Logic IC Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

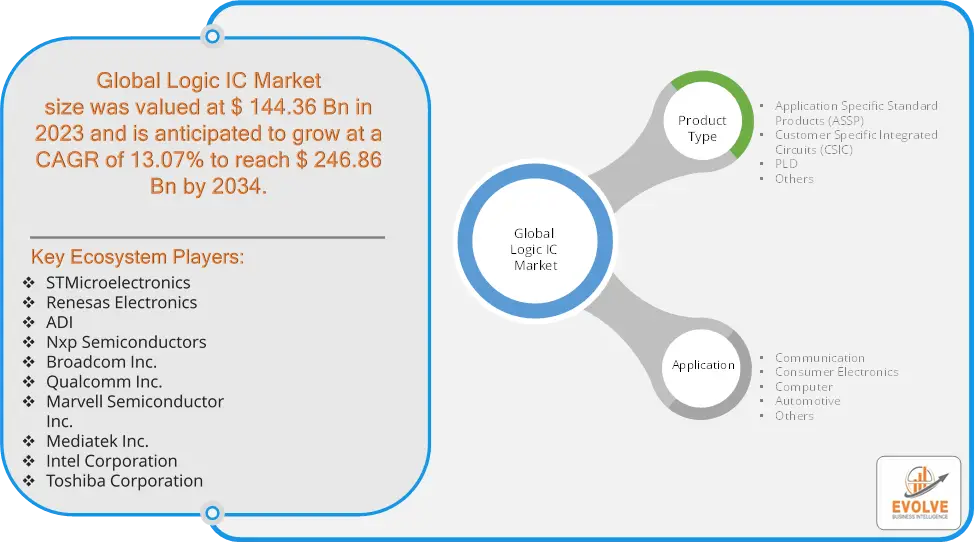

Logic IC Market Research Report: Information By Product Type (Application Specific Standard Products (ASSP), Customer Specific Integrated Circuits (CSIC), PLD, Others), By Application (Communication, Consumer Electronics, Computer, Automotive, Others), and by Region — Forecast till 2034

Page: 156

Logic IC Market Overview

The Logic IC Market size accounted for USD 144.36 Billion in 2023 and is estimated to account for 148.74 Billion in 2024. The Market is expected to reach USD 246.86 Billion by 2034 growing at a compound annual growth rate (CAGR) of 13.07% from 2024 to 2034. The Logic IC (Integrated Circuit) Market refers to the industry centered around the production, distribution, and use of logic integrated circuits. These ICs are semiconductor devices that perform logical operations, process digital signals, and manage data within electronic systems. Logic ICs are essential components in various devices such as computers, smartphones, consumer electronics, and industrial systems.

The logic IC market is a dynamic and essential part of the global electronics industry. Continued advancements in technology, coupled with increasing demand for electronic devices. As demand for high-performance computing, IoT devices, and miniaturized electronics grows, the Logic IC Market continues to expand, with innovations in areas such as AI, machine learning, and 5G technology driving further growth.

Global Logic IC Market Synopsis

Logic IC Market Dynamics

Logic IC Market Dynamics

The major factors that have impacted the growth of Logic IC Market are as follows:

Drivers:

Ø Technological Innovations in Semiconductor Manufacturing

Continuous advancements in semiconductor technology, such as the development of smaller, more power-efficient logic ICs through nanometer-scale technologies, boost the performance of integrated circuits and drive their adoption across various sectors. The rollout of 5G networks increases demand for high-speed data processing and communication equipment, with logic ICs being essential for handling complex networking tasks and enabling efficient communication in 5G infrastructure and devices. The industrial sector’s shift toward automation and smart manufacturing systems increases the need for logic ICs to manage and process real-time data in automated machinery and robotics.

Restraint:

- Perception of High Design and Development Costs

Designing advanced logic ICs, such as ASICs or FPGAs, involves significant R&D investment, complex design processes, and high costs associated with testing and fabrication. These costs may deter smaller companies from entering the market or developing custom solutions. The continuous push for miniaturization of ICs, especially with advanced technologies like 7nm and 5nm process nodes, increases manufacturing complexity. This requires expensive equipment, stringent quality control, and highly skilled labor, which can limit profitability and production capabilities.

Opportunity:

⮚ Rising Adoption of 5G and Beyond

The global rollout of 5G networks, and the eventual transition to 6G, will create significant demand for logic ICs. These networks require advanced processing capabilities for faster data speeds and improved connectivity, offering a major opportunity for IC manufacturers to develop specialized products for 5G infrastructure and devices. The proliferation of IoT devices across sectors like smart homes, healthcare, industrial automation, and agriculture provides significant opportunities for logic ICs. As these devices become more interconnected, demand for low-power, efficient logic ICs designed for real-time data processing at the edge will grow.

Logic IC Market Segment Overview

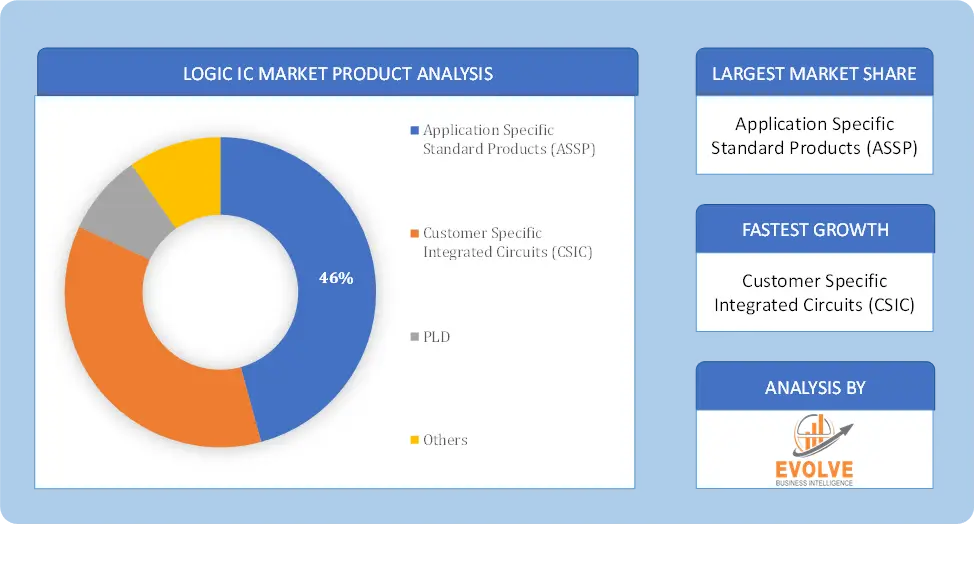

By Product Type

Based on Product Type, the market is segmented based on Application Specific Standard Products (ASSP), Customer Specific Integrated Circuits (CSIC), PLD and Others. The Application Specific Standard Products (ASSP) segment dominant the market. ASSPs are mass-produced, they typically have lower costs compared to custom-designed ASICs. This makes them a cost-effective solution for manufacturers looking to implement specific features without incurring high development costs and ASSPs enable faster product development cycles, as manufacturers can leverage pre-designed components rather than developing custom solutions from scratch. This is crucial in rapidly evolving markets.

Based on Product Type, the market is segmented based on Application Specific Standard Products (ASSP), Customer Specific Integrated Circuits (CSIC), PLD and Others. The Application Specific Standard Products (ASSP) segment dominant the market. ASSPs are mass-produced, they typically have lower costs compared to custom-designed ASICs. This makes them a cost-effective solution for manufacturers looking to implement specific features without incurring high development costs and ASSPs enable faster product development cycles, as manufacturers can leverage pre-designed components rather than developing custom solutions from scratch. This is crucial in rapidly evolving markets.

By Application

Based on Application, the market segment has been divided into Communication, Consumer Electronics, Computer, Automotive and Others. The Consumer electronics segment dominant the market. Consumer electronics have become thinner and more display-driven, and improved haptics are evolving to provide users with a richer, more tactile experience. This market is expected to grow during the forecast period due to the widespread use of integrated circuits in goods like smartphones, computers, computerized cameras, medical equipment, automobiles, and many other things.

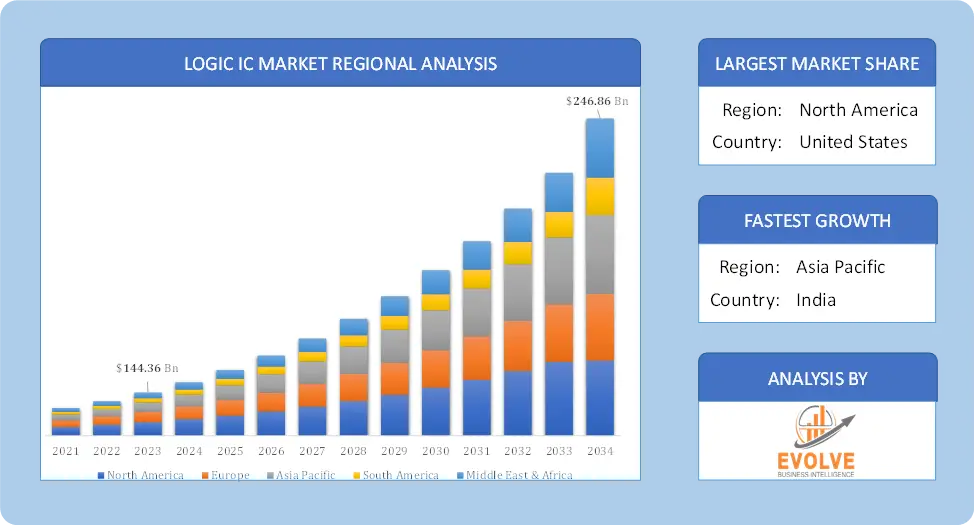

Global Logic IC Market Regional Analysis

Based on region, the global Logic IC Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Logic IC Market followed by the Asia-Pacific and Europe regions.

Logic IC North America Market

Logic IC North America Market

North America holds a dominant position in the Logic IC Market. North America, particularly the United States, is a major hub for technological advancements in semiconductor manufacturing and integrated circuits. The presence of leading semiconductor companies like Intel, AMD, and Qualcomm supports the region’s dominance in the Logic IC Market and high investment in research and development, especially in fields like AI, machine learning, and 5G, provides growth opportunities for logic IC manufacturers.

Logic IC Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Logic IC Market industry. Asia-Pacific is the leading region in terms of semiconductor manufacturing, with countries like China, Taiwan, South Korea, and Japan being key players. Taiwan’s TSMC and South Korea’s Samsung are dominant in advanced logic IC production and Countries like China and Japan are leading in the adoption of automotive electronics and industrial automation, providing significant opportunities for logic IC applications.

Competitive Landscape

The global Logic IC Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- STMicroelectronics

- Renesas Electronics

- ADI

- Nxp Semiconductors

- Broadcom Inc.

- Qualcomm Inc.

- Marvell Semiconductor Inc.

- Mediatek Inc.

- Intel Corporation

- Toshiba Corporation

Key Development

In April 2022, Intel has released information about its new Intel Blockscale ASIC. This application-specific integrated circuit (ASIC) will give users energy-efficient hashing for proof-of-work consensus networks based on years of Intel R&D. Argo Blockchain, Block Inc., Hive Blockchain Technologies, and GRIID Infrastructure will be among the first to use the Intel Blockscale ASIC, which has a hash rate of up to 580 GH/s.

In July 2021: Shanghai Baosight Software Co Ltd debuted a huge programmable logic controller product created in-house in July 2021 in Shanghai. Industrial automation is an important aspect of the growth of the steel ecosystem. The introduction of the PLC product was a milestone in a market dominated by producers from the EU, the US, and Japan.

Scope of the Report

Global Logic IC Market, by Product Type

- Application Specific Standard Products (ASSP)

- Customer Specific Integrated Circuits (CSIC)

- PLD

- Others

Global Logic IC Market, by Application

- Communication

- Consumer Electronics

- Computer

- Automotive

- Others

Global Logic IC Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $ 246.86 Billion |

| CAGR | 13.07% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | STMicroelectronics, Renesas Electronics, ADI, Nxp Semiconductors, Broadcom Inc., Qualcomm Inc., Marvell Semiconductor Inc., Mediatek Inc., Intel Corporation and Toshiba Corporation. |

| Key Market Opportunities | • Rising Adoption of 5G and Beyond • Advances in IoT and Edge Computing |

| Key Market Drivers | • Technological Innovations in Semiconductor Manufacturing • Rising Adoption of 5G Technology |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Logic IC Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Logic IC Market historical market size for the year 2021, and forecast from 2023 to 2033

- Logic IC Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Logic IC Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Logic IC Market is 2021- 2033

What is the growth rate of the global Logic IC Market?

The global Logic IC Market is growing at a CAGR of 13.07% over the next 10 years

Which region has the highest growth rate in the market of Logic IC Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Logic IC Market?

North America holds the largest share in 2022

Who are the key players in the global Logic IC Market?

STMicroelectronics, Renesas Electronics, ADI, Nxp Semiconductors, Broadcom Inc., Qualcomm Inc., Marvell Semiconductor Inc., Mediatek Inc., Intel Corporation and Toshiba Corporation are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Logic IC Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Logic IC Market, By Product Type 6.1. Introduction 6.2. Application Specific Standard Products (ASSP) 6.3. Customer Specific Integrated Circuits (CSIC) 6.3. PLD 6.4. Others Chapter 7. Global Logic IC Market, By Application 7.1. Introduction 7.2. Communication 7.3. Consumer Electronics 7.4. Computer 7.5. Automotive 7.6. Others Chapter 8. Global Logic IC Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. STMicroelectronics 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Renesas Electronics 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. ADI 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Nxp Semiconductors 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Broadcom Inc. 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Qualcomm Inc. 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Marvell Semiconductor, Inc. 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Mediatek, Inc. 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Intel Corporation 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Toshiba Corporation 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology