Distilled Spirits Market Overview

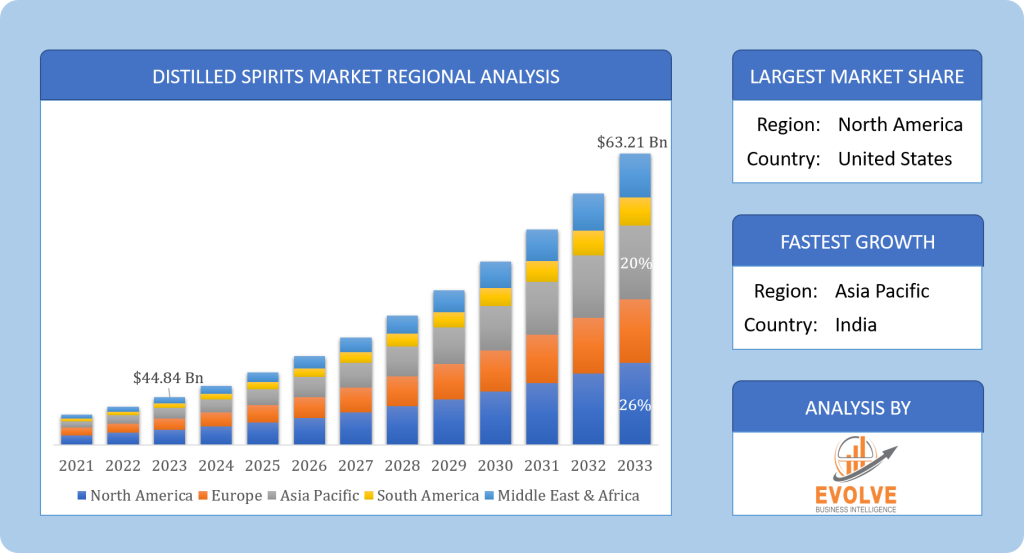

The Distilled Spirits Market Size is expected to reach USD 63.21 Billion by 2033. The Distilled Spirits industry size accounted for USD 44.84 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.85% from 2023 to 2033. Distilled spirits refer to alcoholic beverages that are produced through the process of distillation, which involves heating a fermented mixture to separate and concentrate the alcohol from other compounds. Distilled spirits typically have a higher alcohol content than fermented beverages such as beer or wine. They encompass a wide range of alcoholic products, including but not limited to whiskey, vodka, rum, tequila, gin, brandy, and liqueurs. Each type of distilled spirit has its distinct production methods, raw materials, and flavor profiles, contributing to the diverse offerings in the market. The distilled spirits industry involves aspects such as distillery operations, quality control, regulatory compliance, distribution, marketing, and consumer trends analysis.

Global Distilled Spirits Market Synopsis

COVID-19 Impact Analysis

The distilled spirits market underwent a substantial impact due to the COVID-19 pandemic. The implementation of lockdowns, social distancing measures, and the closure of bars, restaurants, and other hospitality establishments resulted in a significant decline in the demand for distilled spirits. On-trade sales, which traditionally contribute a considerable portion of the market, were severely affected due to limited access to venues. Consequently, consumers shifted their purchasing behavior towards at-home consumption, leading to increased off-trade sales through retail channels and online platforms. However, the overall market volume and revenue experienced negative consequences due to reduced consumer spending, economic uncertainty, and disruptions in supply chains. Although the distilled spirits market is anticipated to gradually recover as the pandemic situation evolves and restrictions are lifted, it may take time to reach pre-pandemic levels due to persistent challenges and shifts in consumer preferences and behaviors.

Distilled Spirits Market Dynamics

The major factors that have impacted the growth of Distilled Spirits are as follows:

Drivers:

- Increasing Consumer Demand

There is a notable rise in the interest and appreciation for premium and craft spirits among consumers. They seek out spirits that offer exceptional quality, distinct characteristics, and a touch of exclusivity. This growing appreciation for craftsmanship and uniqueness has led consumers to explore a wide range of spirits beyond mainstream offerings. Additionally, there is a preference for diverse flavor profiles, with consumers actively seeking out spirits that offer a variety of taste experiences. Whether it’s the complexity of aged whiskies, the botanical-infused profiles of gins, or the rich and nuanced flavors of rums, consumers are eager to experiment and discover new and exciting spirits. This demand is further fueled by the influence of social media, where enthusiasts share their experiences, knowledge, and recommendations, creating a sense of excitement and adventure around distilled spirits. As cocktail culture continues to thrive, consumers also value spirits that serve as key ingredients in creating well-crafted and innovative cocktails, further driving the demand for a wide array of spirits.

Restraint:

- Health and Wellness Concerns

As individuals become more health-conscious, there is a growing awareness of the potential risks associated with excessive alcohol consumption. This heightened consciousness prompts consumers to reassess their alcohol intake and consider healthier alternatives. Many individuals are opting to reduce their overall alcohol consumption or practice moderation in their drinking habits. Additionally, consumers are seeking out distilled spirits that align with their wellness goals, such as low-alcohol options, spirits made from organic ingredients, or those with reduced sugar content. This shift in consumer preferences has driven distillers to respond by developing innovative products that cater to the health-conscious market segment. From low-calorie spirits to alcohol-free alternatives, the industry is adapting to meet the evolving demands of consumers who prioritize their well-being without compromising on taste and enjoyment.

Opportunity:

- E-commerce and Online Platforms

The growth of e-commerce and online sales channels has opened up new possibilities for distillers to expand their reach and tap into a broader consumer base. With the convenience and accessibility of online platforms, distillers can now connect with consumers worldwide, regardless of geographical constraints. This expanded reach not only allows distillers to access new markets but also enables them to cater to niche or specialized consumer segments. Through e-commerce, distillers have the opportunity to provide personalized experiences to customers, offering tailored recommendations, curated selections, and customized promotions based on individual preferences and purchasing history. This personalized approach enhances customer engagement and loyalty, fostering a stronger connection between distillers and consumers. Furthermore, the online space offers convenience by allowing customers to explore and purchase distilled spirits from the comfort of their homes, at any time of the day. Distillers can leverage technology to provide detailed product information, tasting notes, and interactive content to educate and engage customers, creating a seamless and enjoyable online shopping experience.

Distilled Spirits Segment Overview

By Type

Based on Type, the market is segmented based on Whiskey, Vodka, Rum, Gin, Tequila, and Brandy. The Whiskey segment is expected to witness significant growth during the forecast period. There is a growing consumer appreciation for whiskey, driven by the increasing popularity of premium and craft spirits. Consumers are developing a taste for the complex flavors, rich heritage, and craftsmanship associated with whiskey production. Additionally, there is a rising interest in whiskey as an investment and collectible asset, attracting enthusiasts and collectors alike. The expanding middle-class population, particularly in emerging markets, presents a significant consumer base with the disposable income to indulge in premium whiskey offerings.

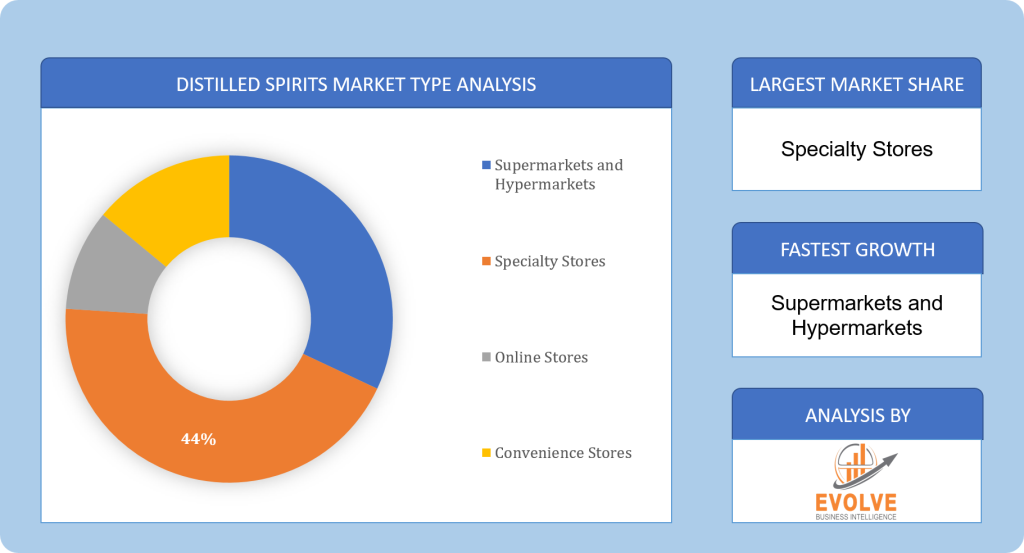

By Distribution Channel

Based on Distribution Channel, the market has been divided into Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Convenience Stores. The Specialty Stores dominate the Distilled Spirits Market. These dedicated retail establishments specialize in offering a wide range of spirits, including a diverse selection of premium and craft options. Specialty stores often provide a unique and curated shopping experience, attracting enthusiasts, connoisseurs, and consumers seeking specific and high-quality spirits. With their knowledgeable staff and specialized product offerings, these stores cater to discerning customers looking for rare or hard-to-find spirits, limited editions, and unique expressions.

Global Distilled Spirits Market Regional Analysis

Based on region, the global Distilled Spirits market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Distilled Spirits market followed by the Asia-Pacific and Europe regions.

North America Market

North America holds a dominant position in the global distilled spirits market. The region’s strong market presence can be attributed to several factors. Firstly, North America has a rich history and tradition in the production and consumption of distilled spirits, with iconic spirits like bourbon, rye whiskey, and Tennessee whiskey originating from the United States. These spirits have gained international recognition and continue to enjoy widespread popularity. Additionally, North America has a large and diverse consumer base, with a strong culture of spirits appreciation and consumption. The region’s affluent population, coupled with a growing interest in premium and craft spirits, further drives the demand for distilled spirits. Furthermore, the presence of well-established distilleries and brands, along with a robust distribution network, contributes to North America’s dominant position. As a result, the region continues to play a pivotal role in shaping trends, innovation, and market dynamics within the distilled spirits industry.

Asia-Pacific Market

The Asia-Pacific region has emerged as the fastest-growing market for the distilled spirits industry. The region has experienced significant economic development, resulting in a rising middle class with increased disposable income and changing lifestyles. As a result, consumers are seeking premium and high-quality spirits, driving the demand for distilled spirits. Secondly, cultural factors play a significant role, as many Asian countries have a long-standing tradition of spirits consumption as part of social gatherings, celebrations, and traditional ceremonies. This cultural affinity towards spirits, combined with changing consumer preferences and a desire for new experiences, has fueled the growth of the market. Additionally, the region’s large population, particularly in countries like China and India, presents a substantial consumer base, attracting the attention of global spirits brands and leading to increased investments and market expansion efforts in the Asia-Pacific region. With a combination of evolving consumer preferences, economic growth, and cultural traditions, the Asia-Pacific region has become a key growth engine for the distilled spirits industry.

Competitive Landscape

The global Distilled Spirits market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Bacardi

- Edrington

- Brown-Forman

- Pernod Ricard

- Marie Brizard Wine and Spirits

- Diageo

- William Grant and Sons

- Kweichow Moutai

- LVMH

- La Martiniquaise

- Remy Cointreau

- Constellation Brands

- Beam Suntory

Key Development

In August 2021, Bacardí introduced a new line of premium spirits by unveiling a rum that has undergone a finishing process in Sherry casks.

Scope of the Report

Global Distilled Spirits Market, by Type

- Whiskey

- Vodka

- Rum

- Gin

- Tequila

- Brandy

Global Distilled Spirits Market, by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Convenience Stores

Global Distilled Spirits Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Values |

|---|---|

| Market Size | 2033: USD 63.2 Billion |

| Compounded Average Growth Rate (CAGR) 2023 to 2033 | 5.85% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Distribution Channel |

| Key Market Opportunities | E-commerce and Online Platforms Premiumization and Innovation |

| Key Market Drivers | Increasing Consumer Demand Changing Consumer Preferences |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Bacardi, Edrington, Brown-Forman, Pernod Ricard, Marie Brizard Wine and Spirits, Diageo, William Grant and Sons, Kweichow Moutai, LVMH, La Martiniquaise, Remy Cointreau, Constellation Brands, Beam Suntory |

Report Content Brief:

- High-level analysis of the current and future Distilled Spirits market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Distilled Spirits market historical market size for the year 2021, and forecast from 2023 to 2033

- Distilled Spirits market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Distilled Spirits market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.