Grains, Soymilk, and Cocoa Drinks Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

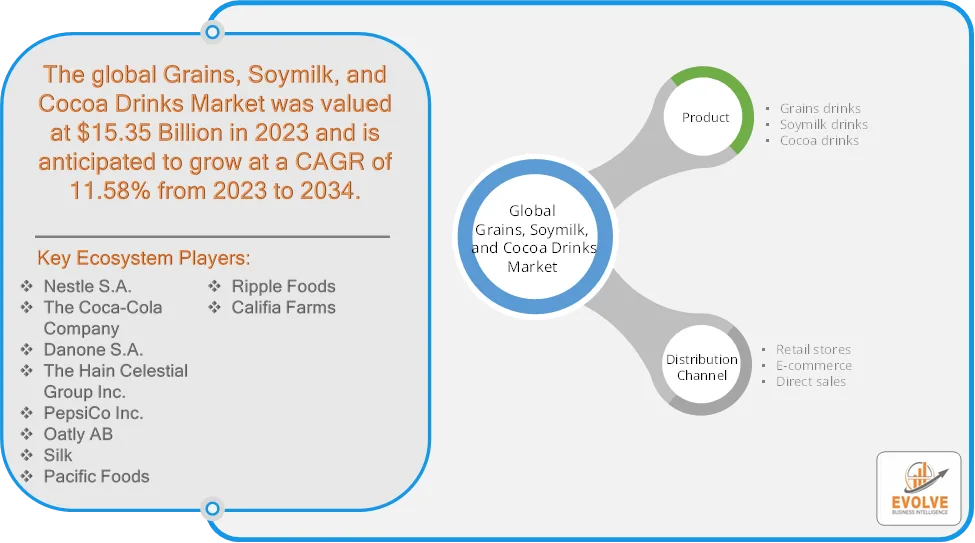

Grains, Soymilk, and Cocoa Drinks Market Research Report: Information By Product (Grains drinks, Soymilk drinks, Cocoa drinks), By Distribution Channel (Retail stores, E-commerce, Direct sales), and by Region — Forecast till 2033

Page: 218

Grains, Soymilk, and Cocoa Drinks Market Overview

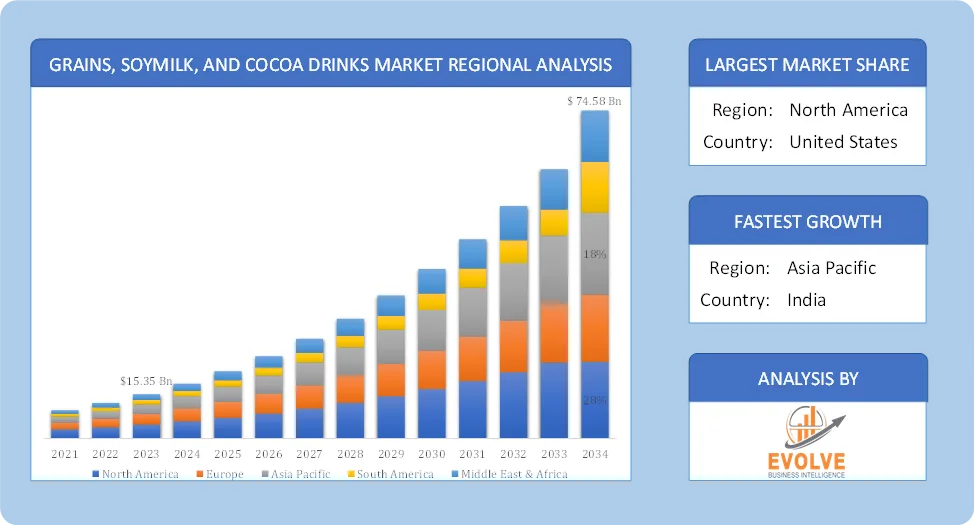

The Grains, Soymilk, and Cocoa Drinks Market size accounted for USD 15.35 Billion in 2023 and is estimated to account for 18.98 Billion in 2024. The Market is expected to reach USD 74.58 Billion by 2034 growing at a compound annual growth rate (CAGR) of 11.58% from 2024 to 2034. The grains, soymilk, and cocoa drinks are dynamic and influenced by several converging trends, particularly those related to health and dietary preferences. The soymilk market is experiencing steady growth, driven by its nutritional profile and versatility. The chocolate powdered drinks market is also expanding, fueled by factors like changing consumer preferences and the widespread appeal of chocolate. Grains are a very large market, and are of course the base of many of the products described above. The market for various grains is subject to many factors, including weather, and global economics.

The Indian soy milk market is poised for robust growth, driven by health trends, urbanization, and increased availability through various retail channels.

Global Grains, Soymilk, and Cocoa Drinks Market Synopsis

Grains, Soymilk, and Cocoa Drinks Market Dynamics

Grains, Soymilk, and Cocoa Drinks Market Dynamics

The major factors that have impacted the growth of Grains, Soymilk, and Cocoa Drinks Market are as follows:

Drivers:

Ø Rise in Lactose Intolerance and Dairy Allergies

The increasing prevalence of lactose intolerance and dairy allergies has prompted consumers to seek alternatives to traditional dairy products. Plant-based beverages like soy milk offer a viable substitute, catering to those unable to consume dairy. A global shift towards veganism and plant-based diets has expanded the consumer base for non-dairy beverages. Soy milk and grain-based drinks serve as essential components of these diets, providing necessary nutrients while adhering to plant-based principles.

Restraint:

- Memory Supply Chain Dependencies and Price Sensitivity

The production of these beverages relies on complex supply chains involving ingredient sourcing, manufacturing, and distribution. Disruptions at any stage—such as raw material shortages, logistical challenges, or geopolitical tensions—can adversely affect product availability and market stability. Plant-based beverages often come at a premium price compared to conventional dairy products. This price difference can deter cost-conscious consumers, especially in developing markets, thereby restraining market growth.

Opportunity:

⮚ Rising Expansion of Plant-Based Diets

The increasing adoption of plant-based diets worldwide is driving demand for non-dairy beverages. Consumers are seeking alternatives to traditional dairy products, leading to a surge in soy milk and grain-based drink consumption. This trend is particularly pronounced in regions with rising health consciousness and environmental awareness. There is a growing opportunity for manufacturers to innovate by introducing new flavors, formulations, and fortified options. Developing beverages that cater to specific dietary needs, such as gluten-free or low-sugar options, can attract a broader consumer base. Additionally, incorporating functional ingredients like vitamins, minerals, and probiotics can enhance the nutritional profile of these drinks, appealing to health-conscious consumers.

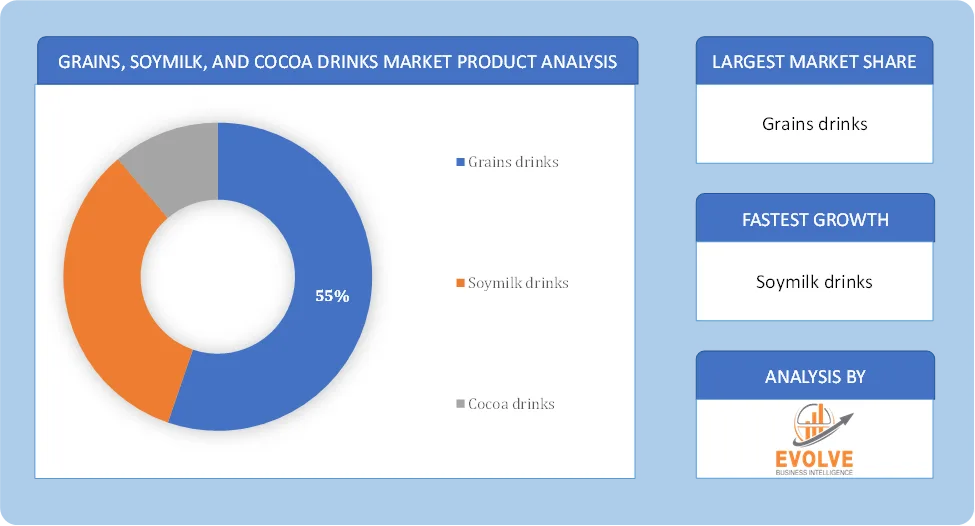

Grains, Soymilk, and Cocoa Drinks Market Segment Overview

Based on Product, the market is segmented based on Grains drinks, Soymilk drinks, Cocoa drinks. The Soymilk drinks segment dominant the market. The rising popularity of plant-based diets and the increasing number of individuals opting for dairy alternatives have created a favorable market environment for Soymilk drinks. These beverages, derived from soybeans, provide a lactose-free, vegan-friendly, and nutritious option for consumers seeking alternatives to traditional dairy milk.

By Distribution Channel

Based on Distribution Channel, the market segment has been divided into the Retail stores, E-commerce, Direct sales. Retail stores dominate the Grains, Soymilk, and Cocoa Drinks Market. These physical brick-and-mortar establishments, including supermarkets, grocery stores, convenience stores, and specialty health food stores, serve as key distribution channels for these beverages. Retail stores offer a wide range of product options, allowing consumers to browse and choose from various brands, flavors, and packaging formats.

Global Grains, Soymilk, and Cocoa Drinks Market Regional Analysis

Based on region, the global Grains, Soymilk, and Cocoa Drinks Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Grains, Soymilk, and Cocoa Drinks Market followed by the Asia-Pacific and Europe regions.

North America Global Grains, Soymilk, and Cocoa Drinks Market

North America Global Grains, Soymilk, and Cocoa Drinks Market

North America holds a dominant position in the Grains, Soymilk, and Cocoa Drinks Market. The demand for soymilk is growing due to the rising popularity of vegan and vegetarian diets, as well as increasing lactose intolerance. The United States and Canada are major markets, with a focus on organic and fortified soymilk.

Asia-Pacific Global Grains, Soymilk, and Cocoa Drinks Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Grains, Soymilk, and Cocoa Drinks Market industry. It’s driven by traditional consumption patterns and increasing health consciousness and Growth is fueled by rising disposable incomes and the adoption of Western dietary trends.

Competitive Landscape

The global Grains, Soymilk, and Cocoa Drinks Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Nestle S.A.

- The Coca-Cola Company

- Danone S.A.

- The Hain Celestial Group Inc.

- PepsiCo Inc.

- Oatly AB

- Silk

- Pacific Foods

- Ripple Foods

- Califia Farms.

Scope of the Report

Global Grains, Soymilk, and Cocoa Drinks Market, by Product

- Grains drinks

- Soymilk drinks

- Cocoa drinks

Global Grains, Soymilk, and Cocoa Drinks Market, by Distribution Channel

- Retail stores

- E-commerce

- Direct sales

Global Grains, Soymilk, and Cocoa Drinks Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 74.58 Billion |

| CAGR (2023-2033) | 11.58% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Distribution Channel |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Nestle S.A., The Coca-Cola Company, Danone S.A., The Hain Celestial Group Inc., PepsiCo Inc., Oatly AB, Silk, Pacific Foods, Ripple Foods and Califia Farms. |

| Key Market Opportunities | · Rising Expansion of Plant-Based Diets · Product Innovation and Diversification |

| Key Market Drivers | · Rise in Lactose Intolerance and Dairy Allergies · Growth of Vegan and Plant-Based Diets |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Grains, Soymilk, and Cocoa Drinks Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Grains, Soymilk, and Cocoa Drinks Market historical market size for the year 2021, and forecast from 2023 to 2033

- Grains, Soymilk, and Cocoa Drinks Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Grains, Soymilk, and Cocoa Drinks Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Grains, Soymilk, and Cocoa Drinks Market is 2021- 2033

What is the growth rate of the global Grains, Soymilk, and Cocoa Drinks Market?

The global Grains, Soymilk, and Cocoa Drinks Market is growing at a CAGR of 11.58% over the next 10 years

Which region has the highest growth rate in the market of Grains, Soymilk, and Cocoa Drinks Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Grains, Soymilk, and Cocoa Drinks Market?

North America holds the largest share in 2022

Who are the key players in the global Grains, Soymilk, and Cocoa Drinks Market?

Nestle S.A., The Coca-Cola Company, Danone S.A., The Hain Celestial Group Inc., PepsiCo Inc., Oatly AB, Silk, Pacific Foods, Ripple Foods and Califia Farms.are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Grains, Soymilk, and Cocoa Drinks Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Grains, Soymilk, and Cocoa Drinks Market 4.8. Import Analysis of the Grains, Soymilk, and Cocoa Drinks Market 4.9. Export Analysis of the Grains, Soymilk, and Cocoa Drinks Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Grains, Soymilk, and Cocoa Drinks Market, By Product 6.1. Introduction 6.2. Grains drinks 6.3. Soymilk drinks 6.4. Cocoa drinks Chapter 7. Global Grains, Soymilk, and Cocoa Drinks Market, By Distribution Channel 7.1. Introduction 7.2. Large Enterprises 7.3. SMEs Chapter 8. Global Grains, Soymilk, and Cocoa Drinks Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2024-2034 8.2.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.5. Market Size and Forecast, By End User, 2024-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.2.6.4. Market Size and Forecast, By End User, 2024-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.7.5. Market Size and Forecast, By End User, 2024-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2024-2034 8.3.4. Market Size and Forecast, By Product Type, 2024-2034 8.3.5. Market Size and Forecast, By End User, 2024-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.6.4. Market Size and Forecast, By End User, 2024-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.7.4. Market Size and Forecast, By End User, 2024-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.8.4. Market Size and Forecast, By End User, 2024-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.9.4. Market Size and Forecast, By End User, 2024-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.11.4. Market Size and Forecast, By End User, 2024-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2024-2034 8.4.4. Market Size and Forecast, By Product Type, 2024-2034 8.12.28. Market Size and Forecast, By End User, 2024-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.6.4. Market Size and Forecast, By End User, 2024-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.7.4. Market Size and Forecast, By End User, 2024-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.8.4. Market Size and Forecast, By End User, 2024-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.9.4. Market Size and Forecast, By End User, 2024-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.10.4. Market Size and Forecast, By End User, 2024-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2024-2034 8.5.4. Market Size and Forecast, By End User, 2024-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Nestle S.A. 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. The Coca-Cola Company 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Danone S.A. 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. The Hain Celestial Group Inc. 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. PepsiCo Inc. 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Oatly AB 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Silk 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Pacific Foods 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Ripple Foods 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Califia Farms 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology