Consumer Finance Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

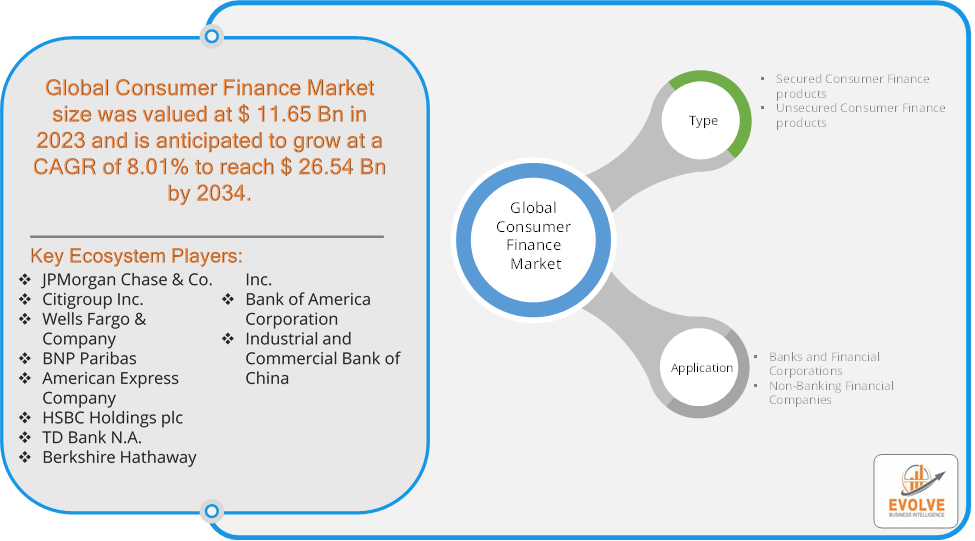

Consumer Finance Market Research Report: Information By Type (Secured Consumer Finance products and Unsecured Consumer Finance products), By Application (Banks and Financial Corporations, and Non-Banking Financial Companies), and by Region — Forecast till 2034

Page: 140

Consumer Finance Market Overview

The Consumer Finance Market size accounted for USD 11.65 Billion in 2023 and is estimated to account for 13.01 Billion in 2024. The Market is expected to reach USD 26.54 Billion by 2034 growing at a compound annual growth rate (CAGR) of 8.01% from 2024 to 2034. The Consumer Finance Market refers to the financial services and products offered to individuals (consumers) to help them manage personal expenses, purchase goods, or invest. It encompasses a broad range of products, including personal loans, credit cards, mortgages, auto loans, and lines of credit. The market primarily serves individual consumers rather than businesses, focusing on providing access to credit, financing options, and financial management tools to support everyday life and larger personal investments.

The consumer finance market plays a crucial role in the economy by providing individuals with the financial tools they need to achieve their financial goals. It helps people purchase homes, cars, and other assets, manage their expenses, and save for retirement.

Global Consumer Finance Market Synopsis

Consumer Finance Market Dynamics

Consumer Finance Market Dynamics

The major factors that have impacted the growth of Consumer Finance Market are as follows:

Drivers:

Ø Digitalization and Fintech Innovation

The rise of mobile banking, digital wallets, and peer-to-peer lending platforms has made financial services more accessible. These innovations improve convenience, lower transaction costs, and broaden access to credit. AI-powered tools like chatbots and automated credit scoring systems help financial institutions process applications faster, making it easier for consumers to obtain loans and manage their finances. These technologies enable faster processing, personalized financial offerings, and better risk management, which benefit both consumers and financial institutions. It has the potential to increase transparency, reduce fraud, and lower transaction costs in consumer finance.

Restraint:

- Perception of High Consumer Debt Levels

As consumer debt levels rise, individuals may face difficulties in securing new credit, which could slow the demand for additional financial products. High debt burdens can also lead to defaults, impacting the profitability of financial institutions. High levels of unsecured debt (e.g., credit cards, personal loans) increase the risk of default, which can make lenders more cautious in issuing loans and credit, potentially tightening the market.

Opportunity:

⮚ Expansion of Digital and Mobile Finance Solutions

The growing adoption of digital and mobile financial solutions presents a significant opportunity for consumer finance. Mobile banking apps, peer-to-peer lending platforms, and digital wallets allow consumers to access financial services more conveniently. Expanding these offerings can reach unbanked populations and tech-savvy consumers. Blockchain technology can offer secure, low-cost financial transactions and expand the scope of consumer finance. Cryptocurrency adoption could provide new financial tools and services, particularly for consumers in countries with unstable currencies. Subscription-based services, where consumers pay a monthly fee for access to financial tools, premium banking features, or personalized financial advice, are gaining traction. This model offers a steady revenue stream for financial institutions and can attract customers seeking convenience and value-added services.

Consumer Finance Market Segment Overview

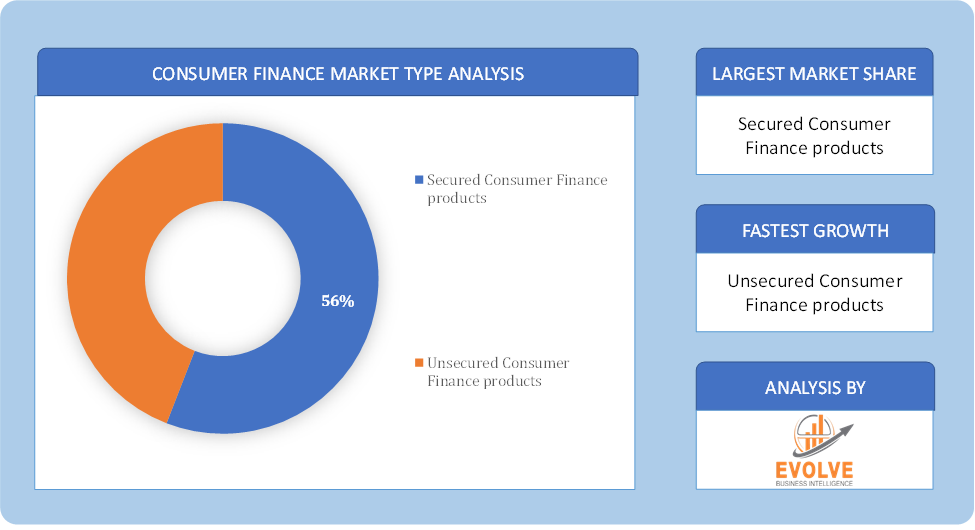

Based on Type, the market is segmented based on Secured Consumer Finance products and Unsecured Consumer Finance products. The secured segment dominant the market. This is because it offers a high level of security to both lenders and borrowers. It offers risk reduction to lenders which increases their confidence in issuing loans by demanding collateral like house, land, or car. This allows them to offer lower interest rates to the borrowers. Moreover, secured consumer finance permits larger loan sums, rendering it an appealing choice for people seeking to finance significant acquisitions or consolidate debt.

By Application

Based on Application, the market segment has been divided into Banks and Financial Corporations, and Non-Banking Financial Companies. The bank & financial corporations segment dominant the market. As they are established, have a strong reputation and brand recognition among consumers. Most consumers feel more comfortable trusting their finances with well-established banks that have been around for decades.

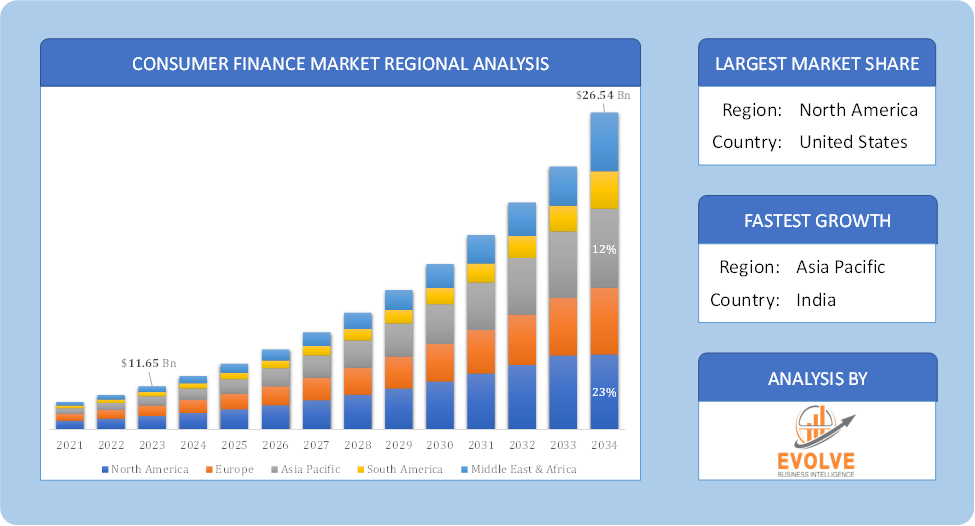

Global Consumer Finance Market Regional Analysis

Based on region, the global Consumer Finance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Consumer Finance Market followed by the Asia-Pacific and Europe regions.

Global Consumer Finance North America Market

Global Consumer Finance North America Market

North America holds a dominant position in the Consumer Finance Market. North America, particularly the U.S. and Canada, has a highly developed consumer finance market with widespread access to credit cards, loans, mortgages, and other financial services. The market is supported by a robust financial infrastructure and high consumer spending and the region is a global leader in fintech innovation, with widespread adoption of digital banking, mobile payments, and online lending platforms. Fintechs are competing with traditional financial institutions, offering more personalized and efficient services.

Global Consumer Finance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Consumer Finance Market industry. The Asia-Pacific region, including major economies like China, India, Japan, and Southeast Asian countries, is experiencing rapid growth in the consumer finance market. Economic development, rising disposable incomes, and increasing urbanization are driving demand for consumer credit and Asia-Pacific is leading the global fintech revolution, with China and India at the forefront of digital payments, mobile banking, and online lending platforms. Mobile payment services such as Alipay and WeChat Pay have transformed consumer finance in China.

Competitive Landscape

The global Consumer Finance Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- JPMorgan Chase & Co.

- Citigroup Inc.

- Wells Fargo & Company

- BNP Paribas

- American Express Company

- HSBC Holdings plc

- TD Bank N.A.

- Berkshire Hathaway Inc.

- Bank of America Corporation

- Industrial and Commercial Bank of China

Key Development

In October 2023, Mastercard announced partnerships with Instacart and Peacock to provide greater everyday value and convenience like online shopping and grocery delivery with Instacart, and streaming service subscription offering with Peacock.

Scope of the Report

Global Consumer Finance Market, by Type

- Secured Consumer Finance products

- Unsecured Consumer Finance products

Global Consumer Finance Market, by Application

- Banks and Financial Corporations

- Non-Banking Financial Companies

Global Consumer Finance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 26.54 Billion |

| CAGR (2024-2034) | 8.01% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | JPMorgan Chase & Co., Citigroup, Inc., Wells Fargo & Company, BNP Paribas, American Express Company, HSBC Holdings plc, TD Bank, N.A., Berkshire Hathaway Inc., Bank of America Corporation and Industrial and Commercial Bank of China. |

| Key Market Opportunities | · Expansion of Digital and Mobile Finance Solutions · Rise of Subscription-Based Financial Services |

| Key Market Drivers | · Digitalization and Fintech Innovation · Technological Infrastructure |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Consumer Finance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Consumer Finance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Consumer Finance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Consumer Finance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Consumer Finance Market is 2021- 2033

What is the growth rate of the global Consumer Finance Market?

The global Consumer Finance Market is growing at a CAGR of 8.01% over the next 10 years

Which region has the highest growth rate in the market of Consumer Finance Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Consumer Finance Market?

North America holds the largest share in 2022

Who are the key players in the global Consumer Finance Market?

JPMorgan Chase & Co., Citigroup, Inc., Wells Fargo & Company, BNP Paribas, American Express Company, HSBC Holdings plc, TD Bank, N.A., Berkshire Hathaway Inc., Bank of America Corporation and Industrial and Commercial Bank of China. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Consumer Finance Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Consumer Finance Market 4.8. Import Analysis of the Consumer Finance Market 4.9. Export Analysis of the Consumer Finance Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Consumer Finance Market, By Type 6.1. Introduction 6.2. Secured Consumer Finance products 6.3. Unsecured Consumer Finance products Chapter 7. Global Consumer Finance Market, By Application 7.1. Introduction 7.2. Banks and Financial Corporations 7.3. Non-Banking Financial Companies Chapter 8. Global Consumer Finance Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2024-2034 8.2.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.5. Market Size and Forecast, By End User, 2024-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.2.6.4. Market Size and Forecast, By End User, 2024-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.7.5. Market Size and Forecast, By End User, 2024-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2024-2034 8.3.4. Market Size and Forecast, By Product Type, 2024-2034 8.3.5. Market Size and Forecast, By End User, 2024-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.6.4. Market Size and Forecast, By End User, 2024-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.7.4. Market Size and Forecast, By End User, 2024-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.8.4. Market Size and Forecast, By End User, 2024-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.9.4. Market Size and Forecast, By End User, 2024-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.11.4. Market Size and Forecast, By End User, 2024-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2024-2034 8.4.4. Market Size and Forecast, By Product Type, 2024-2034 8.12.28. Market Size and Forecast, By End User, 2024-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.6.4. Market Size and Forecast, By End User, 2024-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.7.4. Market Size and Forecast, By End User, 2024-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.8.4. Market Size and Forecast, By End User, 2024-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.9.4. Market Size and Forecast, By End User, 2024-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.10.4. Market Size and Forecast, By End User, 2024-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2024-2034 8.5.4. Market Size and Forecast, By End User, 2024-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. JPMorgan Chase & Co. 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Citigroup, Inc. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Wells Fargo & Company 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. BNP Paribas 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. American Express Company 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. HSBC Holdings plc 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. TD Bank, N.A. 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Berkshire Hathaway Inc. 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Bank of America Corporation and Industrial 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Commercial Bank of China 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology