First and Last-mile Delivery Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

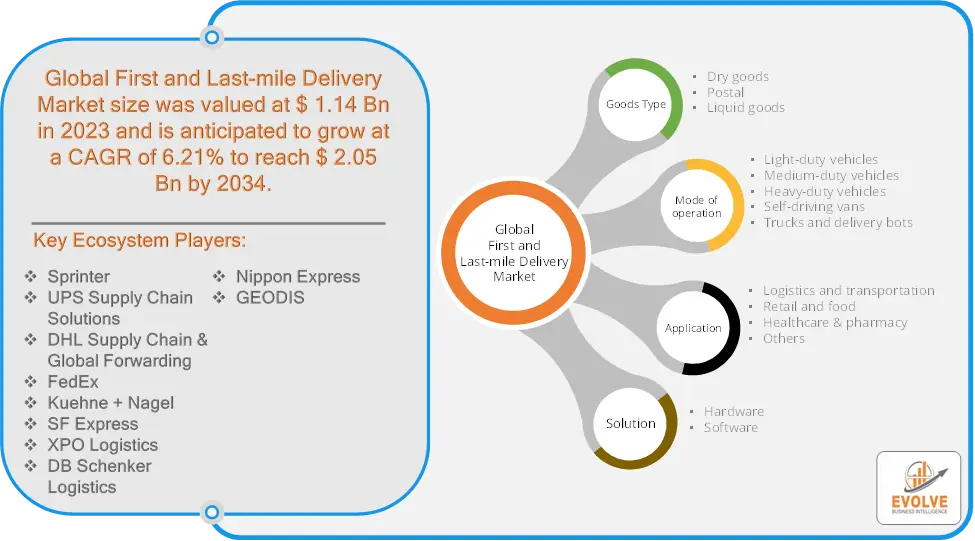

First and Last-mile Delivery Market Research Report: Information By Goods Type (dry goods, postal, and liquid goods), By Mode of Operation (light-duty vehicles, medium-duty vehicles, heavy-duty vehicles, self-driving vans and trucks, and delivery bots),By Application(logistics and transportation (package delivery, postal delivery), retail and food (e-commerce, grocery delivery, food delivery), healthcare & pharmacy (medicine supply, blood supply, organ transport, equipment transport, others), and others), By Solution ( hardware and software), and by Region — Forecast till 2034

Page: 160

First and Last-mile Delivery Market Overview

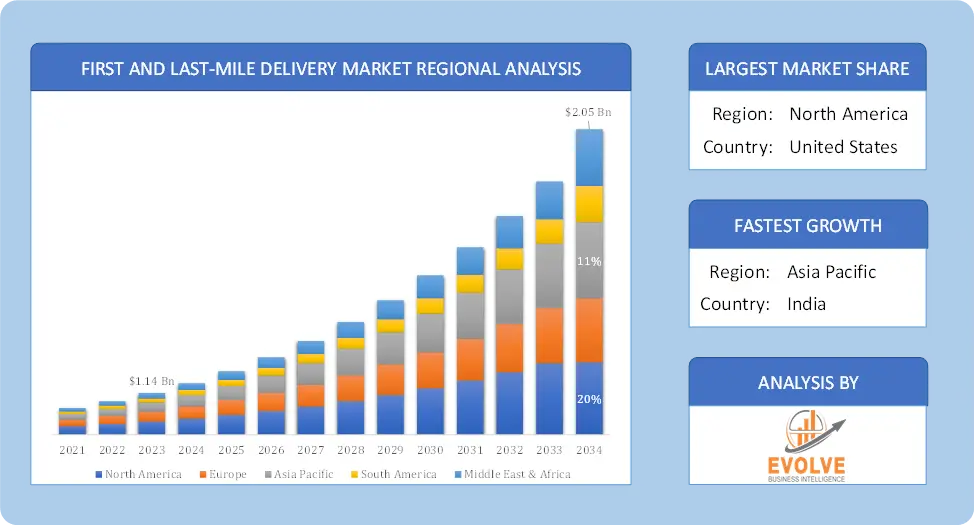

Global First and Last-mile Delivery Market size accounted for USD 1.14 Billion in 2023 and is estimated to account for 1.35 Billion in 2024. The Market is expected to reach USD 2.05 Billion by 2034 growing at a compound annual growth rate (CAGR) of 6.21% from 2024 to 2034. The First and Last-mile Delivery Market refers to the transportation and delivery of goods from a central hub, such as a warehouse or distribution center, to the final destination, which is typically a customer’s doorstep or a specific location within their premises. The market encompasses both the initial movement of goods from the origin point (first mile) and the final delivery to the end-user (last mile).

The First and Last-mile Delivery Market has gained significance with the rise of e-commerce, urbanization, and increasing consumer demands for faster, more convenient deliveries. It includes various modes of transportation, technologies and service providers aiming to optimize efficiency, reduce costs, and enhance the customer experience.

Global First and Last-mile Delivery Market Synopsis

First and Last-mile Delivery Market Dynamics

First and Last-mile Delivery Market Dynamics

The major factors that have impacted the growth of First and Last-mile Delivery Market are as follows:

Drivers:

Ø Technological Advancements

Technologies like GPS tracking, route optimization software, drones, and autonomous vehicles are improving the efficiency of first and last-mile deliveries. These innovations allow companies to deliver goods faster, reduce costs, and provide real-time updates to customers. Consumers now expect same-day or even next-hour delivery options. Meeting these expectations drives innovation in last-mile delivery processes, encouraging companies to adopt technologies such as route optimization, delivery lockers, and autonomous vehicles.

Restraint:

- Perception of High Delivery Costs and Workforce Shortages

First and last-mile deliveries are often the most expensive parts of the logistics process, particularly last-mile delivery. The need for quick, individualized deliveries (especially in urban areas) increases operational costs due to fuel, labor, and vehicle maintenance. The lack of delivery density (few deliveries per trip) can make last-mile services particularly inefficient. The last-mile delivery sector relies heavily on human labor, particularly for driving and handling goods. The growing demand for deliveries has led to a shortage of delivery drivers, increasing labor costs and creating operational bottlenecks. Retaining a workforce for the intensive demands of last-mile logistics can be challenging.

Opportunity:

⮚ Delivery-as-a-Service (DaaS) Platforms

With the growing complexity of logistics, many retailers and small businesses are turning to third-party logistics (3PL) and Delivery-as-a-Service (DaaS) platforms. These services allow companies to outsource their first and last-mile logistics, reducing the burden of maintaining fleets, labor, and technology. The rise of DaaS offers an opportunity for logistics providers to offer scalable, on-demand delivery solutions. Smart lockers and pickup points offer an alternative to home delivery, reducing failed delivery attempts and increasing convenience for consumers. This system provides an efficient way to deliver to high-density residential areas and businesses. Companies can partner with retailers, transportation hubs, and other locations to install pickup points, optimizing last-mile logistics.

First and Last-mile Delivery Market Segment Overview

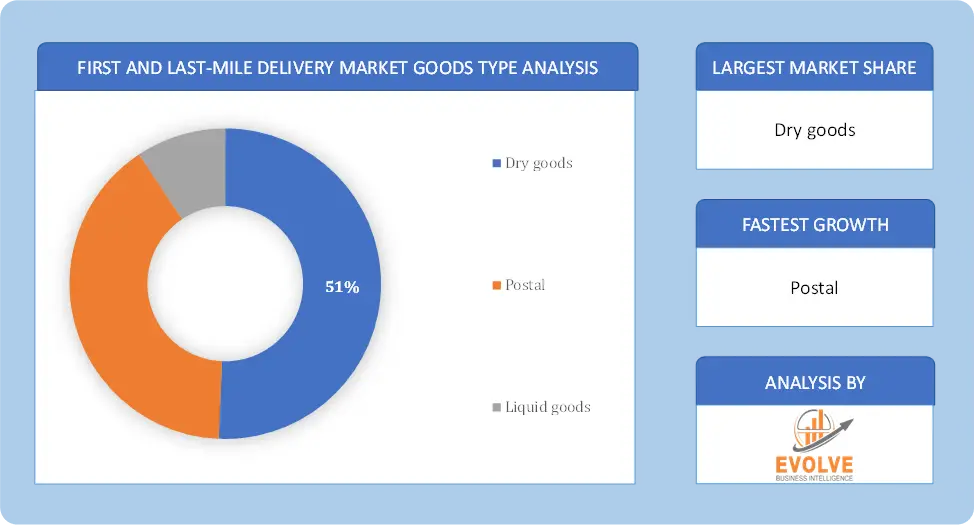

By Goods Type

Based on Goods Type, the market is segmented based on dry goods, postal, and liquid goods. The dry goods segment dominant the market. The growth of the segment is on account of online purchases of dry goods, which are delivered within a certain lead-time. If the promised lead-time is two days, the dry goods are delivered the same day or before time. This creates an opportunity to provide discounts on shorter lead-times in specific areas, e.g., same-day delivery could be discounted if a company is planning on visiting that area today.

Based on Goods Type, the market is segmented based on dry goods, postal, and liquid goods. The dry goods segment dominant the market. The growth of the segment is on account of online purchases of dry goods, which are delivered within a certain lead-time. If the promised lead-time is two days, the dry goods are delivered the same day or before time. This creates an opportunity to provide discounts on shorter lead-times in specific areas, e.g., same-day delivery could be discounted if a company is planning on visiting that area today.

By Mode of Operation

Based on Mode of Operation, the market segment has been divided into light-duty vehicles, medium-duty vehicles, heavy-duty vehicles, self-driving vans and trucks, and delivery bots. The delivery bots segment dominant the market. During the pandemic, the employment of delivery robots increased as these little vehicles met the demand for social distancing by transporting food and vital goods to consumers. For last-mile deliveries, companies are exploring the delivery bot option.

By Application

Based on Application, the market segment has been divided into logistics and transportation, retail and food, healthcare & pharmacy and others. The retail and food segment dominant the market. The first mile in eCommerce refers to the distance between the retailer and the courier who will deliver the goods to the customer’s office, house, collection location, or smart locker. Any worldwide eCommerce shipping must have a smooth first mile delivery. This means that the goods will have a better chance of moving quickly and smoothly through the next stages of the B2C supply chain.

By Solution

Based on Solution, the market segment has been divided into Hardware and Software. The Hardware segment dominant the market. Hardware segment accounts for the highest market size and the growth of the segment is due to the use of hardware units on vehicles. Consumers can track their packages using the same technology that is used in route planning tools. Automated route planning software is a management system that uses hardware devices to track the location of each vehicle.

Global First and Last-mile Delivery Market Regional Analysis

Based on region, the global First and Last-mile Delivery Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the First and Last-mile Delivery Market followed by the Asia-Pacific and Europe regions.

Global First and Last-mile Delivery North America Market

Global First and Last-mile Delivery North America Market

North America holds a dominant position in the First and Last-mile Delivery Market. North America, led by the United States, has one of the most mature e-commerce markets globally. This has spurred significant investment in last-mile delivery solutions, including the adoption of autonomous vehicles, drones, and electric vehicles (EVs). The region also experiences high labor costs and driver shortages, driving the shift towards automation and crowdsourced delivery models and the region has a well-developed e-commerce infrastructure, driving demand for efficient delivery services.

Global First and Last-mile Delivery Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the First and Last-mile Delivery Market industry. The Asia-Pacific region is one of the fastest-growing markets for first and last-mile delivery, driven by countries like China, India, Japan, and Southeast Asia. The growing urban population and congested cities in Asia drive the need for innovative last-mile solutions, including the use of drones, electric scooters, and localized delivery hubs and the region is experiencing the fastest growth in e-commerce, driven by countries like China and India.

Competitive Landscape

The global First and Last-mile Delivery Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Sprinter

- UPS Supply Chain Solutions

- DHL Supply Chain & Global Forwarding

- FedEx

- Kuehne + Nagel

- SF Express

- XPO Logistics

- DB Schenker Logistics

- Nippon Express

- GEODIS

Scope of the Report

Global First and Last-mile Delivery Market, by Goods Type

- Dry goods

- Postal

- Liquid goods

Global First and Last-mile Delivery Market, by Mode of operation

- Light-duty vehicles

- Medium-duty vehicles

- Heavy-duty vehicles

- Self-driving vans

- Trucks and delivery bots

Global First and Last-mile Delivery Market, by Application

- Logistics and transportation

- Retail and food

- Healthcare & pharmacy

- Others

Global First and Last-mile Delivery Market, by Solution

- Hardware

- Software

Global First and Last-mile Delivery Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $2.05 Billion |

| CAGR | 6.21% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Goods Type, Mode of Operation, Application, Solution |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Sprinter, UPS Supply Chain Solutions, DHL Supply Chain & Global Forwarding, FedEx, Kuehne + Nagel, SF Express, XPO Logistics, DB Schenker Logistics, Nippon Express and GEODIS. |

| Key Market Opportunities | • Delivery-as-a-Service (DaaS) Platforms • Smart Lockers and Pickup Point |

| Key Market Drivers | • Technological Advancements • Customer Expectations for Fast and Flexible Delivery |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future First and Last-mile Delivery Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- First and Last-mile Delivery Market historical market size for the year 2021, and forecast from 2023 to 2033

- First and Last-mile Delivery Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global First and Last-mile Delivery Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global First and Last-mile Delivery Market is 2021- 2033

What is the growth rate of the global First and Last-mile Delivery Market?

The global First and Last-mile Delivery Market is growing at a CAGR of 6.21% over the next 10 years

Which region has the highest growth rate in the market of First and Last-mile Delivery Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global First and Last-mile Delivery Market?

North America holds the largest share in 2022

Who are the key players in the global First and Last-mile Delivery Market?

Sprinter, UPS Supply Chain Solutions, DHL Supply Chain & Global Forwarding, FedEx, Kuehne + Nagel, SF Express, XPO Logistics, DB Schenker Logistics, Nippon Express and GEODIS. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Application Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End Users 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on first and last-mile delivery Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Player’s Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 4.5. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of first and last-mile delivery Market 4.8. Import Analysis of first and last-mile delivery Market 4.9. Export Analysis of first and last-mile delivery Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. first and last-mile delivery Market By Good's Type 6.1. Introduction 6.2. dry goods 6.3. postal 6.4. liquid goods Chapter 7. first and last-mile delivery Market, By Mode of Operation 7.1. Introduction 7.2. light-duty vehicle 7.3. medium-duty vehicle 7.4. heavy duty vehicle 7.5. self-driving vans and trucks 7.6. delivery bots Chapter 8. first and last-mile delivery Market, By Application 8.1. Introduction 8.2. logistics and transportation (package delivery, postal delivery) 8.3. retail and food (e-commerce, grocery delivery food delivery) 8.4. healthcare & pharmacy (medicine supply, blood supply, organ transport, equipment transport, others) 8.5. others Chapter 9. first and last-mile delivery Market, By Solution 9.1. Introduction 9.2. hardware 9.3. software Chapter 10. first and last-mile delivery Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Product Type, 2020 - 2028 10.2.5. Market Size and Forecast, By Application, 2020 – 2028 10.2.6. the US 10.2.6.1. Introduction 10.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 10 .2.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.2.6.4. Market Size and Forecast, By Application, 2020 - 2028 10.2.7. Canada 10.2.7.1. Introduction 10.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.2.7.4. Market Size and Forecast, By Application, 2020 - 2028 10.3. Europe 10.3.1. Introduction 103.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Product Type, 2020 - 2028 10.3.5. Market Size and Forecast, By Application, 2020 – 2028 10.3.6. Germany 10.3.6.1. Introduction 10.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.3.6.4. Market Size and Forecast, By Application, 2020 - 2028 10.3.7. France 10.3.7.1. Introduction 10.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.3.7.4. Market Size and Forecast, By Application, 2020 - 2028 10.3.8. the UK 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Application, 2020 - 2028 10.3.9. Italy 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Application, 2020 - 2028 10.3.10. Rest Of Europe 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Application, 2020 - 2028 10.4. Asia-Pacific 10..4.1. Introduction 10..4.2. Driving Factors, Opportunity Analyzed and Key Trends 10..4.3. Market Size and Forecast, By Country, 2020 - 2028 10..4.4. Market Size and Forecast, By Product Type, 2020 - 2028 10..4.5. Market Size and Forecast, By Application, 2020 - 2028 10..4.6. China 10..4.6.1. Introduction 10..4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 10..4.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..4.6.4. Market Size and Forecast, By Application, 2020 - 2028 10..4.7. India 10..4.7.1. Introduction 10..4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 10..4.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..4.7.4. Market Size and Forecast, By Application, 2020 - 2028 10..4.8. Japan 10..4.8.1. Introduction 10..4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10..4.8.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..4.8.4. Market Size and Forecast, By Application, 2020 - 2028 10..4.9. South Korea 10..4.9.1. Introduction 10..4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10..4.9.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..4.9.4. Market Size and Forecast, By Application, 2020 - 2028 10..4.10. Rest Of Asia-Pacific 10..4.10.1. Introduction 10..4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10..4.10.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..4.10.4. Market Size and Forecast, By Application, 2020 - 2028 10..5. Rest Of The World (RoW) 10..5.1. Introduction 10..5.2. Driving Factors, Opportunity Analyzed and Key Trends 10..5.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..5.4. Market Size and Forecast, By Application, 2020 - 2028 10..5.5. Market Size and Forecast, By Region, 2020 - 2028 10..5.6. South America 10..5.6.1. Introduction 10..5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 10..5.6.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..5.6.4. Market Size and Forecast, By Application, 2020 - 2028 10..5.7. The Middle East and Africa 10..5.7.1. Introduction 10..5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 10..5.7.3. Market Size and Forecast, By Product Type, 2020 - 2028 10..5.7.4. Market Size and Forecast, By Application, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 10.1. Sprinter 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. UPS Supply Chain Solutions 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. DHL Supply Chain & Global Forwarding 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. FedEx 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Kuehne + Nagel 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. SF Express 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. XPO Logistics 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. DB Schenker Logistics 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Nippon Express 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. CEVA Logistics 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology