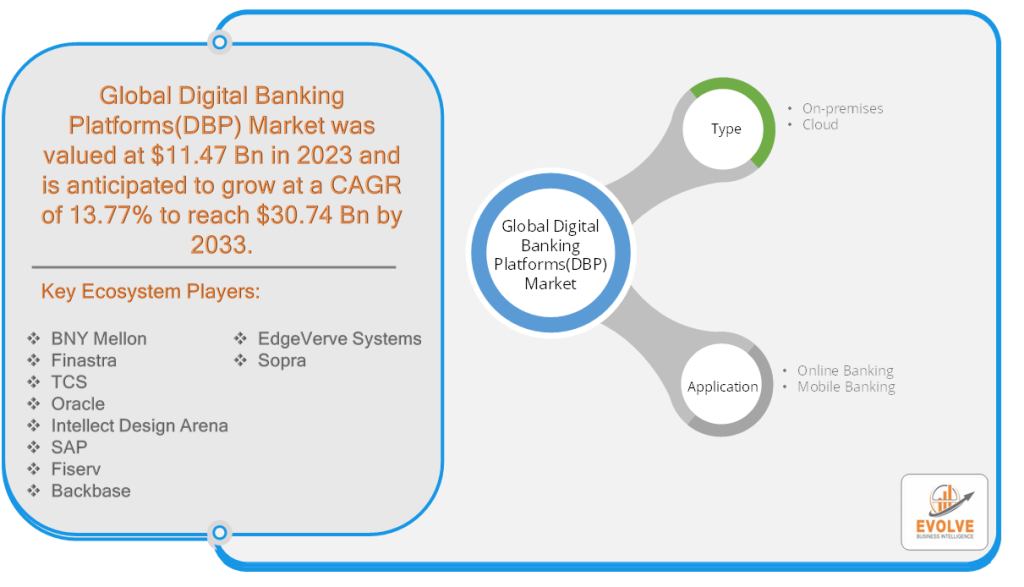

Digital Banking Platforms(DBP) Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

Digital Banking Platforms(DBP) Market Research Report: Information By Type (On-premises, Cloud), By Application (Online Banking, Mobile Banking), and by Region — Forecast till 2033

Digital Banking Platforms(DBP) Market Overview

The Digital Banking Platforms(DBP) Market Size is expected to reach USD 30.74 Billion by 2033. The Digital Banking Platforms(DBP) industry size accounted for USD 11.47 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 13.77% from 2023 to 2033. Digital Banking Platforms (DBPs) refer to comprehensive and integrated software solutions that enable financial institutions, such as banks, to provide a wide range of digital banking services to their customers. DBPs leverage advanced technologies and online channels to deliver a seamless and personalized banking experience across various devices, including desktop computers, smartphones, and tablets. Key components of DBPs may include user-friendly interfaces for customers to access their accounts and perform transactions, robust security measures to protect sensitive financial information, analytics and reporting tools to gain insights into customer behavior and trends, and application programming interfaces (APIs) to enable integration with external systems and services.

Global Digital Banking Platforms(DBP) Market Synopsis

The COVID-19 pandemic has brought about a significant and transformative shift in the Digital Banking Platforms (DBP) market. With widespread lockdowns and social distancing measures, traditional banking channels faced limitations, and customers increasingly turned to digital banking for their financial needs. This sudden surge in demand accelerated the adoption of DBPs by financial institutions, prompting them to invest in robust digital infrastructure and innovative solutions to cater to evolving customer expectations. DBPs played a crucial role in enabling remote access to banking services, facilitating contactless transactions, and providing seamless customer experiences. The pandemic acted as a catalyst for the digital transformation of the banking industry, highlighting the importance of DBPs in ensuring business continuity and resilience during challenging times.

Digital Banking Platforms(DBP) Market Dynamics

The major factors that have impacted the growth of Digital Banking Platforms(DBP) are as follows:

Drivers:

Increased Consumer Demand for Digital Banking Services

One of the main drivers of the Digital Banking Platforms (DBP) market is the growing consumer demand for digital banking services. Customers now expect convenience, accessibility, and personalized experiences in their banking interactions. DBPs offer a wide range of services such as mobile banking, online transactions, and digital wallets, catering to these demands and providing a seamless banking experience.

Restraint:

- Security and Data Privacy Concerns

A significant restraint for the DBP market is the heightened concern over security and data privacy. As digital banking involves the transfer of sensitive financial information, customers and financial institutions alike are increasingly cautious about protecting against cyber threats, data breaches, and unauthorized access. Maintaining robust security measures and complying with stringent regulations to protect customer data poses a challenge for DBP providers.

Opportunity:

Emerging Technologies and Innovation

The DBP market presents ample opportunities through the integration of emerging technologies and innovation. Technologies such as artificial intelligence, machine learning, and blockchain can enhance security, automate processes, and provide advanced analytics for personalized services. Moreover, the rise of open banking and the availability of APIs enable seamless integration with third-party services, fostering collaboration and expanding the range of offerings within DBPs.

Digital Banking Platforms(DBP) Segment Overview

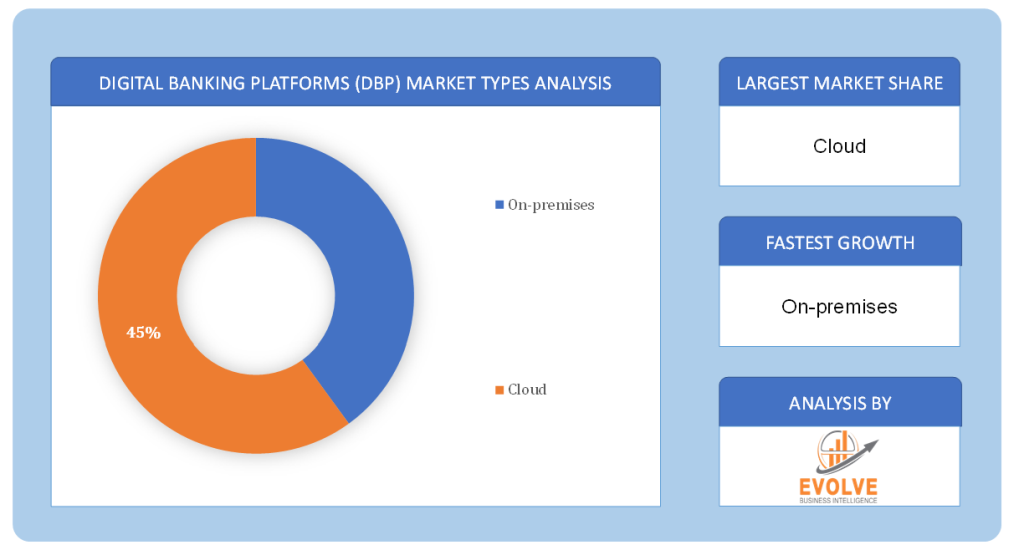

By Type

Based on Type, the market is segmented based on On-premises and cloud. The Cloud segment is expected to witness significant growth during the forecast period. Cloud computing offers numerous advantages to financial institutions, including scalability, cost-effectiveness, flexibility, and improved accessibility. These benefits align well with the evolving needs of the banking industry and drive the adoption of cloud-based DBPs. One of the key factors contributing to the growth of the Cloud segment is the increasing demand for agility and scalability in digital banking operations. Cloud-based DBPs allow banks to quickly scale their infrastructure and resources based on fluctuating customer demands and transaction volumes. This scalability enables banks to efficiently manage peak loads, optimize performance, and enhance customer experiences.

Based on Type, the market is segmented based on On-premises and cloud. The Cloud segment is expected to witness significant growth during the forecast period. Cloud computing offers numerous advantages to financial institutions, including scalability, cost-effectiveness, flexibility, and improved accessibility. These benefits align well with the evolving needs of the banking industry and drive the adoption of cloud-based DBPs. One of the key factors contributing to the growth of the Cloud segment is the increasing demand for agility and scalability in digital banking operations. Cloud-based DBPs allow banks to quickly scale their infrastructure and resources based on fluctuating customer demands and transaction volumes. This scalability enables banks to efficiently manage peak loads, optimize performance, and enhance customer experiences.

By Application

Based on Application, the market has been divided into Online Banking and mobile Banking. Mobile Banking has emerged as the dominant force in the Digital Banking Platforms (DBP) market, revolutionizing the way customers access and engage with banking services. With the widespread adoption of smartphones and the increasing demand for convenience and accessibility, mobile banking has become the primary channel for customers to perform transactions, access account information, and utilize a wide range of financial services. The seamless user experience, coupled with the expanding capabilities of mobile banking apps, such as advanced security features and comprehensive service offerings, has solidified its position as the preferred choice for customers and a key driver of the DBP market’s growth.

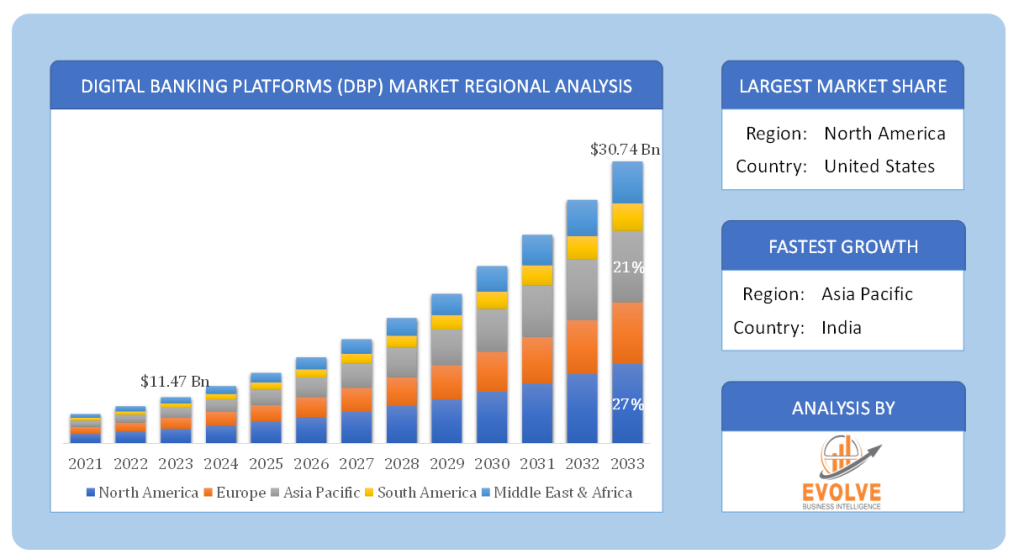

Global Digital Banking Platforms(DBP) Market Regional Analysis

Based on region, the global Digital Banking Platforms(DBP) market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Digital Banking Platforms(DBP) market followed by the Asia-Pacific and Europe regions.

North America Market

North America Market

North America has consistently maintained a dominant position in the Digital Banking Platforms (DBP) market, driving its growth and shaping the industry landscape. This region’s leadership can be attributed to several factors, including the early adoption of digital technologies, a mature banking sector, and a tech-savvy population. North American financial institutions have been at the forefront of digital transformation, investing in robust DBPs to meet evolving customer expectations. Additionally, the presence of established technology companies, innovative fintech startups, and a supportive regulatory environment have fostered a thriving ecosystem for DBPs in North America. The region’s continued focus on digital innovation, combined with its strong financial infrastructure, positions it as a key player in shaping the future of digital banking platforms.

Asia-Pacific Market

The Asia-Pacific region has indeed emerged as a rapidly growing market for the Digital Banking Platforms (DBP) industry, showcasing significant potential and driving the expansion of digital banking services. Several factors contribute to this growth, including the region’s large population, increasing internet and smartphone penetration rates, and a rising middle class with growing disposable income. As a result, financial institutions in the Asia-Pacific region are actively investing in DBPs to capitalize on this market opportunity and meet the changing preferences of tech-savvy customers. Moreover, the region is witnessing a surge in fintech innovation and digital transformation initiatives, supported by favorable government policies and regulatory frameworks. The Asia-Pacific market’s momentum in embracing digital banking platforms is expected to continue, fueling its position as a key driver of industry growth on a global scale.

Competitive Landscape

The global Digital Banking Platforms(DBP) market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- BNY Mellon

- Finastra

- TCS

- Oracle

- Intellect Design Arena

- SAP

- Fiserv

- Backbase

- EdgeVerve Systems

- Sopra

Key Development

In January 2023, Next Bank, a digital bank based in Taiwan, successfully launched its services using the Temenos platform. By leveraging Temenos’ open platform, Next Bank gained the ability to rapidly and efficiently bring new products to market. The bank’s strategic plans include introducing foreign exchange services, specifically remittance services for migrant workers, and expanding its offerings to include wealth management tools. With the support of Temenos, Next Bank aims to achieve a substantial user base of approximately 300,000 within the first nine months of its launch, demonstrating its commitment to swift growth and customer acquisition.

Scope of the Report

Global Digital Banking Platforms(DBP) Market, by Types

- On-premises

- Cloud

Global Digital Banking Platforms(DBP) Market, by Application

- Online Banking

- Mobile Banking

Global Digital Banking Platforms(DBP) Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $30.74 Billion |

| CAGR | 13.77% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | BNY Mellon, Finastra, TCS, Oracle, Intellect Design Arena, SAP, Fiserv, Backbase, EdgeVerve Systems, Sopra |

| Key Market Opportunities | • Regulatory Support and Compliance Requirements • Expansion into Untapped Markets and Financial Inclusion Initiatives • Shift towards Cashless and Contactless Transactions |

| Key Market Drivers | • Increasing Consumer Demand for Digital Banking Services • Growing Adoption of Mobile and Internet Banking • Advancements in Technology, such as AI, ML, and Blockchain |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Digital Banking Platforms(DBP) market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Digital Banking Platforms(DBP) market historical market size for the year 2021, and forecast from 2023 to 2033

- Digital Banking Platforms(DBP) market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Digital Banking Platforms(DBP) market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Digital Banking Platforms(DBP) market is 2021- 2033

What is the growth rate of the global Digital Banking Platforms(DBP) market?

The global Digital Banking Platforms(DBP) market is growing at a CAGR of 13.77% over the next 10 years

Which region has the highest growth rate in the market of Digital Banking Platforms(DBP)?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Digital Banking Platforms(DBP) market?

North America holds the largest share in 2022

Who are the key players in the global Digital Banking Platforms(DBP) market?

BNY Mellon, Finastra, TCS, Oracle, Intellect Design Arena, SAP, Fiserv, Backbase, EdgeVerve Systems, and Sopra are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Material Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Digital Banking Platforms(DBP) Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Digital Banking Platforms(DBP) Market 4.8. Import Analysis of the Digital Banking Platforms(DBP) Market 4.9. Export Analysis of the Digital Banking Platforms(DBP) Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Digital Banking Platforms(DBP) Market, By Type 6.1. Introduction 6.2. On-premises 6.3. Cloud Chapter 7. Global Digital Banking Platforms(DBP) Market, By Application 7.1. Introduction 7.2. Online Banking 7.3. Mobile Banking Chapter 8. Global Digital Banking Platforms(DBP) Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Type, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Type, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. BNY Mellon 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Finastra 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. TCS 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Oracle 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Intellect Design Arena 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. SAP 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Fiserv 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Backbase 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 EdgeVerve Systems 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. Sopra 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology