GRP Pipe Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

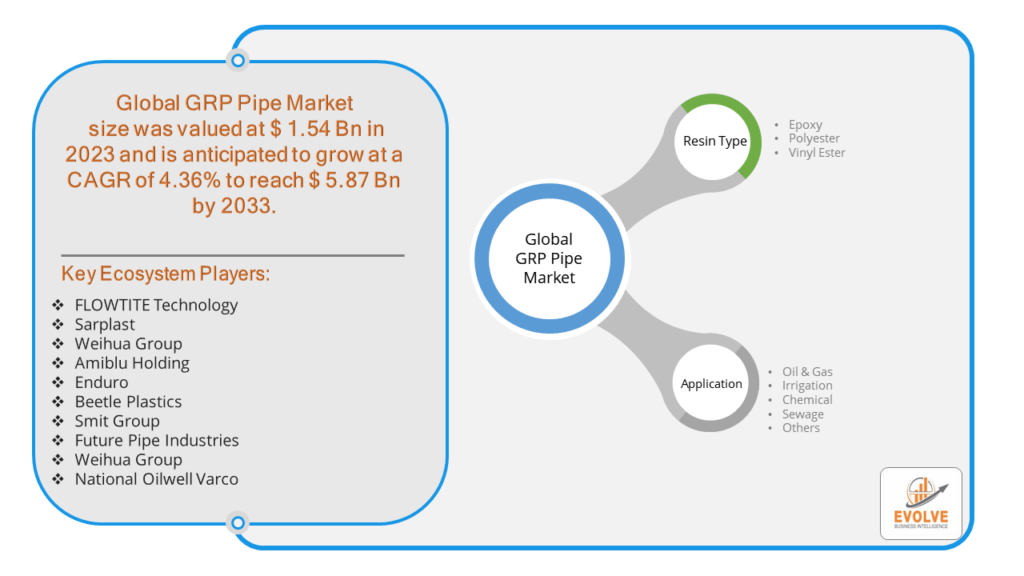

GRP Pipe Market Research Report: Information By Resin Type (Epoxy, Polyester, Vinyl Ester), By Application (Oil & Gas, Irrigation, Chemical, Sewage, Others), and by Region — Forecast till 2033

Page: 168

GRP Pipe Market Overview

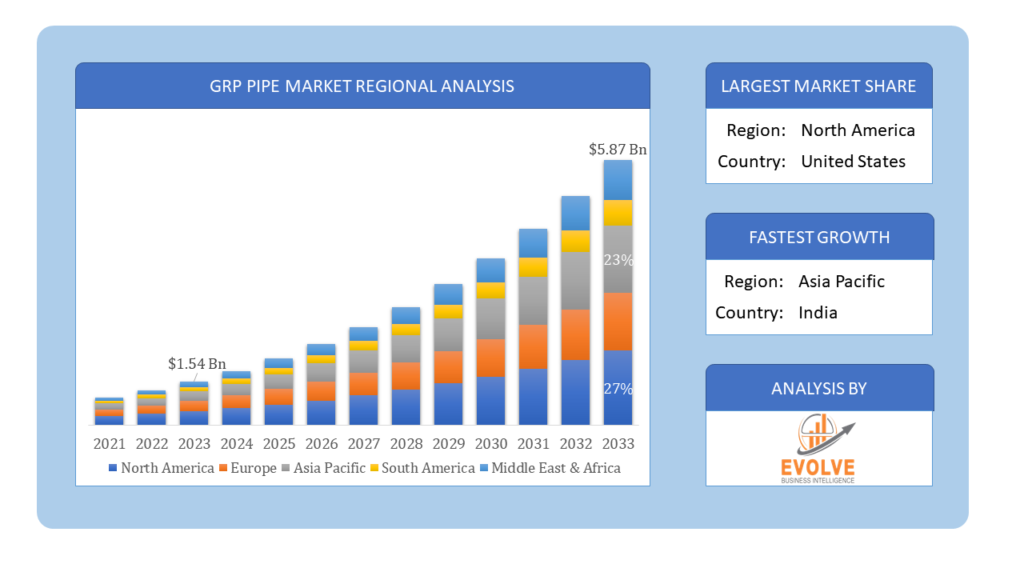

The GRP Pipe Market Size is expected to reach USD 5.87 Billion by 2033. The GRP Pipe Market industry size accounted for USD 1.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.36% from 2023 to 2033. GRP (Glass Reinforced Plastic) pipes are composite materials made of a combination of glass fiber, polyester resin, and sometimes other additives. The GRP Pipe Market refers to the industry involved in manufacturing, distributing, and using these pipes. These pipes are known for their corrosion resistance, lightweight nature, durability, and low maintenance requirements, making them popular in various applications such as water supply, wastewater management, oil and gas transportation, chemical industries, and infrastructure projects. The market encompasses manufacturers, suppliers, distributors, and end-users across different sectors where these pipes are employed.

Global GRP Pipe Market Synopsis

The COVID-19 pandemic had various impacts on the GRP Pipe Market. Many GRP pipe manufacturers faced disruptions in raw material supply chains due to lockdowns and restrictions on movement globally. This affected production schedules and delivery timelines. Demand for GRP pipes varied across different sectors. While some sectors such as water and wastewater management maintained stable demand, others like construction and infrastructure saw delays or cancellations of projects, impacting demand. Implementing safety protocols and social distancing measures in manufacturing facilities slowed down production and increased operational costs. Lockdowns and restrictions on movement hampered the production and transportation of raw materials needed for GRP pipes. This limited the ability of manufacturers to meet existing demand. The overall economic contraction caused by COVID-19 led to businesses delaying or canceling investments in new infrastructure projects, further reducing demand for GRP pipes.

GRP Pipe Market Dynamics

The major factors that have impacted the growth of GRP Pipe Market are as follows:

Drivers:

Ø Technological Advancements

Continuous innovations in manufacturing processes and materials enhance the performance and capabilities of GRP pipes, expanding their applications and improving their overall efficiency. Their lightweight nature makes GRP pipes easier to transport, handle, and install compared to traditional materials like steel or concrete. Additionally, their durability ensures a longer service life and reduced maintenance costs. Despite initial higher costs compared to some traditional materials, GRP pipes offer long-term cost benefits due to their durability and low maintenance requirements. GRP pipes can be customized in terms of size, shape, and properties, making them suitable for a wide range of applications including municipal water distribution, industrial pipelines, and offshore oil platforms.

Restraint:

- Perception of High Initial Costs

While GRP pipes offer long-term cost benefits due to their durability and low maintenance requirements, their initial installation costs can be higher compared to traditional materials like concrete or PVC. This can deter potential customers, especially in cost-sensitive sectors or regions where budget constraints are significant. The price of GRP pipes can be impacted by the fluctuating costs of raw materials like resins and fiberglass. This can make it difficult for manufacturers to maintain stable pricing.

Opportunity:

⮚ Rising Demand in Oil and Gas Industry

GRP pipes are increasingly used in the oil and gas industry for applications such as offshore pipelines and chemical handling due to their corrosion resistance and durability. The expansion of oil and gas exploration activities presents a promising market opportunity for GRP pipe manufacturers. Increasing regulations aimed at reducing environmental impact and improving infrastructure sustainability favor materials like GRP, which are recyclable and have a lower carbon footprint compared to traditional materials. Ongoing advancements in manufacturing processes and materials allow for the development of GRP pipes with enhanced performance characteristics, opening up new applications and markets.

GRP Pipe Market Segment Overview

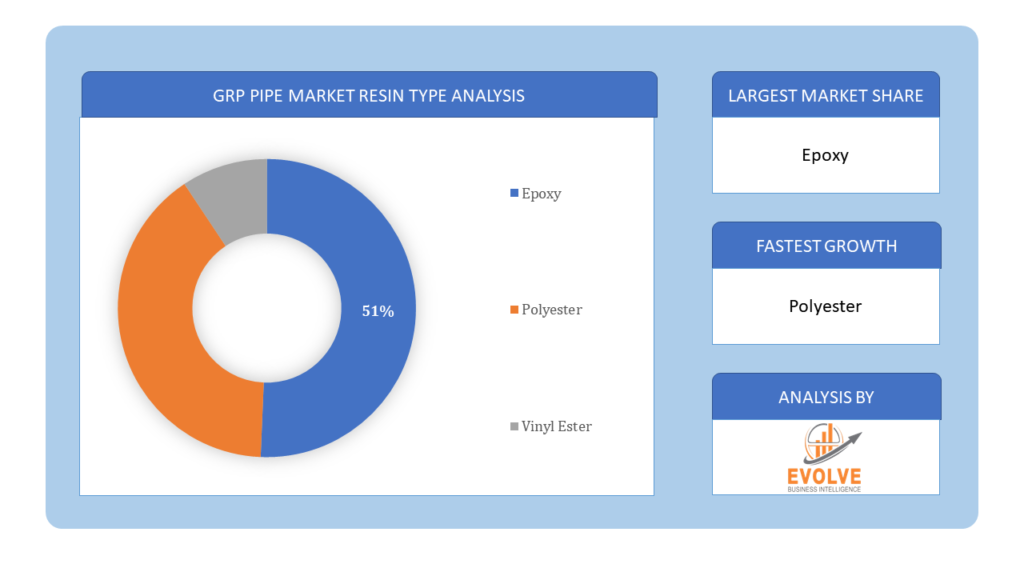

By Resin Type

Based on Resin Type, the market is segmented based on Epoxy, Polyester and Vinyl Ester. The Epoxy segment dominant the market. The epoxy resin GRP pipes have superior properties such as abrasion resistance, corrosion resistance, low friction, high insulation, and others compared to the other resins type. These properties make it a preferred choice for chemical and oil and gas industry. The epoxy resin enhances the flow capacity of the resources and cross linked structure of epoxy resin pipe makes it robust, ensures resistance and thermostability, thus becoming a better choice compared to polyester and vinyl ester for oil and gas applications.

Based on Resin Type, the market is segmented based on Epoxy, Polyester and Vinyl Ester. The Epoxy segment dominant the market. The epoxy resin GRP pipes have superior properties such as abrasion resistance, corrosion resistance, low friction, high insulation, and others compared to the other resins type. These properties make it a preferred choice for chemical and oil and gas industry. The epoxy resin enhances the flow capacity of the resources and cross linked structure of epoxy resin pipe makes it robust, ensures resistance and thermostability, thus becoming a better choice compared to polyester and vinyl ester for oil and gas applications.

By Application

Based on Application, the market segment has been divided into the Oil & Gas, Irrigation, Chemical, Sewage and Others. The Oil & Gas segment dominant the market. The GRP pipes are majorly used in oil and gas in refinery piping, crude oil transmission, offshore, pipeline, and others. Manufacturers have shifted from steel pipes to GRP for high-pressure applications, owing to its corrosion resistance and durability, thereby influencing the demand of GRP pipes in the oil and gas segment. The pipes are mostly used in desalination operations, offshore applications, and others that require weight advantage and fire fighting infrastructure.

Global GRP Pipe Market Regional Analysis

Based on region, the global GRP Pipe Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the GRP Pipe Market followed by the Asia-Pacific and Europe regions.

GRP Pipe North America Market

GRP Pipe North America Market

North America holds a dominant position in the GRP Pipe Market. This region is characterized by stringent environmental regulations and aging infrastructure, driving demand for corrosion-resistant materials like GRP pipes in water supply, wastewater management, and industrial applications. Technological advancements and emphasis on sustainability further bolster market growth.

GRP Pipe Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the GRP Pipe Market industry. Rapid urbanization and industrialization in countries like China, India, and Southeast Asian nations drive significant demand for GRP pipes. Infrastructure expansion projects, particularly in water management and industrial applications, present substantial growth opportunities. Cost-effectiveness and adaptability to diverse environmental conditions are key factors driving adoption in this region.

Competitive Landscape

The global GRP Pipe Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- FLOWTITE Technology

- Sarplast

- Weihua Group

- Amiblu Holding

- Enduro

- Beetle Plastics

- Smit Group

- Future Pipe Industries

- Weihua Group

- National Oilwell Varco

Scope of the Report

Global GRP Pipe Market, by Resin Type

- Epoxy

- Polyester

- Vinyl Ester

Global GRP Pipe Market, by Application

- Oil & Gas

- Irrigation

- Chemical

- Sewage

- Others

Global GRP Pipe Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $30.45 Billion |

| CAGR | 17.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Resin Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | FLOWTITE Technology, Sarplast, Weihua Group, Amiblu Holding, Enduro, Beetle Plastics, Smit Group, Future Pipe Industries, Weihua Group and National Oilwell Varco |

| Key Market Opportunities | • Rising Demand in Oil and Gas Industry |

| Key Market Drivers | • Technological Advancements • Cost-Effectiveness and Versatility |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future GRP Pipe Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- GRP Pipe Market historical market size for the year 2021, and forecast from 2023 to 2033

- GRP Pipe Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global GRP Pipe Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global GRP Pipe Market is 2021- 2033

2.What is the growth rate of the global GRP Pipe Market?

- The global GRP Pipe Market is growing at a CAGR of 17.63% over the next 10 years

3.Which region has the highest growth rate in the market of GRP Pipe Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global GRP Pipe Market?

- North America holds the largest share in 2022

5.Who are the key players in the global GRP Pipe Market?

FLOWTITE Technology, Sarplast, Weihua Group, Amiblu Holding, Enduro, Beetle Plastics, Smit Group, Future Pipe Industries, Weihua Group and National Oilwell Varco are the major companies operating in the market

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the GRP Pipe Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the GRP Pipe Market 4.8. Import Analysis of the GRP Pipe Market 4.9. Export Analysis of the GRP Pipe Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global GRP Pipe Market, By Resin Type 6.1. Introduction 6.2. Epoxy 6.3. Polyester 6.4. Vinyl Ester Chapter 7. Global GRP Pipe Market, By Application 7.1. Introduction 7.2. Oil & Gas 7.3. Irrigation 7.4. Chemical 7.5. Sewage 7.6. Others Chapter 8. Global GRP Pipe Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. FLOWTITE Technology 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Sarplast 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Weihua Group 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Amiblu Holding 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Enduro 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Beetle Plastics 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Smit Group 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Future Pipe Industries 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Weihua Group 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. National Oilwell Varco 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology