Freight and logistics Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

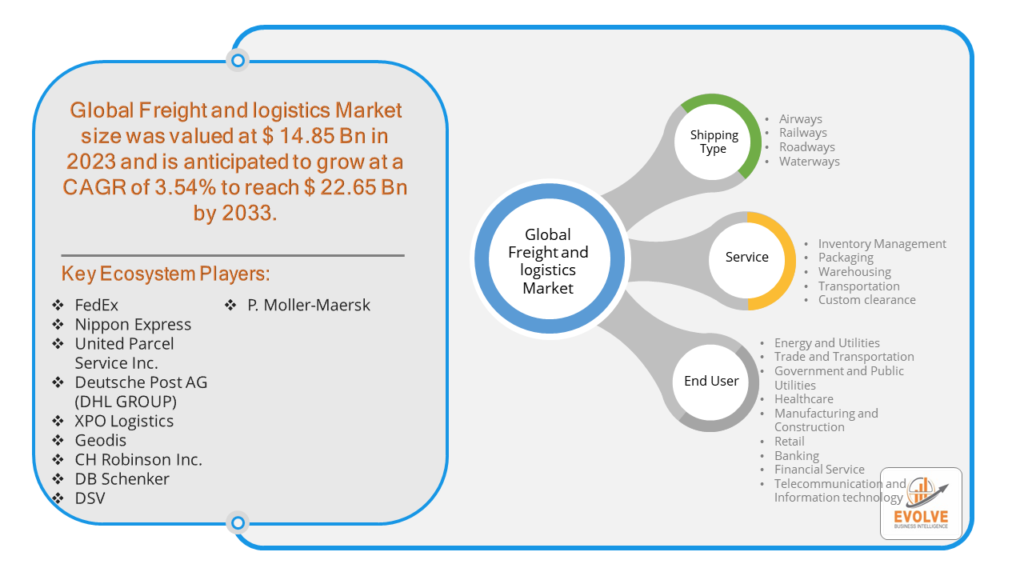

Freight and logistics Market Research Report: Information By Shipping Type (Airways, Railways, Roadways, and Waterways), By Service (Inventory Management, Packaging, Warehousing, Transportation, and Custom clearance), By End-Users (Energy and Utilities, Trade and Transportation, Government and Public Utilities, Healthcare, Manufacturing and Construction, Retail, Banking, Financial Service, Telecommunication and Information technology), and by Region — Forecast till 2033

Page: 165

Freight and logistics Market Overview

The Freight and logistics Market Size is expected to reach USD 22.65 Billion by 2033. The Freight and logistics Market industry size accounted for USD 14.85 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 3.54% from 2023 to 2033. The freight and logistics market encompasses the industry involved in the movement and transportation of goods and materials. It includes various activities such as transportation, warehousing, packaging, inventory management, and related information services.

The market is crucial for global trade, enabling the movement of raw materials to manufacturers, finished goods to consumers, and everything in between. It’s influenced by factors such as economic conditions, technological advancements, regulatory changes, and global supply chain dynamics.

Global Freight and logistics Market Synopsis

The COVID-19 pandemic had a significant impact on the freight and logistics market. Lockdowns and restrictions led to disruptions in global supply chains, affecting the movement of goods and materials. Manufacturing slowdowns and closures in various regions disrupted the flow of raw materials and finished goods. Restrictions on movement, reduced air traffic, and lockdowns affected transportation modes. Air cargo faced decreased capacity due to reduced passenger flights, while trucking and maritime transport faced delays and congestion at ports. Enhanced health and safety measures were implemented across the industry, including sanitization procedures, social distancing requirements, and the use of personal protective equipment (PPE). The pandemic accelerated the adoption of digital technologies in logistics, including remote work solutions, digital freight platforms, and the use of data analytics to manage disruptions and optimize operations.

Freight and logistics Market Dynamics

The major factors that have impacted the growth of Freight and logistics Market are as follows:

Drivers:

Ø Technological Advancements

The rise of e-commerce has significantly increased demand for logistics services, including last-mile delivery and warehousing. E-commerce platforms require efficient and flexible logistics networks to meet customer expectations for fast and reliable delivery. Innovations such as automation, artificial intelligence, blockchain, and the Internet of Things (IoT) are transforming logistics operations. These technologies improve efficiency, reduce costs, and enhance visibility across the supply chain. Changing consumer preferences, such as faster delivery times and sustainable practices, impact logistics strategies and investments.

Restraint:

- Perception of High Operational Costs

Logistics operations involve significant costs, including fuel costs, labor costs, maintenance costs, and technology investments. Fluctuations in fuel prices and labor shortages can affect profitability. While technological advancements offer opportunities for efficiency gains, the adoption of new technologies can be costly and complex. Resistance to change and the need for skilled labor to manage advanced technologies can also be a challenge. Pressure to reduce carbon emissions and adopt sustainable practices can increase costs and require investments in eco-friendly technologies and practices.

Opportunity:

⮚ Growing demand for Green Logistics and Supply Chain Visibility

Increasing focus on sustainability and environmental responsibility presents opportunities for logistics providers to offer eco-friendly solutions, such as alternative fuels, electric vehicles, and sustainable packaging. There is a growing demand for real-time visibility and transparency in supply chains. Technologies that provide better tracking and monitoring of shipments create opportunities for logistics companies to offer value-added services. The use of data analytics and AI in logistics operations offers opportunities to optimize routes, predict demand, and improve decision-making processes.

Freight and logistics Market Segment Overview

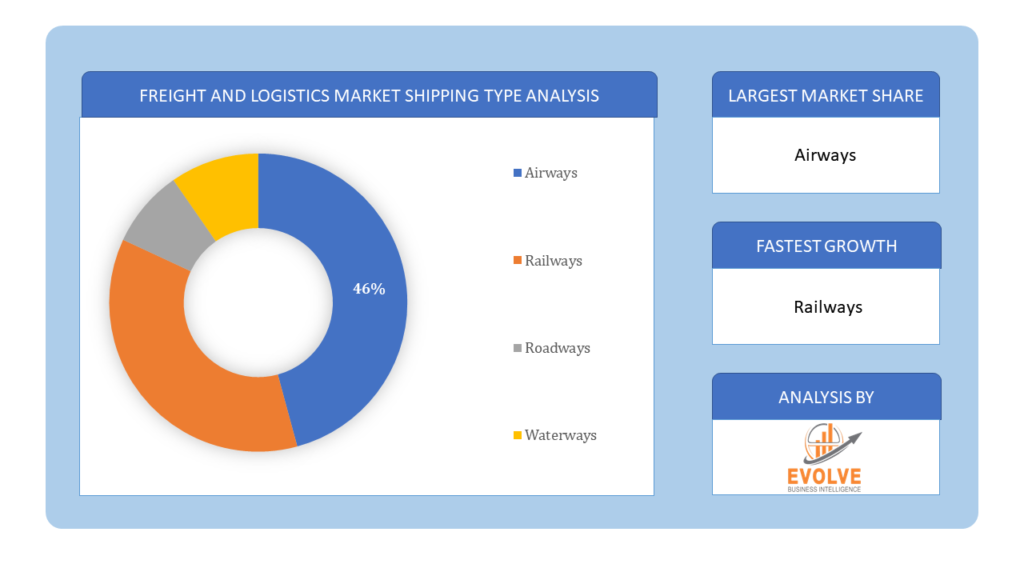

By Shipping Type

Based on Shipping Type, the market is segmented based on Airways, Railways, Roadways and Waterways. The Waterways segment dominated the Freight and Logistics industry. The rising preference for waterways logistics may be attributed to the benefits provided, which include dependable and congested transit. In comparison to trucks and railcars, the benefits given by waterways logistics include higher loading capacity, reduced emissions, efficient transportation for payload, and optimal fuel consumption, which are driving segment growth in the freight and logistics industry shortly.

Based on Shipping Type, the market is segmented based on Airways, Railways, Roadways and Waterways. The Waterways segment dominated the Freight and Logistics industry. The rising preference for waterways logistics may be attributed to the benefits provided, which include dependable and congested transit. In comparison to trucks and railcars, the benefits given by waterways logistics include higher loading capacity, reduced emissions, efficient transportation for payload, and optimal fuel consumption, which are driving segment growth in the freight and logistics industry shortly.

By Service

Based on Service, the market segment has been divided into the Inventory Management, Packaging, Warehousing, Transportation and Custom clearance. The transportation segment dominated the Freight and Logistics industry in 2021 and is estimated to grow at a significant CAGR during the forecast period. The expected massive increase in freight volumes during the forecast period is expected to benefit the global freight forwarding business. The growing network of agreements will open up more trade and investment possibilities, boosting the country’s potential to capitalize on global Freight and Logistics Market growth. These agreements’ investment frameworks serve to create a more appealing investment environment and foster more economic integration in the global Freight and Logistics Market.

By End Users

Based on End Users, the market segment has been divided into the Energy and Utilities, Trade and Transportation, Government and Public Utilities, Healthcare, Manufacturing and Construction, Retail, Banking, Financial Service and Telecommunication and Information technology. The Trade and Transportation segment dominant the market.

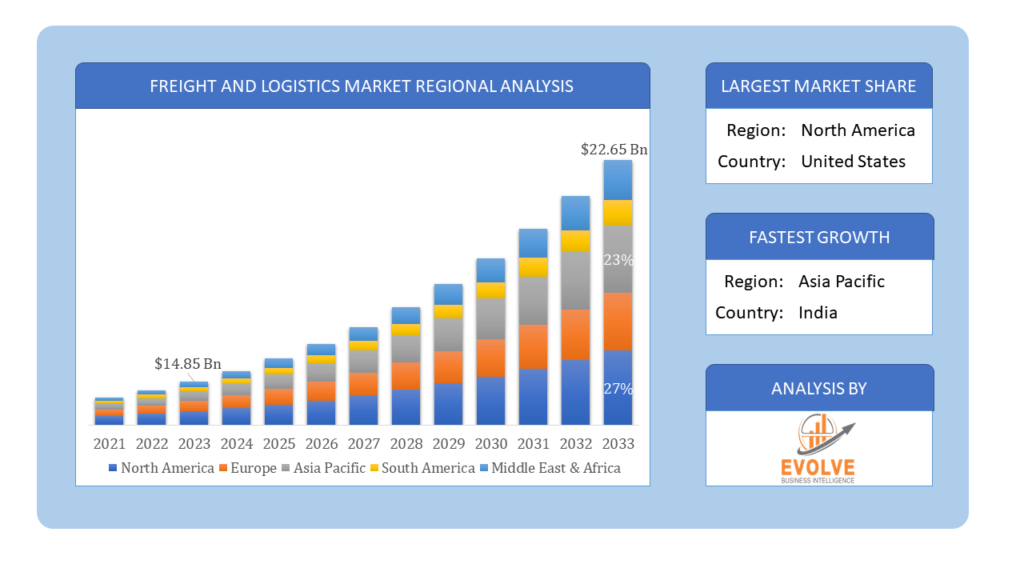

Global Freight and logistics Market Regional Analysis

Based on region, the global Freight and logistics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Freight and logistics Market followed by the Asia-Pacific and Europe regions.

Freight and logistics North America Market

Freight and logistics North America Market

North America holds a dominant position in the Freight and logistics Market. The U.S. dominates the North American market with a highly developed logistics sector, driven by e-commerce, manufacturing, and consumer goods industries. Canada also has a significant logistics industry, focusing on trade with the U.S. and natural resource exports.

Freight and logistics Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Freight and logistics Market. China is largest logistics market in the region and one of the fastest-growing globally, driven by manufacturing, e-commerce, and infrastructure development initiatives like the Belt and Road Initiative. India is also Rapidly growing logistics market due to economic growth, urbanization, and expanding e-commerce.

Competitive Landscape

The global Freight and logistics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- FedEx

- Nippon Express

- United Parcel Service Inc.

- Deutsche Post AG (DHL GROUP)

- XPO Logistics

- Geodis

- CH Robinson Inc.

- DB Schenker

- DSV

- P. Moller-Maersk

Scope of the Report

Global Freight and logistics Market, by Shipping Type

- Airways

- Railways

- Roadways

- Waterways

Global Freight and logistics Market, by Service

- Inventory Management

- Packaging

- Warehousing

- Transportation

- Custom clearance

Global Freight and logistics Market, by End Users

- Energy and Utilities

- Trade and Transportation

- Government and Public Utilities

- Healthcare

- Manufacturing and Construction

- Retail

- Banking

- Financial Service

- Telecommunication and Information technology

Global Freight and logistics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $22.65 Billion |

| CAGR | 3.54% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Shipping Type, Service, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | FedEx, Nippon Express, United Parcel Service Inc., Deutsche Post AG (DHL GROUP), XPO Logistics, Geodis, CH Robinson Inc., DB Schenker, DSV and P. Moller-Maersk. |

| Key Market Opportunities | • Growing demand for Green Logistics and Supply Chain Visibility • Data Analytics and AI |

| Key Market Drivers | • Technological Advancements • E-commerce Growth |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Freight and logistics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Freight and logistics Market historical market size for the year 2021, and forecast from 2023 to 2033

- Freight and logistics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Freight and logistics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Freight and Logistics Market?

The study period for the Freight and Logistics Market is from 2023 to 2033.

What is the growth rate of the Freight and Logistics Market?

The Freight and Logistics Market is expected to grow at a compound annual growth rate (CAGR) of 3.54% from 2023 to 2033.

Which region has the highest growth rate in the Freight and Logistics Market?

The Asia-Pacific region has the highest growth rate in the Freight and Logistics Market due to economic growth and expanding e-commerce.

Which region has the largest share of the Freight and Logistics Market?

North America holds the largest share of the Freight and Logistics Market, driven by a highly developed logistics sector.

Who are the key players in the Freight and Logistics Market?

Key players in the Freight and Logistics Market include FedEx, Nippon Express, United Parcel Service Inc., Deutsche Post AG (DHL Group), XPO Logistics, Geodis, CH Robinson Inc., DB Schenker, DSV, and A.P. Moller-Maersk.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Shipping Type Segement – Market Opportunity Score 4.1.2. Service Segment – Market Opportunity Score 4.1.3. End Users Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Freight and logistics Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Freight and logistics Market, By Shipping Type 7.1. Introduction 7.1.1. Airways 7.1.2. Railways 7.1.3. Roadways 7.1.4. Waterways CHAPTER 8. Freight and logistics Market, By Service 8.1. Introduction 8.1.1. Inventory Management 8.1.2. Packaging 8.1.3. Warehousing 8.1.4. Transportation 8.1.5. Custom clearance CHAPTER 9. Freight and logistics Market, By End Users 9.1. Introduction 9.1.1. Energy and Utilities 9.1.2 Trade and Transportation 9.1.3 Government and Public Utilities 9.1.4 Healthcare 9.1.5 Manufacturing and Construction 9.1.6 Retail 9.1.7 Banking 9.1.8 Financial Service 9.1.9 Telecommunication and Information technology CHAPTER 10. Freight and logistics Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Shipping Type, 2023 – 2033 ($ Million) 10.6.9.2.____________ Rest of Middle East & Africa: Market Size and Forecast, By Service, 2023 – 2033 ($ Million) 10.6.9.3.________ Rest of Middle East & Africa: Market Size and Forecast, By End Users, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. FedEx 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Nippon Express 13.3. United Parcel Service Inc. 13.4. Deutsche Post AG (DHL GROUP) 13.5. XPO Logistics 13.6. Geodis 13.7. CH Robinson Inc. 13.8. DB Schenker 13.9 DSV 13.10 P. Moller-Maersk.

Connect to Analyst

Research Methodology