Global Sensor Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Global Sensor Market Research Report: Information By Sensor Type (Radar Sensor, Optical Sensor, Biosensor, Touch Sensor, Image Sensor, Pressure Sensor, Temperature Sensor, Proximity & Displacement Sensor, Level Sensor, Position Sensor, Humidity Sensor, Accelerometer & Speed Sensor, Others), By Technology (CMOS, CCD, Organic, MEMS, Others), By End User (Consumer Electronics, Industrial & Manufacturing, Energy & Power, Automotive, Aerospace & Defense, Healthcare, Oil & Gas, Metallurgy, Others), and by Region — Forecast till 2033

Global Sensor Market Overview

The Global Sensor Market Size is expected to reach USD 536.87 Billion by 2033. The Global Sensor Market industry size accounted for USD 246.26 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 8.79% from 2023 to 2033. The Global Sensor Market refers to the collective market for sensors worldwide. Sensors are devices that detect and respond to input from the physical environment, converting it into measurable signals. These signals are utilized for various applications across industries such as automotive, consumer electronics, healthcare, industrial automation, aerospace, and more. The market encompasses a wide range of sensor types, including but not limited to temperature sensors, pressure sensors, motion sensors, image sensors, and chemical sensors. With the increasing integration of sensors in various devices and systems for data collection, monitoring, and control purposes, the global sensor market has witnessed significant growth over the years. This market is influenced by factors such as technological advancements, increasing demand for IoT (Internet of Things) devices, rising automation trends, and growing awareness about the benefits of sensor-based solutions in enhancing efficiency and productivity.

Global Sensor Market Synopsis

The COVID-19 pandemic had significant impacts on the global sensor market. The pandemic disrupted global supply chains, leading to shortages of raw materials, components, and finished products. This affected the production and delivery of sensors, causing delays in manufacturing and distribution. With widespread lockdowns and economic uncertainties, demand for sensors experienced fluctuations across different industries. While certain sectors such as healthcare, telecommunication, and food & beverage experienced increased demand for sensors (e.g., medical sensors, temperature sensors for thermal screening, and sensors for remote monitoring), others like automotive and aerospace witnessed a decline due to reduced production and consumer spending. The pandemic accelerated the adoption of digital technologies and automation across various industries. This led to increased demand for sensors used in IoT devices, smart home systems, industrial automation, and remote monitoring solutions to enable businesses to operate with minimal human intervention and maintain continuity during lockdowns.

Global Sensor Market Dynamics

The major factors that have impacted the growth of Global Sensor Market are as follows:

Drivers:

Ø Technological Advancements

Continuous advancements in sensor technology lead to the development of sensors with improved accuracy, sensitivity, reliability, and miniaturization. Innovations such as MEMS (Micro-Electro-Mechanical Systems) sensors, IoT integration, and wireless connectivity contribute to the expansion of sensor applications across various industries. The growing focus on health and wellness drives demand for sensors in healthcare and fitness applications. Sensors are used in medical devices for monitoring vital signs, diagnosing diseases, and providing personalized healthcare solutions. In the fitness and wearable technology market, sensors track physical activity, heart rate, sleep patterns, and other health-related metrics.

Restraint:

- Perception of High Initial Investment Costs

Deploying sensor-based solutions often requires significant initial investment in sensor hardware, infrastructure, and implementation. For some businesses, especially small and medium-sized enterprises (SMEs), the upfront costs may be prohibitive, leading to slower adoption rates and limited market penetration. The proliferation of sensors and IoT devices raises concerns about data privacy and security. Collecting and transmitting sensitive data from sensors, such as personal health information or industrial process data, can expose businesses and individuals to cyber threats, data breaches, and regulatory compliance issues. Addressing these concerns requires robust cybersecurity measures, encryption protocols, and compliance with data protection regulations.

Opportunity:

⮚ Emerging Applications in Healthcare

The healthcare sector offers promising opportunities for sensor technology. Sensors are used in medical devices for patient monitoring, diagnostic testing, telemedicine, and personalized healthcare solutions. With an aging population, increasing prevalence of chronic diseases, and rising demand for remote patient monitoring, the healthcare sensor market is poised for substantial growth. Additionally, advancements in wearable sensors, implantable devices, and point-of-care diagnostics present new avenues for innovation and market expansion. The development of autonomous vehicles (AVs) relies heavily on sensor technology for perception, navigation, and decision-making. Sensors such as LiDAR, radar, cameras, and ultrasonic sensors enable AVs to sense their surroundings, detect obstacles, and navigate safely in complex environments. As the automotive industry progresses towards higher levels of autonomy, the demand for advanced sensor solutions is expected to increase, creating opportunities for sensor manufacturers and technology suppliers.

Global Sensor Market Segment Overview

By Sensor Type

Based on Sensor Type, the market is segmented based on Radar Sensor, Optical Sensor, Biosensor, Touch Sensor, Image Sensor, Pressure Sensor, Temperature Sensor, Proximity & Displacement Sensor, Level Sensor, Position Sensor, Humidity Sensor, Accelerometer & Speed Sensor and Others. The image sensors segment is dominant the sensor market revenue. This primarily owes rising adoption of technologies for improving anti-terror equipment and mitigating security lapses. However, humidity sensors are the fastest-growing category over the forecast period due to the increasing adoption of these sensors for moisture-sensitive uses in industries, such as healthcare, food and beverages, and textile.

By Technology

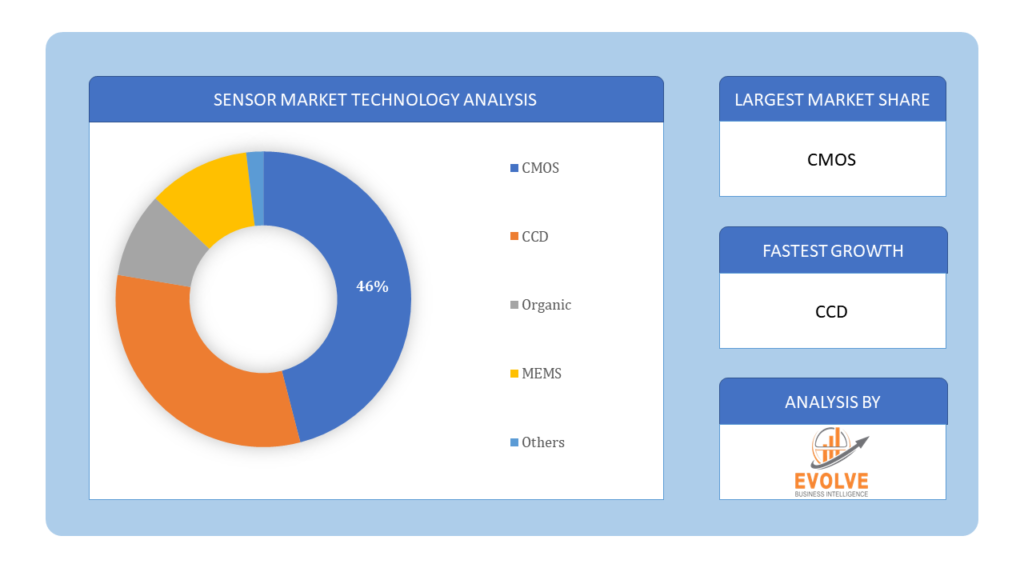

Based on Technology, the market segment has been divided into CMOS, CCD, Organic, MEMS and Others. The CMOS segment dominated the market. CMOS offers low power consumption, small size, faster frame rate, ease of integration, and inferior manufacturing cost. The performance of sensors has progressed due to the development of the CMOS sensor technology. However, MEMS is the fastest-growing category due to the growing usage of semiconductor devices in automobiles, consumer electronics, and healthcare technologies.

Based on Technology, the market segment has been divided into CMOS, CCD, Organic, MEMS and Others. The CMOS segment dominated the market. CMOS offers low power consumption, small size, faster frame rate, ease of integration, and inferior manufacturing cost. The performance of sensors has progressed due to the development of the CMOS sensor technology. However, MEMS is the fastest-growing category due to the growing usage of semiconductor devices in automobiles, consumer electronics, and healthcare technologies.

By End User

Based on End User, the market segment has been divided into Consumer Electronics, Industrial & Manufacturing, Energy & Power, Automotive, Aerospace & Defense, Healthcare, Oil & Gas, Metallurgy and Others. Automotive held the largest segment, owing to the increasing demand for a sensor for enhanced car safety features, convenience functions, and entertainment systems. However, consumer electronics is the fastest-growing category over the forecast period due to the increasing adoption of sensors in consumer electronic products such as cameras, televisions, washing machines, and microwave ovens.

Global Sensor Market Regional Analysis

Based on region, the global Sensor Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Global Sensor Market followed by the Asia-Pacific and Europe regions.

Global Sensor North America Market

Global Sensor North America Market

North America holds a dominant position in the Global Sensor Market. North America is a significant market for sensors, driven by robust technological infrastructure, strong R&D capabilities, and high adoption of IoT and automation technologies. The region is home to several leading sensor manufacturers, technology companies, and end-user industries, including automotive, healthcare, aerospace, and consumer electronics. The United States, in particular, is a key market for advanced sensor applications in automotive safety systems, healthcare diagnostics, and industrial automation.

Global Sensor Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Global Sensor Market industry. Asia-Pacific (APAC) is the fastest-growing region in the global sensor market, fueled by rapid industrialization, urbanization, and technological advancement. China, Japan, South Korea, and India are key markets within the region, accounting for a significant share of sensor production, consumption, and innovation. APAC is a manufacturing hub for consumer electronics, automotive components, and industrial machinery, driving demand for sensors in these sectors. Additionally, the region’s expanding healthcare infrastructure, smart city initiatives, and automotive electrification efforts present lucrative opportunities for sensor vendors.

Competitive Landscape

The global Sensor Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- STMicroelectronics

- NXP Semiconductors

- Infineon Technologies

- TE Connectivity

- Texas Instruments

- Robert Bosch

- Broadcom

- Sensirion AG

- Knowles Electronic

- Honeywell

Scope of the Report

Global Sensor Market, by Sensor Type

- Radar Sensor

- Optical Sensor

- Biosensor

- Touch Sensor

- Image Sensor

- Pressure Sensor

- Temperature Sensor

- Proximity & Displacement Sensor

- Level Sensor

- Position Sensor

- Humidity Sensor

- Accelerometer & Speed Sensor

- Others

Global Sensor Market, by Technology

- CMOS

- CCD

- Organic

- MEMS

- Others

Global Sensor Market, by End User

- Consumer Electronics

- Industrial & Manufacturing

- Energy & Power

- Automotive

- Aerospace & Defense

- Healthcare

- Oil & Gas

- Metallurgy

- Others

Global Sensor Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $536.7 Billion |

| CAGR | 8.79% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Sensor Type, Technology, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | STMicroelectronics, NXP Semiconductors, Infineon Technologies, TE Connectivity, Texas Instruments, Robert Bosch, Broadcom, Sensirion AG, Knowles Electronic and Honeywell. |

| Key Market Opportunities | • Emerging Applications in Healthcare • Advancements in Autonomous Vehicles |

| Key Market Drivers | • Technological Advancements • Increasing Focus on Health and Wellness |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Global Sensor Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Global Sensor Market historical market size for the year 2021, and forecast from 2023 to 2033

- Global Sensor Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Global Sensor Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Sensor Market?

The Sensor Market study spans from 2021 with forecasts extending to 2033, providing comprehensive insights into long-term trends and forecasts in sensor technology worldwide.

What is the growth rate of the Sensor Market?

The Sensor Market is anticipated to grow at a robust compound annual growth rate (CAGR) of 8.79% from 2023 to 2033, indicating significant expansion opportunities in the global sensor industry.

Which region has the highest growth rate in the Sensor Market?

The Asia-Pacific region exhibits the highest growth rate in the Sensor Market, driven by rapid industrialization, urbanization, and technological advancement, particularly in countries like China, Japan, South Korea, and India.

Which region has the largest share of the Sensor Market?

North America commands the largest share of the Sensor Market, owing to its robust technological infrastructure, strong R&D capabilities, and high adoption of IoT and automation technologies across industries.

Who are the key players in the Sensor Market?

Key players in the Sensor Market include STMicroelectronics, NXP Semiconductors, Infineon Technologies, TE Connectivity, Texas Instruments, Robert Bosch, Broadcom, Sensirion AG, Knowles Electronic, and Honeywell, driving innovation and competition in sensor technology worldwide.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Sensor Type Segement – Market Opportunity Score 4.1.2. Technology Segment – Market Opportunity Score 4.1.3. End-user Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Global Sensor Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Sensor Market, By Sensor Type 7.1. Introduction 7.1.1. Radar Sensor 7.1.2. Optical Sensor 7.1.3. Biosensor 7.1.4. Touch Sensor 7.1.5. Image Sensor 7.1.6. Pressure Sensor 7.1.7. Temperature Sensor 7.1.8. Proximity & Displacement Sensor 7.1.9. Level Sensor 7.1.10. Position Sensor 7.1.11. Humidity Sensor 7.1.12 Accelerometer & Speed Sensor 7.1.13 Others CHAPTER 8. Global Sensor Market, By Technology 8.1. Introduction 8.1.1. CMOS, 8.1.2. CCD 8.1.3. Organic 8.1.4. MEMS 8.1.5. Others CHAPTER 9. Global Sensor Market, By End-user 9.1. Introduction 9.1.1. Consumer Electronics 9.1.2. Industrial & Manufacturing 9.1.3. Energy & Power 9.1.4 Automotive 9.1.5 Aerospace & Defense 9.1.6 Healthcare 9.1.7 Oil & Gas 9.1.8 Metallurgy 9.1.9 Others CHAPTER 10. Global Sensor Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. STMicroelectronics 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. NXP Semiconductors 13.3. Infineon Technologies 13.4. TE Connectivity 13.5. Texas Instruments 13.6. Robert Bosch 13.7. Broadcom 13.8. Sensirion AG 13.9. Knowles Electronic 13.10. Honeywell

Connect to Analyst

Research Methodology

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Sensor Type Segement – Market Opportunity Score 4.1.2. Technology Segment – Market Opportunity Score 4.1.3. End-user Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Global Sensor Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Sensor Market, By Sensor Type 7.1. Introduction 7.1.1. Radar Sensor 7.1.2. Optical Sensor 7.1.3. Biosensor 7.1.4. Touch Sensor 7.1.5. Image Sensor 7.1.6. Pressure Sensor 7.1.7. Temperature Sensor 7.1.8. Proximity & Displacement Sensor 7.1.9. Level Sensor 7.1.10. Position Sensor 7.1.11. Humidity Sensor 7.1.12 Accelerometer & Speed Sensor 7.1.13 Others CHAPTER 8. Global Sensor Market, By Technology 8.1. Introduction 8.1.1. CMOS, 8.1.2. CCD 8.1.3. Organic 8.1.4. MEMS 8.1.5. Others CHAPTER 9. Global Sensor Market, By End-user 9.1. Introduction 9.1.1. Consumer Electronics 9.1.2. Industrial & Manufacturing 9.1.3. Energy & Power 9.1.4 Automotive 9.1.5 Aerospace & Defense 9.1.6 Healthcare 9.1.7 Oil & Gas 9.1.8 Metallurgy 9.1.9 Others CHAPTER 10. Global Sensor Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Sensor Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. STMicroelectronics 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. NXP Semiconductors 13.3. Infineon Technologies 13.4. TE Connectivity 13.5. Texas Instruments 13.6. Robert Bosch 13.7. Broadcom 13.8. Sensirion AG 13.9. Knowles Electronic 13.10. Honeywell