Hydrogen Generation Market Analysis and Global Forecast 2021-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

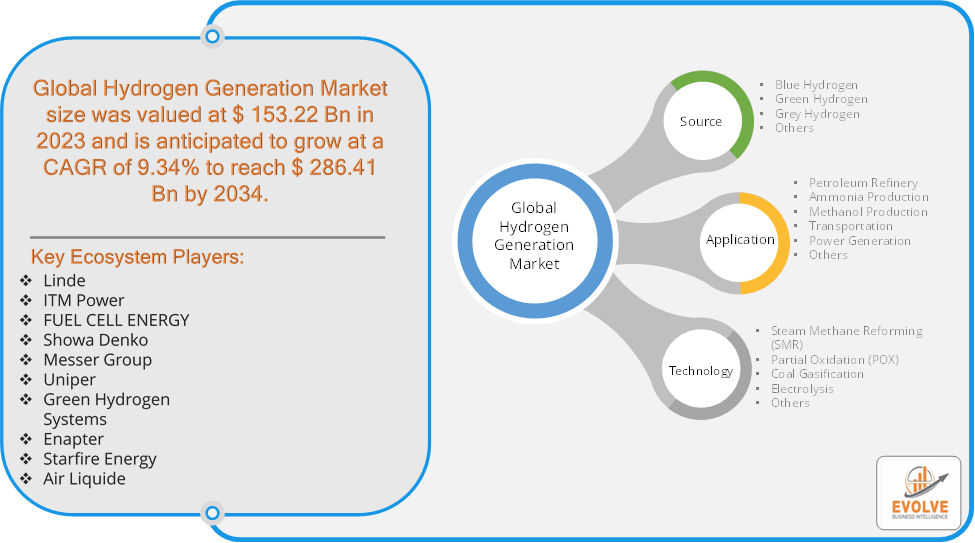

Hydrogen Generation Market Research Report: By Source (Blue Hydrogen, Green Hydrogen, Grey Hydrogen, Others), By Application (Petroleum Refinery, Ammonia Production, Methanol Production, Transportation, Power Generation, Others), By Technology (Steam Methane Reforming (SMR), Partial Oxidation (POX), Coal Gasification, Electrolysis, Others), and by Region — Forecast till 2034

Page: 167

Hydrogen Generation Market Overview

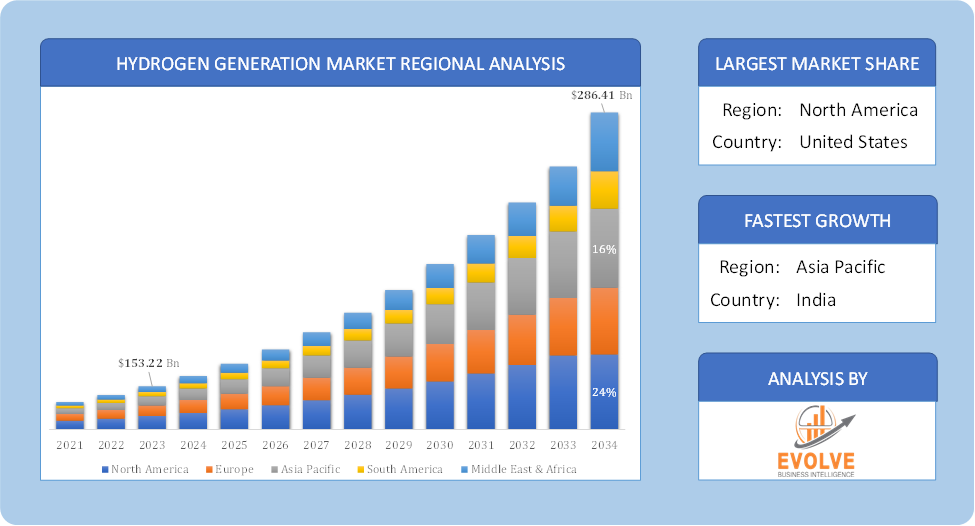

The Hydrogen Generation Market size accounted for USD 153.22 Billion in 2023 and is estimated to account for 156.88 Billion in 2024. The Market is expected to reach USD 286.41 Billion by 2034 growing at a compound annual growth rate (CAGR) of 9.34% from 2024 to 2034. The global industry producing hydrogen gas for use in industrial processes, energy storage, and transportation fuels is included in the hydrogen generation market. There are several ways to make hydrogen, including water electrolysis, coal gasification, and natural gas reforming. Green hydrogen, which is made from renewable energy sources, is becoming more and more popular. The market is driven by the growing need for sustainable and renewable energy solutions, improvements in hydrogen production technology, and pro-carbon policies from the government. Key competitors in the market are investing in infrastructure and ramping up production capabilities to satisfy the increased demand. The market is growing because of the decarbonization movement and the use of hydrogen fuel cells in power generation and transportation.

Global Hydrogen Generation Market Synopsis

Global Hydrogen Generation Market Dynamics

Global Hydrogen Generation Market Dynamics

The major factors that have impacted the growth of Hydrogen Generation are as follows:

Drivers:

⮚ Technological Advancements in Hydrogen Production

The manufacturing of hydrogen is becoming more economical and efficient thanks to technological developments. Green hydrogen production is becoming more scalable because to electrolysis innovations like solid oxide electrolyzer cells (SOECs) and proton exchange membranes (PEMs). Emissions from the manufacture of gray and blue hydrogen are being reduced at the same time by advancements in conventional processes like steam methane reforming (SMR) and the incorporation of carbon capture and storage (CCS) technology. These developments are essential to bringing down the price of hydrogen overall and increasing its competitiveness with conventional fossil fuels.

Restraint:

- High Production Costs, Especially for Green Hydrogen

The most significant obstacle is the high cost of producing hydrogen, especially green hydrogen, which is made by electrolysis utilizing renewable energy sources like sun and wind. In comparison to fossil fuel-based techniques like steam methane reforming (SMR), the process is less efficient and requires expensive infrastructure for renewable energy and electrolyzers. As a result, green hydrogen is still much more expensive than gray hydrogen (from natural gas) or blue hydrogen (gray hydrogen with carbon capture and storage). This cost difference is a significant barrier that reduces the competitiveness of green hydrogen in the absence of significant government backing or subsidies.

Opportunity:

⮚ Technological Advancements and Innovation

Technology innovation has several opportunities at every stage of the hydrogen value chain. Green hydrogen production is becoming increasingly efficient and economical thanks to advancements in electrolyzers, including solid oxide and proton exchange membrane (PEM) technology. Furthermore, new avenues for safer and more useful hydrogen storage are being opened up by developments in hydrogen storage technologies including metal hydrides and liquid organic hydrogen carriers (LOHCs). Organizations that prioritize technical innovations stand to gain from higher productivity, reduced expenses, and broader industry adoption of hydrogen-based technology.

Hydrogen Generation Market Segment Overview

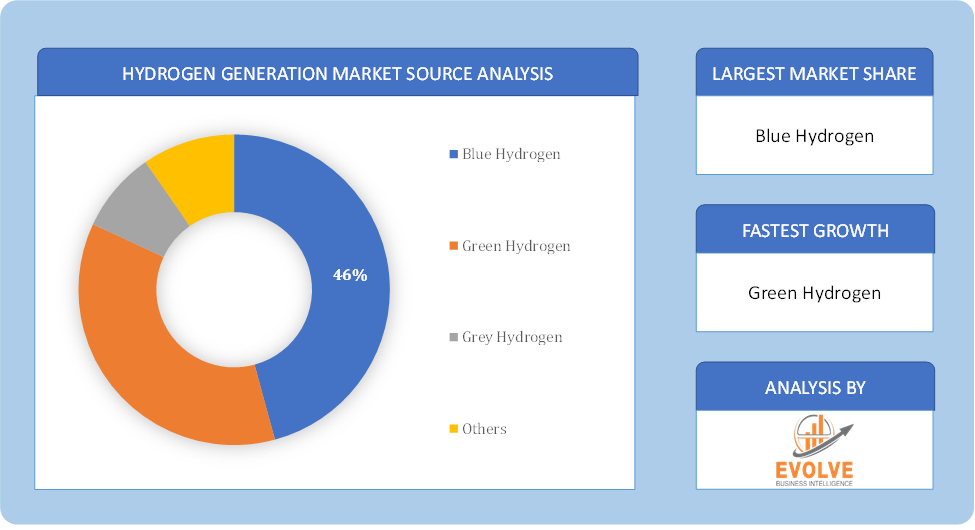

Based on the Source, the market is segmented based on Blue Hydrogen, Green Hydrogen, Grey Hydrogen, Others. Gray Hydrogen dominates, as it is the most cost-effective and widely produced using natural gas, despite its carbon emissions, compared to blue and green hydrogen.

By Application

Based on the Application, the market has been divided into Petroleum Refinery, Ammonia Production, Methanol Production, Transportation, Power Generation, Others. Petroleum Refinery dominates, as hydrogen is widely used in refining processes to remove sulfur and improve fuel quality, making it the largest application segment.

By Technology

Based on Technology , the market has been divided into Steam Methane Reforming (SMR), Partial Oxidation (POX), Coal Gasification, Electrolysis, Others. Steam Methane Reforming (SMR) dominates, primarily due to its cost-effectiveness and widespread use in industrial hydrogen production, despite being carbon-intensive.

Global Hydrogen Generation Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Hydrogen Generation, followed by those in North America and Europe.

Global Hydrogen Generation Asia Pacific Market

Global Hydrogen Generation Asia Pacific Market

Asia Pacific dominates the Hydrogen Generation market due to several factors. The Asia Pacific hydrogen generation market accounted for USD 44.5 billion in 2021 and is predicted to display a 43.50% CAGR during the study period. The presence of additional refineries in the region—particularly in significant countries like China and India—has led to an increase in the production of hydrogen. The governments of some Asia-Pacific countries, such as Japan and Australia, are also looking into greener, cleaner ways to produce hydrogen

Global Hydrogen Generation North America Market

The North America region has been witnessing remarkable growth in recent years. From 2022 to2030, the hydrogen generating market in North America is anticipated to expand at a notable CAGR. Every technology and application has aided in the industry’s explosive expansion. The production of methanol and ammonia, which has had great expansion in countries like the U.S. and Canada over the past five years, is the industry with the quickest rate of growth. In addition, the hydrogen generating market in the US had the biggest market share, while the market in Canada was expanding at the quickest rate in the area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Linde, ITM Power, FUEL CELL ENERGY, Showa Denko, and Messer Group are some of the leading players in the global Hydrogen Generation Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Linde

- ITM Power

- FUEL CELL ENERGY

- Showa Denko

- Messer Group

- Uniper

- Green Hydrogen Systems

- Enapter

- Starfire Energy

- Air Liquide

Key development:

In 2023, Green Hydrogen Systems focused on scaling up their electrolyzer technology, enhancing efficiency and cost-effectiveness for green hydrogen production, while expanding partnerships to support renewable energy projects.

Scope of the Report

Global Hydrogen Generation Market, by Source

- Blue Hydrogen

- Green Hydrogen

- Grey Hydrogen

- Others

Global Hydrogen Generation Market, by Application

- Petroleum Refinery

- Ammonia Production

- Methanol Production

- Transportation

- Power Generation

- Others

Global Hydrogen Generation Market, by Technology

- Steam Methane Reforming (SMR)

- Partial Oxidation (POX)

- Coal Gasification

- Electrolysis

- Others

Global Hydrogen Generation Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 286.41 Billion |

| CAGR (2021-2034) | 9.34% |

| Base year | 2023 |

| Forecast Period | 2021-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, Application, Technology |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa. |

| Key Vendors | Linde, ITM Power, FUEL CELL ENERGY, Showa Denko, Messer Group, Uniper, Green Hydrogen Systems, Enapter, Starfire Energy, Air Liquide |

| Key Market Opportunities | · Increased emphasis on decarbonization and supportive government policies to support growth |

| Key Market Drivers | · Transition to clean energy power to boost market growth Growing demand for fertilizers is a key factor in market expansion. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Hydrogen Generation market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Hydrogen Generation market historical market size for the year 2022, and forecast from 2021 to 2034

- Hydrogen Generation market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Hydrogen Generation market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Hydrogen Generation market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Hydrogen Generation market?

The global Hydrogen Generation market is growing at a CAGR of ~9.34% over the next 10 years

Which region has the highest growth rate in the market of Hydrogen Generation?

North America is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Hydrogen Generation?

Asia Pacific holds the largest share in 2023

Major Key Players in the Market of Hydrogen Generation?

Linde, ITM Power, FUEL CELL ENERGY, Showa Denko, Messer Group, Uniper, Green Hydrogen Systems, Enapter, Starfire Energy, Air Liquide

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Source Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. Technology Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Hydrogen Generation Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Hydrogen Generation Market, By Source 7.1. Introduction 7.1.1. Blue Hydrogen 7.1.2. Green Hydrogen 7.1.3. Grey Hydrogen 7.1.4. Others CHAPTER 8. Global Hydrogen Generation Market, By Application 8.1. Introduction 8.1.1. Petroleum Refinery 8.1.2. Ammonia Production 8.1.3. Methanol Production 8.1.4. Transportation 8.1.5. Power Generation 8.1.6. Others CHAPTER 9. Global Hydrogen Generation Market, By Technology 9.1. Introduction 9.1.1. Steam Methane Reforming (SMR) 9.1.2. Partial Oxidation (POX) 9.1.3. Coal Gasification 9.1.4. Electrolysis 9.1.5. Others CHAPTER 10. Global Hydrogen Generation Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.2.2. North America: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.4. North America: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.5.2. South America: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.4. South America: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Source, 2021 – 2034 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2021 – 2034 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Technology , 2021 – 2034 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2021 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Linde 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. ITM Power 13.3. FUEL CELL ENERGY 13.4. Showa Denko 13.5. Messer Group 13.6. Uniper 13.7. Green Hydrogen Systems 13.8. Enapter 13.9. Starfire Energy 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology