Automotive Acoustic Materials Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

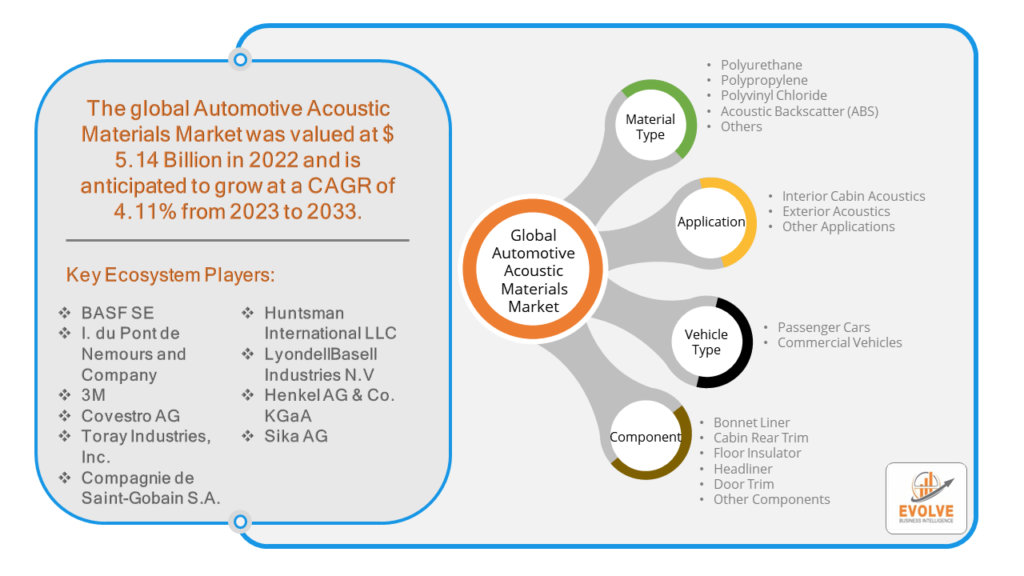

Automotive Acoustic Materials Market Research Report: By Material Type (Polyurethane, Polypropylene, Polyvinyl Chloride, Acoustic Backscatter (ABS), and Others) By Application (Interior Cabin Acoustics, Exterior Acoustics, and Other Applications,) By Vehicle Type (Passenger Cars and Commercial Vehicles) By Component (Bonnet Liner, Cabin Rear Trim, Floor Insulator, Headliner, Door Trim, and Other Components), and by Region — Forecast till 2033.

Page: 141

Automotive Acoustic Materials Market Overview

Automotive Acoustic Materials Market Size is expected to reach USD 8.47 Billion by 2033. The Automotive Acoustic Materials industry size accounted for USD 5.14 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.11% from 2023 to 2033. The automotive acoustic materials market encompasses a range of materials designed to reduce noise and vibrations in vehicles, enhancing cabin comfort and sound quality. These materials include foams, fibers, and barriers strategically placed throughout the vehicle’s interior and exterior. Growing concerns for noise pollution and the increasing demand for quieter rides are driving the market’s expansion. Additionally, stringent regulations regarding vehicle noise emissions further propel the adoption of acoustic materials in automobiles. Advancements in material technology, such as lightweight and eco-friendly options, are also shaping the market landscape

Global Automotive Acoustic Materials Market Synopsis

The Automotive Acoustic Materials market experienced a detrimental effect due to the Covid-19 pandemic. The COVID-19 pandemic initially led to a downturn in the automotive industry, affecting the demand for acoustic materials due to halted production and reduced vehicle sales. However, as the industry recovers, there is a renewed focus on cabin comfort and premium features, driving the demand for acoustic materials to enhance interior quality.

Global Automotive Acoustic Materials Market Dynamics

The major factors that have impacted the growth of Automotive Acoustic Materials are as follows:

Drivers:

⮚ Advancements in Material Technology

Ongoing advancements in material science and engineering are leading to the development of lighter, more effective acoustic materials. These advancements not only improve noise reduction but also contribute to weight reduction in vehicles, thereby enhancing fuel efficiency and sustainability.

Restraint:

- Limited Consumer Awareness

Despite the benefits of acoustic materials in enhancing driving comfort and reducing noise pollution, consumer awareness and understanding of these materials may be limited. Automakers may face challenges in effectively communicating the value proposition of acoustic solutions to consumers, potentially limiting market adoption.

Opportunity:

⮚ Advanced Manufacturing Technologies

Advancements in manufacturing technologies, such as additive manufacturing (3D printing) and nanotechnology, enable the production of acoustic materials with intricate designs and tailored properties. These technologies offer opportunities to develop next-generation acoustic materials that are lighter, stronger, and more effective in reducing noise, opening up new avenues for market growth.

Automotive Acoustic Materials Market Segment Overview

By Material Type

Based on the Material Type, the market is segmented based on Polyurethane, Polypropylene, Polyvinyl Chloride, Acoustic Backscatter (ABS), and Others. Among these, Polyurethane, known for its excellent acoustic damping properties and versatility, dominates the market. Polypropylene and Polyvinyl Chloride (PVC) also hold significant shares due to their affordability and ease of processing, while Acoustic Backscatter (ABS) is gaining traction for its lightweight and high-performance characteristics.

By Application

Based on Application, the market has been divided into Interior Cabin Acoustics, Exterior Acoustics, and Other Applications. nterior Cabin Acoustics stands out as the dominant application segment, driven by the increasing demand for quiet and comfortable cabin environments. Exterior Acoustics also hold a substantial share, primarily driven by the need to reduce exterior noise, such as wind and road noise, for enhanced driving comfort. Other applications encompass a variety of specialized uses, including engine bay insulation and underbody soundproofing, contributing to the overall market growth.

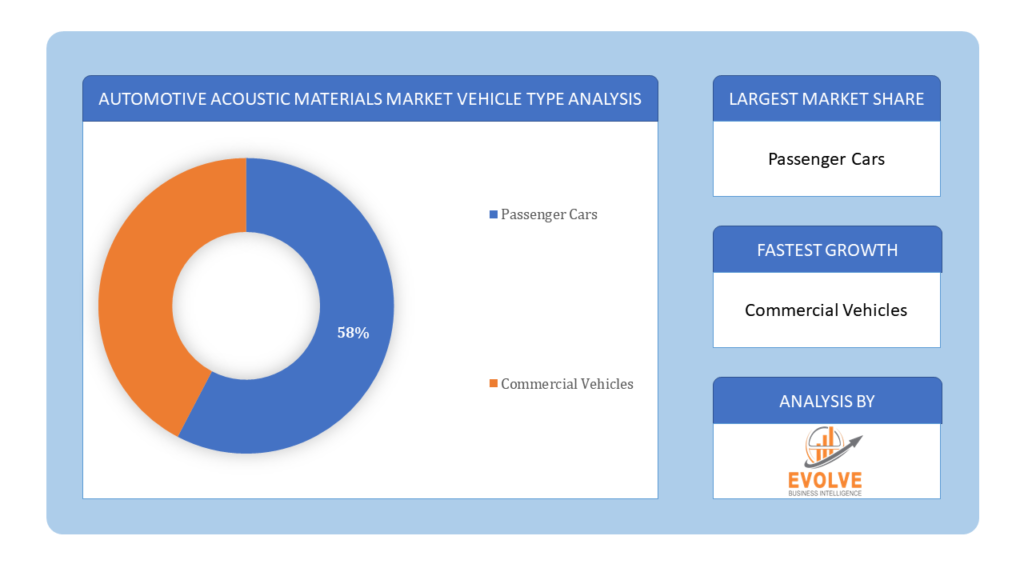

By Vehicle Type

Based on the Vehicle Type, the market has been divided into Passenger Cars and Commercial Vehicles. Acoustic materials play a crucial role in passenger cars to create quieter cabins, thereby improving the overall driving experience. While Commercial Vehicles also utilize acoustic materials, their demand is comparatively lower, primarily focused on reducing noise for driver comfort and compliance with regulatory standards.

Based on the Vehicle Type, the market has been divided into Passenger Cars and Commercial Vehicles. Acoustic materials play a crucial role in passenger cars to create quieter cabins, thereby improving the overall driving experience. While Commercial Vehicles also utilize acoustic materials, their demand is comparatively lower, primarily focused on reducing noise for driver comfort and compliance with regulatory standards.

By Component

Based on Component, the market has been divided into Bonnet Liner, Cabin Rear Trim, Floor Insulator, Headliner, Door Trim, and Other Components Headliners also hold a substantial share, contributing to sound insulation and maintaining interior comfort. Other components such as Floor Insulators and Cabin Rear Trims further contribute to noise reduction and vibration damping, supporting the overall demand for acoustic materials in vehicles.

Global Automotive Acoustic Materials Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of Asia-Pacific is anticipated to dominate the market for the usage of Automotive Acoustic Materials, followed by those in North America and Europe.

Automotive Acoustic Materials Asia-Pacific Market

Automotive Acoustic Materials Asia-Pacific Market

The Asia-Pacific region holds a dominant position in the Automotive Acoustic Materials market. Asia-Pacific is currently the largest market for acoustic materials, and it is expected to continue to hold the largest market share in the future. The growth of the construction industry, increasing urbanization, and rising demand for acoustic materials in various end-use applications such as transportation, building & construction, and industrial & manufacturing facilities are some of the key factors driving the growth of the acoustic materials market in the Asia-Pacific region.

Automotive Acoustic Materials North America Market

The North America region is witnessing rapid growth and emerging as a significant market for the Automotive Acoustic Materials industry. From 2023 through 2030, the Acoustic Materials market in North America is anticipated to develop at the quickest CAGR. The growing focus on lowering noise pollution, the need for eco-friendly and energy-efficient structures, and the expansion of the automotive and aerospace sectors are some of the factors propelling the growth of the acoustic materials market in North America. The market is expanding due in part to the presence of significant acoustic material suppliers and manufacturers in the area, including Owens Corning and 3M Company.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BASF SE, I. du Pont de Nemours and Company, 3M, Covestro AG, and Toray Industries, Inc. are some of the leading players in the global Automotive Acoustic Materials Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BASF SE

- du Pont de Nemours and Company

- 3M

- Covestro AG

- Toray Industries, Inc.

- Compagnie de Saint-Gobain S.A.

- Huntsman International LLC

- LyondellBasell Industries N.V

- Henkel AG & Co. KGaA

- Sika AG

Key Development:

In September 2023, BASF SE, a leading chemical company, announced a significant advancement in automotive acoustic materials. They unveiled a novel acoustic solution leveraging advanced polymer technologies, aimed at enhancing cabin comfort and noise reduction in vehicles. This development reflects BASF’s commitment to innovation and addressing the evolving needs of the automotive industry for quieter and more refined driving experiences.

Scope of the Report

Global Automotive Acoustic Materials Market, by Material Type

- Polyurethane

- Polypropylene

- Polyvinyl Chloride

- Acoustic Backscatter (ABS)

- Others

Global Automotive Acoustic Materials Market, by Application

- Interior Cabin Acoustics

- Exterior Acoustics

- Other Applications

Global Automotive Acoustic Materials Market, by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Global Automotive Acoustic Materials Market, by Component

- Bonnet Liner

- Cabin Rear Trim

- Floor Insulator

- Headliner

- Door Trim

- Other Components

Global Automotive Acoustic Materials Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $8.47 Billion |

| CAGR | 4.11% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material Type, Application, Vehicle Type, Component |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF SE, I. du Pont de Nemours and Company, 3M, Covestro AG, Toray Industries, Inc., Compagnie de Saint-Gobain S.A., Huntsman International LLC, LyondellBasell Industries N.V, Henkel AG & Co. KGaA, Sika AG |

| Key Market Opportunities | Rapid industrialization and the escalating traffic congestion leading to high-decibel sound generation is stimulating the demand |

| Key Market Drivers | The increasing concern of government agencies for reducing noise pollution has compelled the building & construction industry and automotive manufacturers |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Automotive Acoustic Materials Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Automotive Acoustic Materials market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Automotive Acoustic Materials market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Automotive Acoustic Materials Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Automotive Acoustic Materials Market?

The Automotive Acoustic Materials Market analysis covers the period from 2021 to 2033, offering insights into long-term trends and forecasts in noise reduction technology adoption within vehicles.

What is the growth rate of the Automotive Acoustic Materials Market?

The Automotive Acoustic Materials Market is poised to grow at a compound annual growth rate (CAGR) of 4.11% from 2023 to 2033, reflecting a steady increase in demand for materials aimed at enhancing cabin comfort and reducing noise pollution.

Which region has the highest growth rate in the Automotive Acoustic Materials Market?

The Asia-Pacific region demonstrates the highest growth rate in the Automotive Acoustic Materials Market, driven by rapid industrialization, escalating traffic congestion, and increasing demand for noise reduction solutions in vehicles and construction.

Which region has the largest share of the Automotive Acoustic Materials Market?

Asia-Pacific commands the largest share of the Automotive Acoustic Materials Market, owing to factors such as growing urbanization, stringent noise pollution regulations, and a robust automotive industry driving the adoption of acoustic materials.

Who are the key players in the Automotive Acoustic Materials Market?

Key players in the Automotive Acoustic Materials Market include BASF SE, I. du Pont de Nemours and Company, 3M, Covestro AG, Toray Industries, Inc., Compagnie de Saint-Gobain S.A., Huntsman International LLC, LyondellBasell Industries N.V, Henkel AG & Co. KGaA, and Sika AG, leading the innovation and development of noise reduction solutions globally.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Contents

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Material Type Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. Vehicle Type Segment – Market Opportunity Score 4.1.4. Component Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Material Type 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Automotive Acoustic Materials Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Automotive Acoustic Materials Market, By Material Type 7.1. Introduction 7.1.1. Polyurethane 7.1.2. Polypropylene 7.1.3. Polyvinyl Chloride 7.1.4. Acoustic Backscatter (ABS) 7.1.5. Others CHAPTER 8. Global Automotive Acoustic Materials Market, By Application 8.1. Introduction 8.1.1. Interior Cabin Acoustics 8.1.2. Exterior Acoustics 8.1.3. Other Applications CHAPTER 9. Global Automotive Acoustic Materials Market, By Vehicle Type 9.1. Introduction 9.1.1. Passenger Cars 9.1.2. Commercial Vehicles CHAPTER 10. Global Automotive Acoustic Materials Market, By Component 10.1. Introduction 10.1.1. Bonnet Liner 10.1.2. Cabin Rear Trim 10.1.3. Floor Insulator 10.1.4. Headliner 10.1.5. Door Trim 10.1.6. Other Components CHAPTER 11. Global Automotive Acoustic Materials Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Material Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Vehicle Type, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BASF SE 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. I. du Pont de Nemours and Company 13.3. 3M 13.4. Covestro AG 13.5. Toray Industries, Inc. 13.6. Compagnie de Saint-Gobain S.A. 13.7. Huntsman International LLC 13.8. LyondellBasell Industries N.V 13.9. Henkel AG & Co. KGaA 13.10. Sika AG

Connect To Analyst

Research Methodology