Chemical Logistics Market Overview

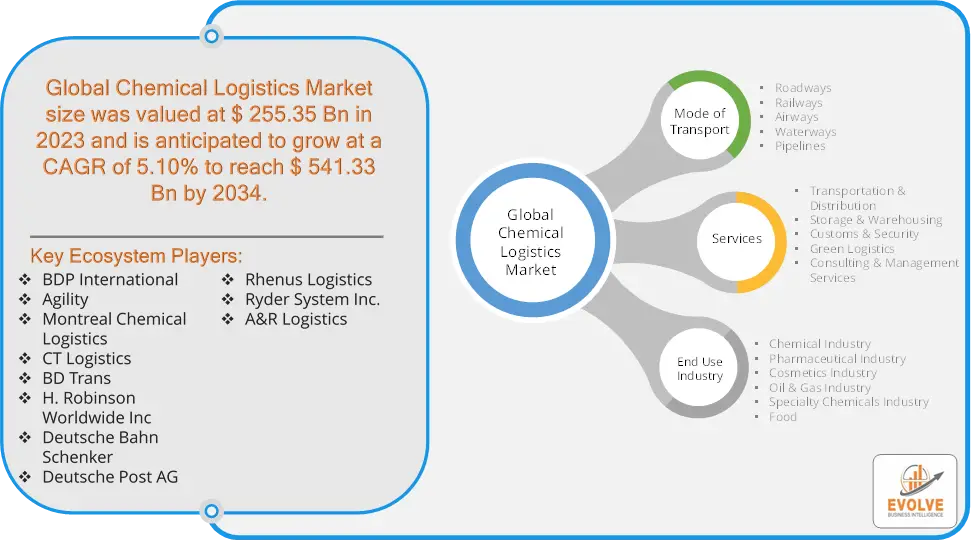

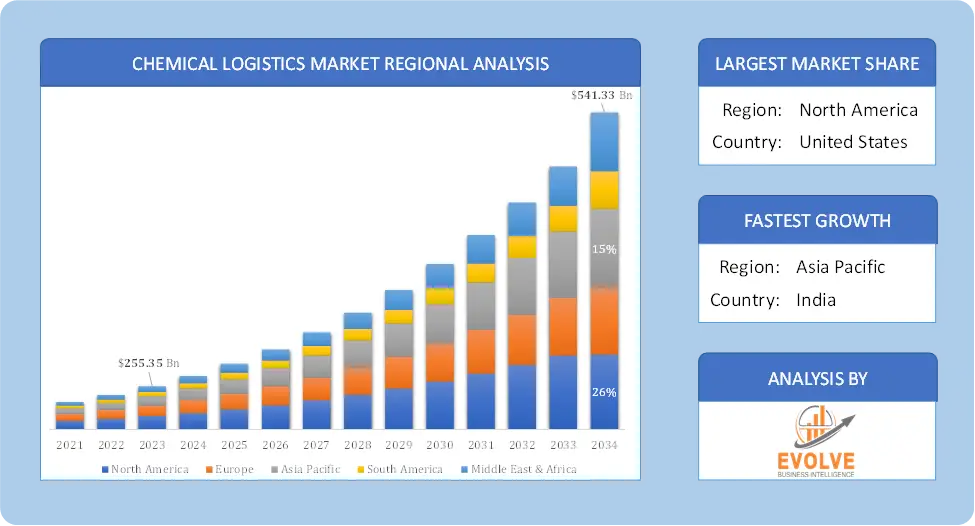

The Chemical Logistics Market size accounted for USD 255.35 Billion in 2023 and is estimated to account for 298.41 Billion in 2024. The Market is expected to reach USD 541.33 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.10% from 2024 to 2034. The chemical logistics market involves the planning, implementation, and control of the flow of chemical products and raw materials from their point of origin to their final destination. This includes the transportation, storage, distribution, and other related activities that ensure the safe and efficient movement of chemicals throughout the supply chain.

The chemical logistics market is a dynamic and complex industry that plays a vital role in the global economy. As the demand for chemicals continues to grow, the importance of efficient and sustainable chemical logistics services will only increase.

Global Chemical Logistics Market Synopsis

Chemical Logistics Market Dynamics

Chemical Logistics Market Dynamics

The major factors that have impacted the growth of Chemical Logistics Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in logistics technology, such as tracking systems, automated warehouses, and improved packaging solutions, enhance efficiency and safety in the chemical supply chain. The increase in online sales of chemical products, particularly specialty chemicals, creates a demand for fast and efficient logistics solutions. Companies are increasingly seeking logistics providers that can offer integrated inventory management solutions to optimize their supply chains and reduce costs.

Restraint:

- Perception of High Operational Costs and Market Volatility

The costs associated with specialized vehicles, storage facilities, and compliance with safety regulations can be prohibitively high, impacting the profitability of logistics companies and fluctuations in demand for chemical products due to economic conditions, changing regulations, or market trends can create uncertainty for logistics providers. While technology can enhance logistics efficiency, integrating new systems and technologies into existing operations can be challenging and costly.

Opportunity:

⮚ Growing focus on Sustainable Logistics Solutions

There is a growing focus on sustainability, creating opportunities for logistics providers to offer eco-friendly transportation and storage solutions, such as electric vehicles and green packaging. The rise of online sales for chemical products, particularly specialty and consumer chemicals, creates demand for efficient logistics solutions that can handle small-scale deliveries and rapid order fulfillment. Providing end-to-end logistics services, including warehousing, transportation, and inventory management, can attract clients looking for comprehensive solutions to streamline their supply chains.

Chemical Logistics Market Segment Overview

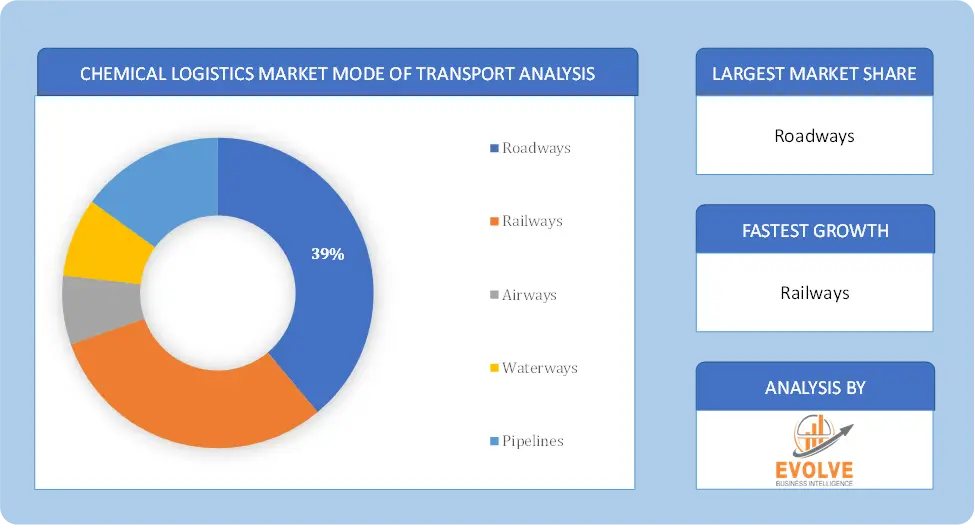

By Mode of Transport

Based on Mode of Transport, the market is segmented based on Roadways, Railways, Airways, Waterways, and Pipelines. The roadways segment dominated the market, due to the flexibility and accessibility it offers for the transportation of chemical products. Many chemicals require specialized handling, and road transportation provides a versatile solution for both short and long-distance movements. The extensive road networks in many regions enable last-mile delivery to be efficiently executed, reaching even remote locations.

Based on Mode of Transport, the market is segmented based on Roadways, Railways, Airways, Waterways, and Pipelines. The roadways segment dominated the market, due to the flexibility and accessibility it offers for the transportation of chemical products. Many chemicals require specialized handling, and road transportation provides a versatile solution for both short and long-distance movements. The extensive road networks in many regions enable last-mile delivery to be efficiently executed, reaching even remote locations.

By Services

Based on Services, the market segment has been divided into Transportation & Distribution, Storage & Warehousing, Customs & Security, Green Logistics, and Consulting & Management Services. The transportation & distribution category dominates the market due to the flexibility and accessibility it provides for the transportation of chemical products. Many chemicals require specialized handling, and road transportation provides a versatile solution for both short and long-distance movements. The extensive road networks in many regions enable last-mile delivery to be efficiently executed, reaching even remote locations.

By End Use Industry

Based on End Use Industry, the market segment has been divided into Chemical Industry, Pharmaceutical Industry, Cosmetics Industry, Oil & Gas Industry, Specialty Chemicals Industry, and Food. The chemical industry category dominates the market due to the highly specialized and regulated nature of transporting and handling chemicals. Chemical logistics services are tailored to the unique requirements and safety standards of the chemical sector, encompassing the transportation of hazardous materials, compliance with regulatory frameworks, and adherence to stringent safety protocols. The sheer diversity of chemical products, ranging from raw materials to finished goods, necessitates specialized logistics solutions that cater to various handling and storage needs, reinforcing the dominance of the chemical industry as the primary end user.

Global Chemical Logistics Market Regional Analysis

Based on region, the global Chemical Logistics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Chemical Logistics Market followed by the Asia-Pacific and Europe regions.

Global Chemical Logistics North America Market

Global Chemical Logistics North America Market

North America holds a dominant position in the Chemical Logistics Market. North America has a well-developed transportation infrastructure, including extensive highway networks, railways, and ports. This facilitates the efficient movement of chemicals and the region has stringent environmental and safety regulations governing the handling and transportation of chemicals, which can increase costs for logistics providers and there is a growing focus on sustainability in the North American chemical industry, driving demand for more environmentally friendly logistics solutions.

Global Chemical Logistics Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Chemical Logistics Market industry. The Asia-Pacific region is experiencing rapid economic growth, driving demand for chemicals and associated logistics services. The fastest-growing region due to rapid industrialization and urbanization, particularly in countries like China, India, and Southeast Asian nations. The demand for chemicals is rising across various sectors, including automotive, construction, and consumer goods.

Competitive Landscape

The global Chemical Logistics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BDP International

- Agility

- Montreal Chemical Logistics

- CT Logistics

- BD Trans

- Robinson Worldwide Inc

- Deutsche Bahn Schenker

- Deutsche Post AG

- Rhenus Logistics

- Ryder System Inc.

- A&R Logistics

Key Development

In September 2021, Aramco a Saudi Arabian Oil Co announced that it will create two new divisions, named Southern Area Gas Operations and Northern Area Gas Operations. This will help to expand the chemical business and to position itself for the energy transition.

In April 2021, BDP International a leading privately-owned global logistics and transportation solutions company has announced the acquisition of DJS Internationala Dallas-based customs brokerage and freight forwarding company. This acquisition will help the BDP international to expand its US import and customize its brokerage portfolio.

Scope of the Report

Global Chemical Logistics Market, by Mode of Transport

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

Global Chemical Logistics Market, by Services

- Transportation & Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

Global Chemical Logistics Market, by End Use Industry

- Chemical Industry

- Pharmaceutical Industry

- Cosmetics Industry

- Oil & Gas Industry

- Specialty Chemicals Industry

- Food

Global Chemical Logistics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $541.33 Billion |

| CAGR | 5.10% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Mode of Transport, Services, End use Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BDP International, Agility, Montreal Chemical Logistics, CT Logistics, BD Trans, H. Robinson Worldwide Inc, Deutsche Bahn Schenker, Deutsche Post AG, Rhenus Logistics, Ryder System Inc. and A&R Logistics |

| Key Market Opportunities | • Growing focus on Sustainable Logistics Solutions • Integrated Supply Chain Solutions |

| Key Market Drivers | • Technological Advancements • Rising E-commerce and Inventory Management Needs |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Chemical Logistics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Chemical Logistics Market historical market size for the year 2021, and forecast from 2023 to 2033

- Chemical Logistics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Chemical Logistics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.