Exterior Wall Systems Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

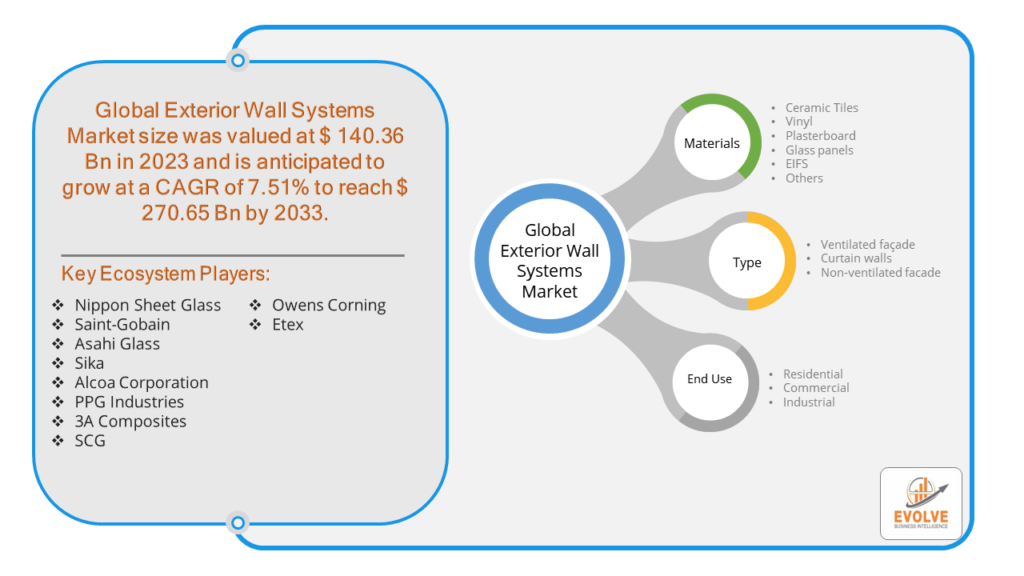

Exterior Wall Systems Market Research Report: Information By Materials (Ceramic Tiles, Vinyl, Plasterboard, Glass panels, EIFS, Others), By Type (Ventilated facade, Curtain walls, Non-ventilated facade), By End-use (Residential, Commercial, Industrial), and by Region — Forecast till 2033

Page: 115

Exterior Wall Systems Market Overview

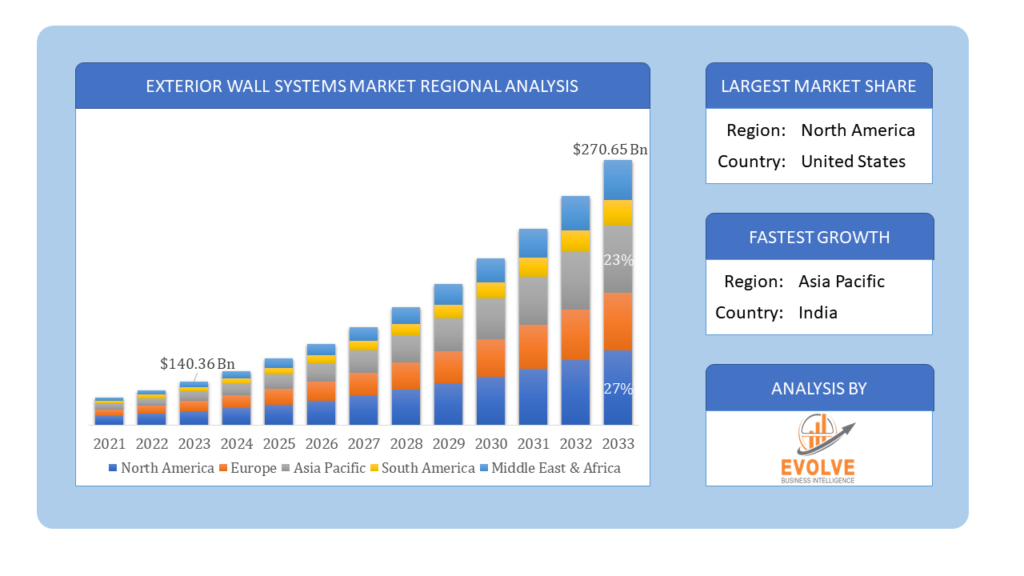

The Exterior Wall Systems Market Size is expected to reach USD 270.65 Billion by 2033. The Exterior Wall Systems Market industry size accounted for USD 140.36 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.51% from 2023 to 2033. The Exterior Wall Systems Market refers to the market segment that encompasses products, materials, and technologies used in the construction of exterior walls for buildings. These systems are designed to provide structural integrity, weather resistance, thermal insulation, sound insulation, and aesthetic appeal to the exterior of buildings.

The Exterior Wall Systems Market is a dynamic and growing industry driven by urbanization, sustainability, technological advancements, and aesthetic trends. While the market faces challenges such as high initial costs and regulatory complexities, significant opportunities exist in sustainable building practices, technological integration, and emerging markets.

Global Exterior Wall Systems Market Synopsis

The COVID-19 pandemic had a significant impact on the Exterior Wall Systems Market. The pandemic caused disruptions in the global supply chain, leading to delays in the delivery of raw materials and finished products. This affected the availability of key materials such as metals, glass, and insulation components. Lockdowns, social distancing measures, and workforce shortages led to delays and halts in construction projects. This slowdown affected demand for exterior wall systems as fewer new buildings were being constructed. Post-pandemic, there has been an increased emphasis on health and safety in building design. This includes improved ventilation systems, antimicrobial surfaces, and other features that can be integrated into exterior wall systems to enhance building health standards. The pandemic highlighted the importance of sustainable and energy-efficient buildings. Governments and organizations are increasingly focusing on green building practices, driving demand for exterior wall systems that improve energy performance and reduce environmental impact.

Exterior Wall Systems Market Dynamics

The major factors that have impacted the growth of Exterior Wall Systems Market are as follows:

Drivers:

Ø Urbanization and Infrastructure Development

Increasing urbanization, particularly in emerging economies, drives the demand for new residential, commercial, and industrial buildings, thereby boosting the demand for exterior wall systems. Governments and private sector investments in infrastructure projects, such as office buildings, shopping centers, and public facilities, contribute significantly to market growth. Advancements in materials science have led to the development of high-performance materials like insulated panels, lightweight composites, and energy-efficient cladding, enhancing the market’s offerings. The increasing use of prefabrication and modular construction techniques improves construction efficiency, reduces waste, and supports the demand for exterior wall systems.

Restraint:

- Perception of High Initial Costs

The high initial cost of advanced exterior wall systems, including materials, installation, and associated technologies, can deter potential buyers, particularly in budget-sensitive projects. The perceived long-term benefits of energy efficiency and durability may not always justify the upfront costs for all stakeholders, limiting market adoption. Delays and increased costs in transportation and logistics can affect the timely availability of materials and components, impacting project timelines and costs.

Opportunity:

⮚ Growing demand for Sustainability and Green Building Initiatives

Increasing demand for sustainable construction practices opens opportunities for exterior wall systems made from eco-friendly and recyclable materials. Developing and marketing energy-efficient exterior wall systems that contribute to reduced energy consumption and lower carbon footprints can attract environmentally conscious buyers and comply with green building certifications. Leveraging Building Information Modeling (BIM) technology to enhance design precision, project management, and collaboration can streamline the adoption of exterior wall systems. Advancements in prefabrication and modular construction techniques offer opportunities to develop exterior wall systems that are easy to install and reduce on-site construction time.

Exterior Wall Systems Market Segment Overview

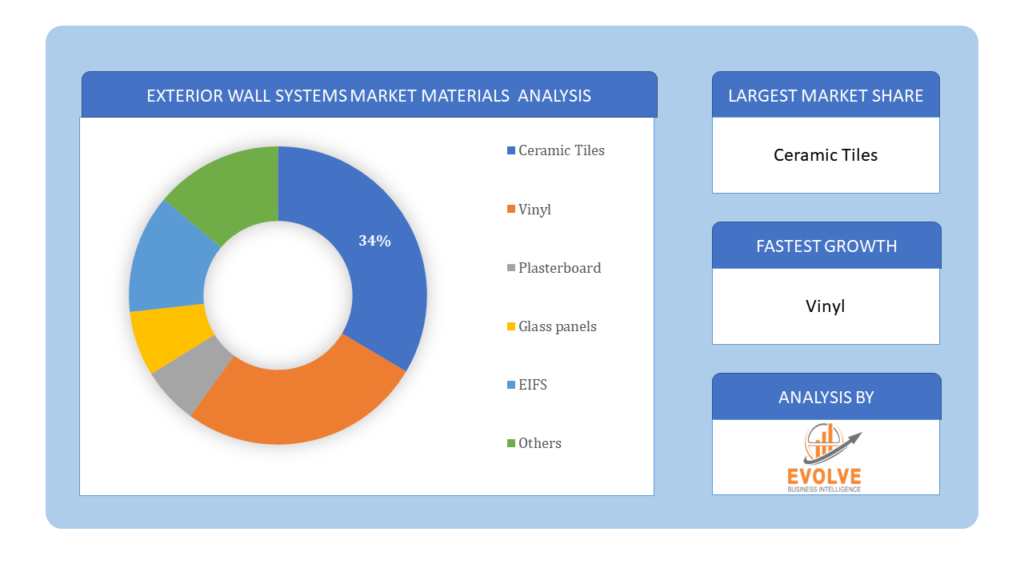

By Materials

Based on Materials, the market is segmented based on Ceramic Tiles, Vinyl, Gypsum/Plasterboard, Glass panels, EIFS and Others. The glass panels sector dominates the market due to its ability to provide both aesthetic appeal and great performance. Implementing new legislation, such as the EU’s proposed plan to transition from almost zero-energy to zero-emission buildings by 2030, encourages the usage of glass panels and the introduction of smart glass. As a result, the demand for glass panels is likely to rise further.

Based on Materials, the market is segmented based on Ceramic Tiles, Vinyl, Gypsum/Plasterboard, Glass panels, EIFS and Others. The glass panels sector dominates the market due to its ability to provide both aesthetic appeal and great performance. Implementing new legislation, such as the EU’s proposed plan to transition from almost zero-energy to zero-emission buildings by 2030, encourages the usage of glass panels and the introduction of smart glass. As a result, the demand for glass panels is likely to rise further.

By Type

Based on Type, the market segment has been divided into the Ventilated facade, Curtain walls and Non-ventilated facade. The curtain wall systems segment is dominant the market. Curtain wall systems reduce the damage caused by natural disasters and give protection from extreme weather conditions, which will drive market expansion even further. Because of these systems’ ability to regulate humidity and operate as excellent outside protection, the ventilated façade segment is growing rapidly. The benefits of non-ventilated façades, such as creative freedom for architects, slimness, time efficiency, and high-quality insulation and noise dampening, assist market expansion.

By End Use

Based on End Use, the market segment has been divided into the Residential, Commercial and Industrial. With the increased number of development and infrastructure projects in emerging nations, the commercial segment leads the external wall systems industry share. Furthermore, foreign company investments in developing nations and standardization in the building and construction industry contribute to the expansion of the commercial segment. Factors such as rapidly increasing population, urbanization activities, and increased real estate investment all contribute to the expansion of the commercial category.

Global Exterior Wall Systems Market Regional Analysis

Based on region, the global Exterior Wall Systems Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Exterior Wall Systems Market followed by the Asia-Pacific and Europe regions.

Exterior Wall Systems North America Market

Exterior Wall Systems North America Market

North America holds a dominant position in the Exterior Wall Systems Market. High levels of urbanization and ongoing infrastructure development projects drive the demand for exterior wall systems. High adoption of advanced construction technologies and materials in the US and Canada. Stringent energy efficiency and sustainability regulations, such as LEED certification, promote the adoption of advanced exterior wall systems.

Exterior Wall Systems Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Exterior Wall Systems Market industry. Rapid urbanization and infrastructure development drive demand. Fast-paced urbanization in countries like China, India, and Southeast Asian nations drives construction activities and demand for exterior wall systems.

Competitive Landscape

The global Exterior Wall Systems Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Nippon Sheet Glass

- Saint-Gobain

- Asahi Glass

- Sika

- Alcoa Corporation

- PPG Industries

- 3A Composites

- SCG

- Owens Corning

- Etex

Key Development

In September 2020, Alcoa announced the addition of EcoSourceTM, the industry’s first low-carbon, smelter-grade alumina brand, to its SustanaTM product portfolio. This expansion intends to reduce carbon emissions and shift towards more sustainable and environmentally friendly products.

In December 2023, A European consortium successfully tests a bio-based insulation material made from mycelium, the root structure of mushrooms. The material offers excellent insulation properties, is fire-resistant, and biodegradable, making it a sustainable alternative to traditional options.

Scope of the Report

Global Exterior Wall Systems Market, by Materials

- Ceramic Tiles

- Vinyl

- Plasterboard

- Glass panels

- EIFS

- Others

Global Exterior Wall Systems Market, by Type

- Ventilated façade

- Curtain walls

- Non-ventilated facade

Global Exterior Wall Systems Market, by End Use

- Residential

- Commercial

- Industrial

Global Exterior Wall Systems Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $270.65 Billion/strong> |

| CAGR | 7.51% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Materials, Type, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Nippon Sheet Glass, Saint-Gobain, Asahi Glass, Sika, Alcoa Corporation, PPG Industries, 3A Composites, SCG, Owens Corning and Etex |

| Key Market Opportunities | • The growing demand for Sustainability and Green Building Initiatives • Digitalization and Construction Technology |

| Key Market Drivers | • Urbanization and Infrastructure Development • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Exterior Wall Systems Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Exterior Wall Systems Market historical market size for the year 2021, and forecast from 2023 to 2033

- Exterior Wall Systems Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Exterior Wall Systems Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Exterior Wall Systems Market is 2021- 2033

2.What is the growth rate of the global Exterior Wall Systems Market?

- The global Exterior Wall Systems Market is growing at a CAGR of 7.51% over the next 10 years

3.Which region has the highest growth rate in the market of Exterior Wall Systems Market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Exterior Wall Systems Market?

- North America holds the largest share in 2022

5.Who are the key players in the global Exterior Wall Systems Market?

Nippon Sheet Glass, Saint-Gobain, Asahi Glass, Sika, Alcoa Corporation, PPG Industries, 3A Composites, SCG, Owens Corning and Etex. are the major companies operating in the market

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Materials Segment – Market Opportunity Score 4.1.3. End Use Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Exterior Wall Systems Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Exterior Wall Systems Market, By Type 7.1. Introduction 7.1.1. Ventilated facade 7.1.2. Curtain walls 7.1.3. Non-ventilated facade CHAPTER 8 Exterior Wall Systems Market, By Materials 8.1. Introduction 8.1.1. Ceramic Tiles 8.1.2. Vinyl 8.1.3. Plasterboard 8.1.4. Glass panels 8.1.5. EIFS 8.1.6. Others CHAPTER 9. Exterior Wall Systems Market, By End Use 9.1. Introduction 9.1.1. Residential 9.1.2 Commercial 9.1.3 Industrial CHAPTER 10. Exterior Wall Systems Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Typess, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Materials, 2023 – 2033 ($ Million) 10.6.9.3.___________ Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Nippon Sheet Glass 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Saint-Gobain 13.3. Asahi Glass 13.4. Sika 13.5. Alcoa Corporation 13.6. PPG Industries 13.7. 3A Composites 13.8. SCG 13.9 Owens Corning 13.10 Etex

Connect to Analyst

Research Methodology