organic ingredients, further appealing to health-conscious consumers.

Restraint:

- Regulatory Challenges Pose a Barrier

While the low-calorie drinks market experiences remarkable growth, it is not immune to certain challenges, with regulatory hurdles being a significant restraining factor. The formulation and marketing of low-calorie beverages require compliance with various regulations and guidelines imposed by regulatory authorities. These regulations aim to ensure the safety, labeling accuracy, and quality of the products, but they can create obstacles for manufacturers and impact the market dynamics.

One of the key challenges in the low-calorie drinks market is the complex and ever-changing landscape of food and beverage regulations. Different countries and regions have their own set of rules and standards regarding ingredients, labeling, health claims, and nutritional information. Complying with these regulations can be time-consuming and costly for manufacturers, especially for companies operating in multiple markets. Failure to meet these regulatory requirements can lead to product recalls, fines, and damage to brand reputation.

Opportunity:

- Rising Consumer Awareness and Market Expansion

While regulatory challenges exist, the low-calorie drinks market also presents numerous opportunities driven by rising consumer awareness and expanding market reach. As more individuals become health-conscious and seek to adopt healthier lifestyles, the demand for low-calorie beverages continues to grow.

One significant opportunity lies in consumer education and awareness campaigns. As consumers become more informed about the health risks associated with excessive sugar intake, they actively seek out healthier alternatives. Manufacturers and industry associations can seize this opportunity by conducting awareness campaigns to educate consumers about the benefits of low-calorie drinks, including their role in weight management, diabetes control, and overall well-being. By emphasizing the positive impact of low-calorie beverages on health, manufacturers can tap into new consumer segments and expand their market reach.

Low Calorie Drinks Segment Overview

By Product

Based on the Product, the market is segmented based on Artificial Sweetener, and Natural Sweetener. Artificial sweeteners hold the largest share in the low-calorie drinks market. These sweeteners have been widely adopted by manufacturers due to their high sweetness intensity, low-calorie content, and stability under various processing conditions. Artificial sweeteners enable the creation of low-calorie beverages that closely mimic the taste of their sugary counterparts, appealing to consumers who desire a guilt-free indulgence.

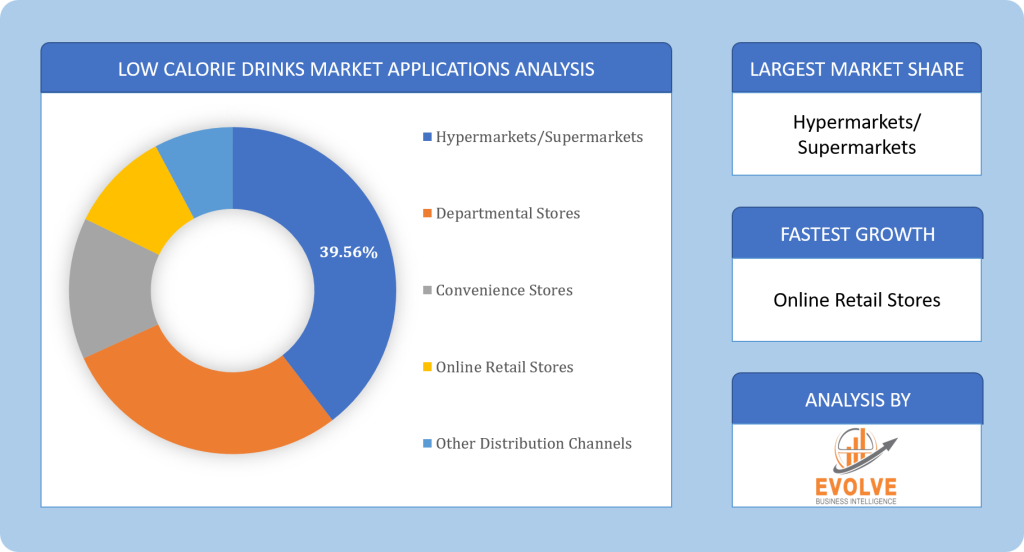

By Distribution Channel

Based on Distribution Channel, the market has been divided into Supermarkets/Hypermarkets, Departmental Stores, Online Retail Stores, and Others. supermarkets/hypermarkets hold the largest share in the distribution of low-calorie drinks. These stores offer a wide range of beverage options, including low-calorie drinks, making them easily accessible to consumers. The convenience of one-stop shopping and the ability to compare different products play a significant role in the popularity of supermarkets/hypermarkets as a distribution channel.

Global Low Calorie Drinks Market Regional Analysis

Based on region, the global Low Calorie Drinks market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America has emerged as a leading market for low-calorie drinks, driven by several factors. The region has been grappling with the increasing prevalence of obesity and related health concerns, prompting individuals to seek healthier alternatives to high-calorie beverages. This rising awareness about the impact of excess sugar consumption on health has fueled the demand for low-calorie drinks.

In addition to health consciousness, shifting consumer preferences and a desire for healthier lifestyles have played a crucial role in market growth. There has been a significant cultural shift towards clean eating and wellness, leading consumers to actively seek low-calorie options. This trend is further supported by a robust fitness culture and a focus on weight management among individuals in North America. Furthermore, the presence of well-established beverage companies and a highly developed retail infrastructure in the region has facilitated the availability and accessibility of low-calorie drinks. Supermarkets, convenience stores, and specialty health stores stock a wide range of low-calorie beverage options, catering to the diverse needs and preferences of consumers.

Europe Market

Europe has also been a leading market for low-calorie drinks, with countries like the United Kingdom, Germany, and France at the forefront of the industry. The region has witnessed a notable rise in health consciousness and a growing focus on reducing sugar consumption, leading to an increased demand for low-calorie beverages. Regulatory initiatives and campaigns promoting healthier lifestyles have played a significant role in shaping consumer behavior in Europe. For instance, the introduction of sugar taxes and stricter labeling regulations has pushed consumers to opt for low-calorie drinks as a healthier alternative. These regulations have compelled manufacturers to reformulate their products, reducing sugar content and offering low-calorie options.

Moreover, Europe has a strong tradition of functional beverages, which has further driven the demand for low-calorie drinks. Consumers are increasingly seeking beverages that not only provide hydration but also offer additional health benefits. Low-calorie drinks enriched with vitamins, minerals, and antioxidants are gaining popularity among health-conscious individuals in the region.

Competitive Landscape

The global Low Calorie Drinks market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Diageo plc.

- Asahi Breweries, Ltd.

- Global Brands Limited

- Bacardi Limited

- Kold Group

- PepsiCo, Inc.

- THE COCA-COLA COMPANY

- SGC Global, LLC

- Malibu Drinks

- Herbal Water, Inc.

Key Development:

January 2021: The company Diageo launched a low-calorie Seltzer (Club Soda) under its brand Smirnoff. The company also provides these low-calorie RTD beverages which also have low carbohydrates, zero-sugar, and synthetic sweeteners.

Scope of the Report

Global Low Calorie Drinks Market, by Product

- Artificial Sweetener

- Natural Sweetener

Global Low Calorie Drinks Market, by Distribution Channel

- Supermarkets/Hypermarkets

- Departmental Stores

- Online Retail Stores

- Others

Global Low Calorie Drinks Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 61.7 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 8.4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Distribution Channel |

| Key Market Opportunities | Rising Consumer Awareness and Market Expansion |

| Key Market Drivers | Rising Health Consciousness Fuels the Low Calorie Drinks Market |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Diageo plc., Asahi Breweries, Ltd., Global Brands Limited, Bacardi Limited, Kold Group, PepsiCo, Inc., THE COCA-COLA COMPANY, SGC Global, LLC, Malibu Drinks, and Herbal Water, Inc. |

Report Content Brief:

- High-level analysis of the current and future Low Calorie Drinks market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Low Calorie Drinks market historical market size for the year 2021, and forecast from 2023 to 2033

- Low Calorie Drinks market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Non-Store Based strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Low Calorie Drinks market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Non-Store Based health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Low Calorie Drinks market is 2021- 2033

What is the growth rate of the global Low Calorie Drinks market?

The global Low Calorie Drinks market is growing at a CAGR of 8.4% over the next 10 years

Which region has the highest growth rate in the market of Low Calorie Drinks?

North America is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Low Calorie Drinks market?

North America holds the largest share in 2022

Who are the key players in the global Low Calorie Drinks market?

Diageo plc., Asahi Breweries, Ltd., Global Brands Limited, Bacardi Limited, Kold Group, PepsiCo, Inc., THE COCA-COLA COMPANY, SGC Global, LLC, Malibu Drinks, and Herbal Water, Inc. the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Low Calorie Drinks Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Low Calorie Drinks Market 4.8.Import Analysis of the Low Calorie Drinks Market 4.9.Export Analysis of the Low Calorie Drinks Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Low Calorie Drinks Market, By Product 6.1. Introduction 6.2. Artificial Sweetener 6.3. Natural Sweetener 6.4. Prescriptive Analysis Chapter 7. Global Low Calorie Drinks Market, By Distribution Channel 7.1. Introduction 7.2. Supermarkets/Hypermarkets, Departmental Store 7.3. Departmental Stores Chapter 8. Global Low Calorie Drinks Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product, 2023-2033 8.2.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product, 2023-2033 8.2.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product, 2023-2033 8.2.7.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product, 2023-2033 8.3.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product, 2023-2033 8.3.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product, 2023-2033 8.3.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product, 2023-2033 8.3.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product, 2023-2033 8.3.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product, 2023-2033 8.3.11.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product, 2023-2033 8.4.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product, 2023-2033 8.4.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product, 2023-2033 8.4.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product, 2023-2033 8.4.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product, 2023-2033 8.4.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product, 2023-2033 8.4.10.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product, 2023-2033 8.5.4. Market Size and Forecast, By Distribution Channel, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Diageo plc. 10.1.1. Business Overview 10.1.2. Non-Store Based Analysis 10.1.2.1. Non-Store Based – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Asahi Breweries, Ltd. 10.2.1. Business Overview 10.2.2. Non-Store Based Analysis 10.2.2.1. Non-Store Based – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Global Brands Limited 10.3.1. Business Overview 10.3.2. Non-Store Based Analysis 10.3.2.1. Non-Store Based – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Bacardi Limited 10.4.1. Business Overview 10.4.2. Non-Store Based Analysis 10.4.2.1. Non-Store Based – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Kold Group 10.5.1. Business Overview 10.5.2. Non-Store Based Analysis 10.5.2.1. Non-Store Based – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. PepsiCo, Inc. 10.6.1. Business Overview 10.6.2. Non-Store Based Analysis 10.6.2.1. Non-Store Based – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. THE COCA-COLA COMPANY 10.7.1. Business Overview 10.7.2. Non-Store Based Analysis 10.7.2.1. Non-Store Based – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. SGC Global, LLC 10.8.1. Business Overview 10.8.2. Non-Store Based Analysis 10.8.2.1. Non-Store Based – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Malibu Drinks 10.9.1. Business Overview 10.9.2. Non-Store Based Analysis 10.9.2.1. Non-Store Based – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Herbal Water, Inc. 10.10.1. Business Overview 10.10.2. Non-Store Based Analysis 10.10.2.1. Non-Store Based – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Pricing

| Report Type | Description | Price | How to Purchase |

|---|---|---|---|

| Full Report (200+ Pages PDF Report) | This report gives a detailed analysis of the industry which includes Market Dynamics, Industry Trends, Segmental, Regional and Country level market estimation & forecast to 2033, competitive landscape, and company profiles. (Customization Possible as per your need) | $3,475 | Click on Buy Now |

| Market Overview Report (10-15 Page PDF Summary Report) | This report gives a brief idea about the industry, without being too heavy on your budget. It gives you an understanding of current and future market scenarios (long-term and short-term), major dynamics and their impact analysis, top-level regional analysis, and competitive benchmarking of 10 key competitors in the market. (Customization Possible as per your need) | $250 | Connect with our Sales Representative by Email or Filling Form on the side |

| Competitive Intelligence Report (35-45 Pages PDF Report) | This report gives you a detailed understanding of key competitors in the market. This report includes competitive benchmarking of 15 key competitors, market share of the top 5 competitors, key strategies adopted by the top 5 players, and key market share acquisition strategies adopted in the market. (Customization Possible as per your need) | $750 | Connect with our Sales Representative by Email or Filling Form on the side |

| Excel Data Pack (Excel Report) | This report includes market Segmental, Regional, and Country level market estimation & forecast to 2033 in Excel format. (Customization Possible as per your need) | $2,499 | Connect with our Sales Representative by Email or Filling Form on the side |

Research Methodology