IoT in Water Utility Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

Global IoT in Water Utility Market By Product Type (Device, Gateways), By Application (Commercial, Residential) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Report Code: EB_LS_1265 | Page: 99 | Published Date: Nov 2021

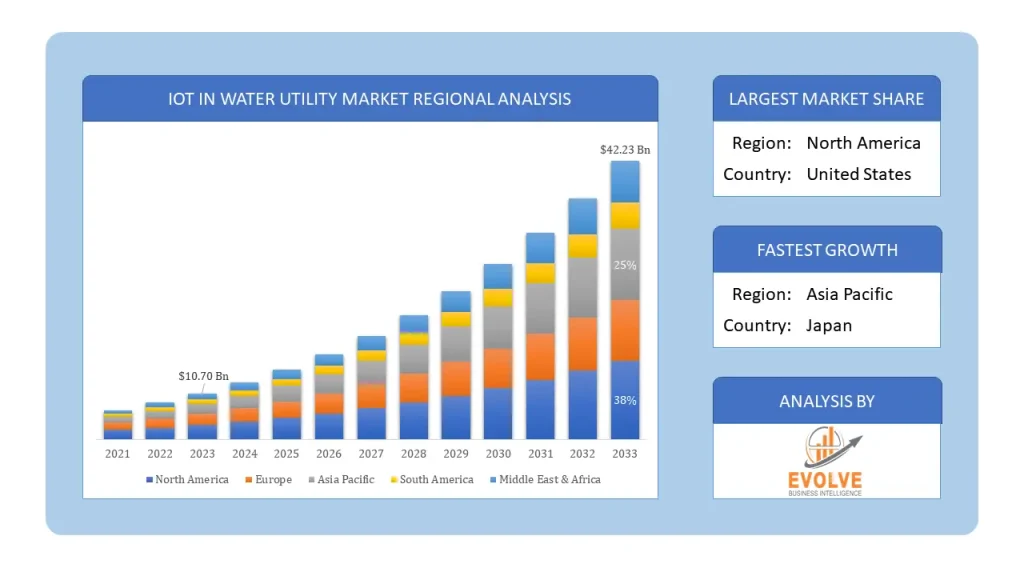

The global IoT in Water Utility market size is projected to reach approximately USD 42.23 Billion by 2033, at a CAGR of 14.72% from 2023 to 2033. IoT in water utility refers to the use of Internet of Things (IoT) technologies and devices to monitor and manage water resources more efficiently and sustainably. IoT in water utility solutions typically include sensors, devices, and software applications that collect and analyze data on water usage, quality, and distribution. By using IoT solutions in water utilities, organizations can gain real-time insights into water usage patterns and identify areas where water can be conserved and waste reduced. This can help water utilities to optimize their operations and reduce costs, while also improving water quality and sustainability.

The COVID-19 pandemic had a negative impact on the IoT in Water Utility market. The pandemic has caused disruptions in supply chains and has led to the shutdown of manufacturing facilities and delayed project timelines. Additionally, the pandemic has led to a decrease in demand for IoT solutions in the water utility sector due to budget constraints faced by municipalities and water utilities. Many water utilities and municipalities have had to divert their resources towards addressing the immediate challenges posed by the pandemic, such as ensuring the supply of safe drinking water and managing the increased demand for water due to the pandemic. This has resulted in a decrease in investment in IoT solutions for water utilities.

IoT in Water Utility Market Dynamics

The major factors that have impacted the growth of IoT in Water Utility are as follows:

Drivers:

Increasing Adoption Of Smart Water Metering

The IoT in the water utility market is growing rapidly due to the increasing adoption of smart water metering. This technology allows utilities to automatically meter water usage and bill customers based on their consumption. This is a major advantage over traditional metering methods, which can be inaccurate and require manual reading and billing. Smart water metering also provides customers with more transparency and control over their water usage, which can help them to save money. The need for reducing water losses and non-revenue water is driving market growth. The demand for effective water management is also increasing, which is further driving the market growth.

Restraint:

- Lack Of Infrastructure And Connectivity

Many water utilities are located in remote areas, making it difficult to implement and maintain IoT devices and systems. In addition, some water utilities may not have the necessary infrastructure in place to support IoT devices, such as reliable internet connectivity or updated equipment. This lack of infrastructure and connectivity can create challenges for water utilities to effectively implement IoT technologies to improve their operations and services. Without proper infrastructure and connectivity, IoT devices may not function as intended, leading to inefficiencies and potential failures. Therefore, addressing the infrastructure and connectivity challenges is crucial for the growth and success of IoT in the water utility market. Water utilities need to invest in the necessary infrastructure and connectivity to support IoT devices and systems, which can help improve their operations and services, reduce costs, and increase efficiency.

Opportunity:

Rapid Growth In The Number Of Smart Cities Across The Globe

There are several opportunities for the adoption of the Internet of Things (IoT) in the water utility market. These include the ability to improve the efficiency and reliability of water treatment and distribution systems, to better manage and conserve water resources, and to reduce the risk of water-borne diseases. Additionally, the use of IoT technologies can help water utilities to comply with regulatory requirements and to reduce operating costs. IoT sensors and devices can be used to monitor the quality of water in real time and to automatically control treatment and distribution processes. This can help to improve the efficiency and reliability of water systems and to reduce the risk of contamination or other problems. IoT technologies can be used to monitor the condition of water infrastructure assets, such as pipelines and pumps, and to predict when maintenance or repairs are needed. This can help water utilities to reduce downtime and to extend the lifespan of their assets. IoT sensors can be used to detect leaks in water pipelines and to automatically shut off the flow of water to minimize water loss. This can help water utilities to reduce water waste and to conserve resources. IoT technologies can be used to collect feedback from customers about water quality and other issues and to provide real-time information to customers about their water usage and billing. This can help water utilities to improve customer satisfaction and to increase transparency and accountability.

IoT in Water Utility Segment Overview

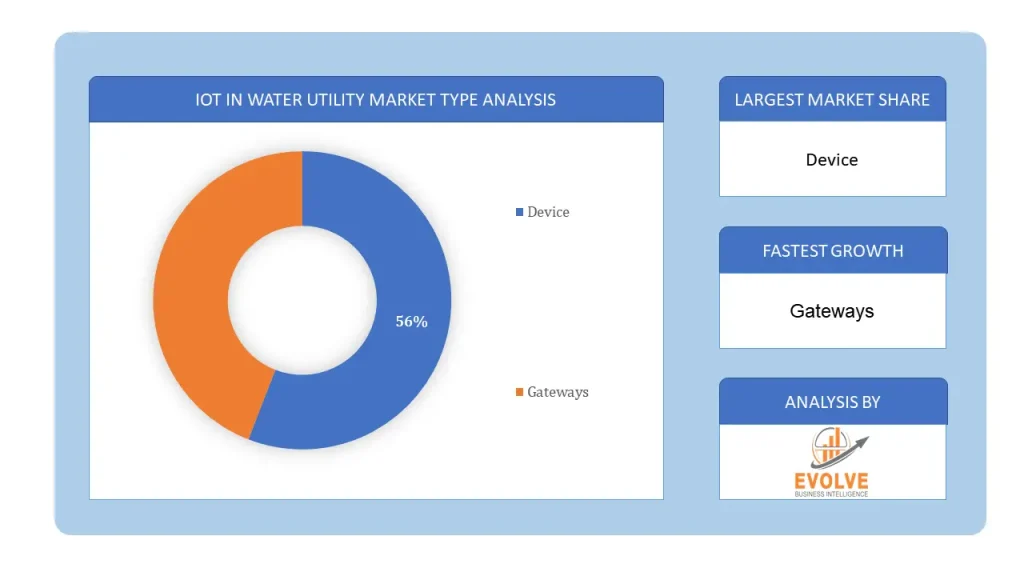

By Type

Based on the Type, the IoT in Water Utility market is segmented based on Devices and Gateways. The Devices segment is expected to hold the largest market share of IoT in Water Utility market. This is primarily due to the increasing adoption of IoT-enabled devices such as smart meters, sensors, and controllers in the water utility industry. These devices are used to monitor and control various aspects of the water supply and distribution network, including water quality, flow rate, pressure, and leakage.

Based on the Type, the IoT in Water Utility market is segmented based on Devices and Gateways. The Devices segment is expected to hold the largest market share of IoT in Water Utility market. This is primarily due to the increasing adoption of IoT-enabled devices such as smart meters, sensors, and controllers in the water utility industry. These devices are used to monitor and control various aspects of the water supply and distribution network, including water quality, flow rate, pressure, and leakage.

By Application

Based on Application, the global IoT in Water Utility market has been divided into Commercial and Residential. The Commercial segment is expected to hold the largest market share. Due to the high demand for water from these industries. The commercial segment typically refers to businesses, industries, and institutions that require large amounts of water for their operations. This segment may include sectors such as agriculture, manufacturing, and hospitality.

Global IoT in Water Utility Market Share, by Segmentation

IoT in Water Utility Regional Analysis

IoT in Water Utility Regional Analysis

Based on region, the global IoT in Water Utility market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to dominate the use of the IoT in Water Utility market followed by the Asia-Pacific and Europe regions.

North America Market

North America region dominates the IoT in Water Utility market. As it attributes this to factors such as the high adoption of advanced technologies, favorable government initiatives, and developed infrastructure for water management in the region. Additionally, many water utilities in North America have been investing in IoT solutions to improve their operational efficiency and reduce water losses. However, it’s important to note that the IoT in water utility market is constantly evolving, and market dynamics can change over time.

Asia-Pacific Market

Asia Pacific is expected to experience the fastest growth in the IoT in Water Utility market. The increasing adoption of smart water management solutions and the growing focus on reducing non-revenue water (NRW) are some of the key factors driving the growth of the market in this region. Additionally, the increasing government initiatives for water conservation and the implementation of smart city projects are also contributing to the growth of the IoT in Water Utility market in the Asia Pacific region.

Competitive Landscape

The market comprises tier-1, tier-2, and local players. With their wide product portfolios, tier-1 and tier-2 players have a global reach. Since of their strategic innovations and broad regional presence, companies such as IBM, Oracle, Verizon, and Cisco lead the global IoT in Water Utility business. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as growth, product releases, and alliances.

Prominent Players:

- IBM

- ORACLE

- VERIZON

- CISCO

- TELIT

- LANDIS GYR

- ITRON

- SCHNEIDER ELECTRIC

- SIEMENS

Scope of the Report

Global IoT in Water Utility Market, by Type

- Device

- Gateways

Global IoT in Water Utility Market, by Application

- Commercial

- Residential

Global IoT in Water Utility Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- Rest of the World

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $ 42.23 Billion |

| CAGR | 14.72% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | IBM, Oracle, Verizon, Cisco, Telit, Landis Gyr, Itron, Schneider Electric, Siemens |

| Key Market Opportunities | Rapid Growth In The Number Of Smart Cities Across The Globe |

| Key Market Drivers | Increasing Adoption Of Smart Water Metering |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future IoT in Water Utility market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- IoT in Water Utility market historical market size for the year 2021, and forecast from 2023 to 2033

- IoT in Water Utility market share analysis at each product level

- Competitor analysis with a detailed insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global IoT in Water Utility market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

<p class=”Release”>Press Release</p>

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global IoT in Water Utility market is 2022- 2033

What is the growth rate of the global IoT in Water Utility market?

The global IoT in Water Utility market is growing at a CAGR of ~14.72% over the next 10 years

Which region has the highest growth rate in the global IoT in Water Utility market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global IoT in Water Utility market?

North America holds the largest share in 2022

Who are the key players in the global IoT in Water Utility market?

IBM, Oracle, Verizon, Cisco, Telit, Landis Gyr, Itron, Schneider Electric, and Siemens are the major companies operating in the global IoT in Water Utility

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Global IoT in Water Utility Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global IoT in Water Utility Market, By Product Type 6.1. Introduction 6.2. Device 6.3. Gateways Chapter 7. Global IoT in Water Utility Market, By Application 7.1. Introduction 7.2. Commercial 7.3. Residential Chapter 8. Global IoT in Water Utility Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.5. Market Size and Forecast, By Application, 2020 – 2026 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.5. Market Size and Forecast, By Application, 2020 – 2026 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.5. Market Size and Forecast, By Application, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.7.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.8.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.9.4. Market Size and Forecast, By Application, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.4.10.4. Market Size and Forecast, By Application, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.6.4. Market Size and Forecast, By Application, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 8.5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. IBM 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Oracle 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Verizon 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Cisco 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Telit 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Landis Gyr 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Itron 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Schneider Electric 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Huawei 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Trimble 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology