Exterior insulation and finish system (EIFS) Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

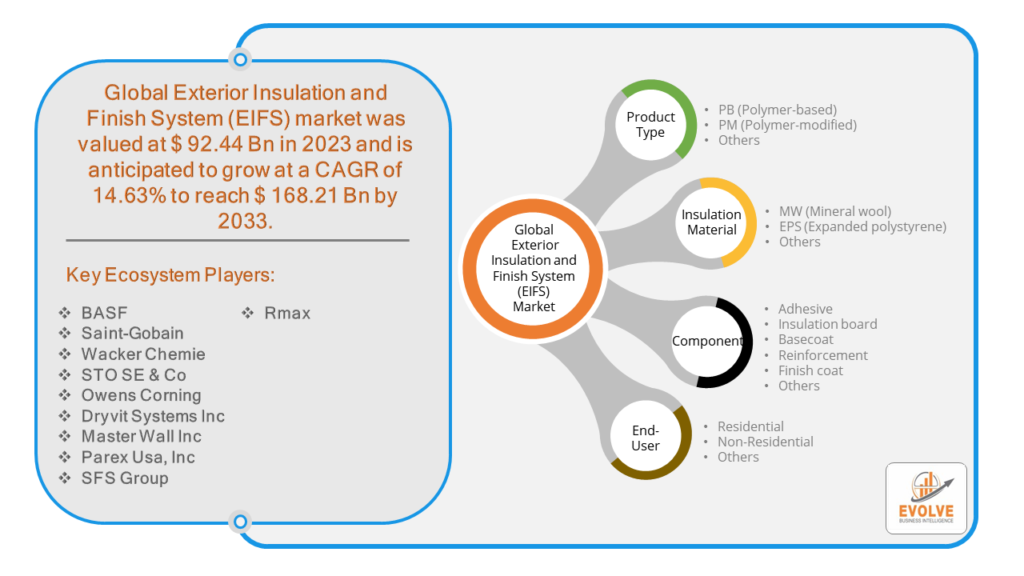

Exterior insulation and finish system (EIFS) Market Research Report: By Product Type (PB (Polymer-based), PM (Polymer-modified), Others), By Insulation Material (MW (Mineral Wool), EPS (Expanded Polystyrene), Others), By Component (Adhesive, Insulation Board, Base Coat, Reinforcement, Finish Coat, Others), By End-User (Residential, Non-Residential, Others), and by Region — Forecast till 2033.

Exterior insulation and finish system (EIFS) Market Overview

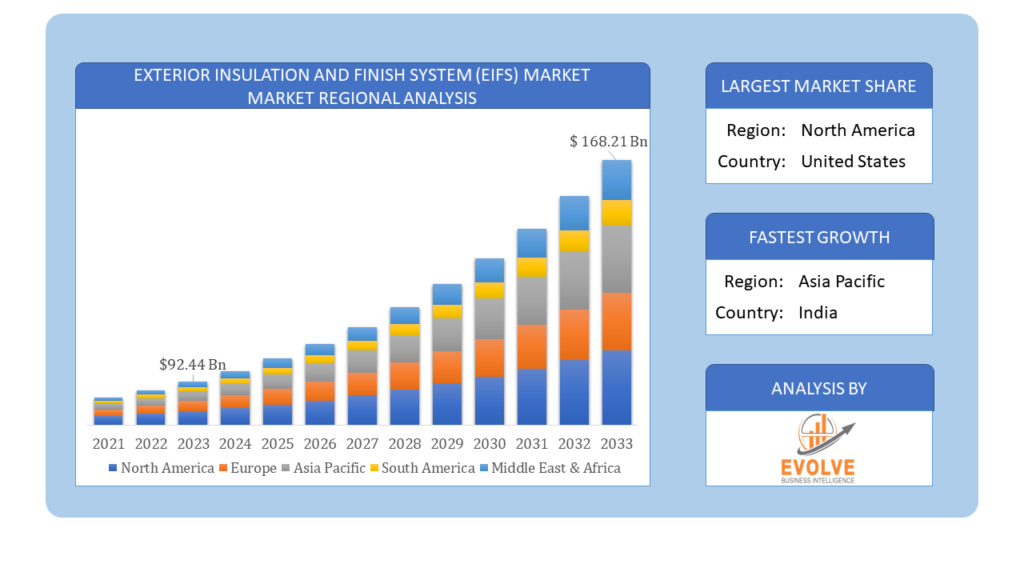

Exterior insulation and finish system (EIFS) Market Size is expected to reach USD 168.21 Billion by 2033. The Exterior insulation and finish system (EIFS) industry size accounted for USD 92.44 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 14.63% from 2023 to 2033. The Exterior Insulation and Finish System (EIFS) market is a rapidly growing industry valued at approximately USD 90.2 billion in 2022, projected to reach USD 160.3 billion by 2028, with a CAGR of 10.1%. EIFS is a non-load bearing exterior wall treatment that enhances energy efficiency and design flexibility. Major players in the market include Wacker Chemie AG, BASF SE, Saint-Gobain, and others. The market is driven by increased investment in construction globally, while the availability of alternative green insulation materials poses a challenge. EIFS offers benefits like energy efficiency, aesthetic appeal, and cost-effectiveness, contributing to its market growth.

Global Exterior insulation and finish system (EIFS) Market Synopsis

The Exterior insulation and finish system (EIFS) market experienced a detrimental effect due to the Covid-19 pandemic. There are shortages or decreased demand in the Exterior Insulation and Finish System (EIFS) industry as a result of supply chain interruptions brought on by the COVID-19 epidemic. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, leading manufacturers, developers, and service providers to implement several measures in an attempt to stabilize their businesses.

Global Exterior insulation and finish system (EIFS) Market Dynamics

The major factors that have impacted the growth of Exterior insulation and finish system (EIFS) are as follows:

Drivers:

⮚ Technological Advancements

Ongoing advancements in EIFS technology lead to improvements in performance, durability, and installation efficiency. Innovations such as enhanced moisture management systems, improved adhesives, and better insulation materials enhance the overall quality and reliability of EIFS. These technological advancements address previous concerns related to moisture infiltration and ensure superior performance, driving market growth.

Restraint:

- Maintenance and Repair Concerns

While EIFS offer low-maintenance benefits compared to some traditional cladding materials, they may require periodic inspection, maintenance, and repair to ensure optimal performance and appearance. Concerns about potential moisture intrusion, cracking, or damage to the EIFS finish may deter building owners from choosing these systems, particularly if they perceive maintenance requirements as burdensome or costly over the long term.

Opportunity:

⮚ Rising Demand for Energy-Efficient Buildings

Increasing awareness of energy conservation and rising utility costs drive demand for energy-efficient building solutions. EIFS, with their superior insulation properties, contribute to reducing heating and cooling expenses, making them a preferred choice for energy-conscious building projects. Market players can capitalize on this demand by promoting the energy-saving benefits of EIFS and offering tailored solutions to meet stringent energy efficiency requirements.

Exterior insulation and finish system (EIFS) Market Segment Overview

By Product Type

Based on the Product Type, the market is segmented based on PB (Polymer-based), PM (Polymer-modified) and Others The Exterior Insulation and Finish System (EIFS) market is experiencing significant growth, with a projected value of USD 160.3 billion by 2028. The market is segmented by product type into polymer-based (PB) and polymer-modified (PM) EIFS. Polymer-based EIFS, containing closed expanded polystyrene (EPS), is expected to be the fastest-growing product type due to its high thermal insulation properties and cost-effectiveness

By Insulation Material

Based on Insulation Material, the market has been divided into MW (Mineral wool), EPS (Expanded polystyrene) and Others. Because of its superior thermal, acoustic, and fire-retardant qualities, the mineral wool segment has become the leading player in the market, finding widespread application in the transportation, building, and industrial sectors. It’s crucial to understand that mineral wool refers to all synthetic non-metallic inorganic fibers rather than any one particular product category.

By Component

Based on the Component, the market has been divided into Adhesive, Insulation board, Basecoat, Reinforcement, Finish coat and Others. The base coat segment dominated the market. In order to guarantee the long-term effectiveness of the EIFS, the base coat provides crucial weather resistance and moisture protection. With a variety of formulation choices and unique qualities, the base coat section may meet a wide range of project requirements and environmental circumstances.

By End-User

Based on End-User, the market has been divided into Residential, Non-Residential and Others. The end-user segment in the Exterior Insulation and Finish System (EIFS) market encompasses both residential and commercial sectors. EIFS is widely used in residential buildings for its energy efficiency and aesthetic appeal, while the commercial sector benefits from its cost-effectiveness and design flexibility.

Based on End-User, the market has been divided into Residential, Non-Residential and Others. The end-user segment in the Exterior Insulation and Finish System (EIFS) market encompasses both residential and commercial sectors. EIFS is widely used in residential buildings for its energy efficiency and aesthetic appeal, while the commercial sector benefits from its cost-effectiveness and design flexibility.

Global Exterior insulation and finish system (EIFS) Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Blister Packaging, followed by those in Asia-Pacific and Europe.

North America Market

North America Market

The North American region holds a dominant position in the Exterior insulation and finish system (EIFS) market. The government’s increased support, which has led to numerous corporations, individuals, and other technologies ready to roll out in the market, will propel market growth in this region, and as a result, the North American exterior insulation and finish system market will dominate this market.

Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Exterior insulation and finish system (EIFS) industry. From 2023 to 2032, the exterior insulation and finish system market in Asia-Pacific is anticipated to develop at the fastest rate. This is a result of government measures to reduce greenhouse gas emissions and growing investment requirements for the development of infrastructure. In addition, the Exterior Insulation & Finish System market in China had the biggest market share, while the market in India had the quickest rate of growth in the Asia-Pacific area.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BASF, Saint-Gobain, Wacker Chemie, STO SE & Co, and Owens Corning are some of the leading players in the global Exterior insulation and finish system (EIFS) Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BASF

- Saint-Gobain

- Wacker Chemie

- STO SE & Co

- Owens Corning

- Dryvit Systems Inc

- Master Wall Inc

- Parex Usa, Inc

- SFS Group

- Rmax

Key Development:

June 2022: Owens Corning, an American company specializing in insulation, roofing, and fiberglass composites, has acquired WearDeck. WearDeck is a renowned premium composite decking and structural lumber manufacturer in Ocala, Florida. This strategic acquisition is expected to play a vital role in Owens Corning’s growth strategy by enabling the company to shift its focus within the Composites business toward high-value material solutions in the building and construction industry. By incorporating WearDeck’s innovative solutions, Owens Corning aims to enhance its offerings and strengthen its position in the market.

Scope of the Report

Global Exterior insulation and finish system (EIFS) Market, by Product Type

- PB (Polymer-based)

- PM (Polymer-modified)

- Others

Global Exterior insulation and finish system (EIFS) Market, by Insulation Material

- MW (Mineral wool)

- EPS (Expanded polystyrene)

- Others

Global Exterior insulation and finish system (EIFS) Market, by Component

- Adhesive

- Insulation board

- Basecoat

- Reinforcement

- Finish coat

- Others

Global Exterior insulation and finish system (EIFS) Market, by End-User

- Residential

- Non-Residential

- Others

Global Exterior insulation and finish system (EIFS) Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $168.21 Billion |

| CAGR | 14.63% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Insulation Material, Component, End-User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BASF, Saint-Gobain, Wacker Chemie, STO SE & Co, Owens Corning, Dryvit Systems Inc, Master Wall Inc, Parex Usa, Inc, SFS Group, Rmax |

| Key Market Opportunities | • Government initiatives for reducing greenhouse gas emissions |

| Key Market Drivers | • Supportive government regulation on building insulations • Rising investment requirement for infrastructure development • Rising demand for energy-efficient buildings |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Exterior insulation and finish system (EIFS) Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Exterior insulation and finish system (EIFS) market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Exterior insulation and finish system (EIFS) market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Exterior insulation and finish system (EIFS) Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Exterior insulation and finish system (EIFS) market is 2022- 2033

2.What are the 10 Years CAGR (2023 to 2033) of the global Exterior insulation and finish system (EIFS) market?

- The global Exterior insulation and finish system (EIFS) market is growing at a CAGR of ~63% over the next 10 years

3.Which region has the highest growth rate in the market of Exterior insulation and finish system (EIFS)?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region accounted for the largest share of the market of Exterior insulation and finish system (EIFS)?

- North America holds the largest share in 2022

5.Major Key Players in the Market of Blister Packaging?

- BASF, Saint-Gobain, Wacker Chemie, STO SE & Co, Owens Corning, Dryvit Systems Inc, Master Wall Inc, Parex Usa, Inc, SFS Group, and Rmax are the major companies operating in the Exterior insulation and finish system (EIFS)

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you deliver sections of a report?

- Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Raw material Segement – Market Opportunity Score 4.1.2. Type Segment – Market Opportunity Score 4.1.3. Production Technique Segment – Market Opportunity Score 4.1.4. Application Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Exterior insulation and finish system (EIFS) Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Exterior insulation and finish system (EIFS) Market, By Product Type 7.1. Introduction PB (Polymer-based) PM (Polymer-modified) Others. CHAPTER 8. Global Exterior insulation and finish system (EIFS) Market, By Insulation Material 8.1. Introduction 8.1.1. MW (Mineral wool) 8.1.2. EPS (Expanded polystyrene) 8.1.3. Others CHAPTER 9. Global Exterior insulation and finish system (EIFS) Market, By Component 9.1. Introduction 9.1.1. Adhesive 9.1.2. Insulation board 9.1.3. Basecoat 9.1.4. Reinforcement 9.1.5.Finish coat 9.1.6. Others CHAPTER 10. Global Exterior insulation and finish system (EIFS) Market, By End-User 10.1. Introduction 10.1.1. Residential 10.1.2. Non-Residential 10.1.3.Others CHAPTER 11. Global Exterior insulation and finish system (EIFS) Market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Raw material, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Production Technique, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BASF 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Saint-Gobain 13.3. Wacker Chemie 13.4. STO SE & Co 13.5. Owens Corning 13.6. Dryvit Systems Inc 13.7. Master Wall Inc 13.8. Parex Usa, Inc 13.9. SFS Group 13.10. Rmax

Connect to Analyst

Research Methodology