Insulated Wire and Cable Market Overview

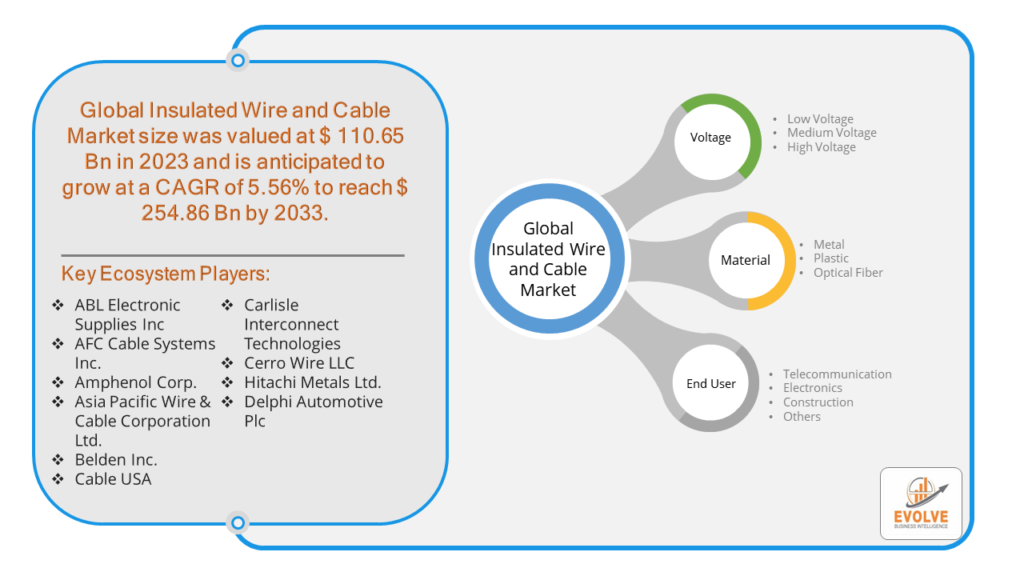

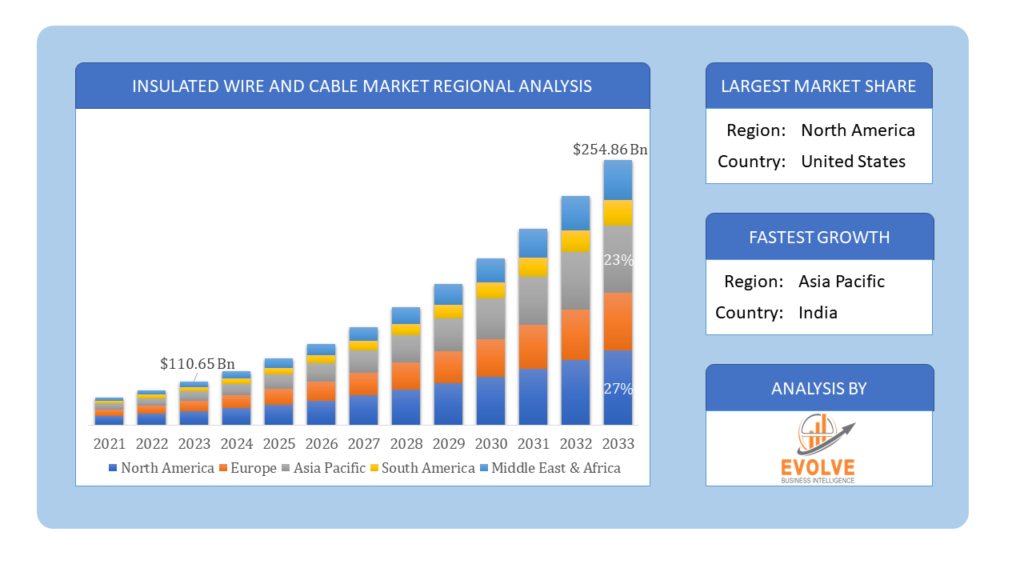

The Insulated Wire and Cable Market Size is expected to reach USD 254.86 Billion by 2033. The Insulated Wire and Cable Market industry size accounted for USD 110.65 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.56% from 2023 to 2033. The Insulated Wire and Cable Market refers to the global market for wires and cables that are insulated to prevent electrical leakage and ensure the safe transmission of electricity. These products are essential for various applications, including power distribution, telecommunications, electronics, and construction. These insulating materials prevent the flow of electricity between the conducting wires and their surroundings, ensuring safety and proper functioning.

Overall, the Insulated Wire and Cable Market is a crucial segment of the electrical and electronics industry, driven by the need for reliable and safe electrical transmission and growing technological advancements.

Global Insulated Wire and Cable Market Synopsis

The COVID-19 pandemic had a significant impact on the Insulated Wire and Cable Market. Lockdowns and restrictions led to temporary shutdowns of manufacturing facilities, causing delays in production. Restrictions on transportation and international trade affected the timely delivery of raw materials and finished products. The pandemic led to a slowdown in construction activities, reducing the demand for insulated wires and cables in the construction sector. With the shift to remote work and online activities, there was an increased demand for telecommunications infrastructure, boosting the need for communication cables. Many companies in the insulated wire and cable market faced revenue declines due to reduced demand and operational challenges. The accelerated digital transformation and increased reliance on digital infrastructure could lead to sustained growth in the demand for communication cables. An increased focus on renewable energy and sustainable practices may drive demand for specialized cables in the energy sector.

Insulated Wire and Cable Market Dynamics

The major factors that have impacted the growth of Insulated Wire and Cable Market are as follows:

Drivers:

Ø Technological Advancements

Advancements in insulation materials, such as cross-linked polyethylene (XLPE) and ethylene propylene rubber (EPR), enhance the performance and durability of cables. The development of smart grids and the integration of the Internet of Things (IoT) in power distribution systems require advanced insulated cables for efficient data and power transmission. The growing need for high-speed internet, data transfer, and telecommunication services drives the demand for insulated communication cables, including fiber optic cables. The rollout of 5G networks increases the demand for advanced cabling solutions to support higher data rates and connectivity.

Restraint:

- Perception of Raw Material Price Volatility

The prices of raw materials like copper, aluminum, and insulation materials can be highly volatile. Price fluctuations can lead to increased production costs and affect profit margins for manufacturers. Disruptions in the supply chain for these raw materials, due to geopolitical issues, natural disasters, or other factors, can impact the availability and cost of materials. The presence of numerous players in the market leads to intense competition, which can result in pricing pressures and reduced profit margins. In some segments, wires and cables are considered commodity products, making it difficult for manufacturers to differentiate their offerings and command premium prices.

Opportunity:

⮚ Renewable Energy Integration

The increasing adoption of solar, wind, and other renewable energy sources creates opportunities for specialized cables for energy transmission and distribution. Upgrading and modernizing power grids with smart grid technologies and energy storage systems require advanced cables to enhance efficiency and reliability. Increasing focus on energy efficiency and reducing transmission losses drives demand for high-efficiency cables and insulation materials. Demand for cables compliant with green building certifications and sustainable construction practices presents growth opportunities.

Insulated Wire and Cable Market Segment Overview

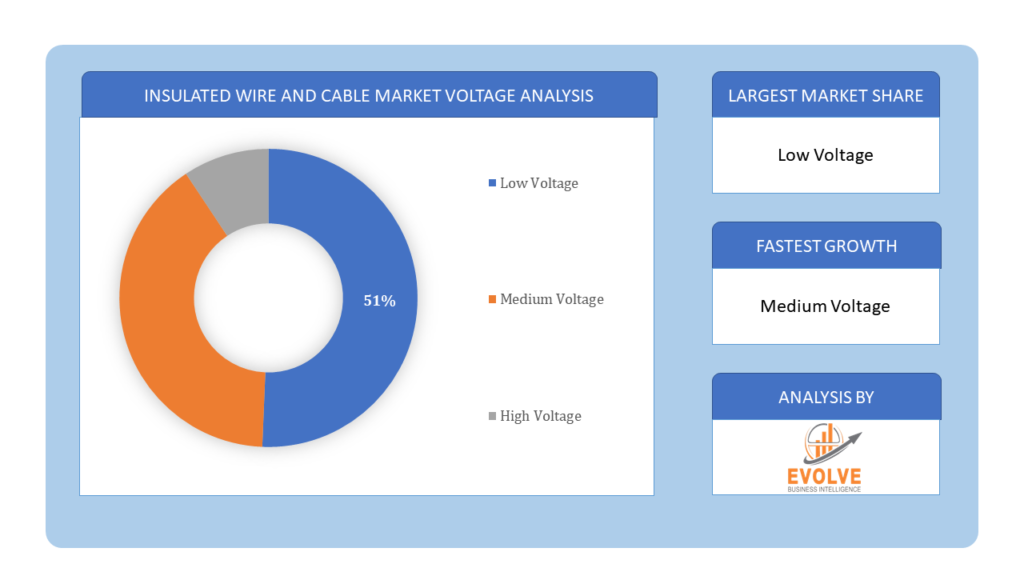

By Voltage

Based on Voltage, the market is segmented based on Low Voltage, Medium Voltage and High Voltage. The low voltage segment dominant the market. This is because, low-voltage cables consist of flexible, bare, or tin-plated copper conductors in addition to rigid, solid, or stranded copper and aluminum conductors. Furthermore, this low-voltage segment is utilized in numerous applications such as smart grids, building cables, distribution networks, and other appliances.

Based on Voltage, the market is segmented based on Low Voltage, Medium Voltage and High Voltage. The low voltage segment dominant the market. This is because, low-voltage cables consist of flexible, bare, or tin-plated copper conductors in addition to rigid, solid, or stranded copper and aluminum conductors. Furthermore, this low-voltage segment is utilized in numerous applications such as smart grids, building cables, distribution networks, and other appliances.

By Material

Based on Material, the market segment has been divided into the Metal, Plastic and Optical Fiber. The metal segment dominant the market. This is because, metal-insulated wire is widely utilized in a variety of household products and to transfer electricity throughout residential, commercial, and industrial structures. Therefore, a metal segment of the global insulated wire and cable market will develop as a result of the world’s rapid building of homes, offices, and other commercial spaces.

By End User

Based on End User, the market segment has been divided into the Telecommunication, Electronics, Construction and Others. The telecommunication segment dominant the market. This is due to cables are necessary for sending voice and data information over long distances, which makes the telecommunication segment the fastest growing in the global insulated wire and cable market.

Global Insulated Wire and Cable Market Regional Analysis

Based on region, the global Insulated Wire and Cable Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Insulated Wire and Cable Market followed by the Asia-Pacific and Europe regions.

Insulated Wire and Cable North America Market

Insulated Wire and Cable North America Market

North America holds a dominant position in the Insulated Wire and Cable Market. Mature market with a strong emphasis on technological innovation and regulatory compliance. Demand driven by infrastructure upgrades, telecommunications expansion, and renewable energy projects. Growth in smart grid investments, 5G rollout, and electric vehicle infrastructure.

Insulated Wire and Cable Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Insulated Wire and Cable Market industry. Fast-growing market driven by rapid urbanization and industrialization. Infrastructure development, urban expansion, and increasing consumer electronics demand. Growing renewable energy projects, 5G infrastructure deployment, and expanding automotive sector.

Competitive Landscape

The global Insulated Wire and Cable Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- ABL Electronic Supplies Inc

- AFC Cable Systems Inc.

- Amphenol Corp.

- Asia Pacific Wire & Cable Corporation Ltd.

- Belden Inc.

- Cable USA

- Carlisle Interconnect Technologies

- Cerro Wire LLC

- Hitachi Metals Ltd.

- Delphi Automotive Plc

Scope of the Report

Global Insulated Wire and Cable Market, by Voltage

- Low Voltage

- Medium Voltage

- High Voltage

Global Insulated Wire and Cable Market, by Material

- Metal

- Plastic

- Optical Fiber

Global Insulated Wire and Cable Market, by End User

- Telecommunication

- Electronics

- Construction

- Others

Global Insulated Wire and Cable Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $254.86 Billion/strong> |

| CAGR | 5.56% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Voltage, Material, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | ABL Electronic Supplies Inc, AFC Cable Systems Inc., Amphenol Corp., Asia Pacific Wire & Cable Corporation Ltd., Belden Inc., Cable USA, Carlisle Interconnect Technologies, Cerro Wire LLC, Hitachi Metals Ltd. And Delphi Automotive Plc |

| Key Market Opportunities | • Renewable Energy Integration • Energy Efficiency Initiatives |

| Key Market Drivers | • Technological Advancements • Increasing Urbanization |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Insulated Wire and Cable Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Insulated Wire and Cable Market historical market size for the year 2021, and forecast from 2023 to 2033

- Insulated Wire and Cable Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Insulated Wire and Cable Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.