Fiber Cement Boards Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

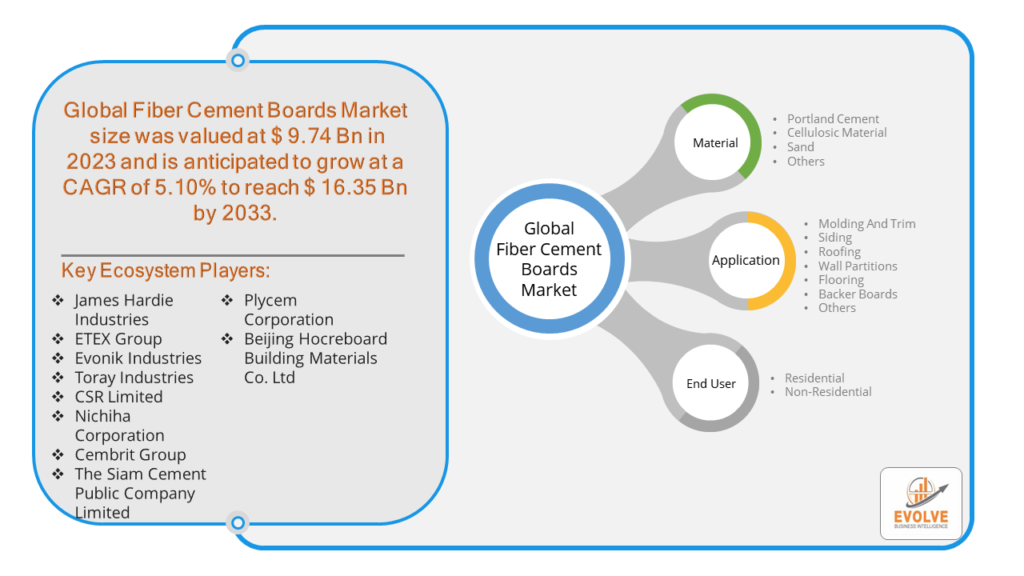

Fiber Cement Boards Market Research Report: Information By Material (Portland Cement, Cellulosic Material, Sand, Others), By Application (Molding And Trim, Siding, Roofing, Wall Partitions, Flooring, Backer Boards, Others), By End-User (Residential, Non-Residential), and by Region — Forecast till 2033

Page: 158

Fiber Cement Boards Market Overview

The Fiber Cement Boards Market Size is expected to reach USD 16.35 Billion by 2033. The Fiber Cement Boards Market industry size accounted for USD 9.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.10% from 2023 to 2033. The Fiber Cement Boards Market refers to the industry involved in the production, distribution, and sale of fiber cement boards. Fiber cement boards are composite building materials made of cement reinforced with cellulose fibers, which enhances their durability and strength. These boards are widely used in construction for both residential and commercial buildings due to their resistance to fire, moisture, termites, and rot, as well as their versatility in design and application.

The Fiber Cement Boards Market is expected to grow significantly due to the increasing demand for durable and low-maintenance building materials, coupled with the rise in construction activities globally.

Global Fiber Cement Boards Market Synopsis

The COVID-19 pandemic had a significant impact on the Fiber Cement Boards Market. Lockdowns and restrictions led to the temporary closure of manufacturing facilities, causing delays in production. Many construction projects were put on hold or delayed due to lockdowns and economic uncertainty. Increased demand for materials that are easy to clean and maintain, such as fiber cement boards, due to their low maintenance and durability. With more people spending time at home, there was a rise in home renovation and improvement projects, leading to increased demand for building materials. Post-pandemic, there is likely to be an increased emphasis on sustainable and eco-friendly building materials, driving demand for fiber cement boards. As economies recover and construction activities resume, the fiber cement boards market is expected to regain momentum.

Fiber Cement Boards Market Dynamics

The major factors that have impacted the growth of Fiber Cement Boards Market are as follows:

Drivers:

Ø Technological Advancements

Advances in manufacturing processes have improved the quality and performance of fiber cement boards, making them more competitive with traditional materials. Continuous product innovation, including enhanced aesthetic options and improved performance characteristics, is driving market demand. The trend of home renovations and remodeling, particularly in developed regions, is increasing the demand for fiber cement boards. Businesses and institutions are also investing in upgrading their facilities, contributing to market growth.

Restraint:

- Perception of High Initial Cost

Fiber cement boards are generally more expensive than traditional materials like wood, vinyl, and other siding options, which can deter cost-conscious builders and homeowners. The higher initial investment required for purchasing and installing fiber cement boards can be a barrier for some projects, particularly in cost-sensitive markets. Cutting fiber cement boards generates silica dust, which poses health risks if inhaled. Proper safety measures, including the use of protective equipment and adequate ventilation, are necessary during installation.

Opportunity:

⮚ Growing demand for Eco-Friendly Construction

Increasing awareness and demand for sustainable and eco-friendly building materials provide a significant opportunity for fiber cement boards, which are known for their durability and low environmental impact. As more builders and developers aim to achieve green building certifications (such as LEED), the demand for materials like fiber cement boards, which contribute to energy efficiency and sustainability, is expected to rise. As the frequency and intensity of natural disasters increase, there is a growing need for building materials that offer resilience against extreme weather conditions. Fiber cement boards, known for their durability and resistance to elements, are well-positioned to meet this demand. Supportive regulations and incentives for using disaster-resilient materials in construction can further drive the adoption of fiber cement boards.

Fiber Cement Boards Market Segment Overview

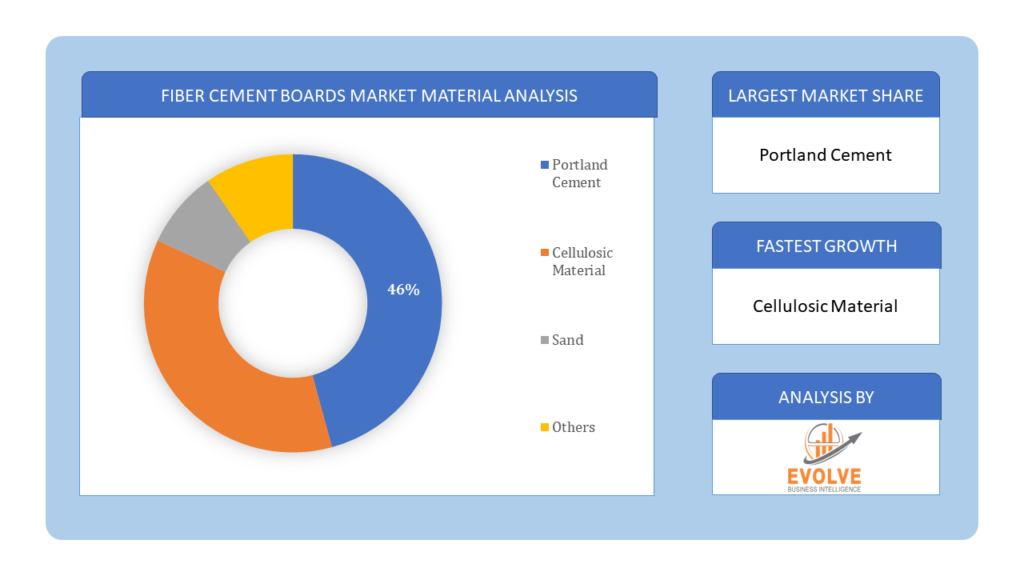

By Material

Based on Material, the market is segmented based on Portland Cement, Cellulosic Material, Sand and Others. The Portland cement segment dominated the market due to its widely used binding agent in Fiber Cement Board production. Portland cement offers remarkable strength, durability, and resistance to fire, moisture, and pests. It ensures the structural integrity of Fiber Cement Boards by providing excellent adhesion to reinforcing fibers. Moreover, the versatility of Portland Cement allows manufacturers to customize Fiber Cement Boards by incorporating different raw materials and additives, catering to specific requirements.

Based on Material, the market is segmented based on Portland Cement, Cellulosic Material, Sand and Others. The Portland cement segment dominated the market due to its widely used binding agent in Fiber Cement Board production. Portland cement offers remarkable strength, durability, and resistance to fire, moisture, and pests. It ensures the structural integrity of Fiber Cement Boards by providing excellent adhesion to reinforcing fibers. Moreover, the versatility of Portland Cement allows manufacturers to customize Fiber Cement Boards by incorporating different raw materials and additives, catering to specific requirements.

By Application

Based on Application, the market segment has been divided into the Molding And Trim, Siding, Roofing, Wall Partitions, Flooring, Backer Boards and Others. The siding segment dominated the market. The growth of the segment is attributed to the increasing use of siding fiber cement for the increasing exterior look of the building. Fiber cement siding is the lower maintenance exterior of residential and non-residential buildings. Siding protects and helps to maintain the building from the exterior elements. Siding is a major application or type of fiber cement in both the residential and non-residential sectors.

By End User

Based on End User, the market segment has been divided into the Residential and Non-Residential. The residential buildings segment dominated the market. fiber cement boards are resistant to moisture, rot, and pests, ensuring long-term performance and reliability in residential structures. They also provide excellent thermal insulation and are highly fire-resistant, contributing to residential buildings’ safety and energy efficiency. Moreover, fiber cement boards offer versatility in design options and color choices, allowing homeowners to achieve their desired aesthetics.

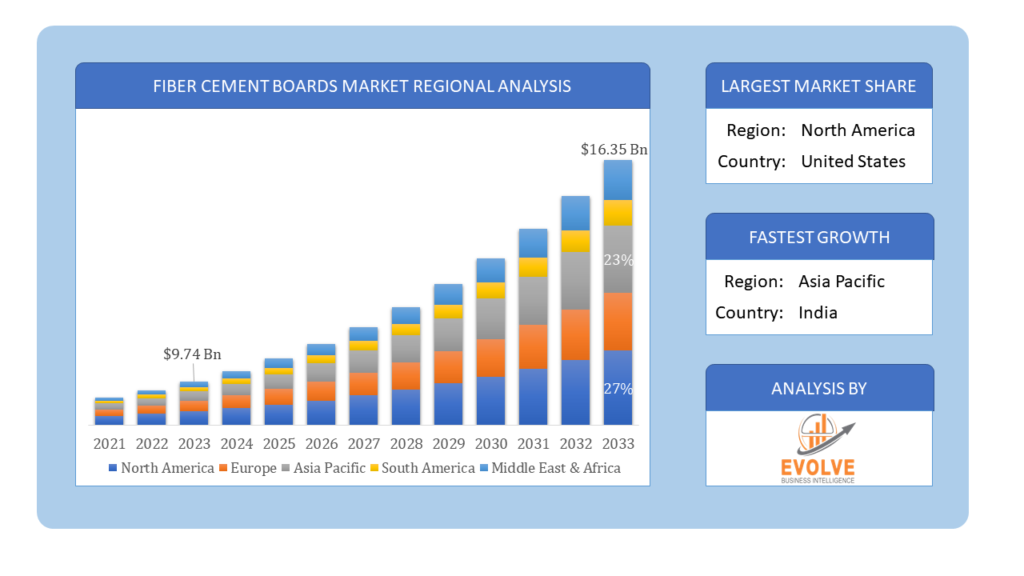

Global Fiber Cement Boards Market Regional Analysis

Based on region, the global Fiber Cement Boards Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Fiber Cement Boards Market followed by the Asia-Pacific and Europe regions.

Fiber Cement Boards North America Market

Fiber Cement Boards North America Market

North America holds a dominant position in the Fiber Cement Boards Market. North America had high demand due to stringent building codes and regulations emphasizing fire resistance and durability. Strong presence of major market players and advanced manufacturing facilities. Increasing trend of home renovations and remodeling and rising awareness of sustainable and energy-efficient building materials.

Fiber Cement Boards Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Fiber Cement Boards Market industry. Asia-Pacific region is rapidly growing market due to urbanization and industrialization. Significant investments in infrastructure development in emerging economies and Increasing awareness of the benefits of fiber cement boards.

Competitive Landscape

The global Fiber Cement Boards Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- James Hardie Industries

- ETEX Group

- Evonik Industries

- Toray Industries

- CSR Limited

- Nichiha Corporation

- Cembrit Group

- The Siam Cement Public Company Limited

- Plycem Corporation

- Beijing Hocreboard Building Materials Co. Ltd

Key Development

In June 2022, Swisspearl Group has recently made an announcement regarding its acquisition of Cembrit. This strategic decision was undertaken by the Swisspearl Group with the aim of expanding its presence in the international market and strengthening its portfolio of production sites.

Scope of the Report

Global Fiber Cement Boards Market, by Material

- Portland Cement

- Cellulosic Material

- Sand

- Others

Global Fiber Cement Boards Market, by Application

- Molding And Trim

- Siding

- Roofing

- Wall Partitions

- Flooring

- Backer Boards

- Others

Global Fiber Cement Boards Market, by End User

- Residential

- Non-Residential

Global Fiber Cement Boards Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $16.35 Billion |

| CAGR | 5.10% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Material, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | James Hardie Industries, ETEX Group, Evonik Industries, Toray Industries, CSR Limited, Nichiha Corporation, Cembrit Group, The Siam Cement Public Company Limited, Plycem Corporation and Beijing Hocreboard Building Materials Co. Ltd |

| Key Market Opportunities | • Growing demand for Eco-Friendly Construction • Increasing Focus on Disaster-Resilient Construction |

| Key Market Drivers | • Technological Advancements • Renovation and Remodeling Trends |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Fiber Cement Boards Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Fiber Cement Boards Market historical market size for the year 2021, and forecast from 2023 to 2033

- Fiber Cement Boards Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Fiber Cement Boards Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Fiber Cement Boards Market is 2021- 2033

2.What is the growth rate of the global Fiber Cement Boards Market?

- The global Fiber Cement Boards Market is growing at a CAGR of 5.10% over the next 10 years

3.Which region has the highest growth rate in the market of Fiber Cement Boards Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Fiber Cement Boards Market?

- North America holds the largest share in 2022

5.Who are the key players in the global Fiber Cement Boards Market?

James Hardie Industries, ETEX Group, Evonik Industries, Toray Industries, CSR Limited, Nichiha Corporation, Cembrit Group, The Siam Cement Public Company Limited, Plycem Corporation and Beijing Hocreboard Building Materials Co. Ltd. are the major companies operating in the market

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Application Segement – Market Opportunity Score 4.1.2. Material Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Fiber Cement Boards Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Fiber Cement Boards Market, By Material 7.1. Introduction 7.1.1. Portland Cement 7.1.2. Cellulosic Material 7.1.3. Sand 7.1.4. Others CHAPTER 8 Fiber Cement Boards Market, By Application 8.1. Introduction 8.1.1. Molding And Trim 8.1.2. Siding, Roofing 8.1.3. Wall Partitions 8.1.4 Flooring 8.1.5 Backer Boards 8.1.6 Others CHAPTER 9. Fiber Cement Boards Market, By End User 9.1. Introduction 9.1.1. Residential 9.1.2 Non-Residential CHAPTER 10. Fiber Cement Boards Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Material, 2023 – 2033 ($ Million) 10.6.9.3.__________ Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. James Hardie Industries 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. ETEX Group 13.3. Evonik Industries 13.4. Toray Industries 13.5. CSR Limited 13.6. Nichiha Corporation 13.7. Cembrit Group 13.8. The Siam Cement Public Company Limited 13.9 Plycem Corporation 13.10 Beijing Hocreboard Building Materials Co. Ltd.

Connect to Analyst

Research Methodology