Hard Seltzers Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Hard Seltzers Market Research Report: Information By ABV Content (1.0 To 4.9%, 5.0 To 6.9%) By Distribution Channel (Off-trade, On-trade), and By Region — Forecast till 2033

Page: 218

Press Release: https://evolvebi.com/global-hard-seltzers-market-is-estimated-to-record-a-cagr-of-around-23-1-during-the-forecast-period/Hard Seltzers Market Overview

The global Hard Seltzers Market Size is expected to reach USD 123.1 Billion by 2033. The global Hard Seltzers industry size accounted for USD 16.0 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 22.63% from 2023 to 2033. Hard seltzers have taken the beverage market by storm, becoming one of the most popular alcoholic beverages in recent years. These carbonated beverages infused with alcohol and flavored essences offer a refreshing alternative to traditional drinks. The unique blend of sparkling water, alcohol, and fruit flavors has captivated the taste buds of consumers worldwide. Hard seltzers are known for their light and crisp profile, low calorie content, and gluten-free nature, making them a go-to choice for health-conscious individuals.

Global Hard Seltzers Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic has significantly impacted the global beverage industry, including the hard seltzers market. The initial lockdowns and restrictions on social gatherings led to a decline in on-trade sales channels such as bars and restaurants. However, the pandemic also created an opportunity for the off-trade segment, including retail stores and e-commerce platforms, as consumers shifted their consumption patterns towards at-home consumption.

Hard Seltzers Market Dynamics

The major factors that have impacted the growth of Hard Seltzers are as follows:

Drivers:

Growing Health Consciousness and Shift in Drinking Preferences

In recent years, there has been a significant shift in consumer drinking preferences driven by a growing focus on health and wellness. Health consciousness has become a prevalent trend among consumers across various demographics, prompting them to seek out healthier alternatives in their beverage choices. This shift has played a key role in the rising demand for hard seltzers in the market.

One of the primary factors contributing to the popularity of hard seltzers is the desire for low-calorie and low-sugar beverages. Traditional alcoholic drinks such as beer, wine, and spirits are often associated with higher calorie and sugar content, which can pose challenges for individuals who are mindful of their calorie intake or following specific dietary guidelines. Hard seltzers, on the other hand, are known for their relatively low calorie and sugar profiles, making them an appealing choice for health-conscious consumers.

Restraint:

Regulatory Hurdles and Taxation Policies

One of the significant challenges encountered by the hard seltzers market is the complex regulatory landscape and taxation policies that differ across various regions. The classification of hard seltzers can vary among jurisdictions, leading to inconsistencies in labeling requirements, alcohol content regulations, and taxation. These variations pose hurdles for manufacturers and may potentially hinder the growth of the market in certain regions.

One aspect of regulatory hurdles is the classification and labeling requirements for hard seltzers. The regulatory bodies responsible for overseeing the alcohol industry in different countries or regions often have distinct definitions and classifications for different alcoholic beverages. This can result in ambiguity when it comes to categorizing hard seltzers, as they may not fit neatly into existing definitions for beer, wine, or spirits. The lack of standardized classification can lead to confusion for manufacturers and consumers, affecting product labeling and compliance with regulatory guidelines.

Opportunity:

Expanding Distribution Channels and Product Innovation

The hard seltzers market presents several opportunities for growth and innovation. Manufacturers are actively exploring new distribution channels to expand their consumer reach. Apart from traditional retail stores, online platforms and direct-to-consumer models are gaining traction, providing convenience and accessibility to consumers. Furthermore, product innovation in terms of flavors, ingredient quality, and packaging formats is crucial in attracting new consumers and sustaining their interest in the market.

Hard Seltzers Segment Overview

By ABV Content

Based on the ABV Content, the market is segmented based on 1.0 To 4.9%, 5.0 To 6.9%. 1.0% to 4.9% ABV holds the largest share in the hard seltzers market. This segment represents hard seltzers with lower alcohol content. It caters to consumers who prefer lighter alcoholic options or are focused on health and wellness. Many individuals are conscious of their alcohol intake and seek beverages with lower ABV to enjoy social occasions without the same level of alcohol impact.

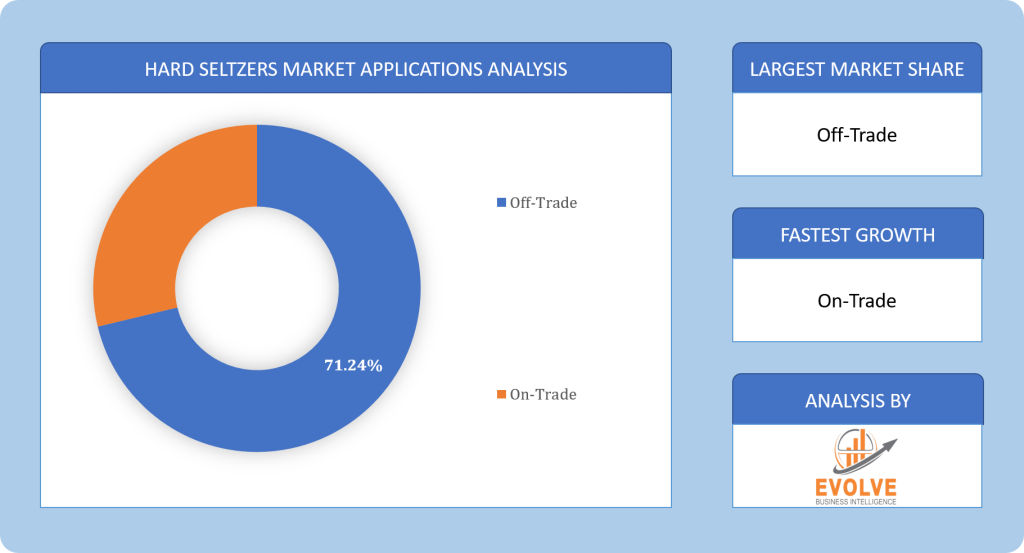

By Distribution Channel

Based on Distribution Channel, the market has been divided into Off-trade, On-trade. The On-trade segment holds the largest share in the Hard Seltzers market. On-trade channels consist of bars, restaurants, and other establishments where consumers can enjoy alcoholic beverages in a social setting. Although on-trade channels faced challenges during the pandemic due to closures and restrictions, they remain important for the hard seltzers market. These channels provide opportunities for brand exposure, trial, and building consumer loyalty. On-trade channels are crucial in introducing new consumers to the category and creating a buzz around specific hard seltzer brands and flavors.

Global Hard Seltzers Market Regional Analysis

Based on region, the global Hard Seltzers market has been divided into North America, Europe, Asia-Pacific, South America and Middle East & Africa. North America is projected to dominate the use of the market followed by the Europe and Asia-Pacific regions.

North America Market

North America is one of the leading regions in the hard seltzers market, with the United States at the forefront of this trend. The region has experienced a substantial surge in demand for hard seltzers, driven by factors such as changing consumer preferences, the rise of health-consciousness, and the demand for innovative and refreshing beverages.

The United States dominates the North American hard seltzers market due to several key factors. First, the culture of convenience and on-the-go consumption aligns well with the portability and refreshing nature of hard seltzers. Consumers are attracted to the convenience of grabbing a canned hard seltzer for social gatherings, outdoor activities, or casual occasions. Second, the health and wellness trend has greatly influenced the popularity of hard seltzers in the United States. Many consumers are seeking lighter alcoholic options with lower calorie and sugar content. Hard seltzers, with their low ABV, low-calorie profiles, and gluten-free nature, perfectly cater to this demand. Furthermore, the United States has witnessed the emergence of several established and emerging players in the hard seltzers market. These companies have focused on product innovation, introducing a wide range of flavors and experimenting with ingredient quality to attract consumers. The introduction of seasonal flavors and limited-edition releases has also contributed to the market’s growth and excitement.

Europe Market

Europe has emerged as another significant market for hard seltzers, with countries such as the United Kingdom, Germany, and Spain leading the way. The market growth in Europe can be attributed to changing consumer preferences, an increasing focus on health and wellness, and the rising demand for low-alcohol alternatives.

The United Kingdom has witnessed a remarkable surge in hard seltzer consumption. The market is driven by a combination of factors, including the influence of American culture, a growing interest in low-calorie beverages, and the popularity of ready-to-drink alcoholic options. The British consumers, particularly the younger demographic, are drawn to the light and refreshing profile of hard seltzers, making them an appealing choice for social occasions and outdoor activities.

Germany, known for its beer culture, has also embraced the trend of hard seltzers. Consumers in Germany are seeking variety and novelty in their beverage choices, and hard seltzers provide a refreshing alternative to traditional beer and mixed drinks. The market is witnessing an influx of local and international brands catering to the growing demand. Spain, with its warm climate and vibrant social scene, presents a favorable environment for hard seltzers. The market has gained traction among young adults and the urban population who seek low-alcohol options for leisure and social gatherings. The availability of hard seltzers in popular tourist destinations and beach areas further fuels the market growth.

Competitive Landscape

The global Hard Seltzers market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Seltzer, Inc.

- Mark Anthony Brands International

- Anheuser-Busch InBev

- The Coca-Cola Company

- Diageo plc

- Heineken N.V.

- The Boston Beer Company

- Molson Coors Beverage Company

- Constellation Brands, Inc.

- Kopparberg

- San Juan Seltzer, Inc.

Key Development:

January 2020: The Coca-Cola Company unveils its first alcoholic beverage, Topo Chico Hard Seltzer. The Coca-Cola Company, known for its non-alcoholic beverages, entered the alcoholic beverages market by launching Topo Chico Hard Seltzer. The move marked the company’s foray into the competitive hard seltzers segment.

Scope of the Report

Global Hard Seltzers Market, by ABV Content

- 0 To 4.9%

- 0 To 6.9%

Global Hard Seltzers Market, by Distribution Channel

- Off-trade

- On-trade

Global Hard Seltzers Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Australia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 123.1 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 22.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | ABV Content, Distribution Channel |

| Key Market Opportunities | Expanding Distribution Channels and Product Innovation |

| Key Market Drivers | Growing Health Consciousness and Shift in Drinking Preferences |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Mark Anthony Brands International; Anheuser-Busch InBev; The Coca-Cola Company; Diageo plc; Heineken N.V.; The Boston Beer Company; Molson Coors Beverage Company; Constellation Brands, Inc.; Kopparberg; San Juan |

Report Content Brief:

- High-level analysis of the current and future Hard Seltzers market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Hard Seltzers market historical market size for the year 2021, and forecast from 2023 to 2033

- Hard Seltzers market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, Commercial Use strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Hard Seltzers market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Commercial Use health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Hard Seltzers market is 2021- 2033

What is the growth rate of the global Hard Seltzers market?

The global Hard Seltzers market is growing at a CAGR of 23.1% over the next 10 years

Which region has the highest growth rate in the market of Hard Seltzers?

North America is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Hard Seltzers market?

Europe holds the largest share in 2022

Who are the key players in the global Hard Seltzers market?

Mark Anthony Brands International; Anheuser-Busch InBev; The Coca-Cola Company; Diageo plc; Heineken N.V.; The Boston Beer Company; Molson Coors Beverage Company; Constellation Brands, Inc.; Kopparberg; San Juan the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Hard Seltzers Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Hard Seltzers Market 4.8.Import Analysis of the Hard Seltzers Market 4.9.Export Analysis of the Hard Seltzers Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Hard Seltzers Market, By ABV Content 6.1. Introduction 6.2. 1.0 To 4.9% 6.3. 5.0 To 6.9% Chapter 7. Global Hard Seltzers Market, By Distribution Channel 7.1. Introduction 7.2. Off-trade 7.3. On-trade Chapter 8. Global Hard Seltzers Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By ABV Content, 2023-2033 8.2.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By ABV Content, 2023-2033 8.2.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By ABV Content, 2023-2033 8.2.7.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By ABV Content, 2023-2033 8.3.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By ABV Content, 2023-2033 8.3.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By ABV Content, 2023-2033 8.3.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By ABV Content, 2023-2033 8.3.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By ABV Content, 2023-2033 8.3.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By ABV Content, 2023-2033 8.3.11.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By ABV Content, 2023-2033 8.4.5. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By ABV Content, 2023-2033 8.4.6.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By ABV Content, 2023-2033 8.4.7.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By ABV Content, 2023-2033 8.4.8.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By ABV Content, 2023-2033 8.4.9.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By ABV Content, 2023-2033 8.4.10.4. Market Size and Forecast, By Distribution Channel, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By ABV Content, 2023-2033 8.5.4. Market Size and Forecast, By Distribution Channel, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Seltzer, Inc. 10.1.1. Business Overview 10.1.2. Commercial Use Analysis 10.1.2.1. Commercial Use – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Mark Anthony Brands International 10.2.1. Business Overview 10.2.2. Commercial Use Analysis 10.2.2.1. Commercial Use – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Anheuser-Busch InBev 10.3.1. Business Overview 10.3.2. Commercial Use Analysis 10.3.2.1. Commercial Use – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. The Coca-Cola Company 10.4.1. Business Overview 10.4.2. Commercial Use Analysis 10.4.2.1. Commercial Use – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Diageo plc 10.5.1. Business Overview 10.5.2. Commercial Use Analysis 10.5.2.1. Commercial Use – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Heineken N.V. 10.6.1. Business Overview 10.6.2. Commercial Use Analysis 10.6.2.1. Commercial Use – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. The Boston Beer Company 10.7.1. Business Overview 10.7.2. Commercial Use Analysis 10.7.2.1. Commercial Use – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Radico Khaitan Limited 10.8.1. Business Overview 10.8.2. Molson Coors Beverage Company 10.8.2.1. Commercial Use – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Constellation Brands, Inc. 10.9.1. Business Overview 10.9.2. Commercial Use Analysis 10.9.2.1. Commercial Use – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Kopparberg 10.10.1. Business Overview 10.10.2. Commercial Use Analysis 10.10.2.1. Commercial Use – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology