Digital Set-Top Box Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

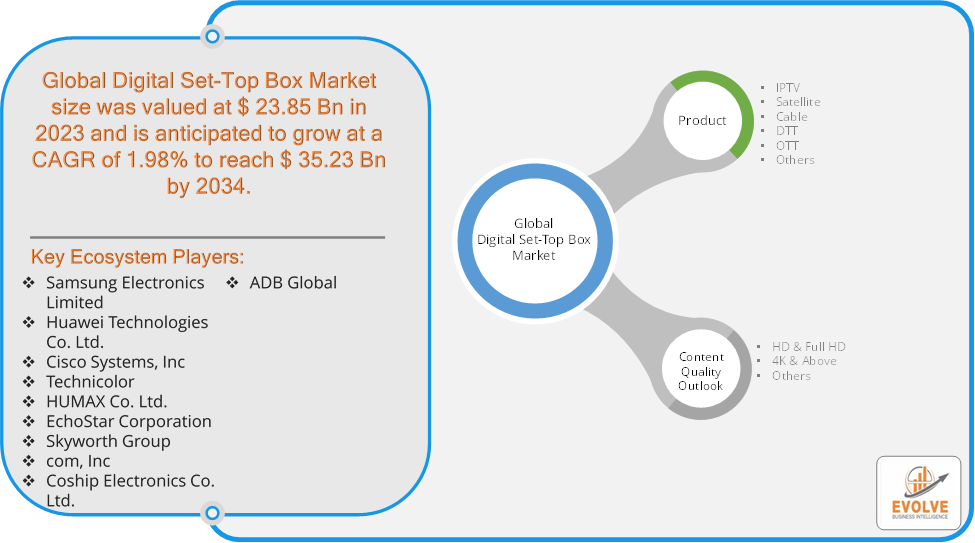

Digital Set-Top Box Market by Product Type (IPTV, Satellite, Cable, DTT, OTT, Others), By Content Quality Outlook (HD & Full HD, 4K & Above, Others) and By Geography – COVID-19 Impact Analysis, Post COVID Analysis, Opportunities, Trends and Forecast from 2021 to 2028

Report Code: EB_ES_859| Page: 116 | Published Date: June 2021

Digital Set-Top Box Market Overview

The Digital Set-Top Box Market size accounted for USD 23.85 Billion in 2023 and is estimated to account for 25.32 Billion in 2024. The Market is expected to reach USD 35.23 Billion by 2034 growing at a compound annual growth rate (CAGR) of 1.98% from 2024 to 2034. The digital set-top box (STB) market refers to the industry focused on devices that decode and convert digital signals for display on televisions. These devices allow users to access various services such as cable and satellite television, streaming content, and on-demand programming.

The digital set-top box market is a dynamic segment of the broader entertainment and telecommunications industries, reflecting technological advancements and shifting consumer behaviours. The digital set-top box market plays a crucial role in the delivery of digital television content and continues to evolve in response to changing consumer needs and technological innovations.

Global Digital Set-Top Box Market Synopsis

Digital Set-Top Box Market Dynamics

Digital Set-Top Box Market Dynamics

The major factors that have impacted the growth of Digital Set-Top Box Market are as follows:

Drivers:

Ø Technological Advancements

Innovations in STB technology, such as support for 4K resolution, HDR, and advanced user interfaces, enhance the viewing experience and attract consumers. While smart TVs can offer many features, dedicated STBs often provide better performance and additional functionalities, driving their continued relevance. The ability to record and store content for later viewing remains a significant draw for consumers, particularly in regions with traditional cable services. As internet penetration and digital infrastructure improve in developing regions, the demand for digital STBs is increasing, offering new growth opportunities.

Restraint:

- Perception of High Cost of Advanced Models and Technical Complexity

Premium STBs with advanced features (like 4K, DVR, etc.) can be expensive, which may deter budget-conscious consumers. Some consumers find STBs complicated to set up and use, which can lead to frustration and decreased adoption. Growing concerns about data privacy and cybersecurity may make consumers hesitant to adopt new digital technologies, including STBs that connect to the internet.

Opportunity:

⮚ Adoption of 5G Technology

The rollout of 5G networks can improve streaming quality and speed, driving demand for advanced STBs capable of leveraging this technology. Developing STBs that integrate with smart home ecosystems can attract tech-savvy consumers looking for cohesive control over their entertainment and home devices. Offering cloud-based recording solutions can attract consumers who prefer the convenience of accessing their recorded content from multiple devices.

Digital Set-Top Box Market Segment Overview

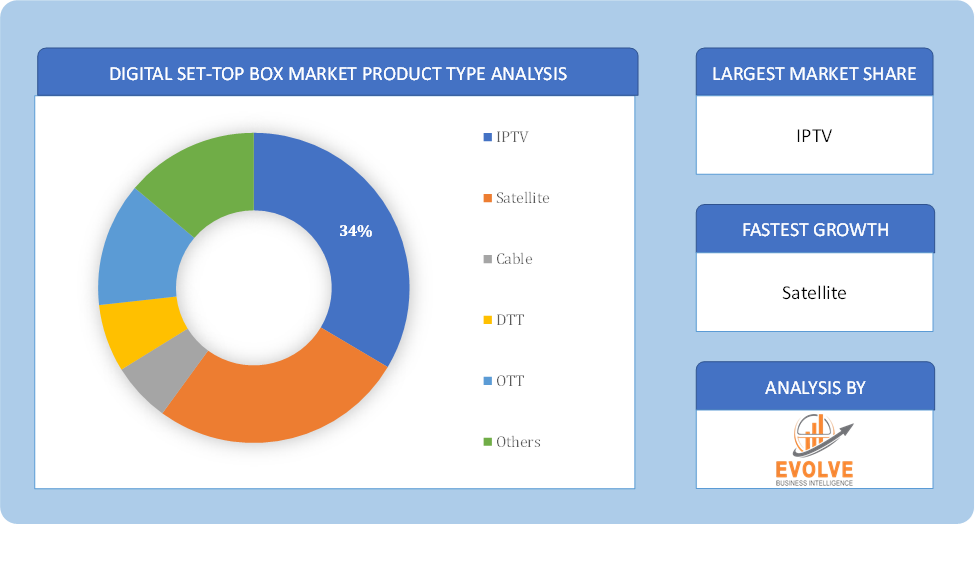

Based on Product Type, the market is segmented based on IPTV, Satellite, Cable, DTT, OTT and Others. The IPTV segment dominant the market. The set-top box in IPTV networks is a compact computer that enables two-way communication and decodes streaming video. In most cases, IPTV technology is utilized lawfully. The boxes that access the signals were first created to let users broadcast legal video to their TVs through a broadband connection. The public is buying an increasing number of IPTV systems that let them watch live Premier League football and other sporting events without paying a membership fee.

By Content Quality Outlook

Based on Content Quality Outlook, the market segment has been divided into HD & Full HD, 4K & Above and Others. The HD segment dominant the market. Full HD resolution indicates a width of 1920 pixels and a height of 1080 pixels. A high-definition set-top box can display both standard-definition and high-definition channels, while a standard-definition set-top box typically only has access to standard-definition channels. Since 1080-pixel monitors have inundated the market over the past five years, HD has emerged as the new norm.

Global Digital Set-Top Box Market Regional Analysis

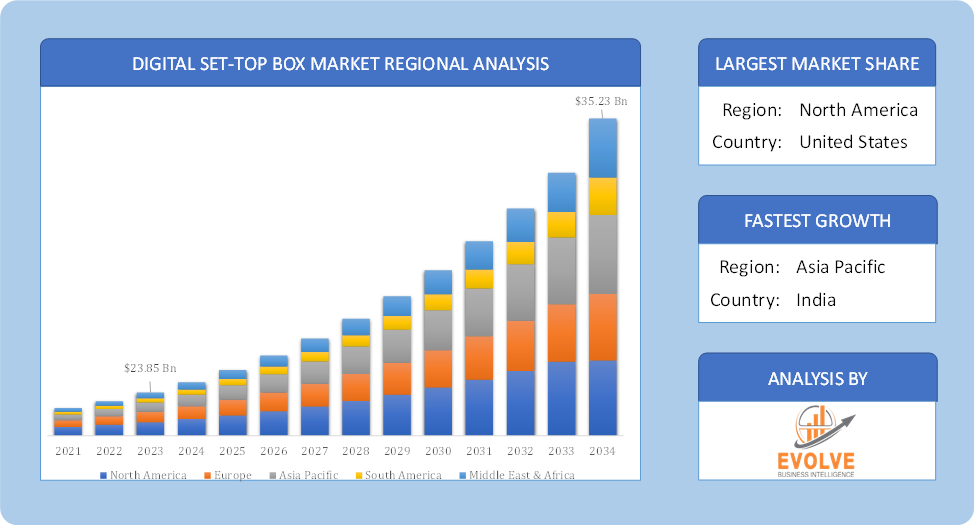

Based on region, the global Digital Set-Top Box Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Digital Set-Top Box Market followed by the Asia-Pacific and Europe regions.

Digital Set-Top Box North America Market

Digital Set-Top Box North America Market

North America holds a dominant position in the Digital Set-Top Box Market. The North American market is relatively mature, with a high penetration of digital television services. The United States and Canada are the primary markets in this region and increasing adoption of OTT services and integration with smart home technologies. The focus is on advanced features such as 4K resolution, voice control, and integration with streaming platforms.

Digital Set-Top Box Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Digital Set-Top Box Market industry. This region dominates the global set-top box market due to its large population, growing urbanization, and increasing adoption of digital television and rapidly growing market driven by increasing internet penetration and smartphone usage and government initiatives for digital television migration, rising disposable income, and increasing demand for smart TVs are fueling the market.

Competitive Landscape

The global Digital Set-Top Box Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Samsung Electronics Limited

- Huawei Technologies Co. Ltd.

- Cisco Systems, Inc

- Technicolor

- HUMAX Co. Ltd.

- EchoStar Corporation

- Skyworth Group

- com, Inc

- Coship Electronics Co. Ltd.

- ADB Global

Key Development

In January 2020, HUMAX Electronics announced that it will be supplying UHD set-top boxes with Android TV operating system to T-Broad, the largest cable TV operator in South Korea.

In August 2023, Roku announced that it will be adding over forty free channels, along with local news through its free Roku channel, which is available on all Roku devices.

Scope of the Report

Global Digital Set-Top Box Market, by Product

- IPTV

- Satellite

- Cable

- DTT

- OTT

- Others

Global Digital Set-Top Box Market, by Content Quality Outlook

- HD & Full HD

- 4K & Above

- Others

Global Digital Set-Top Box Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 35.23 Billion |

| CAGR (2024-2034) | 1.98% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Content Quality Outlook |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Samsung Electronics Limited, Huawei Technologies Co. Ltd., Cisco Systems, Inc, Technicolor, HUMAX Co. Ltd., EchoStar Corporation, Skyworth Group, com, Inc, Coship Electronics Co. Ltd. and ADB Global |

| Key Market Opportunities | · Adoption of 5G Technology · Smart Home Integration |

| Key Market Drivers | · Technological Advancements · Rise of Smart TVs |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Digital Set-Top Box Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Digital Set-Top Box Market historical market size for the year 2021, and forecast from 2023 to 2033

- Digital Set-Top Box Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Digital Set-Top Box Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Digital Set-Top Box Market is 2021- 2033

What is the growth rate of the global Digital Set-Top Box Market?

The global Digital Set-Top Box Market is growing at a CAGR of 1.98% over the next 10 years

Which region has the highest growth rate in the market of Digital Set-Top Box Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Digital Set-Top Box Market?

North America holds the largest share in 2022

Who are the key players in the global Digital Set-Top Box Market?

Samsung Electronics Limited, Huawei Technologies Co. Ltd., Cisco Systems, Inc, Technicolor, HUMAX Co. Ltd., EchoStar Corporation, Skyworth Group, com, Inc, Coship Electronics Co. Ltd. and ADB Global are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw End Users Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Digital Set-Top Box Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Digital Set-Top Box Market 4.8. Import Analysis of the Digital Set-Top Box Market 4.9. Export Analysis of the Digital Set-Top Box Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Digital Set-Top Box Market, By Product Type 6.1. Introduction 6.2. IPTV 6.3. Satellite 6.4. Cable 6.5. DTT 6.6. OTT 6.7. Others Chapter 7. Global Digital Set-Top Box Market, By Content Quality Outlook 7.1. Introduction 7.2. HD & Full HD 7.3. 4K & Above 7.4. Others Chapter 8. Global Digital Set-Top Box Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2024-2034 8.2.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.5. Market Size and Forecast, By End User, 2024-2034 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.2.6.4. Market Size and Forecast, By End User, 2024-2034 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2024-2034 8.2.7.5. Market Size and Forecast, By End User, 2024-2034 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2024-2034 8.3.4. Market Size and Forecast, By Product Type, 2024-2034 8.3.5. Market Size and Forecast, By End User, 2024-2034 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.6.4. Market Size and Forecast, By End User, 2024-2034 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.7.4. Market Size and Forecast, By End User, 2024-2034 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.8.4. Market Size and Forecast, By End User, 2024-2034 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.9.4. Market Size and Forecast, By End User, 2024-2034 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2024-2034 8.3.11.4. Market Size and Forecast, By End User, 2024-2034 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2024-2034 8.4.4. Market Size and Forecast, By Product Type, 2024-2034 8.12.28. Market Size and Forecast, By End User, 2024-2034 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.6.4. Market Size and Forecast, By End User, 2024-2034 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.7.4. Market Size and Forecast, By End User, 2024-2034 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.8.4. Market Size and Forecast, By End User, 2024-2034 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.9.4. Market Size and Forecast, By End User, 2024-2034 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2024-2034 8.4.10.4. Market Size and Forecast, By End User, 2024-2034 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2024-2034 8.5.4. Market Size and Forecast, By End User, 2024-2034 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Samsung Electronics Limited 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Huawei Technologies Co. Ltd. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Cisco Systems Inc 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Nestle 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Technicolor 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. HUMAX Co. Ltd. 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. EchoStar Corporation 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Skyworth Group, com, Inc 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 Coship Electronics Co. Ltd. 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. ADB Global 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology