Gaming Console Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Gaming Console Market Research Report: Information By type of gamer (Casual gamers, Hardcore gamers), By type (TV consoles, Handheld consoles), and by Region — Forecast till 2033

Page: 173

Gaming Console Market Overview

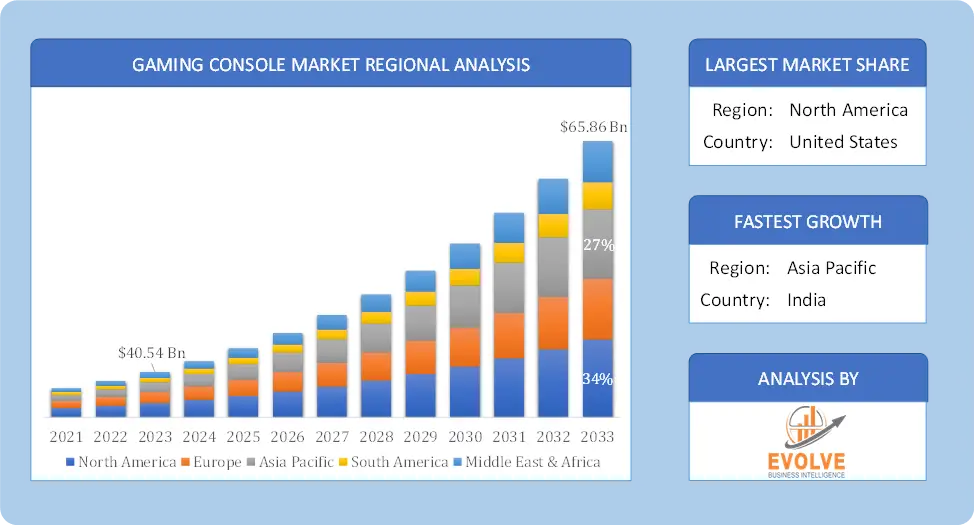

The Gaming Console Market Size is expected to reach USD 65.86 Billion by 2033. The Gaming Console industry size accounted for USD 40.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 2.05% from 2023 to 2033. The gaming console market encompasses the production, sale, and distribution of devices designed specifically for playing video games. This market includes major players such as Sony, Microsoft, and Nintendo, who offer consoles like the PlayStation, Xbox, and Nintendo Switch. Key trends include the evolution of consoles with enhanced graphics, processing power, and integrated online services. The market is influenced by technological advancements, game exclusivity, and consumer preferences. It also faces competition from mobile gaming and PC gaming, which offer alternative gaming experiences. Market dynamics are driven by innovation, gaming content, and hardware upgrades.

Global Gaming Console Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Gaming Console market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers to adopt various strategies to stabilize the company.

Gaming Console Market Dynamics

The major factors that have impacted the growth of Gaming Console are as follows:

Drivers:

Ø Technological Advancements

Continuous improvements in hardware and software technology drive demand for the latest gaming consoles. Advances in processing power, graphics capabilities, and storage solutions enhance the gaming experience, making newer models more attractive to consumers. Innovations like 4K resolution, ray tracing, and faster load times play a significant role in this dynamic.

Restraint:

- Rapid Technological Changes

The fast pace of technological advancements can lead to rapid obsolescence of gaming consoles. Consumers may be reluctant to invest in a console that could quickly become outdated as new technologies emerge. This can lead to shorter product lifecycles and increased pressure on manufacturers to continuously innovate.

Opportunity:

⮚ Advancements in Technology

Emerging technologies such as virtual reality (VR), augmented reality (AR), and 8K resolution offer substantial opportunities for innovation in gaming consoles. Incorporating these technologies can enhance user experiences and attract a new segment of tech-savvy gamers. VR and AR can provide immersive gameplay and new ways of interacting with games, while advancements in graphics and processing power can offer more detailed and realistic gaming environments.

Gaming Console Segment Overview

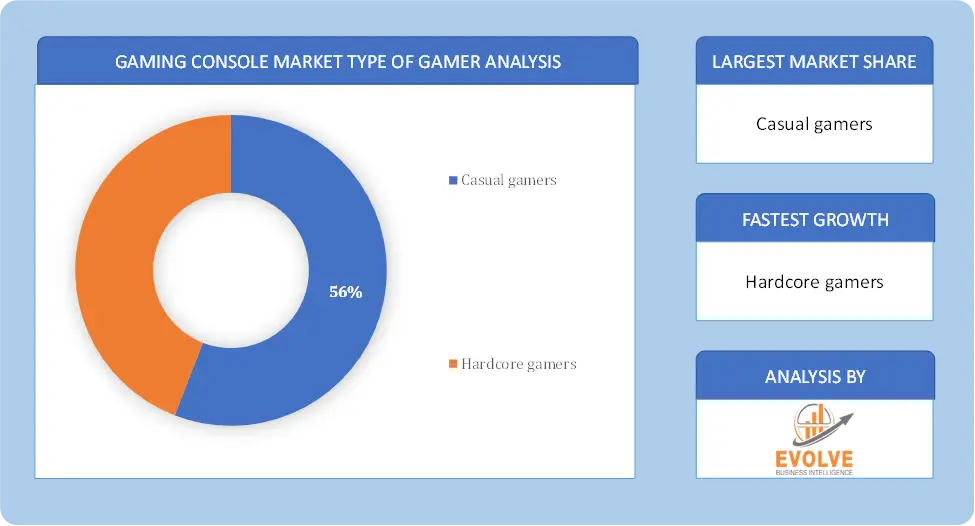

By Type of gamer

Based on Type of gamer, the market is segmented based on Casual gamers, Hardcore gamers. hardcore gamers dominate due to their higher spending on high-performance consoles, accessories, and games, seeking advanced features and immersive experiences.

Based on Type of gamer, the market is segmented based on Casual gamers, Hardcore gamers. hardcore gamers dominate due to their higher spending on high-performance consoles, accessories, and games, seeking advanced features and immersive experiences.

By Type

Based on Types, the market has been divided into the TV consoles, Handheld consoles. TV consoles dominate due to their superior graphics, processing power, and immersive gaming experiences, appealing to a broader audience compared to handheld consoles.

Global Gaming Console Market Regional Analysis

Based on region, the global Gaming Console market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Gaming Console market followed by the Asia-Pacific and Europe regions.

Global Gaming Console North America Market

Global Gaming Console North America Market

North America holds a dominant position in the Gaming Console Market. The gaming console market in North America, which was valued at USD 9.8 billion in 2021, is anticipated to grow at a rate of 43.20% CAGR during the course of the study due to advances in technology and an increase in the number of players that are actively participating. It is anticipated that the region would be able to hold onto its dominance during the projection period due to the strong demand for cutting-edge gaming technology and the concentration of significant video game developers in the area.

Global Gaming Console Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Gaming Console industry. The market for gaming consoles in Asia Pacific is expanding at the quickest rate due to the rise in internet gaming and rising affluence among customers in developing countries like China and India. There’s a chance that the amount of e-commerce sites offering reconditioned or previously used consoles will increase, which might help this local industry expand.

Competitive Landscape

The global Gaming Console market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as type of gamer launches, and strategic alliances.

Prominent Players:

- Atari

- Dell

- Mad Catz Global Ltd

- Mattel

- Microsoft

- Nintendo Co. Ltd

- NVIDIA

- Razer

- Sony Corp.

- VALVE CORP

Key Development

By the end of this fiscal year, Nintendo, a well-known manufacturer of gaming consoles, which has seen a significant increase in popularity as a result of its Switch device, will launch the Switch 2 game system. Confirmation of the development was provided by the corporation during its meeting with investors. Additionally, Nintendo President Shuntaro Furukawa made an appearance at X and stated that the Switch 2 would be going on sale. In the past, it was rumored that the debut date of the Switch 2 will be delayed until the beginning of the year 2025

Scope of the Report

Global Gaming Console Market, by Type of gamer

- Casual gamers

- Hardcore gamers

Global Gaming Console Market, by Type

- TV consoles

- Handheld consoles

Global Gaming Console Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $65.86 Billion |

| CAGR | 2.05% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type of gamer, Type |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Atari, Dell, Mad Catz Global Ltd, Mattel, Microsoft, Nintendo Co. Ltd, NVIDIA, Razer, Sony Corp., VALVE CORP |

| Key Market Opportunities | • Advancement in core wireless connectivity |

| Key Market Drivers | • Rising demand of 3D video games Increasing number of e-sport tournaments |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Gaming Console market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Gaming Console market historical market size for the year 2021, and forecast from 2023 to 2033

- Gaming Console market share analysis at each type of gamer level

- Competitor analysis with detailed insight into its type of gamer segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including type of gamer launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Gaming Console market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, type of gamer offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Gaming Console market is 2021- 2033

What is the growth rate of the global Gaming Console market?

The global Gaming Console market is growing at a CAGR of 2.05% over the next 10 years

Which region has the highest growth rate in the market of Gaming Console?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Gaming Console market?

North America holds the largest share in 2022

Who are the key players in the global Gaming Console market?

Atari, Dell, Mad Catz Global Ltd, Mattel, Microsoft, Nintendo Co. Ltd, NVIDIA, Razer, Sony Corp., and VALVE CORP are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Gaming Console Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Gaming Console Market, By type of gamer 6.1. Introduction 6.2. Casual gamers 6.3. Hardcore gamers Chapter 7. Global Gaming Console Market, By type 7.1. Introduction 7.2. TV consoles 7.3. Handheld consoles Chapter 8. Global Gaming Console Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.3. Market Size and Forecast, By Country, 2020 - 2028 8.2.4. Market Size and Forecast, By type of gamer, 2020 - 2028 8.2.5. Market Size and Forecast, By type, 2020 – 2028 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.6.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.2.6.4. Market Size and Forecast, By type, 2020 - 2028 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.2.7.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.2.7.4. Market Size and Forecast, By type, 2020 - 2028 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.3. Market Size and Forecast, By Country, 2020 - 2028 8.3.4. Market Size and Forecast, By type of gamer, 2020 - 2028 8.3.5. Market Size and Forecast, By type, 2020 – 2028 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.6.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.3.6.4. Market Size and Forecast, By type, 2020 - 2028 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.7.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.3.7.4. Market Size and Forecast, By type, 2020 - 2028 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.8.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.3.8.4. Market Size and Forecast, By type, 2020 - 2028 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.9.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.3.9.4. Market Size and Forecast, By type, 2020 - 2028 8.3.10. Rest Of Europe 8.3.10.1. Introduction 8.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.3.10.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.3.10.4. Market Size and Forecast, By type, 2020 - 2028 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.3. Market Size and Forecast, By Country, 2020 - 2028 8.4.4. Market Size and Forecast, By type of gamer, 2020 - 2028 8.4.5. Market Size and Forecast, By type, 2020 - 2028 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.6.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.4.6.4. Market Size and Forecast, By type, 2020 - 2028 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.7.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.4.7.4. Market Size and Forecast, By type, 2020 - 2028 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.8.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.4.8.4. Market Size and Forecast, By type, 2020 - 2028 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.9.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.4.9.4. Market Size and Forecast, By type, 2020 - 2028 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 8.4.10.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.4.10.4. Market Size and Forecast, By type, 2020 - 2028 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.5.4. Market Size and Forecast, By type, 2020 - 2028 8.5.5. Market Size and Forecast, By Region, 2020 - 2028 8.5.6. South America 8.5.6.1. Introduction 8.5.6.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.6.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.5.6.4. Market Size and Forecast, By type, 2020 - 2028 8.5.7. Middle East and Africa 8.5.7.1. Introduction 8.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 8.5.7.3. Market Size and Forecast, By type of gamer, 2020 - 2028 8.5.7.4. Market Size and Forecast, By type, 2020 - 2028 Chapter 9. Competitive Landscape 9.1. Introduction 9.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 10. Company Profiles 10.1. Atari 10.1.1. Business Overview 10.1.2. Financial Analysis 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Dell 10.2.1. Business Overview 10.2.2. Financial Analysis 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Mad Catz Global Ltd 10.3.1. Business Overview 10.3.2. Financial Analysis 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Mattel 10.4.1. Business Overview 10.4.2. Financial Analysis 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.4.5. SWOT Analysis 10.5. Microsoft 10.5.1. Business Overview 10.5.2. Financial Analysis 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Nintendo Co. Ltd 10.6.1. Business Overview 10.6.2. Financial Analysis 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. NVIDIA 10.7.1. Business Overview 10.7.2. Financial Analysis 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8. Razer 10.8.1. Business Overview 10.8.2. Financial Analysis 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9. Sony Corp. 10.9.1. Business Overview 10.9.2. Financial Analysis 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Valve Corp 10.10.1. Business Overview 10.10.2. Financial Analysis 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis Chapter 11. Key Takeaways

Connect to Analyst

Research Methodology