Electronic Warfare Market Analysis and Global Forecast 2021-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

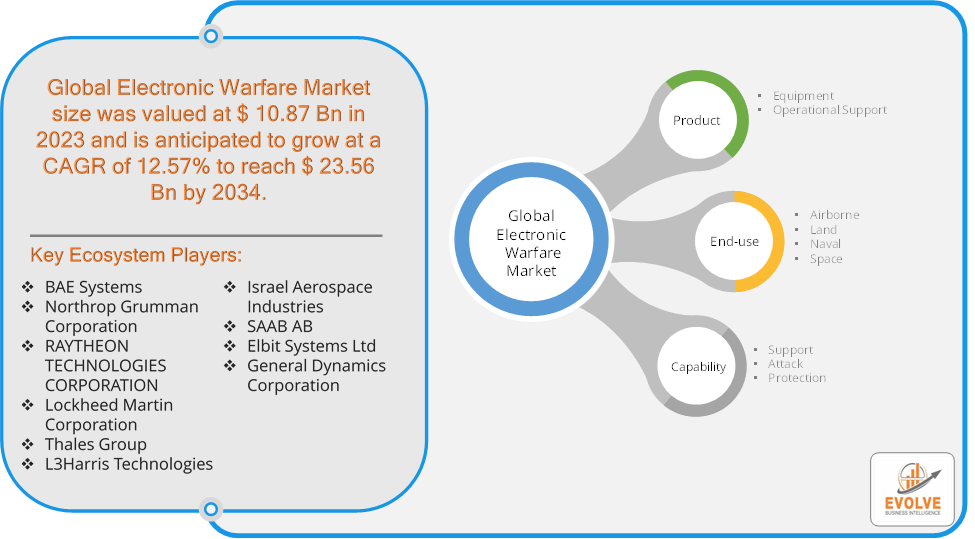

Electronic Warfare Market Research Report: By Product (Equipment, Operational Support), By End-use (Airborne, Land, Naval, Space), By Capability (Support, Attack, Protection), and by Region — Forecast till 2034

Page: 107

Electronic Warfare Market Overview

The Electronic Warfare in Semiconductor & Electronics Market size accounted for USD 10.87 Billion in 2023 and is estimated to account for 12.52 Billion in 2024. The Market is expected to reach USD 23.56 Billion by 2034 growing at a compound annual growth rate (CAGR) of 12.57% from 2024 to 2034. The Electronic Warfare (EW) Market involves the use of electromagnetic spectrum to detect, disrupt, or manipulate enemy communications, radar, and other electronic signals. It encompasses technologies like jamming, electronic countermeasures, and intelligence gathering. EW is vital for military operations, enhancing both defensive and offensive capabilities by protecting assets from adversary attacks while compromising their systems. The market is driven by increasing geopolitical tensions, modernization of military equipment, and advancements in cyber and electromagnetic technologies. Applications include air, naval, ground, and space-based platforms used by defense forces globally.

Global Electronic Warfare Market Synopsis

Global Electronic Warfare Market Dynamics

Global Electronic Warfare Market Dynamics

The major factors that have impacted the growth of Electronic Warfare are as follows:

Drivers:

⮚ Technological Advancements in Electronics and Cyber Warfare

Rapid technological advancements in the fields of cyber warfare, signal processing, artificial intelligence (AI), and machine learning are transforming the landscape of electronic warfare. These technologies enable more sophisticated electronic intelligence gathering, automated signal jamming, and precise targeting of enemy electronic systems. The integration of AI in EW systems allows for faster and more effective responses to enemy threats, making defense systems smarter and more resilient to electronic attacks.

Restraint:

- Cybersecurity Vulnerabilities

While EW systems are designed to protect military assets from electronic attacks, they are themselves vulnerable to cyber threats. The increasing integration of software and digital technologies in EW systems opens them up to potential cyberattacks that could disable or compromise their functions. Adversaries may exploit these vulnerabilities to gain unauthorized access to EW systems, tamper with their operations, or gather sensitive intelligence.

Opportunity:

⮚ Expansion of Cyber Warfare Capabilities

As cyber warfare becomes increasingly important in modern conflicts, there is a growing opportunity for EW systems that can integrate cybersecurity measures to protect against and respond to cyberattacks. This includes developing EW solutions that can safeguard communication networks, command-and-control systems, and critical infrastructure from cyber threats.

Electronic Warfare Market Segment Overview

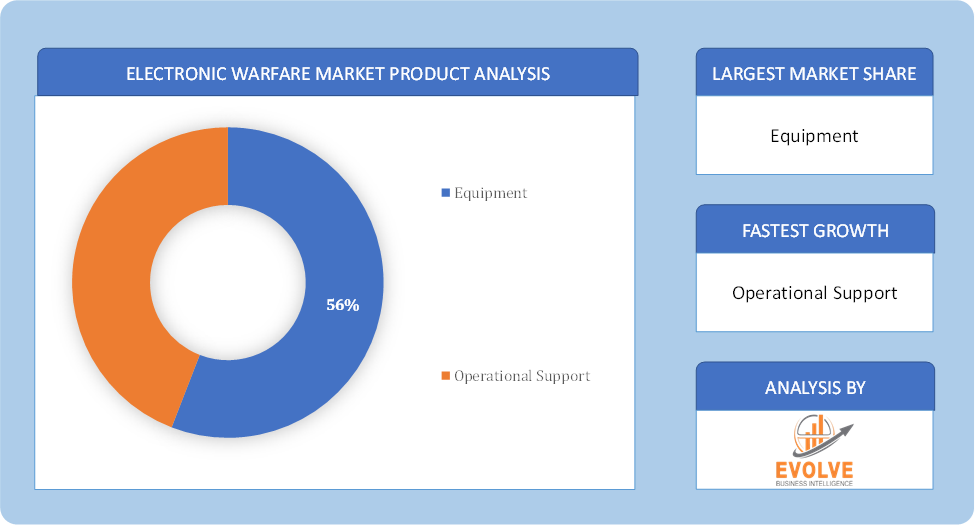

Based on the Product, the market is segmented based on Equipment, Operational Support. the Equipment segment dominates. This is due to the essential role of physical EW systems, such as radar jammers and electronic countermeasure devices, in both defensive and offensive operations.

By End-use

Based on the End-use, the market has been divided into Airborne, Land, Naval, Space. the Airborne segment dominates. This is driven by the extensive use of EW systems in aircraft for both offensive and defensive operations, as well as their critical role in air superiority and surveillance missions

By Capability

Based on Capability, the market has been divided into Support, Attack, Protection. the Protection segment dominates. This is due to the high demand for EW systems designed to safeguard military assets and communication networks from electronic attacks and interference

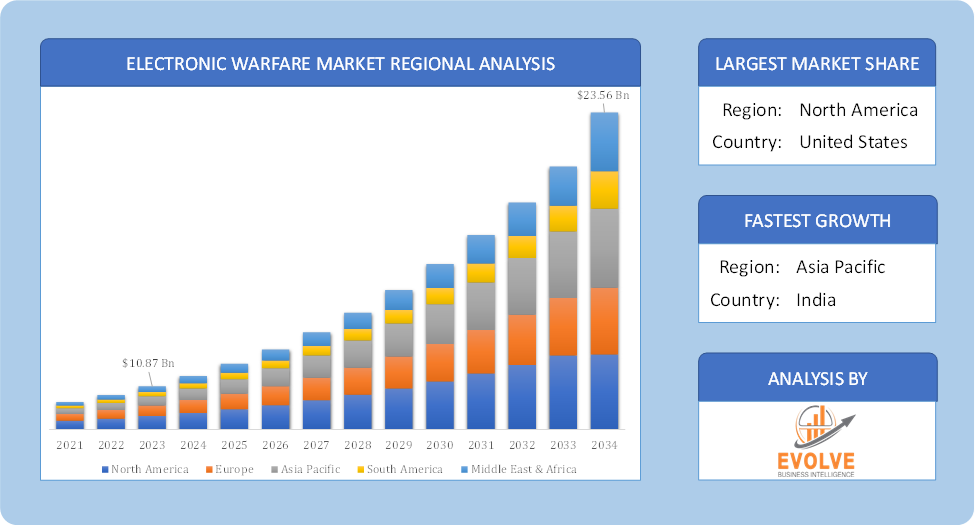

Global Electronic Warfare Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Electronic Warfare, followed by those in Asia-Pacific and Europe.

Electronic Warfare North America Market

Electronic Warfare North America Market

North America dominates the Electronic Warfare market due to several factors. In 2022, the North American Electronic Warfare Market was valued at USD 7.099 billion, and it is anticipated to increase at a substantial compound annual growth rate (CAGR) throughout the course of the research. The Department of Defense’s largest defense spending in the United States is to blame for the surge. The United States of America allocated USD 782 billion for defense in 2022. The government allocated USD 3.17 billion by 2021 to the U.S. 45 Electronic Warfare programs across military service divisions and other platforms.

Electronic Warfare Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. From 2022 to 2030, the Asia-Pacific Electronic Warfare Market is anticipated to expand at the fastest rate. The expansion of the region is attributed to rising defense spending from countries like Australia, China, Japan, and India. The Indian Air Force plans to equip its fleet of fighter aircraft with an advanced Electronic Warfare suite. The Indian defense ministry entered into an agreement with Bharat Electronics Limited (BEL) to supply the Indian Air Force with state-of-the-art fighter aircraft equipped with these features.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as BAE Systems, Northrop Grumman Corporation, RAYTHEON TECHNOLOGIES CORPORATION, Lockheed Martin Corporation, and Thales Group are some of the leading players in the global Electronic Warfare Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- BAE Systems

- Northrop Grumman Corporation

- RAYTHEON TECHNOLOGIES CORPORATION

- Lockheed Martin Corporation

- Thales Group

- L3Harris Technologies

- Israel Aerospace Industries

- SAAB AB

- Elbit Systems Ltd

- General Dynamics Corporation

Key development:

May 2022 The U.S. government awarded a contract to Northrop Grumman Corporation. S. The AN/ALQ-257 Integrated Viper Electronic Warfare Suite (IVEWS) will continue to be prepared by the Air Force for developmental testing and complete hardware qualification.

Scope of the Report

Global Electronic Warfare Market, by Product

- Equipment

- Operational Support

Global Electronic Warfare Market, by End-use

- Airborne

- Land

- Naval

- Space

Global Electronic Warfare Market, by Capability

- Support

- Attack

- Protection

Global Electronic Warfare Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 23.56 Billion |

| CAGR (2021-2034) | 12.57% |

| Base year | 2023 |

| Forecast Period | 2021-2034. |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, End-use, Capability |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | BAE Systems, Northrop Grumman Corporation, RAYTHEON TECHNOLOGIES CORPORATION, Lockheed Martin Corporation, Thales Group, L3Harris Technologies, Israel Aerospace Industries, SAAB AB, Elbit Systems Ltd, General Dynamics Corporation |

| Key Market Opportunities | · Warfare Equipment Use increased due to the Use of Cyber Operations |

| Key Market Drivers | · Increase in the Use of EW Equipment Due to Drone Threats and Remotely Triggered IEDs. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Electronic Warfare market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Electronic Warfare market historical market size for the year 2022, and forecast from 2021 to 2034

- Electronic Warfare market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Electronic Warfare market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Electronic Warfare market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Electronic Warfare market?

The global Electronic Warfare market is growing at a CAGR of ~12.57% over the next 10 years

Which region has the highest growth rate in the market of Electronic Warfare?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Electronic Warfare?

North America holds the largest share in 2023

Major Key Players in the Market of Electronic Warfare?

BAE Systems, Northrop Grumman Corporation, RAYTHEON TECHNOLOGIES CORPORATION, Lockheed Martin Corporation, Thales Group, L3Harris Technologies, Israel Aerospace Industries, SAAB AB, Elbit Systems Ltd, General Dynamics Corporation

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Segement – Market Opportunity Score 4.1.2. End-use Segment – Market Opportunity Score 4.1.3. Capability Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Electronic Warfare Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Electronic Warfare Market, By Product 7.1. Introduction 7.1.1. Equipment 7.1.2. Operational Support CHAPTER 8. Global Electronic Warfare Market, By End-use 8.1. Introduction 8.1.1. Airborne 8.1.2. Land 8.1.3. Naval 8.1.4. Space CHAPTER 9. Global Electronic Warfare Market, By Capability 9.1. Introduction 9.1.1. Support 9.1.2. Attack 9.1.3. Protection CHAPTER 10. Global Electronic Warfare Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.2.2. North America: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.2.3. North America: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.2.4. North America: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.2.5.2. US: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.2.5.3. US: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.3. Europe: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.4. Europe: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.7.2. France: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.7.3. France: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.5.2. China: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.5.3. China: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.7.2. India: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.7.3. India: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.5.2. South America: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.5.3. South America: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.5.4. South America: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2021 – 2034 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2021 – 2034 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By End-use, 2021 – 2034 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By Capability, 2021 – 2034 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2021 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. BAE Systems 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Northrop Grumman Corporation 13.3. RAYTHEON TECHNOLOGIES CORPORATION 13.4. Lockheed Martin Corporation 13.5. Thales Group 13.6. L3Harris Technologies 13.7. Israel Aerospace Industries 13.8. SAAB AB 13.9. Elbit Systems Ltd 13.10. Genie AI Ltd

Connect to Analyst

Research Methodology