Food Processing Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Food Processing Market Research Report: Information By Equipment Type (Cleaning, Sorting, & Grading Equipment, Cutting, Peeling & Grinding Equipment, Mixers, Blenders and Homogenizers and Extrusion & Thermal Equipment), Application (Bakery & Confectionery, Dairy Products, Meat, Poultry, & Seafood Products, Fruit & Vegetable, Beverages and others), and by Region — Forecast till 2033

Food Processing Market Overview

The Food Processing Market Size is expected to reach USD 633.30 Billion by 2033. The Food Processing Market industry size accounted for USD 200.3Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 12.2% from 2023 to 2033. The Food Processing Market refers to the industry segment involved in transforming raw agricultural products or ingredients into processed food products that are ready for consumption or further use. This market plays a crucial role in the food supply chain as it adds value to raw materials, extends their shelf life, enhances their taste and texture, and makes them more convenient for consumers. The food processing market is driven by the growing demand for processed and convenience foods due to factors such as urbanization, changing lifestyles, and a rise in disposable incomes. It has led to an increase in the consumption of packaged and ready-to-eat foods, which offer ease and convenience to consumers in preparing and consuming meals. The food processing market is continually evolving, with ongoing advancements in technology and innovations to improve efficiency, sustainability, and the nutritional value of processed food items.

Global Food Processing Market Synopsis

COVID-19 had a significant impact on the food processing market. During the early stages of the pandemic, many countries implemented lockdowns and travel restrictions, leading to disruptions in the global food supply chain. Transportation challenges, labor shortages, and border closures affected the movement of raw materials and finished products, causing delays and shortages in some regions. With people staying at home due to lockdowns and restrictions, there was a surge in demand for packaged and processed foods. Consumers sought products with longer shelf lives and convenience, which led to increased sales of frozen foods, canned goods, and ready-to-eat meals. Food processing facilities faced labor shortages as employees fell ill, were quarantined, or faced difficulties commuting to work during lockdowns. This situation put additional pressure on the industry to maintain production levels. The pandemic influenced consumer preferences, leading to shifts in food choices. Health and wellness considerations, along with the desire for immunity-boosting foods, led to an increased demand for products with perceived health benefits.

Food Processing Market Dynamics

The major factors that have impacted the growth of Food Processing Market are as follows:

Drivers:

Ø Changing Consumer Lifestyles and Preferences

The world’s population continues to increase, leading to a higher demand for food products. Food processing helps meet this demand by efficiently converting raw agricultural materials into processed foods that are more accessible, convenient, and have an extended shelf life. Global urbanization trends have resulted in larger urban populations with limited access to fresh, locally produced foods. As a result, there is a higher demand for processed and packaged foods that can be transported and distributed efficiently across urban centers. Rising disposable incomes in many regions have allowed consumers to spend more on processed and value-added food products. This has driven the demand for premium and specialty food items that offer unique flavors, better quality, and improved nutritional profiles. Consumers are increasingly health-conscious and seek healthier food options. The food processing industry has responded by offering products with reduced salt, sugar, and fat content, as well as fortifying foods with essential nutrients and vitamins.

Restraint:

- Perception of Food Safety and Quality Concerns

Food safety remains a paramount concern for consumers, regulators, and industry stakeholders. Incidents of foodborne illnesses, product recalls, or contamination can severely damage a company’s reputation and erode consumer trust. As a result, food processing companies must invest heavily in robust quality control measures, sanitation practices, and compliance with strict food safety regulations to mitigate these risks. The food processing industry is subject to a wide range of regulations and standards, varying from country to country and even at the regional level. These regulations cover aspects such as food safety, labeling, packaging, hygiene, and environmental sustainability. Adhering to these requirements can be costly and time-consuming for businesses, particularly smaller players with limited resources. The prices of agricultural commodities and raw materials used in food processing can be volatile, influenced by factors such as weather conditions, global demand and supply, and geopolitical events. Such price fluctuations can impact profit margins for food processing companies, making it challenging to maintain consistent product pricing. The industry faces increasing pressure to adopt more sustainable practices and reduce its impact on the environment. Companies that fail to embrace sustainable practices may face reputational risks and may be less attractive to environmentally-conscious consumers.

Opportunity:

⮚ Growing demand for healthier food options

The growing consumer interest in health and wellness presents a significant opportunity for food processors to develop and market products with enhanced nutritional profiles. There is an increasing demand for functional foods, fortified with vitamins, minerals, and other beneficial ingredients, as well as products catering to specific dietary needs, such as gluten-free, vegan, or organic options. Consumers are seeking transparency in food labels and are showing a preference for clean label products with recognizable and natural ingredients. Food processors can capitalize on this trend by offering minimally processed, natural, and preservative-free products, which appeal to health-conscious and environmentally-conscious consumers. The rising popularity of plant-based diets and concerns about the environmental impact of animal agriculture have opened up opportunities for food processors to develop and market plant-based and alternative protein products. This includes plant-based meat substitutes, dairy alternatives, and other innovative protein sources. The rise of e-commerce and the increasing comfort of consumers with online shopping have opened up new avenues for food processors to reach customers directly. Establishing an online presence and offering direct-to-consumer sales can help companies tap into a broader customer base and build brand loyalty.

Food Processing Market Segment Overview

By Type

Based on Type, the market is segmented based on Cleaning, Sorting, & Grading Equipment, Cutting, Peeling & Grinding Equipment, Mixers, Blenders and Homogenizers and Extrusion & Thermal Equipment. Cleaning equipment is used to remove impurities, foreign materials, and contaminants from raw agricultural produce before further processing. This ensures food safety and hygiene. Grading equipment categorizes raw materials into different classes based on predefined quality criteria. This helps in ensuring consistency and standardization in the final product. Cutting equipment is used to slice, dice, or chop raw materials into desired shapes and sizes. It is commonly used in the preparation of fruits, vegetables, and meat products. Grinding equipment is used to reduce the size of solid raw materials into smaller particles. It is commonly used to create powders, pastes, and flours from various ingredients.

Based on Type, the market is segmented based on Cleaning, Sorting, & Grading Equipment, Cutting, Peeling & Grinding Equipment, Mixers, Blenders and Homogenizers and Extrusion & Thermal Equipment. Cleaning equipment is used to remove impurities, foreign materials, and contaminants from raw agricultural produce before further processing. This ensures food safety and hygiene. Grading equipment categorizes raw materials into different classes based on predefined quality criteria. This helps in ensuring consistency and standardization in the final product. Cutting equipment is used to slice, dice, or chop raw materials into desired shapes and sizes. It is commonly used in the preparation of fruits, vegetables, and meat products. Grinding equipment is used to reduce the size of solid raw materials into smaller particles. It is commonly used to create powders, pastes, and flours from various ingredients.

By Application

Based on Application, the market has been divided into Bakery, Confectionery and Dairy Products, Meat, Poultry, & Seafood Products and Fruit, Vegetable and Beverages. Meat, Poultry, and Seafood segment includes processed meats, poultry products, and seafood, such as sausages, bacon, canned tuna, and frozen chicken nuggets. Demand for processed meat products remains steady due to their convenience and longer shelf life. Bakery and Confectionery segment includes processed bakery products like bread, cakes, and pastries, as well as confectionery items such as chocolates, candies, and sweets. Consumer indulgence and the popularity of ready-to-eat snacks drive the growth of this segment.

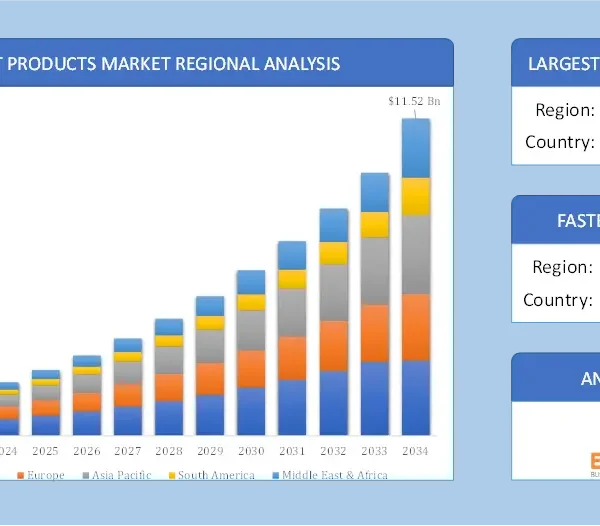

Global Food Processing Market Regional Analysis

Based on region, the global Food Processing Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Food Processing Market followed by the Asia-Pacific and Europe regions.

Food Processing North America Market

Food Processing North America Market

North America holds a dominant position in the Food Processing Market. The region’s dominance can be attributed to various factors. The food processing market in North America is mature and highly developed, with a well-established infrastructure and advanced technologies. The region places a strong emphasis on food safety, quality, and innovation, leading to a wide variety of processed food options and convenience products. Health and wellness trends drive the demand for natural and organic food products. Large food companies dominate the market, but there is also a growing trend of smaller, niche players offering specialized and innovative products.

Food Processing Asia-Pacific Market

The Asia-Pacific region was considered one of the fastest-growing regions in the food processing market. The region’s rapid economic growth, increasing population, and changing dietary preferences have contributed to its significant expansion in the food processing industry. The Asia-Pacific region is home to more than half of the world’s population, with countries like China and India being the most populous. This vast consumer base provides a massive market for processed food products and convenience foods. Economic growth in many Asian countries has resulted in an expanding middle class with higher disposable incomes. As a result, there is an increased demand for processed and value-added food products, including ready-to-eat meals, snacks, and convenience foods. The rapid urbanization in the region has led to significant changes in consumer lifestyles. Urban populations have busier schedules and seek quick and convenient food options, which has driven the demand for processed and ready-to-eat foods.

Competitive Landscape

The global Food Processing Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Marel

- GEA Group AG

- The Bühler Holding AG

- JBT Corporation

- Alfa Laval AB

- TNA Solution Pty Ltd

- Bucher Industries AG

- Clextral S.A.S

- SPX Flow

- Bigtem Makine A.S.

- FENCO Food Machinery s.r.l.

Key Development

In September 2021, GEA Group AG, has launched a solution called Batch2Flow. The novel solution is developed to enhance the security of the food production process, curtail the consumption of cleaning chemicals, and reduce the usage of water and power consumption to provide economic benefits to the customers.

Scope of the Report

Global Food Processing Market, by Type

- Cleaning, Sorting, & Grading Equipment

- Cutting, Peeling & Grinding Equipment

- Mixers, Blenders and Homogenizers

- Extrusion & Thermal Equipment

Global Food Processing Market, by Application

- Bakery, Confectionery and Dairy Products

- Meat, Poultry, & Seafood Products

- Fruit, Vegetable and Beverages

Global Food Processing Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $633.30 Billion |

| CAGR | 12.2% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Marel, GEA Group AG, The Bühler Holding AG, JBT Corporation, Alfa Laval AB, TNA Solution Pty Ltd, Bucher Industries AG, Clextral S.A.S, SPX Flow, Bigtem Makine A.S., FENCO Food Machinery s.r.l. |

| Key Market Opportunities | • The growing demand for healthier food options |

| Key Market Drivers | • Changing Consumer Lifestyles and Preferences |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Food Processing Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Food Processing Market historical market size for the year 2021, and forecast from 2023 to 2033

- Food Processing Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Food Processing Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Food Processing Market?

The study period for the Food Processing Market spans from 2021 to the projected years of 2023 to 2033.

What is the growth rate of the Food Processing Market?

The Food Processing Market is expected to witness significant growth, with a compound annual growth rate (CAGR) of 12.2% from 2023 to 2033.

Which region has the highest growth rate in the Food Processing Market?

The Asia-Pacific region is anticipated to experience the highest growth rate in the Food Processing Market due to rapid economic growth and changing dietary preferences.

Which region has the largest share of the Food Processing Market?

Currently, North America holds the largest share in the Food Processing Market, driven by its mature and highly developed infrastructure and advanced technologies.

Who are the key players in the Food Processing Market?

Key players in the Food Processing Market include Marel, GEA Group AG, The Bühler Holding AG, JBT Corporation, Alfa Laval AB, TNA Solution Pty Ltd, Bucher Industries AG, Clextral S.A.S, SPX Flow, Bigtem Makine A.S., and FENCO Food Machinery s.r.l.

Do you offer Post sales support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Food Processing Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7.Demand Supply Gap Analysis of the Food Processing Market 4.8.Import Analysis of the Food Processing Market 4.9.Export Analysis of the Food Processing Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Food Processing Market, By Type 6.1. Introduction 6.2. Cleaning, Sorting, & Grading Equipment 6.3. Cutting, Peeling & Grinding Equipment 6.4. Mixers, Blenders and Homogenizers 6.5. Extrusion & Thermal Equipment Chapter 7. Global Food Processing Market, By Application 7.1. Introduction 7.2. Bakery, Confectionery and Dairy Products 7.3. Meat, Poultry, & Seafood Products 7.4. Fruit, Vegetable and Beverages Chapter 8. Global Food Processing Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By End User, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By End User, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By End User, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By End User, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By End User, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By End User, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By End User, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By End User, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By End User, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By End User, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By End User, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By End User, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By End User, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By End User, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By End User, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By End User, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Marel, GEA Group AG 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. The Buhler Holding AG 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. JBT Corporation 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Alfa Laval AB 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. TNA Solution Pty Ltd 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. Bucher Industries AG 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Clextral S.A.S 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Bigtem Makine A.S. 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 FENCO Food Machinery s.r.l. 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. SPX Flow 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology