DRAM Market Overview

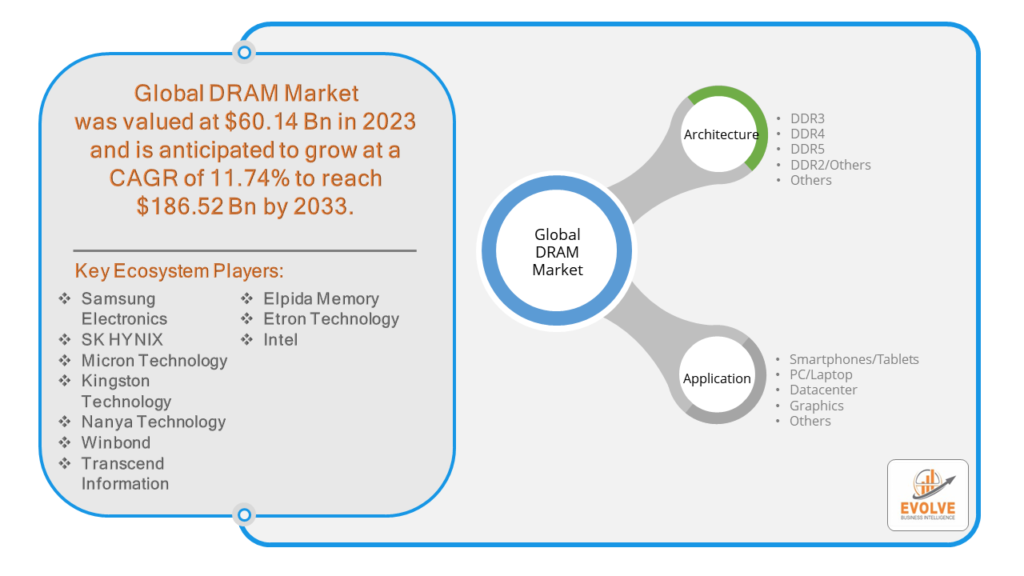

The DRAM Market Size is expected to reach USD 186.52 Billion by 2033. The DRAM industry size accounted for USD 60.14 Billion in 2023 and is expected to expand at a CAGR of 11.74% from 2023 to 2033. DRAM, or Dynamic Random Access Memory, is a type of volatile semiconductor memory used in electronic devices for temporary data storage and retrieval. Unlike non-volatile memory like ROM (Read-Only Memory), which retains data even when the power is turned off, DRAM requires constant electrical power to maintain stored data, hence the term “dynamic.” DRAM is commonly used as main memory (RAM) in computers, smartphones, and other digital devices due to its fast access times and relatively low cost. It stores data in a digital format and requires periodic refreshing to maintain the stored information.

Global DRAM Market Synopsis

The COVID-19 pandemic exerted a multifaceted impact on the DRAM market, causing disruptions across the supply chain and demand landscape. Initially, the pandemic led to uncertainties in manufacturing operations, logistics, and workforce availability, resulting in temporary slowdowns in the production and delivery of DRAM components. However, as remote work and digitalization efforts surged, there was an increased demand for devices requiring DRAM, such as PCs, laptops, and servers, driving a rebound in market demand. Additionally, the shift towards online learning, remote communication, and e-commerce further fueled demand for data center infrastructure, boosting DRAM sales. Despite these positive trends, economic uncertainties and semiconductor shortages continued to pose challenges for the DRAM market, impacting pricing dynamics and supply chain resilience. As the pandemic situation evolves, the DRAM market remains dynamic, adapting to changing consumer behaviors, technological trends, and global economic conditions.

DRAM Market Dynamics

The major factors that have impacted the growth of DRAM are as follows:

Drivers:

Ø Increasing demand for memory-intensive applications

The growing adoption of memory-intensive applications such as artificial intelligence, machine learning, big data analytics, and virtual reality drives demand for DRAM. These applications require large amounts of fast-access memory to process and analyze data efficiently, fueling the need for higher capacity and faster DRAM solutions.

Restraint:

- Price volatility and cyclicality

The DRAM market is characterized by price volatility and cyclicality, influenced by factors such as supply-demand dynamics, technological advancements, and macroeconomic conditions. Fluctuations in market prices can impact profit margins for DRAM manufacturers and lead to uncertainties in investment and production planning.

Opportunity:

⮚ Emerging applications and markets

The proliferation of emerging technologies and applications, including 5G, Internet of Things (IoT), edge computing, and autonomous vehicles, presents significant opportunities for DRAM market growth. These technologies require robust memory solutions to handle large volumes of data, drive real-time processing, and enable seamless connectivity, driving demand for DRAM across various industries and market segments. Additionally, expanding into emerging markets with growing consumer electronics demand, such as Asia-Pacific and Latin America, offers opportunities for DRAM manufacturers to diversify their customer base and expand market reach.

DRAM Segment Overview

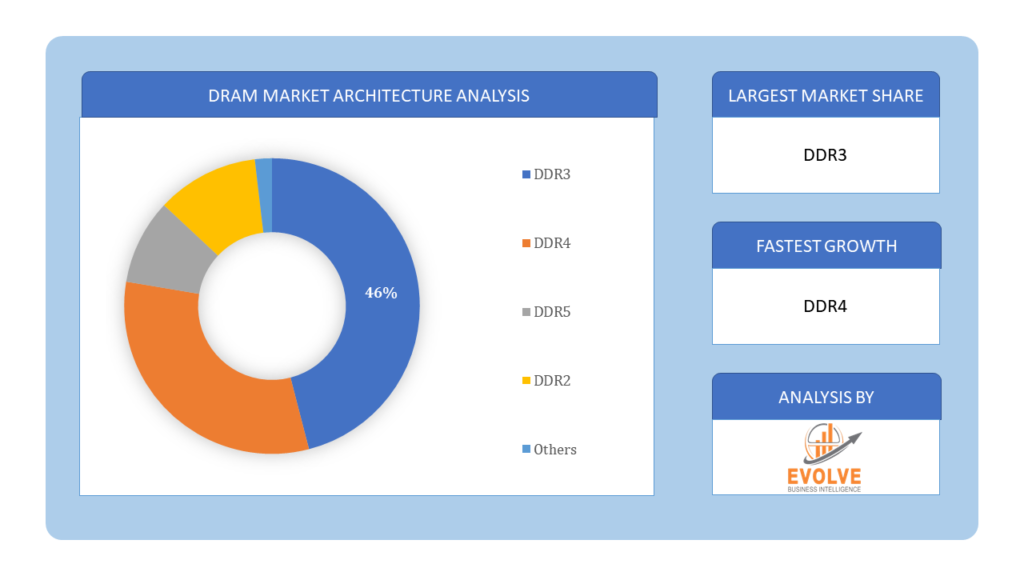

By Architecture

Based on Architecture, the market is segmented based on DDR3, DDR4, DDR5, DDR2, and Others. The DDR3 segment in the DRAM market is poised for substantial growth due to its continued relevance in legacy systems and applications, particularly in industries such as automotive, industrial, and telecommunications, where DDR3 remains a preferred and widely adopted memory standard. Additionally, the availability of cost-effective DDR3 solutions and the compatibility with existing infrastructure drive demand for DDR3 memory modules, contributing to the segment’s anticipated expansion in the market.

Based on Architecture, the market is segmented based on DDR3, DDR4, DDR5, DDR2, and Others. The DDR3 segment in the DRAM market is poised for substantial growth due to its continued relevance in legacy systems and applications, particularly in industries such as automotive, industrial, and telecommunications, where DDR3 remains a preferred and widely adopted memory standard. Additionally, the availability of cost-effective DDR3 solutions and the compatibility with existing infrastructure drive demand for DDR3 memory modules, contributing to the segment’s anticipated expansion in the market.

By Application

Based on the Application, the market has been divided into Smartphones/Tablets, PC/Laptop, Datacenter, Graphics, and Others. The Smartphones/Tablets segment in the DRAM market is poised for substantial growth driven by increasing demand for higher memory capacity in mobile devices to support advanced features such as high-resolution displays, multi-tasking, and AI capabilities. Additionally, the proliferation of 5G technology and the expansion of mobile gaming and content streaming further fuel the need for faster and more efficient DRAM solutions in smartphones and tablets, driving the anticipated growth of this segment in the market.

Global DRAM Market Regional Analysis

Based on region, the global DRAM market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the DRAM market followed by the Asia-Pacific and Europe regions.

DRAM North America Market

North America has consistently maintained a dominant position in the DRAM market owing to several key factors. The region benefits from a robust ecosystem of technology companies, research institutions, and infrastructure supporting innovation and development in the semiconductor industry. Moreover, North America is home to major players in the DRAM market, as well as leading consumers of DRAM chips across various sectors such as data centers, cloud computing, artificial intelligence, and consumer electronics. Additionally, the region’s strong focus on technological advancement, coupled with significant investments in research and development, enables continuous improvements in DRAM technology, driving its competitiveness and market leadership in North America and globally.

DRAM Asia-Pacific Market

The Asia-Pacific region has witnessed a rapid and remarkable surge in the DRAM industry, fueled by factors such as the proliferation of data centers, widespread adoption of smartphones and other consumer electronics, and the region’s dominance in semiconductor manufacturing. Countries like South Korea, Taiwan, and China host major DRAM manufacturers, benefitting from a skilled workforce, advanced technology infrastructure, and favorable government policies that encourage investment and innovation in the semiconductor sector. This surge in the Asia-Pacific DRAM market has significantly contributed to the region’s growing influence and competitiveness in the global semiconductor industry.

Competitive Landscape

The Global DRAM market is highly competitive, with numerous players offering a wide range of solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Samsung Electronics

- SK HYNIX

- Micron Technology

- Kingston Technology

- Nanya Technology

- Winbond

- Transcend Information

- Elpida Memory

- Etron Technology

- Intel

Key Development:

August 2023: Winbond Electronics Corporation and Mobiveil have recently forged a partnership to create an advanced IP controller tailored for diverse applications such as Automotive, Smart IoT, Industrial, Wearables, TWS, Wireless Headsets, Smart Speakers, and Connectivity. Within this collaboration, Mobiveil has seamlessly integrated its HYPERRAM Controller with Winbond’s innovative HYPERRAM device, featuring impressive capabilities such as speeds reaching 250MHz and accommodating densities ranging from 32 Mb to 512 Mb in x8/x16 modes. This joint effort aims to deliver heightened performance and functionality to address the evolving demands across various industries.

May 2023: SK Hynix Inc. announced the successful completion of the industry’s most advanced 1bnm, marking the fifth generation of the 10nm process technology. Additionally, the company initiated a joint evaluation of 1bnm and validation within the Intel Data Center Certified memory program for DDR5 products targeted at Intel Xeon Scalable platforms, in collaboration with Intel. This milestone follows SK Hynix’s attainment of 1anm readiness and the successful completion of Intel’s system validation of the 1anm DDR5, representing the fourth generation of the 10nm technology.

Scope of the Report

Global DRAM Market, by Architecture

- DDR3

- DDR4

- DDR5

- DDR2

- Others

Global DRAM Market, by Application

- Smartphones/Tablets

- PC/Laptop

- Datacenter

- Graphics

- Others

Global DRAM Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $186.52 Billion |

| CAGR | 11.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Architecture, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Samsung Electronics, SK HYNIX, Micron Technology, Kingston Technology, Nanya Technology, Winbond, Transcend Information, Elpida Memory, Etron Technology, Intel |

| Key Market Opportunities | • Technological advancements lead to higher DRAM densities and improved performance. • Rising adoption of Internet of Things (IoT) devices and smart connected devices fueling demand for DRAM in embedded systems and consumer electronics. |

| Key Market Drivers | • Increasing demand for data storage and processing across various industries. • Growth of cloud computing, artificial intelligence, and big data analytics driving demand for DRAM chips. |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future DRAM market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- DRAM market historical market size for the year 2021, and forecast from 2023 to 2033

- DRAM market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government and defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global DRAM market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government and defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.