Global Soft Magnetic Materials Market Analysis and Global Forecast 2022-2030

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

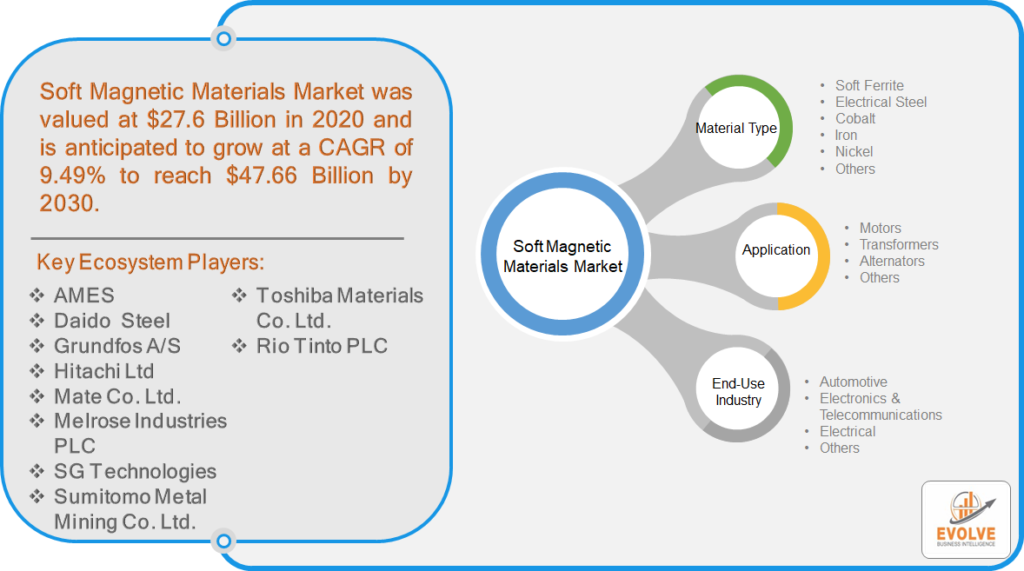

Global Soft Magnetic Materials Market Research Report: Information By Material Type (Soft Ferrite, Electrical Steel, Cobalt, Iron, Nickel, and Others), By Application (Motors, Transformers, Alternators, and Others), By End-Use Industry (Automotive, Electronics & Telecommunications, Electrical, Energy and Power, and Others) and Region — Forecast till 2030

The global Soft Magnetic Materials market size is projected to reach approximately $ 47.66 Billion by 2028, at a CAGR of 9.49% from 2022 to 2030. Soft magnetic materials are those materials that have a steep rising magnetization curve, minimal energy loss during each magnetization cycle, and a small and narrow hysteresis loop. Soft magnetic materials are become of significant use in multiple ends user industries such as automotive, electronics and telecommunications, electrical and energy and power as well as in different applications which include motors, transformers, and alternators. This is due to a decrease in eddy current loss which increases the efficiency of motors and the high permeability offered by soft magnetic materials. Soft magnetic material is widely used in motors since it enhances the field produced by motor winding.

COVID-19 Impact Analysis

The COVID-19 pandemic has severely impacted the prices and supply of Soft Magnetic Materials. The pandemic also led to a greater need for medical equipment that uses motors, like ventilators. These are needed because they have high torque density and don’t create too much noise. Demand for ventilators is increasing quickly due to the increased number of coronavirus cases. This will increase demand for ventilator motors, which will eventually lead to market growth.

Market Dynamics

The factors driving the growth of the global Soft Magnetic Materials market include the rising demand for soft magnetic materials by the automotive end-user industry which are widely used in electric vehicles due to energy savings, low noise, and compact design. Furthermore, stepper motors, alternators, claw pole motors, brushed DC motors, and brushless DC motors also widely use soft magnetic materials which further drive the demand.

Drivers:

⮚ Increasing Demand from the Automotive Industry Players

The demand for electric vehicles is growing considerably due to which the demand for soft magnetic materials is rising considerably. Soft magnetic materials help to suppress noises at high-frequency ranges which are generated due to downsizing and space-saving designs in electric vehicles. In addition to this, soft magnetic materials are used in components such as alternators, induction coils, gearboxes, and antenna cores which are used in vehicles. Inductors occupy a large space in an automobile and are therefore being downsized which is enabled with the help of soft magnetic materials. Growing sales of hybrid automobiles which combine diesel and petrol engines with an electric motor is another significant factor affecting the demand for soft magnetic materials. In conclusion, all the aforementioned factors contribute to the growth of the global soft magnetic materials market.

Restraint:

Fluctuations in Raw Material Prices

The global soft magnetic materials market is expected to stall due to disruptions in the raw material supply chain that may be caused by sudden fluctuations in prices and difficulties with manufacturing. The price of iron ore fell sharply in August 2019 as more supply became available, along with the natural seasonal decline in demand. Since then, the price has fluctuated from USD 85 per MT to USD 96 per MT between August 2019 and January 2020 (prior to the Covid period). Iron ore prices have been volatile during the Covid period, but there has been no significant drop-off in price. Though it’s uncommon to see such a fluctuation in prices, other steel and mineral prices were also mostly up during the same time.

Opportunity:

⮚ Awareness about the Beneficial Properties of Soft Magnetic Materials

Soft magnetic materials are easy to magnetize and demagnetize due to which they are used to make temporary magnets. Since the domain wall movement is easy, they are easy to magnetize. Soft magnetic materials do not possess any void and have a homogenous structure hence the materials are not contaminated by impurities. Soft magnetic materials also possess high electrical resistivity due to which the eddy current loss is reduced drastically. Therefore, this factor contributes significantly to the growth of the global soft magnetic materials market.

Segment Overview

By Material Type

Based on the Material Type, the Soft Magnetic Materials market is segmented based on Soft Ferrite, Electrical Steel, Cobalt, Iron, Nickel, and Others. The Electric Steel Segment is anticipated to account for the large market share. Electric steel is used as an electrical insulator in electrical engineering and transmission; it has good permeability, low coactivity, and a low resistivity to iron. It also minimizes magnetic losses. Electric Steel materials are used in many different applications, such as electricity transformers, motors, and generators. They also have a large hysteresis area which lowers eddy current losses. This all boils down to the material’s higher efficiency for these applications

By Application

Based on Application, the global Soft Magnetic Materials market has been divided into Motors, Transformers, Alternators, and Others. The Motors segment is expected to hold the largest market share. Electric motors are used in a wide range of industries, including power transmission, consumer electronics, electric vehicles, and medical equipment. Medical equipment such as high-quality pumps, infusion pumps, hemodialysis machines, compressors, and respirators use small electric motors to function. They are also utilized in scanners and centrifuges.

By End-Use Industry

Based on End-Use Industry, the global Soft Magnetic Materials market has been divided into Automotive, Electronics & Telecommunications, Electrical, Energy and Power, and Others. The Automotive Industry segment is expected to hold the largest market share. Uses of Soft Magnetic Materials in the Automotive Industry include diesel engine induction coils and fuel injectors. The automotive industry has been at the forefront in utilizing soft magnetic materials in anti-lock brake systems, fuel injectors, and compressors. Because of this, they are projected to continue to lead the market during the forecast period.

Global Soft Magnetic Materials Market Share, by Segmentation

Regional Analysis

Based on region, the global Soft Magnetic Materials market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is projected to dominate the use of the Soft Magnetic Materials market followed by the North America and Europe regions.

Asia-Pacific Market

The Asia Pacific region dominates the soft magnetic materials market and is also expected to witness the highest growth due to large amounts of consumption as well as production from countries such as India and China. In addition to this, rapid industrialization in multiple countries in the Asia Pacific area along with geographical advantages which includes the presence of iron mines in China and India fuel the growth of Soft Magnetic Materials.

North America Market

The North American region is expected to witness considerable growth during the forecast period which is attributed to rapid technological developments and innovations in the soft magnetic materials field. The majority of the growth is in the United States. The country consumes electric motors, which are extensively used for several industrial applications. Some uses are pumping, compressed air, fans, refrigeration, and material processing.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. Because of their strategic innovations and broad regional presence, companies such as AMES, and Daido Steel. Grundfos A/S, Hitachi Ltd, Mate Co. Ltd., Melrose Industries PLC, SG Technologies, Sumitomo Metal Mining Co. Ltd., Toshiba Materials Co. Ltd., and Rio Tinto PLC, lead the global Soft Magnetic Materials business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- AMES

- Daido Steel

- Grundfos A/S

- Hitachi Ltd

- Mate Co. Ltd.

- Melrose Industries PLC

- SG Technologies

- Sumitomo Metal Mining Co. Ltd.

- Toshiba Materials Co. Ltd.

- Rio Tinto PLC

In March 2020, Sumitomo Metal Mining Co. Ltd. Announced that the lithium nickel manganese cobalt oxide (NMC) which is manufactured by them as cathode material which is used in lithium-ion batteries was selected by Toyota Motor Corporation to be used in their new Yaris hybrid car launch. This deal will ensure Sumitomo Metal Mining’s top position in the market.

Scope of the Report

Global Soft Magnetic Materials Market, by Material Type

- Soft Ferrite

- Electrical Steel

- Cobalt

- Iron

- Nickel

- Others

Global Soft Magnetic Materials Market, by Application

- Motors

- Transformers

- Alternators

- Others

Global Soft Magnetic Materials Market, by End-Use Industry

- Automotive

- Electronics & Telecommunications

- Electrical

- Others

Global Soft Magnetic Materials Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- Rest of the World

| Parameters | Indicators |

|---|---|

| Market Size | 2030: $ $ 47.66 Billion |

| CAGR | 9.49% CAGR (2022-2030) |

| Base year | 2021 |

| Forecast Period | 2022-2030 |

| Historical Data | 2020 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material Type, Application, and End-Use Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | AMES, Daido Steel. Grundfos A/S, Hitachi Ltd, Mate Co. Ltd., Melrose Industries PLC, SG Technologies, Sumitomo Metal Mining Co. Ltd., Toshiba Materials Co. Ltd., Rio Tinto PLC |

| Key Market Opportunities | Awareness about the Beneficial Properties of Soft Magnetic Materials |

| Key Market Drivers | Increasing Demand from the Automotive Industry Players |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Soft Magnetic Materials market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Soft Magnetic Materials market historical market size for the year 2020, and forecast from 2021 to 2028

- Soft Magnetic Materials market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Soft Magnetic Materials market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

<p class=”Release”>Press Release</p>

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Soft Magnetic Materials market is 2021 - 2028

What is the growth rate of the global Soft Magnetic Materials market?

The global Soft Magnetic Materials market is growing at a CAGR of ~ 49% over the next 7 years

Which region has the highest growth rate in the global Soft Magnetic Materials market?

North America is expected to register the highest CAGR from 2022-to 2030

Which region has the largest share in the global Soft Magnetic Materials market?

Asia-Pacific holds the largest share in 2021

Who are the key players in the global Soft Magnetic Materials market?

AMES, Daido Steel. Grundfos A/S, Hitachi Ltd, Mate Co. Ltd., Melrose Industries PLC, SG Technologies, Sumitomo Metal Mining Co. Ltd., Toshiba Materials Co. Ltd., and Rio Tinto PLC are the major companies operating in the global Soft Magnetic Materials

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Application Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End Users 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on Soft Magnetic Materials 4.3.1. Impact on Market Size 4.3.2. End-User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of Soft Magnetic Materials 4.8. Import Analysis of Soft Magnetic Materials 4.9. Export Analysis of Soft Magnetic Materials Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Soft Magnetic Market, By Material Type 6.1. Introduction 6.2. Soft Ferrite 6.3. Electrical Steel 6.4. Cobalt 6.5. Iron 6.6. Nickel 6.7. Others Chapter 7. Global Soft Magnetic Market, By Application 7.1. Introduction 7.2. Motors 7.3. Transformers 7.4. Alternators 7.5. Others Chapter 8. Global Soft Magnetic Market, By End User Industry 8.1. Introduction 8.2. Automotive 8.3. Electronics and Telecommunications 8.4. Electrical 8.5. Energy and Power 8.6. Others Chapter 9. Global Soft Magnetic Materials, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.6. US 9.2.6.1. Introduction 9.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.2.7. Canada 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.6. Germany 9.3.6.1. Introduction 9.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.7. France 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.8. UK 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.9. Italy 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 9.3.10. Rest Of Europe 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Application, 2020 - 2028 9.4.6. China 9.4.6.1. Introduction 9.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.7. India 9.4.7.1. Introduction 9.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.8. Japan 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.9. South Korea 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 9.4.10. Rest Of Asia-Pacific 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Application, 2020 - 2028 9.5.5. Market Size and Forecast, By Region, 2020 - 2028 9.5.6. South America 9.5.6.1. Introduction 9.5.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 9.5.7. Middle East and Africa 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 9.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 11. Company Profiles 11.1. AMES 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.2.1. Financial – Existing/Funding 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Daido Steel 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.2.1. Financial – Existing/Funding 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Grundfos A/S 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.2.1. Financial – Existing/Funding 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Hitachi Ltd. 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.2.1. Financial – Existing/Funding 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Mate Co. Ltd. 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.2.1. Financial – Existing/Funding 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Melrose Industries PLC 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.2.1. Financial – Existing/Funding 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. SG Technologies 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.2.1. Financial – Existing/Funding 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Sumitomo Metal Mining Co. Ltd. 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.2.1. Financial – Existing/Funding 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Toshiba Materials Co. Ltd. 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.2.1. Financial – Existing/Funding 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Rio Tinto PLC 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.2.1. Financial – Existing/Funding 11.10.3. Product Portfolio 11.10.4. Recent Development and Strategies Adopted 11.10.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology