India Microfinance Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

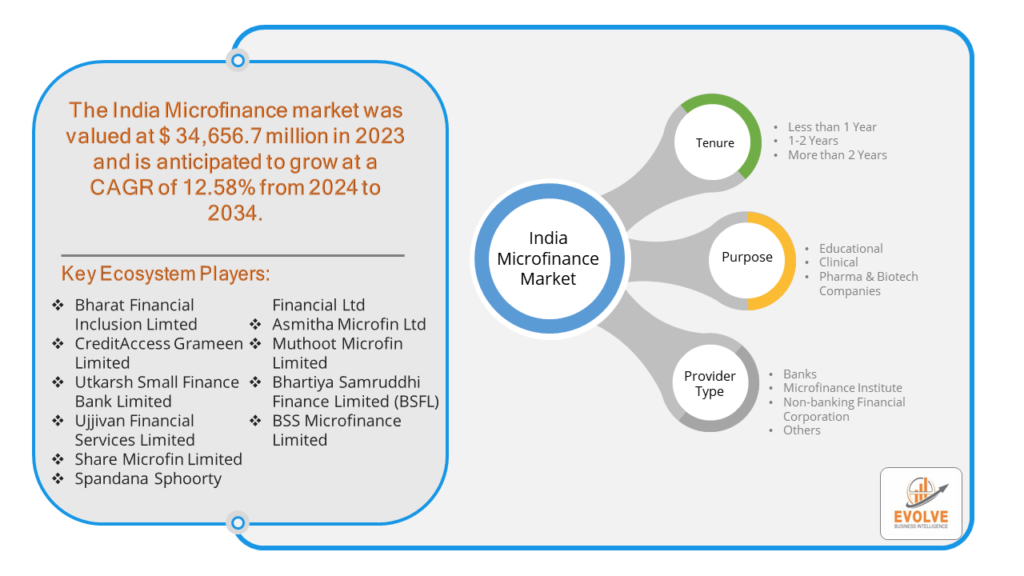

India Microfinance Market Research Report: By Tenure (Less than 1 Year, 1-2 Years and More than 2 Years), By Purpose (Educational, Clinical, Pharma & Biotech Companies), By Provider Type (Banks, Microfinance Institute, Non-banking Financial Corporation and Others), and by Region — Forecast till 2033

India Microfinance Market Overview

The India Microfinance market was valued at $ 34,656.7 million in 2023 and is anticipated to grow at a CAGR of 12.58% from 2024 to 2034. The microfinance market in India provides financial services to the underserved and low-income segments, primarily in rural areas. It encompasses small loans, savings, insurance, and other basic financial products aimed at fostering financial inclusion and entrepreneurship. The market is driven by a mix of Non-Banking Financial Companies (NBFCs), microfinance institutions (MFIs), and self-help groups (SHGs). Regulatory frameworks and government initiatives, like the Pradhan Mantri Jan Dhan Yojana, support its growth. Despite challenges like high-interest rates and over-indebtedness, the sector plays a crucial role in poverty alleviation and economic empowerment.

Global India Microfinance Market Synopsis

The COVID-19 pandemic significantly impacted India’s microfinance market, causing disruptions in loan disbursements and collections due to lockdowns and economic slowdowns. Many borrowers faced income losses, leading to increased defaults and higher non-performing assets (NPAs). However, the sector showed resilience with digital adoption and government support through relief measures and moratoriums. The pandemic underscored the need for robust risk management and diversification strategies within the microfinance institutions.

Global India Microfinance Market Dynamics

The major factors that have impacted the growth of India Microfinance are as follows:

Drivers:

⮚ Technological Advancements

The adoption of digital technology in the financial sector has revolutionized the microfinance industry. Mobile banking, digital payment systems, and online loan applications have made it easier and more cost-effective for MFIs to reach remote areas and for clients to access services.

Restraint:

- Credit Risk and Defaults

High credit risk and defaults remain significant concerns for MFIs. The informal nature of income sources for many borrowers makes it difficult to assess their creditworthiness accurately. Economic downturns, natural disasters, and other unforeseen events can further exacerbate the risk of defaults.

Opportunity:

⮚ Digital Financial Services

The rapid adoption of digital technology offers significant opportunities for MFIs to enhance their operations and outreach. Digital financial services, including mobile banking, digital wallets, and online loan applications, can streamline processes, reduce operational costs, and improve access to financial services in remote and underserved areas. The increased penetration of smartphones and internet connectivity facilitates the widespread adoption of these digital solutions.

India Microfinance Market Segment Overview

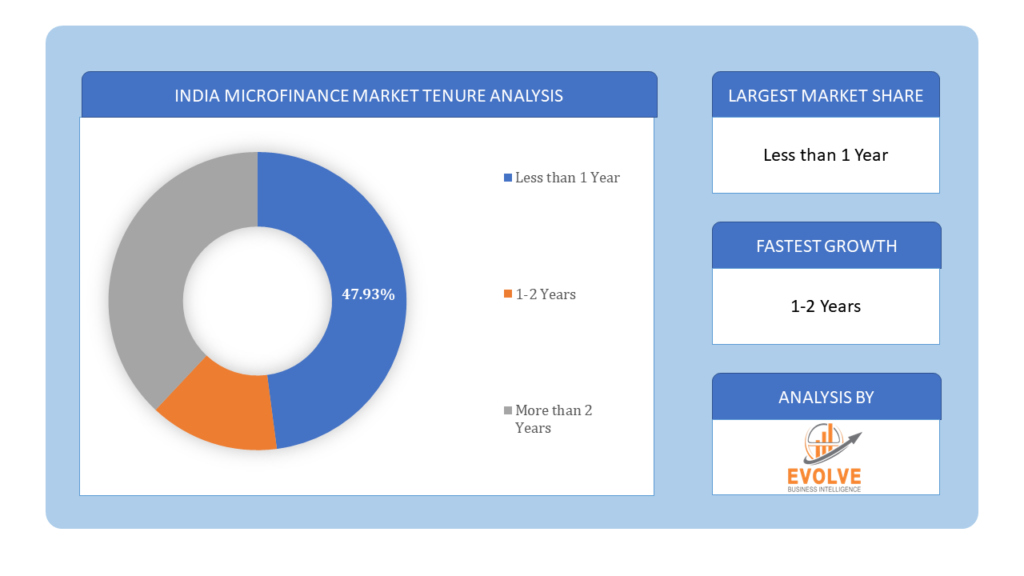

By Tenure

Based on the Tenure, the market is segmented based on Less than 1 Year, 1-2 Years and More than 2 Years. In the Indian microfinance market, loans with a tenure of 1-2 years dominate, as they balance affordability for borrowers with manageable risk for lenders, while shorter and longer-term loans also cater to specific financial needs and repayment capacities.

By Purpose

Based on the Purpose, the market has been divided into Educational, Clinical, Pharma & Biotech Companies. In the Indian microfinance market, the dominant purposes for microloans are primarily for entrepreneurial and income-generating activities, followed by significant allocations towards educational and clinical needs, supporting overall socio-economic development.

Based on the Purpose, the market has been divided into Educational, Clinical, Pharma & Biotech Companies. In the Indian microfinance market, the dominant purposes for microloans are primarily for entrepreneurial and income-generating activities, followed by significant allocations towards educational and clinical needs, supporting overall socio-economic development.

By Provider Type

Based on Provider Type, the market has been divided into Banks, Microfinance Institute, Non-banking Financial Corporation and Others. In the Indian microfinance market, Non-Banking Financial Corporations (NBFCs) and Microfinance Institutions (MFIs) dominate by providing the majority of microloans and financial services, while banks and other entities also play significant roles in extending financial inclusion to underserved populations.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Bharat Financial Inclusion Limted, CreditAccess Grameen Limited, UTKARSH SMALL FINANCE BANK LIMITED, Ujjivan Financial Services Limited, and Share Microfin Limited are some of the leading players in the global India Microfinance Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Bharat Financial Inclusion Limted

- CreditAccess Grameen Limited

- UTKARSH SMALL FINANCE BANK LIMITED

- Ujjivan Financial Services Limited

- Share Microfin Limited

- Spandana Sphoorty Financial Ltd

- Asmitha Microfin Ltd

- Muthoot Microfin Limited

- Bhartiya Samruddhi Finance Limited (BSFL)

- BSS Microfinance Limited

Key development:

In September 2022, Muthoot Microfin Limited received approval from the Securities and Exchange Board of India (SEBI) to raise INR 700 crore through an Initial Public Offering (IPO), marking a significant development for the company’s expansion and growth plans.

Scope of the Report

Global India Microfinance Market, by Tenure

- Less than 1 Year

- 1-2 Years

- More than 2 Years

Global India Microfinance Market, by Purpose

- Educational

- Clinical

- Pharma & Biotech Companies

Global India Microfinance Market, by Provider Type

- Banks

- Microfinance Institute

- Non-banking Financial Corporation

- Others

Global India Microfinance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $131,241.1 Million |

| CAGR | 12.58% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Tenure, Purpose, Provider Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Bharat Financial Inclusion Limted, CreditAccess Grameen Limited, UTKARSH SMALL FINANCE BANK LIMITED, Ujjivan Financial Services Limited, Share Microfin Limited, Spandana Sphoorty Financial Ltd, Asmitha Microfin Ltd, Muthoot Microfin Limited, Bhartiya Samruddhi Finance Limited (BSFL), BSS Microfinance Limited |

| Key Market Opportunities | • Creative Content Generation and Personalization • Advancements technology |

| Key Market Drivers | • Advancements in AI research and technology • Growing demand for personalized and creative content |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future India Microfinance Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- India Microfinance market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global India Microfinance market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global India Microfinance Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the India Microfinance Market?

The study period for the India Microfinance Market spans from 2023 to 2033.

What is the growth rate of the India Microfinance Market?

The India Microfinance Market is anticipated to grow at a compound annual growth rate (CAGR) of 12.58% from 2024 to 2034.

Which region has the highest growth rate in the India Microfinance Market?

The Asia-Pacific region, particularly India, has the highest growth rate in the India Microfinance Market.

Which region has the largest share of the India Microfinance Market?

India holds the largest share of the India Microfinance Market, driven by significant demand and supportive government policies.

Who are the key players in the India Microfinance Market?

Key players in the India Microfinance Market include Bharat Financial Inclusion Limited, CreditAccess Grameen Limited, UTKARSH Small Finance Bank Limited, Ujjivan Financial Services Limited, and Share Microfin Limited.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Tenure Segement – Market Opportunity Score 4.1.2. Purpose Segment – Market Opportunity Score 4.1.3. Provider Type Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on India Microfinance Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global India Microfinance Market, By Tenure 7.1. Introduction 7.1.1. Less than 1 Year 7.1.2. 1-2 Years 7.1.3. More than 2 Years CHAPTER 8. Global India Microfinance Market, By Purpose 8.1. Introduction 8.1.1. Educational 8.1.2. Clinical 8.1.3. Pharma & Biotech Companies CHAPTER 9. Global India Microfinance Market, By Provider Type 9.1. Introduction 9.1.1. Banks 9.1.2. Microfinance Institute 9.1.3. Non-banking Financial Corporation 9.1.4. Others CHAPTER 10. Global India Microfinance Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Tenure, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Purpose, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Provider Type, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Bharat Financial Inclusion Limted 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. CreditAccess Grameen Limited 13.3. UTKARSH SMALL FINANCE BANK LIMITED 13.4. Ujjivan Financial Services Limited 13.5. Share Microfin Limited 13.6. Spandana Sphoorty Financial Ltd 13.7. Asmitha Microfin Ltd 13.8. Muthoot Microfin Limited 13.9. Bhartiya Samruddhi Finance Limited (BSFL) 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology