Global Aircraft Seating Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

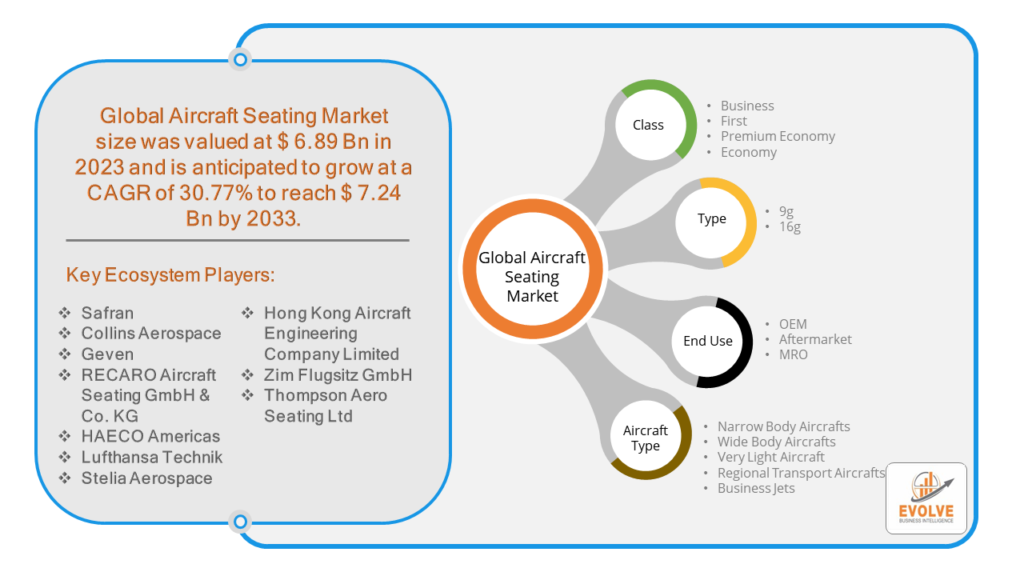

Aircraft Seating Market Research Report: By Class (Business, First, Premium Economy and Economy), by Type (9g and 16g), by End Use (OEM, Aftermarket and MRO), by Aircraft Type (Narrow Body Aircrafts, Wide Body Aircrafts, Very Light Aircraft, Regional Transport Aircrafts and Business Jets), by Fit (Line Fit and Retrofit), and by Region — Forecast till 2033.

Page: 146

Aircraft Seating Market Overview

The Aircraft Seating Market Size is expected to reach USD 7.24 Billion by 2033. The Aircraft Seating industry size accounted for USD 6.89 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 30.77% from 2023 to 2033. The Aircraft Seating Market refers to the global market for aircraft seats, which includes a wide range of seating options for different aircraft types and classes. The market is expected to grow significantly in the coming years, driven by factors such as the increasing demand for premium economy seats, the growing trend of installing IFEC systems in aircraft seats, and the increasing number of aircraft deliveries. The market is segmented by seat type, class, end-use, aircraft type, materials, components, and region. The narrowbody aircraft type segment held the largest share in 2022, and North America was the leading region in 2022.

Global Aircraft Seating Market Synopsis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the aircraft seating market, causing uncertainty, slowing down the supply chain, and falling business confidence. The temporary lockdown of various design, development, and manufacturing facilities limited market growth, and the focus on fighting the pandemic negatively affected demand. However, the market has seen tremendous growth post-COVID due to the regular availability of raw materials required for manufacturing. The market is expected to continue growing, with the UAM aircraft type segment expected to grow at a CAGR of 9.5% from 2020 to 2030, and the MRO use to rise at 7.9% CAGR.

Global Aircraft Seating Market Dynamics

The major factors that have impacted the growth of Aircraft Seating are as follows:

Drivers:

- Maintenance and retrofitting of existing aircraft

Multiple airlines are upgrading their aircraft seats since the old seats have become outdated. The introduction of lightweight and advanced materials for cabin seats has resulted in the upgrade to new seats. Moreover, business jet owners are increasingly personalizing their cabin seats Therefore, the maintenance and retrofitting of existing aircraft drives the growth of the aircraft seating market significantly.

Restraint:

- High Initial Costs

Aircraft seating involves high initial costs for both airlines and manufacturers. Airlines may be hesitant to invest in new seating solutions due to budget constraints or uncertainty about return on investment, especially during economic downturns or periods of low profitability.

Opportunity:

⮚ opportunities due to the rapid demand for improved technology

The market for aircraft seating is expanding rapidly as a result of the growing need for better technology in urban air mobility. The aviation sector is improving to offer safer and more comfortable travel, which is creating a lot of chances for the global market. The Aircraft Seating Market Size has enormous opportunities due to the rise of low-cost aircraft.

Aircraft Seating Market Segment Overview

By Type

Based on the Type, the market is segmented based on 9g and 16g. Seats certified under 9g can withstand forces up to nine times the force of gravity, while 16g seats can endure forces up to sixteen times the force of gravity. This segmentation caters to varying safety requirements and preferences across different aircraft and aviation regulations.

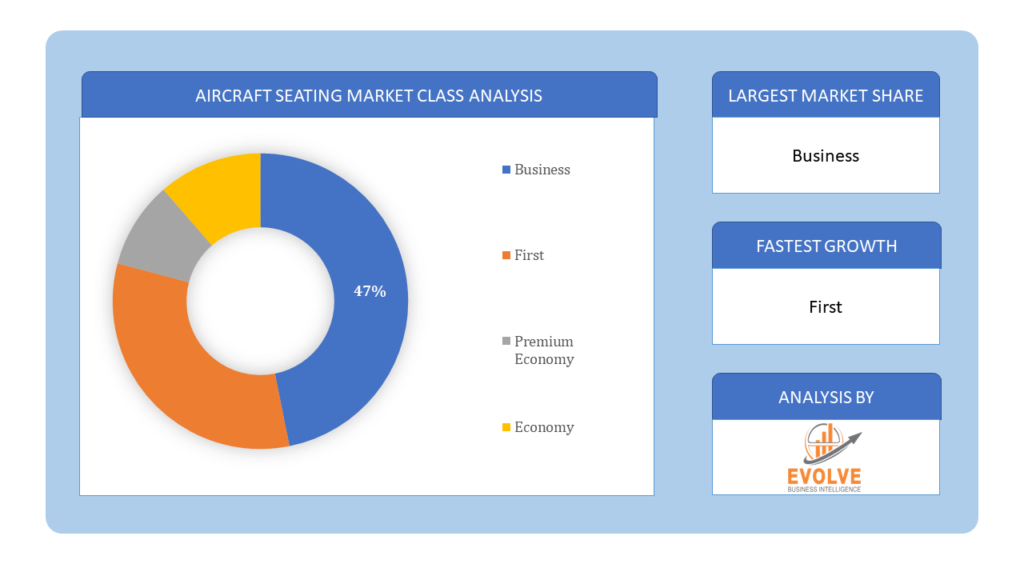

By Class

Based on Class, the market has been divided into Business, First, Premium Economy, and Economy. The premium economy class is anticipated to grow at the fastest rate among these seat-type divisions, with a solid CAGR percent. This is because the demand for the premium economy class sector has increased due to the emergence of low-cost carriers. Even so, the other seat-type groups showed consistent growth.

By End Use

Based on the End Use, the market has been divided into OEM, Aftermarket, and MRO. Original Equipment Manufacturers (OEM) produce seating during aircraft manufacturing. Aftermarket services cater to replacement and upgrade needs post-delivery. Maintenance, Repair, and Overhaul (MRO) focuses on servicing existing seating to ensure safety and compliance throughout the aircraft’s operational lifespan.

By Aircraft Type

Based on Aircraft Type, the market has been divided into Narrow Body Aircrafts, Wide Body Aircrafts, Very Light Aircraft, Regional Transport Aircrafts, and Business Jets. The wide body type is predicted to increase at the quickest rate among the aforementioned body types and is expected to reach the highest CAGR over the forecast period. Compared to other aircraft segments, wide-body aircraft have a somewhat larger need for better interiors.

By Fit

Based on Fit, the market has been divided into Line Fit and Retrofit. Both segments account significant growth rate with a decent CAGR during the assessment period.

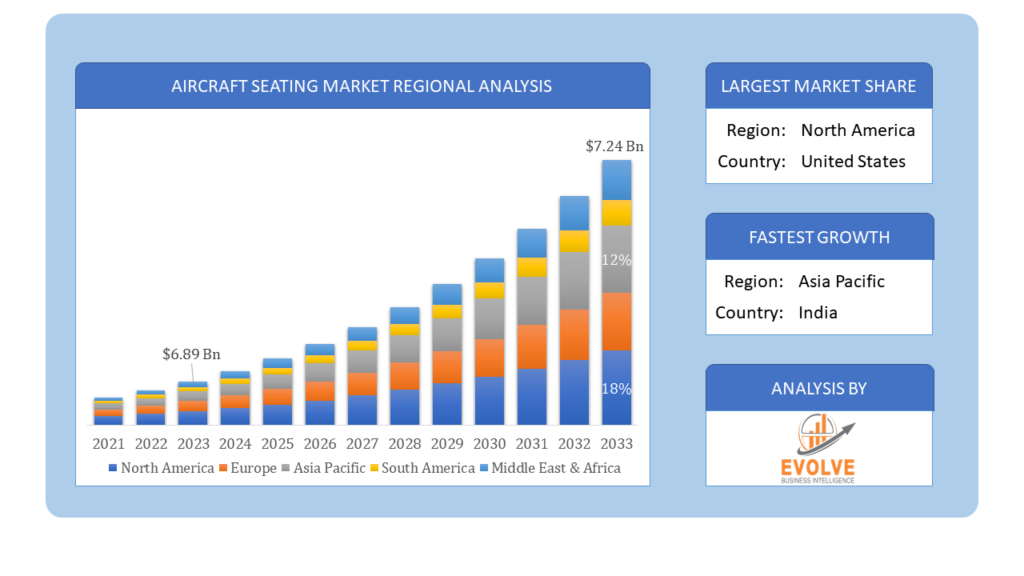

Global Aircraft Seating Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Aircraft Seating, followed by those in Asia Pacific and Europe.

Aircraft Seating North America Market

The North American region holds a dominant position in the Aircraft Seating market. North America will continue to lead the global aircraft seating market. By 2029, North America is anticipated to have the most market shares. This is because the area is home to a sizable population of high-net-worth individuals. It is anticipated that their presence will increase demand for business class travel. Business class seating will experience a surge in demand during the forthcoming time in North America in line with market trends. Throughout the projected period of 2022–2029, these are the main factors propelling the expansion of the North American region in the worldwide market.

Aircraft Seating Asia Pacific Market

The Asia Pacific region is witnessing rapid growth and emerging as a significant market for the Aircraft Seating industry. Throughout the projection period, Asia Pacific is anticipated to grow quickly at a CAGR of xx%. The operational competence of aircraft OEMs, including Mitsubishi, is anticipated to drive the Asia Pacific market throughout the projection period. During the forecast period of 2022-2029, this is the primary element propelling the expansion of the Asia Pacific region in the worldwide market.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as SAFRAN, Collins Aerospace, Lufthansa Technik, RECARO Aircraft Seating GmbH & Co. KG, and HAECO Americas are some of the leading players in the global Aircraft Seating Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- SAFRAN

- Collins Aerospace

- Lufthansa Technik

- RECARO Aircraft Seating GmbH & Co. KG

- HAECO Americas

- Lufthansa Technik

- Stelia Aerospace

- Hong Kong Aircraft Engineering Company Limited

- Zim Flugsitz GmbH

- THOMPSON AERO SEATING LTD

Key Development:

In 2019, Thompson agreed with Swiss International Airlines AG to supply new first-class and business-class seats for the retrofit of their Airbus A340 aircraft.

Scope of the Report

Global Aircraft Seating Market, by Type

- 9g

- 16g

Global Aircraft Seating Market, by Class

- Business

- First

- Premium Economy

- Economy

Global Aircraft Seating Market, by End Use

- OEM

- Aftermarket

- MRO

Global Aircraft Seating Market, by Aircraft Type

- Narrow Body Aircrafts

- Wide Body Aircrafts

- Very Light Aircraft

- Regional Transport Aircrafts

- Business Jets

Global Aircraft Seating Market, by Fit

- Line Fit

- Retrofit

Global Aircraft Seating Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $7.24 Billion |

| CAGR | 30.77% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Class , End Use , Aircraft Type , Fit |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | SAFRAN, Collins Aerospace, Lufthansa Technik, RECARO Aircraft Seating GmbH & Co. KG, HAECO Americas, Lufthansa Technik, Stelia Aerospace, Hong Kong Aircraft Engineering Company Limited, Zim Flugsitz GmbH, THOMPSON AERO SEATING LTD |

| Key Market Opportunities | great opportunities due to the rapid demand for improved technology |

| Key Market Drivers | Consumer Trends and Preferences Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Aircraft Seating Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Aircraft Seating market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Aircraft Seating market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Aircraft Seating Market.

Frequently Asked Questions (FAQ)

What is the study period of the Aircraft Seating Market?

The study period for the Aircraft Seating Market spans from 2023 to 2033.

What is the growth rate of the Aircraft Seating Market?

The Aircraft Seating Market is expected to grow at a CAGR of 30.77% from 2023 to 2033.

Which region has the highest growth rate in the Aircraft Seating Market?

The Asia-Pacific region has the highest growth rate in the Aircraft Seating Market.

Which region has the largest share of the Aircraft Seating Market?

North America holds the largest share of the Aircraft Seating Market.

Who are the key players in the Aircraft Seating Market?

Key players in the Aircraft Seating Market include SAFRAN, Collins Aerospace, Lufthansa Technik, and RECARO Aircraft Seating GmbH & Co. KG.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Class Segment – Market Opportunity Score 4.1.3. End Use Segment – Market Opportunity Score 4.1.4. Aircraft Type Segment – Market Opportunity Score 4.1.5. Fit Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. Aircraft Type 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Aircraft Seating Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Aircraft Seating Market, By Type 7.1. Introduction 7.1.1. 9g 7.1.2. 16g CHAPTER 8. Global Aircraft Seating Market, By Class 8.1. Introduction 8.1.1. Business 8.1.2. First 8.1.3. Premium Economy 8.1.4. Economy CHAPTER 9. Global Aircraft Seating Market, By End Use 9.1. Introduction 9.1.1. OEM 9.1.2. Aftermarket 9.1.3. MRO CHAPTER 10. Global Aircraft Seating Market, By Aircraft Type 10.1.1. Narrow Body Aircrafts 10.1.2. Wide Body Aircrafts 10.1.3. Very Light Aircraft 10.1.4. Regional Transport Aircrafts 10.1.5. Business Jets CHAPTER 11. Global Aircraft Seating Market, By Fit 11.1.1 Introduction 11.1.2. Line Fit 11.1.3. Retrofit CHAPTER 12. Global Aircraft Seating Market, By Region 12.1. Introduction 12.2. NORTH AMERICA 12.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.2.2. North America: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.2.3. North America: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.2.4. North America: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.2.5. North America: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.2.6. North America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.2.7. US 12.2.7.1. US: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.2.7.2. US: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.2.7.3. US: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.2.7.4. US: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.2.7.5. North America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.2.8. CANADA 12.2.8.1. Canada: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.2.8.2.Canada: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.2.8.3. Canada: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.2.8.4.Canada: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.2.8.5 . North America: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.2.9. MEXICO 12.2.9.1.Mexico: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.2.9.2.Mexico: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.2.9.3.Mexico: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.2.9.4.Mexico: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.2.9.5 North America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3. Europe 12.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.3.2. Europe: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.3. Europe: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.4. Europe: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.5. Europe: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.6. North America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.7. U.K. 12.3.7.1. U.K.: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.7.2. U.K.: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.7.3. U.K.: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.7.4. U.K.: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.7.5. North America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.8. GERMANY 12.3.8.1 Germany: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.8.2 Germany: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.8.3 Germany: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.8.4 Germany: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.8.5 North America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.9. FRANCE 12.3.9.1. France: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.9.2. France: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.9.3. France: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.9.4. France: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.9.5. France: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.10. ITALY 12.3.10.1. Italy: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.10.2. Italy: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.10.3. Italy: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.10.4. Italy: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.10.5. Italy: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.11. SPAIN 12.3.11.1. Spain: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.11.2. Spain: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.11.3. Spain: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.11.4. Spain: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.11.5. Spain: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.12. BENELUX 12.3.12.1. BeNeLux: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.12.2. BeNeLux: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.12.3. BeNeLux: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.12.4. BeNeLux: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.12.5. BeNeLux: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.13. RUSSIA 12.3.13.1. Russia: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.13.2. Russia: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.13.3. Russia: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.13.4. Russia: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.13.5. Russia: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.3.14. REST OF EUROPE 12.3.14.1. Rest of Europe: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.3.14.2. Rest of Europe: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.3.14.3. Rest of Europe: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.3.14.4. Rest of Europe: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.3.14.5. Rest of Europe: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4. Asia Pacific 12.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.4.2. Asia Pacific: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.3. Asia Pacific: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.4. Asia Pacific: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.5. Asia Pacific: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.6. Asia Pacific: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.7. CHINA 12.4.7.1. China: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.7.2. China: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.7.3. China: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.7.4. China: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.7.5. China: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.8. JAPAN 12.4.8.1. Japan: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.8.2. Japan: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.8.3. Japan: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.8.4. Japan: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.8.5. . Japan: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.9. INDIA 12.4.9.1. India: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.9.2. India: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.9.3, India: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.9.4. India: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.9.5. India: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.10. SOUTH KOREA 12.4.10.1. South Korea: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.10.2. South Korea: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.10.3, South Korea: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.10.4. South Korea: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.10.5. South Korea: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.11. THAILAND 12.4.11.1. Thailand: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.11.2. Thailand: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.11.3. Thailand: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.11.4. Thailand: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.11.5. Thailand: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.12. INDONESIA 12.4.12.1. Indonesia: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.12.2. Indonesia: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.12.3. Indonesia: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.12.4. Indonesia: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.12.5. Indonesia: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.13. MALAYSIA 12.4.13.1. Malaysia: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.13.2. Malaysia: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.13.3. Malaysia: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.13.4. Malaysia: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.13.5. Malaysia: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.14. AUSTRALIA 12.4.14.1. Australia: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.14.2. Australia: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.14.3. Australia: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.14.4. Australia: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.14.5. Australia: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.4.15. REST FO ASIA PACIFIC 12.4.15.1. Rest fo Asia Pacific: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.4.15.2. Rest fo Asia Pacific: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.4.15.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.4.15.4. Rest fo Asia Pacific: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.4.15.5. Rest fo Asia Pacific: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.5. South America 12.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.5.2. South America: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.5.3. South America: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.5.4. South America: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.5.5. South America: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.5.5. South America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.5.6. BRAZIL 12.5.6.1. Brazil: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.5.6..2. Brazil: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.5.6.3. Brazil: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.5.6.4. Brazil: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.5.6.5. Brazil: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.5.6. ARGENTINA 12.5.6.1. Argentina: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.5.6.2. Argentina: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.5.6.3. Argentina: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.5.6.4. Argentina: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.5.6.5. Argentina: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.5.7. REST OF SOUTH AMERICA 12.5.7.1. Rest of South America: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.5.7.2. Rest of South America: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.5.7.3. Rest of South America: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.5.7.4. Rest of South America: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.5.7.5. Rest of South America: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.6. Middle East & Africa 12.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 12.6.2. Middle East & Africa: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.6.3. Middle East & Africa: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.6.4. Middle East & Africa: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.6.5. Middle East & Africa: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 13.6.6. Middle East & Africa: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.6.7. SAUDI ARABIA 12.6.7..1. Saudi Arabia: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.6.7.2. Saudi Arabia: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.6.7.3. Saudi Arabia: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.6.7.4. Saudi Arabia: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.6.7.5. Saudi Arabia: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.6.8. UAE 12.6.8.1. UAE: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.6.8.2. UAE: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.6.8.3. UAE: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.6.8.4. UAE: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.6.8.5. UAE: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.6.9. EGYPT 12.6.9.1. Egypt: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.6.9.2. Egypt: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.6.9.3. Egypt: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.6.9.4. Egypt: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.6.9.5. Egypt: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.6.10. SOUTH AFRICA 12.6.10.1. South Africa: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.6.10.2. South Africa: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.6.10.3. South Africa: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.6.10.4. South Africa: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.6.10.5. South Africa: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) 12.6.11. REST OF MIDDLE EAST & AFRICA 12.6.11.1. Rest of Middle East & Africa: Market Size and Forecast, By Type 2023 – 2033 ($ Million) 12.6.11.2. Rest of Middle East & Africa: Market Size and Forecast, By Class , 2023 – 2033 ($ Million) 12.6.11.3. Rest of Middle East & Africa: Market Size and Forecast, By End Use 2023 – 2033 ($ Million) 12.6.11.4. Rest of Middle East & Africa: Market Size and Forecast, By Aircraft Type 2023 – 2033 ($ Million) 12.6.11.5. Rest of Middle East & Africa: Market Size and Forecast, By Fit 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. SAFRAN 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Collins Aerospace 13.3. Lufthansa Technik 13.4. RECARO Aircraft Seating GmbH & Co. KG 13.5. HAECO Americas 13.6. Lufthansa Technik 13.7. Stelia Aerospace 13.8. Hong Kong Aircraft Engineering Company Limited 13.9. Zim Flugsitz GmbH 13.10. THOMPSON AERO SEATING LTD

Connect to Analyst

Research Methodology