Digital Remittance Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

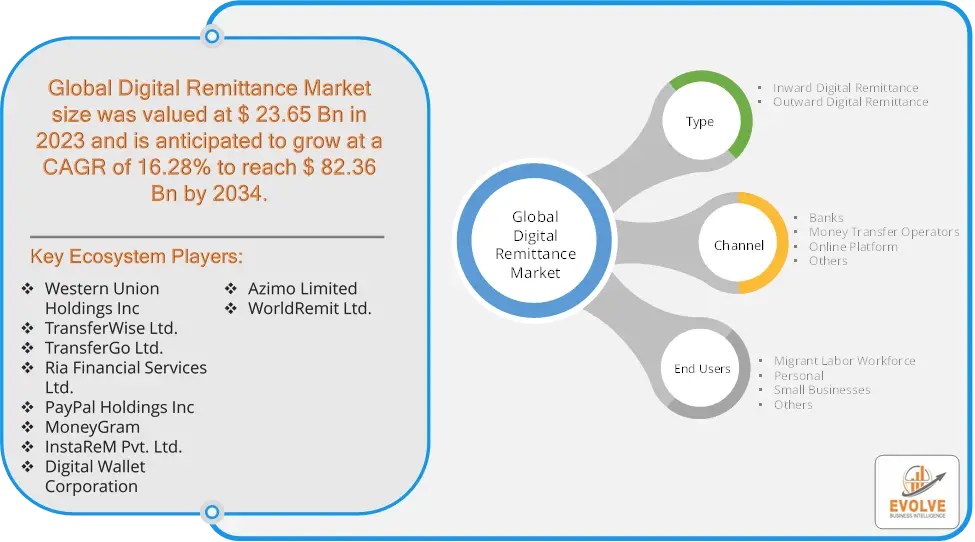

Digital Remittance Market Research Report: Information By Type (Inward Digital Remittance, Outward Digital Remittance), By Channel (Banks, Money Transfer Operators, Online Platform, Others), By End-Users (Migrant Labor Workforce, Personal, Small Businesses, Others), and by Region — Forecast till 2034

Page: 121

Digital Remittance Market Overview

The Digital Remittance Market accounted for USD 23.65 Billion in 2023 and is estimated to account for 30.74 billion in 2024. The Market is expected to reach USD 82.36 Billion by 2034 growing at a compound annual growth rate (CAGR) of 16.28% from 2024 to 2034. The Digital Remittance Market refers to the sector focused on the digital transfer of money across borders. It involves the use of electronic Channels and technologies to facilitate the sending and receiving of funds from one country to another, typically through mobile apps, online portals, or digital wallets.

The Digital Remittance Market is driven by the increasing adoption of digital financial services and the growing need for seamless cross-border money transfers. The digital remittance market has revolutionized the way people send and receive money across borders, offering a more efficient, convenient, and cost-effective solution.

Global Digital Remittance Market Synopsis

Digital Remittance Market Dynamics

Digital Remittance Market Dynamics

The major factors that have impacted the growth of Digital Remittance Market are as follows:

Drivers:

Ø Advancements in Technology

Innovations in technology, such as blockchain and artificial intelligence, enhance the efficiency, security, and speed of digital remittance transactions. Digital remittance services often offer lower fees compared to traditional methods, making them a more attractive option for users. The convenience of sending and receiving money from mobile devices or online Channels appeals to users seeking easy and accessible financial solutions. Improved security measures and fraud prevention technologies boost consumer confidence in using digital remittance services.

Restraint:

- Perception of Infrastructure Limitations and High Transaction Fees

In areas with underdeveloped digital infrastructure or limited internet connectivity, the adoption of digital remittance services may be constrained. While many digital remittance services offer competitive fees, some providers may still charge higher transaction fees compared to traditional methods, which can be a barrier for cost-sensitive users. The growing number of digital remittance service providers can lead to intense competition and market saturation, making it challenging for new entrants to gain a foothold.

Opportunity:

⮚ Integration with Financial Services

Partnering with banks, fintech companies, and mobile network operators can create integrated solutions that enhance the functionality and reach of digital remittance services. The increasing volume of cross-border e-commerce transactions drives demand for digital remittance solutions that facilitate payments between businesses and customers internationally. Expanding beyond remittances to offer additional financial services such as microloans, insurance, and investment opportunities can create new revenue streams and enhance customer loyalty.

Digital Remittance Market Segment Overview

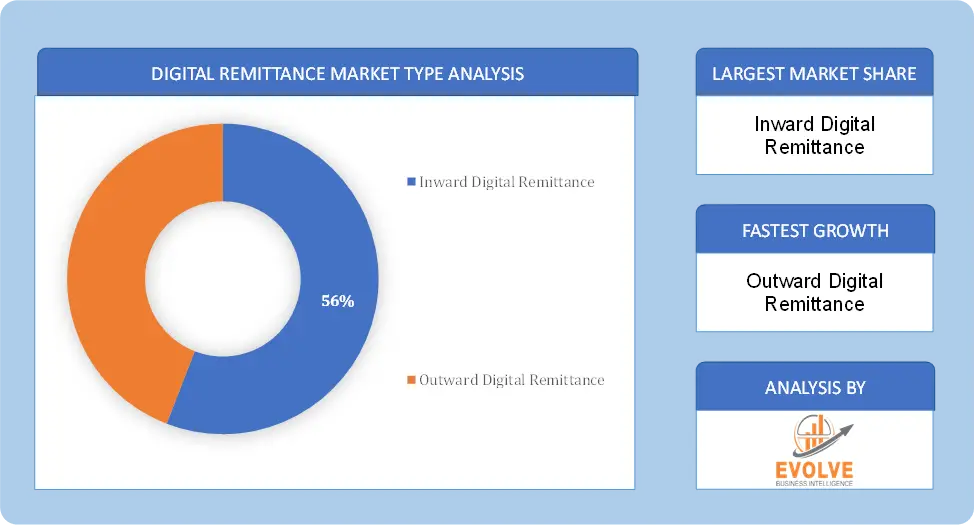

By Type

Based on Type, the market has been divided into Inward Digital Remittance and Outward Digital Remittance. The Outward digital remittance segment dominant the market. The Outward digital remittance is the transfer of funds from a sender in one country to a recipient located in another country or region using digital channels and Channels. The sender initiates the transaction, and the recipient receives the funds. Users access a digital remittance platform or service provider, input the details of the recipient and the amount to be sent, and then choose the preferred payment method. The funds are electronically transferred to the account of the recipient or made available for cash pickup at a local partner agent in the country of the recipient.

Based on Type, the market has been divided into Inward Digital Remittance and Outward Digital Remittance. The Outward digital remittance segment dominant the market. The Outward digital remittance is the transfer of funds from a sender in one country to a recipient located in another country or region using digital channels and Channels. The sender initiates the transaction, and the recipient receives the funds. Users access a digital remittance platform or service provider, input the details of the recipient and the amount to be sent, and then choose the preferred payment method. The funds are electronically transferred to the account of the recipient or made available for cash pickup at a local partner agent in the country of the recipient.

By Channel

Based on Type, the market has been divided into Banks, Money Transfer Operators, Online Platform and Others. The Money transfer segment dominant the market. Money transfer operators are companies or service providers that specialize in facilitating the transfer of funds from one location to another, usually for remittance purposes. They often have a network of physical agent locations worldwide. Users can visit physical agent locations to initiate remittance transactions. They can provide cash to the agent, who then processes the transfer to be received by the recipient at another location of the agent.

By End Users

Based on End Users, the market is segmented based on Migrant Labor Workforce, Personal, Small Businesses and Others. The personal segment dominant the market. The personal segment holds a major share in various markets due to its substantial user base and diverse needs. This segment dominates the market because of the sheer volume of personal transactions made on a regular basis, often driven by factors like international migration, education, and financial support for loved ones. The convenience, speed, and cost-effectiveness of digital remittance services appeal to this broad user base, making it a dominant force in the market.

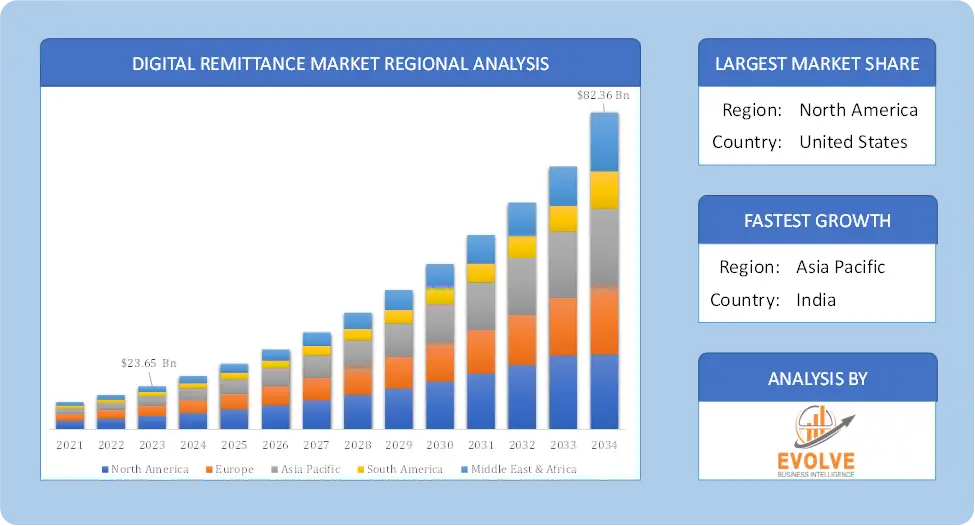

Global Digital Remittance Market Regional Analysis

Based on region, the global Digital Remittance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Digital Remittance Market followed by the Asia-Pacific and Europe regions.

Global Digital Remittance North America Market

Global Digital Remittance North America Market

North America holds a dominant position in the Digital Remittance Market. High adoption of digital payment solutions and advanced financial infrastructure support the growth of digital remittance services. Regulatory environments are generally supportive but require strict compliance with AML and KYC regulations. The US is a major source and destination for digital remittances, with a large immigrant population and well-developed financial infrastructure and Canada also has a significant digital remittance market, with a diverse population and strong ties to other countries.

Global Digital Remittance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Digital Remittance Market industry. Rapidly growing smartphone and internet penetration, combined with large migrant worker populations in countries like India, China, and the Philippines, drive demand for digital remittance services an expanding services to underserved regions, leveraging mobile technology, and addressing regulatory challenges can drive growth.

Competitive Landscape

The global Vehicle Leasing Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Western Union Holdings Inc

- TransferWise Ltd.

- TransferGo Ltd.

- Ria Financial Services Ltd.

- PayPal Holdings Inc

- MoneyGram

- InstaReM Pvt. Ltd.

- Digital Wallet Corporation

- Azimo Limited

- WorldRemit Ltd.

Key Development

In December 2021– In order to support digital business transformation by concentrating on new business outcomes, Kyndryl, another significant competitor in the market for machine learning as a service, engaged into a relationship with Google Cloud.

Scope of the Report

Global Digital Remittance Market, by Type

- Inward Digital Remittance

- Outward Digital Remittance

Global Digital Remittance Market, by Channel

- Banks

- Money Transfer Operators

- Online Platform

- Others

Global Digital Remittance Market, by End Users

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

Global Digital Remittance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $82.36 Billion |

| CAGR | 16.28% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Channel, End users |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Western Union Holdings, Inc, TransferWise Ltd., TransferGo Ltd., Ria Financial Services Ltd., PayPal Holdings, Inc, MoneyGram, InstaReM Pvt. Ltd., Digital Wallet Corporation, Azimo Limited and WorldRemit Ltd |

| Key Market Opportunities | • Integration with Financial Services • Cross-Border E-Commerce Growth |

| Key Market Drivers | • Advancements in Technology • Increased Consumer Confidence |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Digital Remittance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Digital Remittance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Digital Remittance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Digital Remittance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Digital Remittance Market is 2024- 2034

What is the growth rate of the global Digital Remittance Market?

The global Digital Remittance Market is growing at a CAGR of 16.28% over the next 10 years

Which region has the highest growth rate in the market of Digital Remittance Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Digital Remittance Market?

North America holds the largest share in 2022

Who are the key players in the global Digital Remittance Market?

Western Union Holdings, Inc, TransferWise Ltd., TransferGo Ltd., Ria Financial Services Ltd., PayPal Holdings, Inc, MoneyGram, InstaReM Pvt. Ltd., Digital Wallet Corporation, Azimo Limited and WorldRemit Ltd. are the major companies operating in the market

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Digital Remittance Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Digital Remittance Market, By Type 6.1. Introduction 6.2. Inward Digital Remittance 6.3. Outward Digital Remittance Chapter 7. Global Digital Remittance Market, By Channel 7.1. Introduction 7.2. Banks 7.3. Money Transfer Operators 7.4. Online Platforms 7.5. Others Chapter 8. Global Digital Remittance Market, By End-Users 8.1. Introduction 8.2. Migrant Labor Workforce 8.3. Personal 8.4. Small Businesses 8.5. Others Chapter 9. Global Digital Remittance Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Channel, 2020 - 2028 9.2.6. Market Size and Forecast, By End-Users, 2020 - 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Channel, 2020 - 2028 9.2.7.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Type, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Channel, 2020 - 2028 9.2.8.6. Market Size and Forecast, By End-Users, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Channel, 2020 - 2028 9.3.6. Market Size and Forecast, By End-Users, 2020 - 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Channel, 2020 - 2028 9.3.7.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Channel, 2020 - 2028 9.3.8.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Channel, 2020 - 2028 9.3.9.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Channel, 2020 - 2028 9.3.10.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.3.11. Rest Of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Channel, 2020 - 2028 9.3.11.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Channel, 2020 - 2028 9.4.7. Market Size and Forecast, By End-Users, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Channel, 2020 - 2028 9.4.8.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Channel, 2020 - 2028 9.4.9.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Channel, 2020 - 2028 9.4.10.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Channel, 2020 - 2028 9.4.11.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.4.12. Rest Of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Channel, 2020 - 2028 9.4.12.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.5. Rest Of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Channel, 2020 - 2028 9.5.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Channel, 2020 - 2028 9.5.7.5. Market Size and Forecast, By End-Users, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Channel, 2020 - 2028 9.5.8.5. Market Size and Forecast, By End-Users, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Western Union Holdings, Inc 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. TransferWise Ltd. 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. TransferGo Ltd. 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Ria Financial Services Ltd. 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. PayPal Holdings, Inc 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. MoneyGram 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. InstaReM Pvt. Ltd. 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. Digital Wallet Corporation 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Azimo Limited 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. WorldRemit Ltd. 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology

Our Most Viewed Report and gain instant expertise

Corporate Training, Lifelong Learning and Credentialing Market Analysis and Forecast 2020-2028

E-books Market Analysis and Global Forecast 2023-2033

Global & Australia Vocational Training Market Analysis and Global Forecast 2024-2034

Global & Australia Vocational Training Market Research Report: Information By Type (Accredited, Non-Accredited), by Program Type (High School programs, Tech Prep Education, Postsecondary Vocational School, Apprenticeship Programs, On-the-job Training, Others), by RTO Types (Private RTOs, TAFE Institutes, Community RTOs, Schools, Enterprise RTOs, Universities), and by Region — Forecast till 2034

Page: 55Karaoke Market Analysis and Global Forecast 2023-2033

Negative Pressure Wound Therapy (NPWT) Market Analysis and Global Forecast 2023-2033

Negative Pressure Wound Therapy (NPWT) Market Research Report: By Device Type (Conventional NPWT, and Single-use NPWT), By Indication (Diabetic Foot Ulcers, Pressure Ulcers, Burns & Trauma, and Others), By End User (Hospitals, Clinics, Homecare Settings, and Others), and Region — Forecast till 2033

Report Code: EB_LS_1271 | Page: 194 | Published Date: UpcomingPress Release: https://evolvebi.com/the-negative-pressure-wound-therapy-market-is-estimated-to-record-a-cagr-of-around-6-4-during-the-forecast-period/