Gunshot Detection System Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Gunshot Detection System Market Research Report: Information By solution (System, SaaS), By basis of system (Outdoor, Indoor), By Application (Commercial, Defense), By installation (Fixed Installations, Vehicle Mounted, Soldier Mounted), and by Region — Forecast till 2033

Page: 120

Gunshot Detection System Market Overview

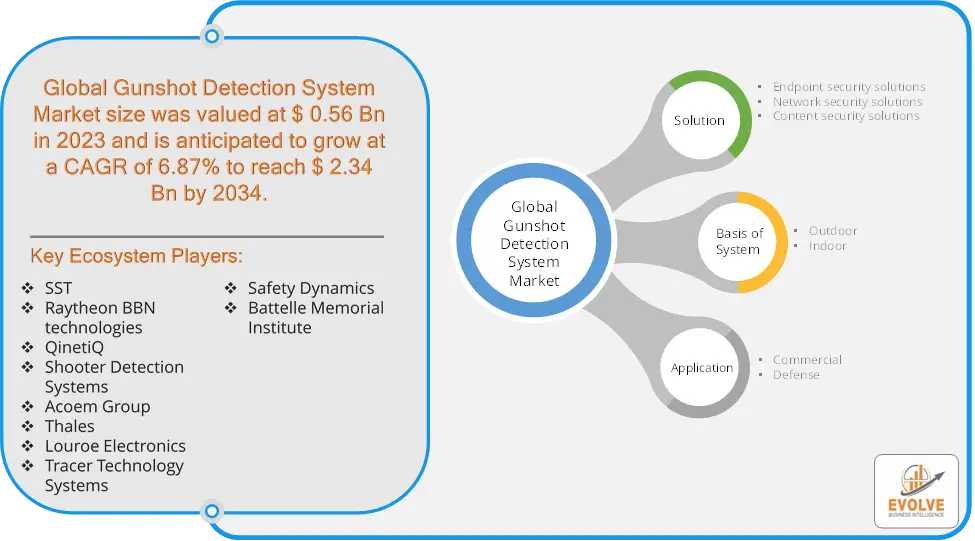

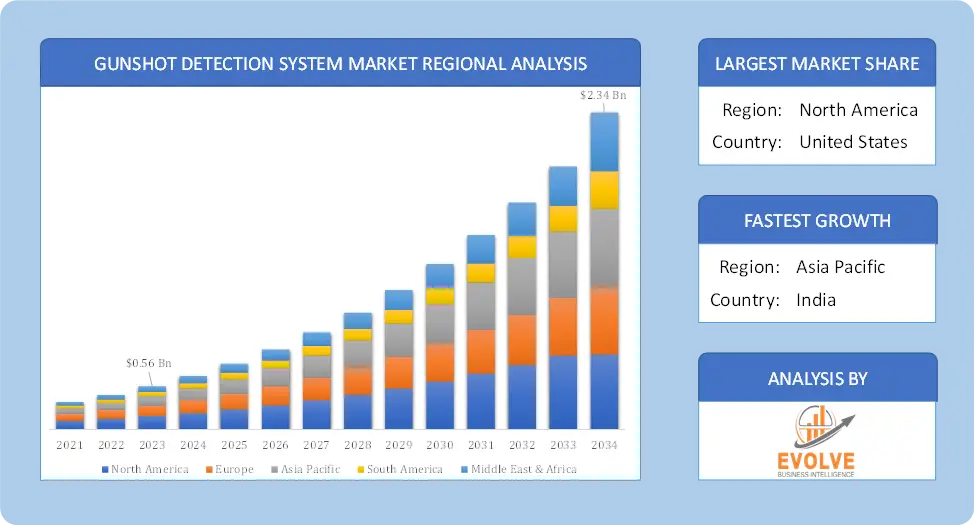

The Gunshot Detection System Market accounted for USD 0.56 Billion in 2023 and is estimated to account for 0.65 billion in 2024. The Market is expected to reach USD 2.34 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.87% from 2024 to 2034. The Gunshot Detection System Market refers to the market for technologies and solutions designed to detect, locate, and respond to gunfire incidents. Gunshot detection systems typically use a combination of acoustic sensors, infrared sensors, and algorithms to identify the sound of gunshots, determine their location, and alert authorities or security personnel in real-time. These systems are widely used for public safety, law enforcement, military, and commercial applications.

The gunshot detection system market is driven by the increasing need for public safety and security, particularly in urban areas. As crime rates rise and the threat of mass shootings becomes more prevalent, governments and organizations are investing in advanced technologies to protect their citizens.

Global Gunshot Detection System Market Synopsis

Gunshot Detection System Market Dynamics

Gunshot Detection System Market Dynamics

The major factors that have impacted the growth of Gunshot Detection System Market are as follows:

Drivers:

Ø Technological Advancements

Improvements in sensor technologies, data analytics, and artificial intelligence are enabling more accurate and efficient gunshot detection systems, which are more appealing to end-users for quick response and real-time monitoring. The integration of gunshot detection systems into broader smart city initiatives, which use technology to improve public safety and urban management, is a significant growth factor, particularly in urban areas. The growing need for advanced surveillance and security technologies in military applications, such as border security and combat zones, is boosting the market for gunshot detection systems.

Restraint:

- Perception of High Installation and Maintenance Costs

The cost of deploying and maintaining gunshot detection systems, especially across large urban areas, can be prohibitive. These systems require advanced sensor networks, data processing infrastructure, and ongoing maintenance, which can strain budgets, particularly for smaller cities and private institutions. The use of gunshot detection systems, especially those integrated with video surveillance and other monitoring tools, can raise privacy concerns among the public, particularly in areas where there are sensitivities around constant monitoring.

Opportunity:

⮚ Integration with Smart City Initiatives

As cities increasingly invest in smart technologies, integrating gunshot detection systems with broader smart city infrastructure offers opportunities for enhancing public safety and urban management. This integration can provide real-time data to improve emergency response and city planning. Leveraging big data and analytics to provide actionable insights and integrate gunshot detection systems with other security measures, such as video surveillance and emergency notification systems, offers opportunities for creating comprehensive security solutions.

Gunshot Detection System Market Segment Overview

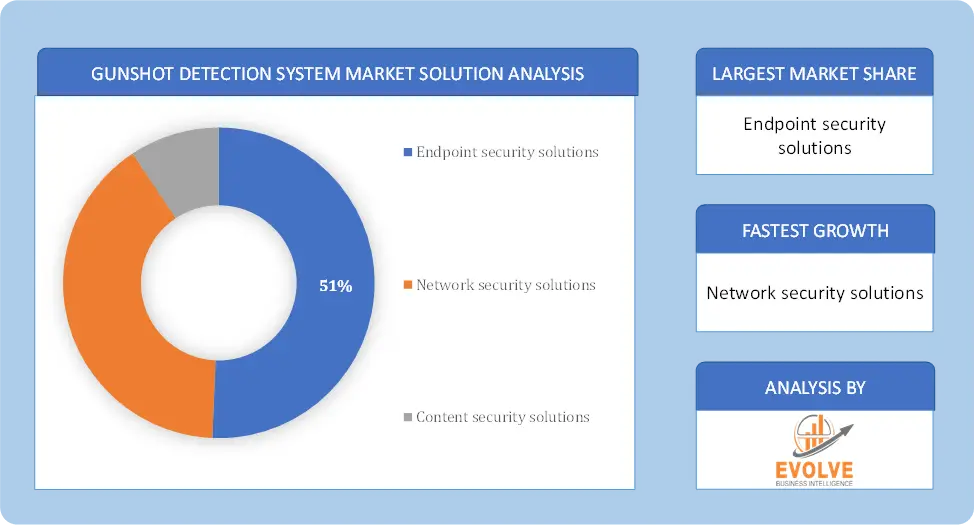

By Solution

Based on Solution, the market is segmented based on System and Saas. The System segment dominant the market. The System solution includes all of the necessary hardware required for detecting gunshots using sensors, such as acoustic sensors and display systems. The rise in incidents of gunfire around the world is driving the demand for gunshot detection systems. These systems are often purchased outright by customers and may require ongoing maintenance and support.

Based on Solution, the market is segmented based on System and Saas. The System segment dominant the market. The System solution includes all of the necessary hardware required for detecting gunshots using sensors, such as acoustic sensors and display systems. The rise in incidents of gunfire around the world is driving the demand for gunshot detection systems. These systems are often purchased outright by customers and may require ongoing maintenance and support.

By Basis of System

Based on Basis of system, the market segment has been divided into Outdoor and indoor. The indoor segment dominant the market. The increasing number of shootings and gunfire incidents in indoor settings, such as schools, malls, and commercial and government buildings, has increased demand for indoor gunshot detection systems, positively impacting the market statistics for these systems.

By Application

Based on Application, the market segment has been divided into Commercial and Defense. The defense segment dominant the market, due to growing security concerns and increased shootings at public areas like malls, schools, and other gathering places.

By Solution

Based on Solution, the market segment has been divided into Fixed Installations, Vehicle Mounted and Soldier Mounted. The fixed installation segment dominant the market, due to enhancements in safety systems in existing school, university, and military infrastructures. Fixed gunshot detection systems utilize acoustic sensor node technology to track instances of gunshots and are typically mounted on walls, poles, or at border crossings for military applications. Fixed installations are permanent installations that are installed in specific locations, such as buildings, streetlights, or other infrastructure.

Global Gunshot Detection System Market Regional Analysis

Based on region, the global Gunshot Detection System Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Gunshot Detection System Market followed by the Asia-Pacific and Europe regions.

Gunshot Detection System North America Market

Gunshot Detection System North America Market

North America holds a dominant position in the Gunshot Detection System Market. The North American region, particularly the United States, is the largest market for gunshot detection systems due to a high prevalence of gun violence and a strong focus on public safety. The region is at the forefront of technological innovations in gunshot detection systems, with companies developing advanced sensors and analytics capabilities and the largest market for gunshot detection systems due to high investment in public safety, advanced technology infrastructure, and frequent adoption in urban areas, schools, and commercial buildings.

Gunshot Detection System Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Gunshot Detection System Market industry. The Asia-Pacific region is witnessing rapid growth in the gunshot detection system market, fueled by urbanization and rising crime rates and countries such as India, China, and Japan are investing in these systems to improve public safety and security. Rapid urbanization and growing concerns about public safety are driving interest in gunshot detection systems.

Competitive Landscape

The global Gunshot Detection System Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- SST

- Raytheon BBN technologies

- QinetiQ

- Shooter Detection Systems

- Acoem Group

- Thales

- Louroe Electronics

- Tracer Technology Systems

- Safety Dynamics

- Battelle Memorial Institute

Scope of the Report

Global Gunshot Detection System Market, Solution

- Endpoint security solutions

- Network security solutions

- Content security solutions

Global Gunshot Detection System Market, by Basis of System

- Outdoor

- Indoor

Global Gunshot Detection System Market, by Application

- Commercial

- Defense

Global Gunshot Detection System Market, by Installation

- Fixed Installations

- Vehicle Mounted

- Soldier Mounted

Global Gunshot Detection System Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.34 Billion |

| CAGR | 6.87% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Solution, Basis of System, Application, Installation |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | SST, Raytheon BBN technologies, QinetiQ, Shooter Detection Systems, Acoem Group, Thales, Louroe Electronics, Tracer Technology Systems, Safety Dynamics and Battelle Memorial Institute |

| Key Market Opportunities | • Integration with Smart City Initiatives • Enhanced Data Analytics and Integration |

| Key Market Drivers | • Technological Advancements • Increased Focus on Smart Cities |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Gunshot Detection System Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Gunshot Detection System Market historical market size for the year 2021, and forecast from 2024 to 2034.

- Gunshot Detection System Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Gunshot Detection System Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Gunshot Detection System Market is 2024- 2033

What is the growth rate of the global Gunshot Detection System Market?

The global Gunshot Detection System Market is growing at a CAGR of 6.87% over the next 10 years

Which region has the highest growth rate in the market of Gunshot Detection System Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Gunshot Detection System Market?

North America holds the largest share in 2022

Who are the key players in the global Gunshot Detection System Market?

SST, Raytheon BBN technologies, QinetiQ, Shooter Detection Systems, Acoem Group, Thales, Louroe Electronics, Tracer Technology Systems, Safety Dynamics and Battelle Memorial Institute. and Raytheon Company are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Gunshot Detection System Market 4.3.1. Impact on Market Size 4.3.2. installation Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Gunshot Detection System Market, By solution 6.1. Introduction 6.2. System 6.3. SaaS Chapter 7. Global Gunshot Detection System Market, By basis of system 7.1. Introduction 7.2. Outdoor 7.3. Indoor Chapter 8. Global Gunshot Detection System Market, By Application 8.1. Introduction 8.2. Commercial 8.3. Defense Chapter 9. Global Gunshot Detection System Market, By installation 9.1. Introduction 9.2. Fixed Installations 9.3. Vehicle Mounted 9.4. Soldier Mounted Chapter 10. Global Gunshot Detection System Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By solution, 2020 - 2028 10.2.5. Market Size and Forecast, By basis of system, 2020 - 2028 10.2.6. Market Size and Forecast, By Application, 2020 – 2028 10.2.7. Market Size and Forecast, By installation, 2020 – 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By solution, 2020 - 2028 10.2.8.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.8.6. Market Size and Forecast, By installation, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By solution, 2020 - 2028 10.2.9.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.9.6. Market Size and Forecast, By installation, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By solution, 2020 - 2028 10.3.5. Market Size and Forecast, By basis of system, 2020 - 2028 10.3.6. Market Size and Forecast, By Application, 2020 – 2028 10.3.7. Market Size and Forecast, By installation, 2020 – 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By solution, 2020 - 2028 10.3.8.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.8.6. Market Size and Forecast, By installation, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By solution, 2020 - 2028 10.3.9.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.9.6. Market Size and Forecast, By installation, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By solution, 2020 - 2028 10.3.10.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.10.6. Market Size and Forecast, By installation, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By solution, 2020 - 2028 10.3.11.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.11.6. Market Size and Forecast, By installation, 2020 - 2028 10.3.12. Rest Of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By solution, 2020 - 2028 10.3.12.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.12.6. Market Size and Forecast, By installation, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By solution, 2020 - 2028 10.4.5. Market Size and Forecast, By basis of system, 2020 - 2028 10.4.6. Market Size and Forecast, By Application, 2020 – 2028 10.4.7. Market Size and Forecast, By installation, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By solution, 2020 - 2028 10.4.8.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.8.6. Market Size and Forecast, By installation, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By solution, 2020 - 2028 10.4.9.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.9.6. Market Size and Forecast, By installation, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By solution, 2020 - 2028 10.4.10.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.10.6. Market Size and Forecast, By installation, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By solution, 2020 - 2028 10.4.11.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.11.6. Market Size and Forecast, By installation, 2020 - 2028 10.4.12. Rest Of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By solution, 2020 - 2028 10.4.12.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Application, 2020 – 2028 10.4.12.6. Market Size and Forecast, By installation, 2020 - 2028 10.5. Rest Of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By solution, 2020 - 2028 10.5.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.5.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.6. Market Size and Forecast, By installation, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By solution, 2020 - 2028 10.5.8.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.8.6. Market Size and Forecast, By installation, 2020 - 2028 10.5.9. Middle East & Afirica 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By solution, 2020 - 2028 10.5.9.4. Market Size and Forecast, By basis of system, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Application, 2020 – 2028 10.5.9.6. Market Size and Forecast, By installation, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. SST 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Raytheon BBN technologies 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. QinetiQ 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. Shooter Detection Systems 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. Acoem Group 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Thales 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. Louroe Electronics 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Tracer Technology Systems 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Safety Dynamics 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Battelle Memorial Institute 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology