Drip Irrigation market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

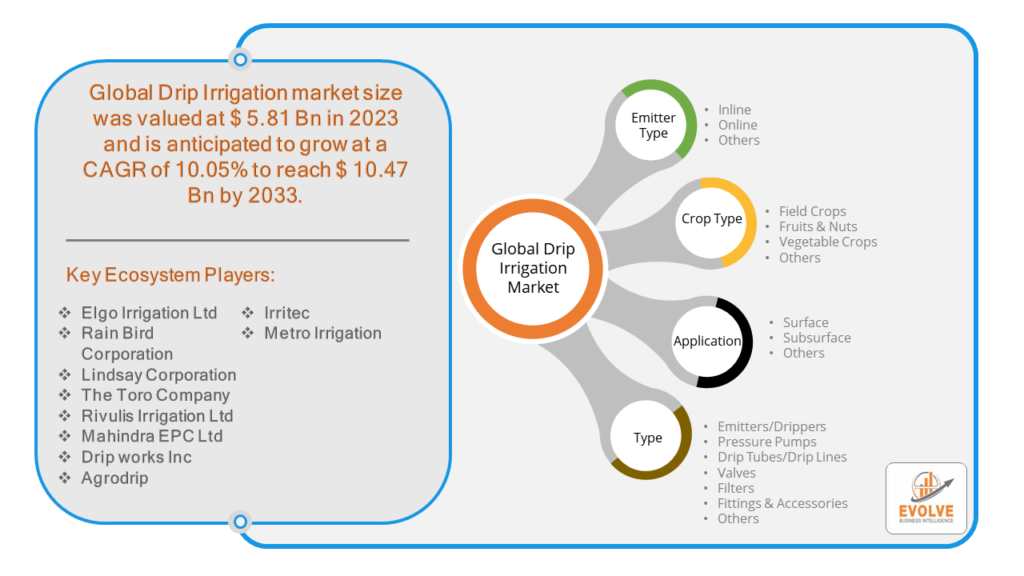

Drip Irrigation market Research Report: Information By Emitter Type (Inline Emitters, Online Emitters, Others), By Crop Type (Field Crops, Fruits & Nuts, Vegetable Crops, Others), By Application (Surface, Subsurface, Others), By Component (Drippers, Pressure Pumps, Drip Tubes, Valves, Filters, Fittings & Accessories, Others) and by Region — Forecast till 2033

Drip Irrigation Market Overview

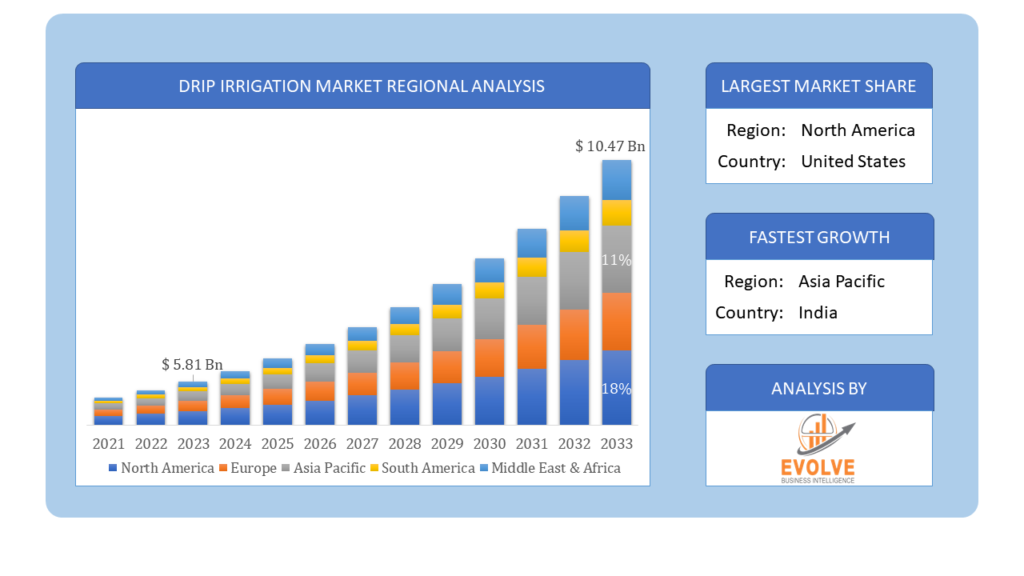

The Drip Irrigation market Size is expected to reach USD 10.47 Billion by 2033. The Drip Irrigation market industry size accounted for USD 5.81 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 10.05% from 2023 to 2033. The drip irrigation market refers to the sector of agriculture and landscaping that involves the production, distribution, and implementation of drip irrigation systems. Drip irrigation, also known as micro-irrigation or trickle irrigation, is a method of watering plants by delivering water directly to the roots of plants in small, controlled amounts through a network of tubes, pipes, valves, and emitters. This targeted approach minimizes water wastage and ensures efficient water usage, making it a preferred choice for irrigation in areas with water scarcity or where water conservation is a priority.

The drip irrigation market encompasses manufacturers, suppliers, distributors, and service providers involved in the design, production, installation, and maintenance of drip irrigation systems, as well as the sale of related components and accessories. The market may also include consulting firms, research institutions, and regulatory bodies that contribute to the development and advancement of drip irrigation technologies and practices.

Global Drip Irrigation market Synopsis

The COVID-19 pandemic had both significant impacts on the drip irrigation market. The pandemic highlighted the importance of food security and self-sufficiency, leading to increased interest in efficient irrigation methods like drip irrigation to enhance crop yield and conserve water resources. The drip irrigation market relies on a global supply chain for raw materials, components, and equipment. Disruptions in transportation, logistics, and manufacturing caused by the pandemic have led to delays in production and distribution, impacting the availability of drip irrigation products. Movement restrictions, social distancing measures, and labor shortages have hindered the installation and maintenance of drip irrigation systems. Agricultural projects may have been delayed or postponed, affecting the demand for drip irrigation services. The economic downturn resulting from the pandemic has affected farmers’ purchasing power and investment decisions. Some may postpone or scale back investments in drip irrigation systems due to financial constraints or uncertainty about future returns.

Drip Irrigation Market Dynamics

The major factors that have impacted the growth of Drip Irrigation market are as follows:

Drivers:

Ø Increasing Demand for Food Production

With a growing global population and changing dietary preferences, there is a rising demand for agricultural products. Drip irrigation enables farmers to increase crop yields and optimize water usage, thereby enhancing productivity and meeting the growing demand for food while minimizing environmental impact. Ongoing advancements in drip irrigation technology have made systems more efficient, reliable, and cost-effective. Innovations such as precision irrigation controllers, sensor-based irrigation management, and remote monitoring capabilities improve water distribution accuracy and optimize resource utilization, driving adoption among farmers. Drip irrigation is particularly well-suited for cultivation in arid and semi-arid regions with limited water availability. As agricultural activities expand into these areas to meet growing demand, the adoption of drip irrigation becomes increasingly essential for efficient water management and crop production.

Restraint:

- Perception of Rising demand for food

The global population is growing, and food production needs to keep pace. Drip irrigation can help farmers improve crop yields and profitability, contributing to food security. The area under cultivation for high-value crops like fruits, vegetables, and nuts is increasing. Drip irrigation is particularly beneficial for these crops as it promotes better growth and quality. The drip irrigation systems offer long-term cost savings and benefits, the initial investment required for installation can be relatively high compared to traditional irrigation methods such as flood irrigation or sprinkler systems. This upfront cost may deter some farmers, particularly those with limited financial resources or access to capital, from adopting drip irrigation technology.

Opportunity:

⮚ Focus on sustainability and Digitalization in agriculture

Environmental awareness is growing, and farmers are increasingly looking for sustainable practices. Drip irrigation’s water conservation capabilities align perfectly with this trend, creating a market pull for eco-conscious farmers. The rise of precision agriculture offers a chance to integrate drip irrigation systems with farm management software and sensors. This allows for data-driven irrigation practices, further optimizing water use and crop yields. Growing awareness of environmental sustainability and the need for efficient resource management presents a significant opportunity for the drip irrigation market. Drip irrigation systems play a crucial role in these initiatives by conserving water, minimizing soil erosion, and reducing chemical runoff, thereby supporting environmentally friendly farming practices.

Drip Irrigation market Segment Overview

By Emitter Type

Based on Emitter Type, the market is segmented based on Inline Emitters, Online Emitters and Others. The inline emitters segment witnessed the largest revenue share of the drip irrigation market. During the manufacturing process of inline drip tubing, drip emitters are inserted directly into the tubing at evenly spaced intervals. For each emitter, typically, two holes are punched into the tubing at a particular spot through which the water will drip. The segment’s growth is increasing at a very rapid pace due to the ease of deployment of this type of emitter this increase the global Drip Irrigationmarket revenue.

Based on Emitter Type, the market is segmented based on Inline Emitters, Online Emitters and Others. The inline emitters segment witnessed the largest revenue share of the drip irrigation market. During the manufacturing process of inline drip tubing, drip emitters are inserted directly into the tubing at evenly spaced intervals. For each emitter, typically, two holes are punched into the tubing at a particular spot through which the water will drip. The segment’s growth is increasing at a very rapid pace due to the ease of deployment of this type of emitter this increase the global Drip Irrigationmarket revenue.

By Crop Type

Based on End Users, the market has been divided into the Field Crops, Fruits & Nuts, Vegetable Crops and Others. The field crop segment is dominate the global market due to its numerous advantages, such as it helps in increasing profit percentages and requires fewer fertilizers and water. Furthermore, expanding population due to urbanization has led farmers to grow sugarcane and corn, which in turn contributes to segment growth over the forecast period.

By Application

Based on End Users, the market has been divided into the Surface, Subsurface and Others. The surface drip segment witnessed the largest drip irrigation market revenue share. The growing demand for surface drip irrigation systems is caused by their low installation and maintenance costs. Widespread usage of surface drip irrigation equipment for perennials, like vines and trees, and annual row crops. However, the design and operation of irrigation equipment for these crops differ from that of conventional row crops.

By Component

Based on Component, the market has been divided into the Drippers, Pressure Pumps, Drip Tubes, Valves, Filters, Fittings & Accessories and Others. The drippers segment held the majority share and is expected to dominate the segment due to its benefits, such as no water clogging. Furthermore, increasing technology development in drippers by market players due to increased demand from commercial & residential industries is expected to support the increasing trends.

Global Drip Irrigation market Regional Analysis

Based on region, the global Drip Irrigation market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Drip Irrigation market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America holds a dominant position in the Drip Irrigation market. The United States and Canada have well-developed agricultural sectors and advanced irrigation infrastructure, driving significant demand for drip irrigation systems. Water scarcity concerns, particularly in western states like California, incentivize farmers to adopt water-efficient irrigation methods such as drip irrigation. Government initiatives and subsidies promoting water conservation and sustainable agriculture further support the adoption of drip irrigation technologies.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Drip Irrigation market industry. Countries like India, China, and Israel are witnessing rapid adoption of drip irrigation systems, driven by the need to improve agricultural productivity, conserve water resources, and mitigate the impacts of water scarcity. Government initiatives, subsidies, and support programs promoting drip irrigation adoption contribute to market growth in the region. Increasing adoption of drip irrigation in emerging economies with large agricultural sectors presents significant market opportunities for manufacturers and suppliers.

Competitive Landscape

The global Drip Irrigation market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Elgo Irrigation Ltd

- Rain Bird Corporation

- Lindsay Corporation

- The Toro Company

- Rivulis Irrigation Ltd

- Mahindra EPC Ltd

- Drip works Inc

- Agrodrip

- Irritec

- Metro Irrigation

Key Development

In Feb-2022, The Toro company introduced ultra-low flow options to its Aqua-Traxx Azul drip tape range of products. With this product expansion, the company aimed to offer a uniform and consistent delivery of nutrients, water, and other essential inputs to enable farmers to achieve increased irrigation uniformity.

In Jan 2022, Netafim came into a partnership with Bayer, a pharmaceutical and biotechnology company. Through this partnership, the companies aimed to develop an accurate Defense program to represent a comprehensive solution developed in order to address nematodes. The new solution would deliver a robust one-two punch by leveraging the precision drip irrigation technology of Netafim.

Scope of the Report

Global Drip Irrigation Market, by Emitter Type

- Inline Emitters

- Online Emitters

- Others

Global Drip Irrigation market, by Crop Type

- Field Crops

- Fruits & Nuts

- Vegetable Crops

- Others

Global Drip Irrigation market, by Application

- Surface

- Subsurface

- Others

Global Drip Irrigation market, by Component

- Drippers

- Pressure Pumps

- Drip Tubes

- Valves

- Filters

- Fittings & Accessories

- Others

Global Drip Irrigation market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of SouthAmerica

- Middle East &Africa

- Saudi Arabia

- UAE

- Egypt

- SouthAfrica

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $10.47 Billion |

| CAGR | 10.05% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Emitter Type, Crop Type, Application, Component |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Elgo Irrigation Ltd, Rain Bird Corporation, Lindsay Corporation, The Toro Company, Rivulis Irrigation Ltd, Mahindra EPC Ltd, Drip works Inc, Agrodrip, Irritec, Metro Irrigation. |

| Key Market Opportunities | • Focus on sustainability and Digitalization in agriculture |

| Key Market Drivers | • Increasing Demand for Food Production • Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Drip Irrigation market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Drip Irrigation market historical market size for the year 2021, and forecast from 2023 to 2033

- Drip Irrigation market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Drip Irrigation market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

1.What is the study period of this market?

- The study period of the global Drip Irrigation market is 2021- 2033

2.What is the growth rate of the global Drip Irrigation market?

- The global Drip Irrigation market is growing at a CAGR of 4.41% over the next 10 years

3.Which region has the highest growth rate in the market of Drip Irrigation market?

- Asia Pacific is expected to register the highest CAGR during 2023-2033

4.Which region has the largest share of the global Drip Irrigation market?

- North America holds the largest share in 2022

5.Who are the key players in the global Drip Irrigation market?

- Elgo Irrigation Ltd, Rain Bird Corporation, Lindsay Corporation, The Toro Company, Rivulis Irrigation Ltd, Mahindra EPC Ltd, Drip works Inc, Agrodrip, Irritec, Metro Irrigation are the major companies operating in the market.

6.Do you offer Post Sale Support?

- Yes, we offer 16 hours of analyst support to solve the queries

7.Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Emitter Type Segement – Market Opportunity Score 4.1.2. Crop Type Segment – Market Opportunity Score 4.1.3. Application Segment – Market Opportunity Score 4.1.4. Component Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Drip Irrigation market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Drip Irrigation market, By Application 7.1. Introduction 7.1.1. Surface 7.1.2 Subsurface 7.1.4. Others CHAPTER 8. Global Drip Irrigation market, By Emitter Type 8.1. Introduction 8.1.1. Inline Emitters 8.1.2. Online Emitters 8.1.3. Others CHAPTER 9. Global Drip Irrigation market, By Crop Type 9.1. Introduction 9.1.1. Field Crops 9.1.2. Fruits & Nuts 9.1.3. Vegetable Crops CHAPTER 10. Global Drip Irrigation market, By Component 10.1.Introduction 10.1.1. Drippers 10.1.2. Pressure Pumps 10.1.3. Drip Tubes/Drip Lines 10.1.4. Valves 10.1.5. Filters 10.1.6. Fittings & Accessories 10.1.7. Others CHAPTER 11. Global Drip Irrigation market, By Region 11.1. Introduction 11.2. NORTH AMERICA 11.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.2.2. North America: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.2.3. North America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.4. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.5. North America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.6. US 11.2.6.1. US: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.2.6.2. US: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.6.3. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.6.4. US: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.7. CANADA 11.2.7.1. Canada: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.2.7.2. Canada: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.7.3. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.7.4. Canada: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.2.8. MEXICO 11.2.8.1. Mexico: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.2.8.2. Mexico: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.2.8.3. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.2.8.4. Mexico: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3. Europe 11.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.3.2. Europe: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.3. Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.4. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.5. Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.6. U.K. 11.3.6.1. U.K.: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.6.2. U.K.: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.6.3. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.6.4. U.K.: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.7. GERMANY 11.3.7.1. Germany: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.7.2. Germany: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.7.3. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.7.4. Germany: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.8. FRANCE 11.3.8.1. France: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.8.2. France: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.8.3. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.8.4. France: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.9. ITALY 11.3.9.1. Italy: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.9.2. Italy: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.9.3. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.9.4. Italy: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.10. SPAIN 11.3.10.1. Spain: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.10.2. Spain: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.10.3. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.10.4. Spain: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.11. BENELUX 11.3.11.1. BeNeLux: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.11.2. BeNeLux: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.11.3. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.11.4. BeNeLux: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.12. RUSSIA 11.3.12.1. Russia: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.12.2. Russia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.12.3. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.12.4. Russia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.3.13. REST OF EUROPE 11.3.13.1. Rest of Europe: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.3.13.2. Rest of Europe: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.3.13.3. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.3.13.4. Rest of Europe: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4. Asia Pacific 11.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.4.2. Asia Pacific: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.3. Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.4. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.5. Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.6. CHINA 11.4.6.1. China: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.6.2. China: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.6.3. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.6.4. China: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.7. JAPAN 11.4.7.1. Japan: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.7.2. Japan: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.7.3. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.7.4. Japan: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.8. INDIA 11.4.8.1. India: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.8.2. India: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.8.3. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.8.4. India: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.9. SOUTH KOREA 11.4.9.1. South Korea: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.9.2. South Korea: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.9.3. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.9.4. South Korea: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.10. THAILAND 11.4.10.1. Thailand: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.10.2. Thailand: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.10.3. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.10.4. Thailand: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.11. INDONESIA 11.4.11.1. Indonesia: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.11.2. Indonesia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.11.3. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.11.4. Indonesia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.12. MALAYSIA 11.4.12.1. Malaysia: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.12.2. Malaysia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.12.3. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.12.4. Malaysia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.13. AUSTRALIA 11.4.13.1. Australia: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.13.2. Australia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.13.3. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.13.4. Australia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.4.14. REST FO ASIA PACIFIC 11.4.14.1. Rest fo Asia Pacific: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.4.14.2. Rest fo Asia Pacific: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.4.14.3. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.4.14.4. Rest fo Asia Pacific: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5. South America 11.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.5.2. South America: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.5.3. South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.4. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.5. South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.6. BRAZIL 11.5.6.1. Brazil: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.5.6.2. Brazil: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.6.3. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.6.4. Brazil: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.7. ARGENTINA 11.5.7.1. Argentina: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.5.7.2. Argentina: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.7.3. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.7.4. Argentina: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.5.8. REST OF SOUTH AMERICA 11.5.8.1. Rest of South America: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.5.8.2. Rest of South America: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.5.8.3. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.5.8.4. Rest of South America: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6. Middle East & Africa 11.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 11.6.2. Middle East & Africa: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.6.3. Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.4. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.5. Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.6. SAUDI ARABIA 11.6.6.1. Saudi Arabia: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.6.6.2. Saudi Arabia: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.6.3. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.6.4. Saudi Arabia: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.7. UAE 11.6.7.1. UAE: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.6.7.2. UAE: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.7.3. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.7.4. UAE: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.8. EGYPT 11.6.8.1. Egypt: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.6.8.2. Egypt: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.8.3. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.8.4. Egypt: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.9. SOUTH AFRICA 11.6.9.1. South Africa: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.6.9.2. South Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.9.3. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.9.4. South Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) 11.6.10. REST OF MIDDLE EAST & AFRICA 11.6.10.1. Rest of Middle East & Africa: Market Size and Forecast, By Emitter Type, 2023 – 2033 ($ Million) 11.6.10.2. Rest of Middle East & Africa: Market Size and Forecast, By Crop Type, 2023 – 2033 ($ Million) 11.6.10.3. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 11.6.10.4. Rest of Middle East & Africa: Market Size and Forecast, By Component, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Elgo Irrigation Ltd 13.1.1. Business Overview 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2. Geographic Revenue Mix, 2020 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Rain Bird Corporation 13.3. Lindsay Corporation 13.4. The Toro Company 13.5. Rivulis Irrigation Ltd 13.6. Mahindra EPC Ltd 13.7. Drip works Inc 13.8. Agrodrip 13.9. Irritec 13.10. Metro Irrigation

Connect to Analyst

Research Methodology