Data Center Cooling Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

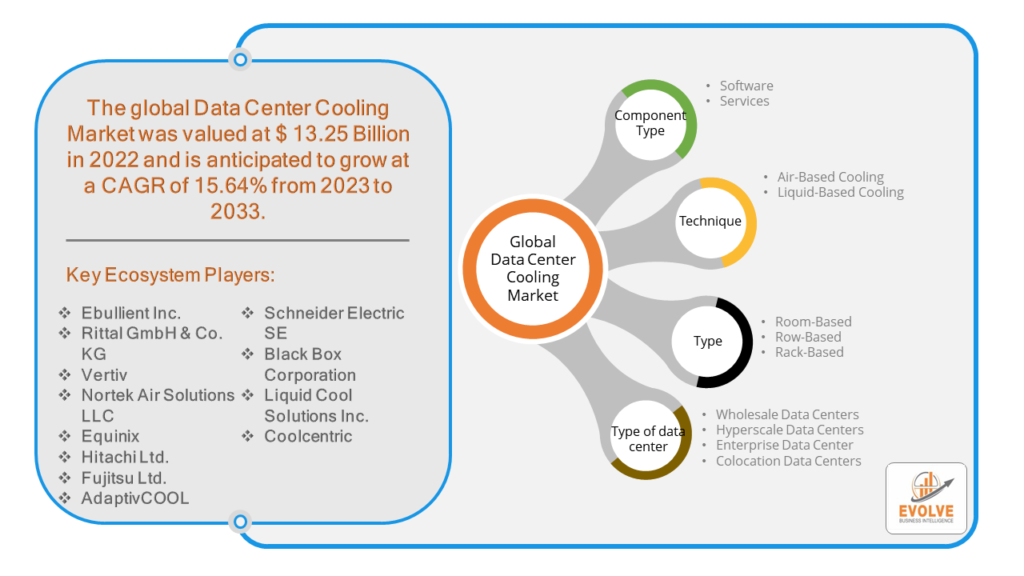

Data Center Cooling Market Research Report: Information By Component Type (Software and Services), By Technique (Air-Based Cooling and Liquid-Based Cooling), By Type (Room-Based, Row-Based, and Rack-Based), By Type of Data Center (Wholesale Data Centers, Hyperscale Data Centers, Enterprise Data Center and Colocation Data Centers), By End user (IT & Telecom, Healthcare, Government & Defense, Energy, Manufacturing, Retail, BFSI and others), and by Region — Forecast till 2033

Page: 144

Data Center Cooling Market Overview

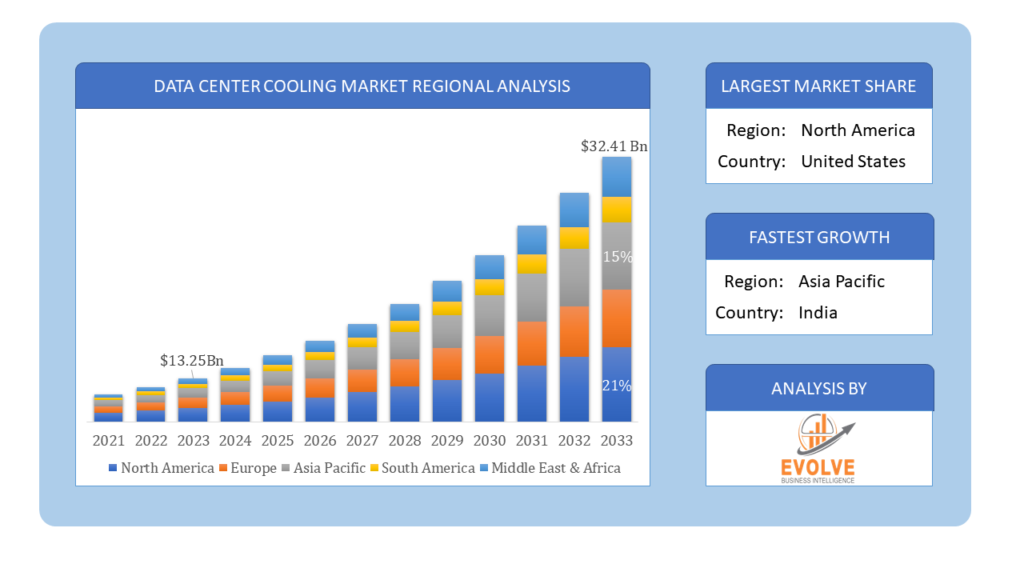

The Data Center Cooling Market Size is expected to reach USD 32.41 Billion by 2033. The Data Center Cooling Market industry size accounted for USD 13.25 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 15.64% from 2023 to 2033. The Data Center Cooling Market refers to the industry segment involved in providing cooling solutions and technologies for data centers. Data centers are facilities that house computer systems and associated components, such as telecommunications and storage systems. These centers generate significant amounts of heat due to the operation of servers and other equipment.

Efficient cooling is crucial for maintaining optimal operating conditions within data centers to prevent equipment overheating, which can lead to system failures and data loss. As data centers continue to expand in size and capacity to meet the growing demands of cloud computing, big data analytics, and other digital services, the need for effective cooling solutions becomes increasingly critical. The Data Center Cooling Market is driven by factors such as the increasing adoption of cloud-based services, the proliferation of data-intensive applications, and efforts to improve energy efficiency and reduce operating costs in data center operations.

Global Data Center Cooling Market Synopsis

The COVID-19 pandemic had significant impacts on the Data Center Cooling Market. With the shift to remote work, online education, and increased internet usage during lockdowns, there has been a surge in demand for data center services. This increased demand has put pressure on existing data center infrastructure, including cooling systems, as data centers need to handle higher workloads and process more data. The pandemic disrupted global supply chains, leading to delays in the delivery of equipment and components needed for data center cooling systems. This has impacted the deployment of new data centers and the expansion of existing ones, potentially causing project delays and increased costs. ssThe pandemic has accelerated the pace of digital transformation across industries, leading to greater adoption of cloud services and data-intensive applications. This has further increased the demand for data center cooling solutions to support the growing volume of digital infrastructure.

Data Center Cooling Market Dynamics

The major factors that have impacted the growth of Data Center Cooling Market are as follows:

Drivers:

Ø Rapid Growth of Data Centers

The proliferation of digital services, cloud computing, big data analytics, and the Internet of Things (IoT) has led to a significant increase in the number and size of data centers globally. This growth drives the demand for efficient cooling solutions to maintain optimal operating conditions and prevent equipment overheating. As data centers become more densely packed with servers and other hardware to accommodate growing workloads and data processing requirements, the heat generated per unit of floor space (power density) is increasing. This trend necessitates more sophisticated cooling technologies capable of effectively dissipating heat from high-density server racks. Ongoing advancements in cooling technologies, such as direct liquid cooling, immersion cooling, and advanced thermal management techniques, are enabling data center operators to achieve higher levels of efficiency and scalability. Innovations in heat removal, airflow management, and thermal modeling contribute to improved cooling performance and reduced energy consumption.

Restraint:

- Perception of High Initial Investment Costs

Implementing advanced cooling technologies and infrastructure upgrades in data centers often requires a significant initial investment. The high upfront costs associated with purchasing and installing cooling systems may deter some data center operators, especially smaller enterprises or those with budget constraints, from adopting more efficient cooling solutions. Integrating new cooling technologies into existing data center infrastructure can be complex and challenging. Compatibility issues, space constraints, and operational disruptions during the installation process may pose barriers to the adoption of advanced cooling solutions. Data center operators may hesitate to invest in new cooling systems due to concerns about potential integration difficulties and downtime risks.

Opportunity:

⮚ Increasing Demand for Hyperscale Data Centers

The rapid expansion of hyperscale data centers driven by cloud computing, big data, and artificial intelligence applications creates significant opportunities for cooling solution providers. Hyperscale facilities require highly efficient and scalable cooling systems capable of handling massive heat loads while minimizing energy consumption and operating costs. Liquid cooling technologies, including direct-to-chip and immersion cooling solutions, offer substantial opportunities for improving cooling efficiency and density in data centers. As power densities increase and air-based cooling approaches reach their limits, liquid cooling provides a promising alternative for dissipating heat more effectively and reducing overall energy consumption. The increasing complexity and dynamic nature of data center environments require advanced cooling management solutions that leverage data analytics, machine learning, and predictive modeling to optimize cooling system performance and energy efficiency. Opportunities exist for developing intelligent cooling management platforms that dynamically adjust cooling resources based on real-time operational conditions and workload demands.

Data Center Cooling Market Segment Overview

By Component Type

Based on Component Type, the market is segmented based on Software and Services. The services segment is dominant the market. Implementation of services ensures the effective functioning of solutions with transparency and control throughout a process. Data center cooling services include professional and managed services. Professional services include installation and deployment, support and maintenance, and consulting services. Implementation services ensure comprehensive scheduling, installation, and configuration of solutions and have the solution package’s components and a custom program designed to meet specific needs.

By Technique

Based on Technique, the market segment has been divided into the Air-Based Cooling and Liquid-Based Cooling. The Liquid-based cooling segment is anticipated to dominant the market. Liquid-based cooling is a highly efficient method of dissipating heat from electronic components, such as computer processors and graphics cards. In a typical liquid cooling setup, a network of tubes or channels carries the cooling fluid to components that generate heat. These components are equipped with water blocks or heat exchangers, which remain in direct contact with the hot surfaces.

By Type

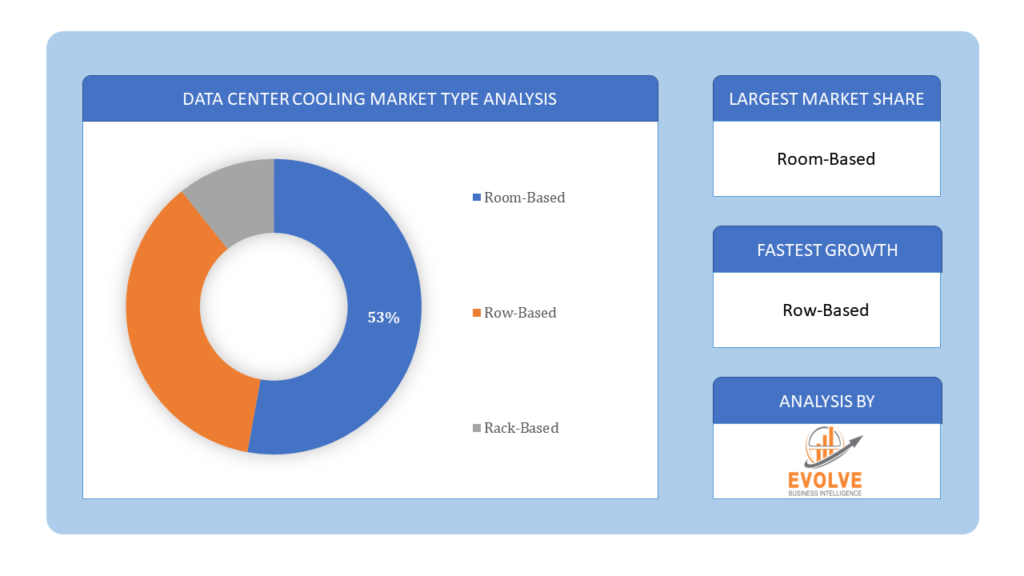

Based on Type, the market segment has been divided into the Room-Based, Row-Based and Rack-Based. Room-based cooling refers to a method of cooling a specific space or room within a building rather than cooling the entire building or home. Room-based cooling consists of window air conditioners, ductless mini-split systems, and portable air conditioners, which are movable units that can be placed in any room that needs cooling and typically require a window for venting hot air outside. It also includes swap coolers, which use the natural cooling effect of evaporating water to cool the air.

Based on Type, the market segment has been divided into the Room-Based, Row-Based and Rack-Based. Room-based cooling refers to a method of cooling a specific space or room within a building rather than cooling the entire building or home. Room-based cooling consists of window air conditioners, ductless mini-split systems, and portable air conditioners, which are movable units that can be placed in any room that needs cooling and typically require a window for venting hot air outside. It also includes swap coolers, which use the natural cooling effect of evaporating water to cool the air.

By Type of data center

Based on Type of data center, the market segment has been divided into the Wholesale Data Centers, Hyperscale Data Centers, Enterprise Data Center and Colocation Data Centers. The Enterprise Data Center segment is dominant the market. Enterprise data centers are centralized facilities or locations where the IT infrastructure of an organization, including servers, storage devices, networking equipment, and other computing resources, are housed and managed. These data centers play a critical role in the modern business landscape, as they are responsible for hosting and processing the digital information and applications necessary for the operation of the enterprise.

By End User

Based on End User, the market segment has been divided into the IT & Telecom, Healthcare, Government & Defense, Energy, Manufacturing, Retail, BFSI and others. The information technology (IT) and telecom sectors rely heavily on data centers to store and process vast amounts of digital information and provide essential services. Modern data centers often use high-performance computing equipment that generates a considerable amount of heat in a relatively small physical space. Effective cooling is essential to manage the high heat density and prevent equipment overheating. The IT and telecom sectors often use high-performance computing equipment that generates a considerable amount of heat in a relatively small physical space. Effective cooling is essential to manage the high heat density and prevent equipment overheating.

Global Data Center Cooling Market Regional Analysis

Based on region, the global Data Center Cooling Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Data Center Cooling Market followed by the Asia-Pacific and Europe regions.

Data Center Cooling North America Market

Data Center Cooling North America Market

North America holds a dominant position in the Data Center Cooling Market. North America is a significant market for data center cooling solutions, driven by the presence of major technology companies, cloud service providers, and hyperscale data center operators. The United States, in particular, accounts for a substantial share of the market, with regions like Silicon Valley, Northern Virginia, and Texas being key hubs for data center development. Energy efficiency regulations, such as the U.S. Environmental Protection Agency’s Energy Star program and state-level initiatives, influence the adoption of efficient cooling technologies.

Data Center Cooling Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Data Center Cooling Market industry. The Asia-Pacific region is experiencing rapid growth in the data center sector, fueled by increasing internet penetration, digitalization initiatives, and the adoption of cloud services across countries like China, India, Japan, Singapore, and Australia. In countries with tropical climates like Singapore and Malaysia, cooling accounts for a significant portion of data center operating costs, driving demand for efficient cooling solutions. Government incentives, such as tax breaks and subsidies for energy-efficient data centers, influence market dynamics in some Asia-Pacific countries.

Competitive Landscape

The global Data Center Cooling Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Ebullient Inc.

- Rittal GmbH & Co. KG

- Vertiv

- Nortek Air Solutions LLC

- Equinix

- Hitachi Ltd.

- Fujitsu Ltd.

- AdaptivCOOL

- Schneider Electric SE

- Black Box Corporation

- Liquid Cool Solutions Inc.

- Coolcentric

Key Development

In July 2023, Airedale International Air Conditioning announced the launch of MultiChillTM, a modular, low-GWP, free-cooling heat pump chiller range, which offers flexibility and efficiency as a smaller capacity heat pump chiller with modularity built into its design.

In August 2023, STULZ GmbH announced the launch of its Micro Data Centre, a single rack, all-in-one micro data center solution that combines power protection and distribution, monitoring, cooling, and management with fire protection and security.

Scope of the Report

Global Data Center Cooling Market, by Component Type

- Software

- Services

Global Data Center Cooling Market, by Technique

- Air-Based Cooling

- Liquid-Based Cooling

Global Data Center Cooling Market, by Type

- Room-Based

- Row-Based

- Rack-Based

Global Data Center Cooling Market, by Type of data center

- Wholesale Data Centers

- Hyperscale Data Centers

- Enterprise Data Center

- Colocation Data Centers

Global Data Center Cooling Market, by End User

- IT & Telecom

- Healthcare

- Government & Defense

- Energy

- Manufacturing

- Retail

- BFSI

- others

Global Data Center Cooling Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $32.41 Billion |

| CAGR | 15.64% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component Type, Technique, Type, Type of data center, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Ebullient Inc., Rittal GmbH & Co. KG, Vertiv, Nortek Air Solutions LLC, Equinix, Hitachi Ltd., Fujitsu Ltd., AdaptivCOOL, Schneider Electric SE, Black Box Corporation, Liquid Cool Solutions Inc. and Coolcentric |

| Key Market Opportunities | • Increasing Demand for Hyperscale Data Centers • Adoption of Liquid Cooling Technologies |

| Key Market Drivers | • Rapid Growth of Data Centers • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Data Center Cooling Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Data Center Cooling Market historical market size for the year 2021, and forecast from 2023 to 2033

- Data Center Cooling Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Data Center Cooling Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Data Center Cooling market?

The study period for the Data Center Cooling market spans from 2023 to 2033.

What is the growth rate of the Data Center Cooling market?

The Data Center Cooling market is expected to grow at a compound annual growth rate (CAGR) of 15.64% from 2023 to 2033.

Which region has the highest growth rate in the Data Center Cooling market?

The Asia-Pacific region is anticipated to have the highest growth rate in the Data Center Cooling market due to rapid digitalization and increasing internet penetration.

Which region has the largest share of the Data Center Cooling market?

Currently, North America holds the largest share of the Data Center Cooling market, driven by major technology companies and cloud service providers.

Who are the key players in the Data Center Cooling market?

Key players in the Data Center Cooling market include Ebullient Inc., Rittal GmbH & Co. KG, Vertiv, Nortek Air Solutions LLC, Equinix, Hitachi Ltd., Fujitsu Ltd., AdaptivCOOL, Schneider Electric SE, Black Box Corporation, Liquid Cool Solutions Inc., and Coolcentric.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Component Type Segement – Market Opportunity Score 4.1.2. Technique Segment – Market Opportunity Score 4.1.3. Type Segment – Market Opportunity Score 4.1.4. Type of data center Segment – Market Opportunity Score 4.1.5 End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Data Center Cooling Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Data Center Cooling Market, By Component Type 7.1. Introduction 7.1.1. Software 7.1.2 Services CHAPTER 8. Global Data Center Cooling Market, By Technique 8.1. Introduction 8.1.1. Air-Based Cooling 8.1.2. Liquid-Based Cooling CHAPTER 9. Global Data Center Cooling Market, By Type 9.1. Introduction 9.1.1. Room-Based 9.1.2. Row-Based 9.1.3. Rack-Based CHAPTER 10. Global Data Center Cooling Market, By Type of data center 10.1.Introduction 10.1.1. Wholesale Data Centers 10.1.2. Hyperscale Data Centers 10.1.3. Enterprise Data Center 10.1.4. Colocation Data Centers CHAPTER 11. Global Data Center Cooling Market, By End User 11.1.Introduction 11.1.1. IT & Telecom 11.1.2. Healthcare 11.1.3. Government & Defense 11.1.4. Energy 11.1.5. Manufacturing 11.1.6 Retail 11.1.7 BFSI 11.1.8 others CHAPTER 12. Global Data Center Cooling Market, By Region 12.1. Introduction 12.2. NORTH AMERICA 12.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.2.2. North America: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.2.3. North America: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.2.4. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.2.5. North America: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.2.6. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.2.6. US 12.2.6.1. US: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.2.6.2. US: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.2.6.3. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.2.6.4. US: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.2.6.5. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.2.7. CANADA 12.2.7.1. Canada: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.2.7.2. Canada: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.2.7.3. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.2.7.4. Canada: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.2.7.5. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.2.8. MEXICO 12.2.8.1. Mexico: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.2.8.2. Mexico: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.2.8.3. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.2.8.4. Mexico: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.2.8.5. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3. Europe 12.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.3.2. Europe: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.3. Europe: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.4. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.5. Europe: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.6. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.6. U.K. 12.3.6.1. U.K.: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.6.2. U.K.: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.6.3. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.6.4. U.K.: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.6.5. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.7. GERMANY 12.3.7.1. Germany: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.7.2. Germany: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.7.3. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.7.4. Germany: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.7.5. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.8. FRANCE 12.3.8.1. France: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.8.2. France: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.8.3. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.8.4. France: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.8.5. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.9. ITALY 12.3.9.1. Italy: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.9.2. Italy: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.9.3. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.9.4. Italy: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.9.5. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.10. SPAIN 12.3.10.1. Spain: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.10.2. Spain: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.10.3. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.10.4. Spain: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.10.5. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.11. BENELUX 12.3.11.1. BeNeLux: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.11.2. BeNeLux: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.11.3. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.11.4. BeNeLux: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.11.5. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.12. RUSSIA 12.3.12.1. Russia: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.12.2. Russia: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.12.3. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.12.4. Russia: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.12.5. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.3.13. REST OF EUROPE 12.3.13.1. Rest of Europe: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.3.13.2. Rest of Europe: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.3.13.3. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.3.13.4. Rest of Europe: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.3.13.5. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4. Asia Pacific 12.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.4.2. Asia Pacific: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.3. Asia Pacific: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.4. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.5. Asia Pacific: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.6. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.6. CHINA 12.4.6.1. China: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.6.2. China: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.6.3. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.6.4. China: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.6.5. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.7. JAPAN 12.4.7.1. Japan: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.7.2. Japan: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.7.3. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.7.4. Japan: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.7.5. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.8. INDIA 12.4.8.1. India: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.8.2. India: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.8.3. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.8.4. India: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.8.5. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.9. SOUTH KOREA 12.4.9.1. South Korea: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.9.2. South Korea: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.9.3. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.9.4. South Korea: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.9.5. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.10. THAILAND 12.4.10.1. Thailand: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.10.2. Thailand: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.10.3. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.10.4. Thailand: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.10.5. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.11. INDONESIA 12.4.11.1. Indonesia: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.11.2. Indonesia: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.11.3. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.11.4. Indonesia: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.11.5. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.12. MALAYSIA 12.4.12.1. Malaysia: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.12.2. Malaysia: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.12.3. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.12.4. Malaysia: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.12.5. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.13. AUSTRALIA 12.4.13.1. Australia: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.13.2. Australia: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.13.3. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.13.4. Australia: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.13.5. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.4.14. REST FO ASIA PACIFIC 12.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.4.14.5. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.5. South America 12.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.5.2. South America: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.5.3. South America: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.5.4. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.5.5. South America: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.5.6. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.5.6. BRAZIL 12.5.6.1. Brazil: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.5.6.2. Brazil: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.5.6.3. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.5.6.4. Brazil: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.5.6.5. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.5.7. ARGENTINA 12.5.7.1. Argentina: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.5.7.2. Argentina: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.5.7.3. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.5.7.4. Argentina: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.5.7.5. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.5.8. REST OF SOUTH AMERICA 12.5.8.1. Rest of South America: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.5.8.2. Rest of South America: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.5.8.3. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.5.8.4. Rest of South America: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.5.8.5. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.6. Middle East & Africa 12.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.6.2. Middle East & Africa: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.6.3. Middle East & Africa: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.6.4. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.6.5. Middle East & Africa: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.6.6. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.6.6. SAUDI ARABIA 12.6.6.1. Saudi Arabia: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.6.6.2. Saudi Arabia: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.6.6.3. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.6.6.4. Saudi Arabia: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.6.6.5. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.6.7. UAE 12.6.7.1. UAE: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.6.7.2. UAE: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.6.7.3. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.6.7.4. UAE: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.6.7.5. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.6.8. EGYPT 12.6.8.1. Egypt: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.6.8.2. Egypt: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.6.8.3. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.6.8.4. Egypt: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.6.8.5. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.6.9. SOUTH AFRICA 12.6.9.1. South Africa: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.6.9.2. South Africa: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.6.9.3. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.6.9.4. South Africa: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.6.9.5. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 12.6.10. REST OF MIDDLE EAST & AFRICA 12.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Component Type, 2023 – 2033 ($ Million) 12.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Technique, 2023 – 2033 ($ Million) 12.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 12.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Type of data center, 2023 – 2033 ($ Million) 12.6.10.5. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 13. Competitive Landscape 13.1. Competitior Benchmarking 2023 13.2. Market Share Analysis 13.3. Key Developments Analysis By Top 5 Companies 13.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 14. Company Profiles 14.1. Ebullient Inc. 14.1.1. Business Overview 14.1.2. Financial Analysis 14.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 14.1.2.2. Geographic Revenue Mix, 2020 (% Share) 14.1.3. Product Portfolio 14.1.4. Recent Development and Strategies Adopted 14.1.5. SWOT Analysis 14.2. Rittal GmbH & Co. KG 14.3. Vertiv 14.4. Nortek Air Solutions LLC 14.5. Equinix 14.6. Hitachi Ltd. 14.7. Fujitsu Ltd. 14.8. AdaptivCOOL 14.9. Schneider Electric SE 14.10. Black Box Corporation 14.11 Liquid Cool Solutions Inc. 14.12 Coolcentric

Connect to Analyst

Research Methodology