Cyber Insurance Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

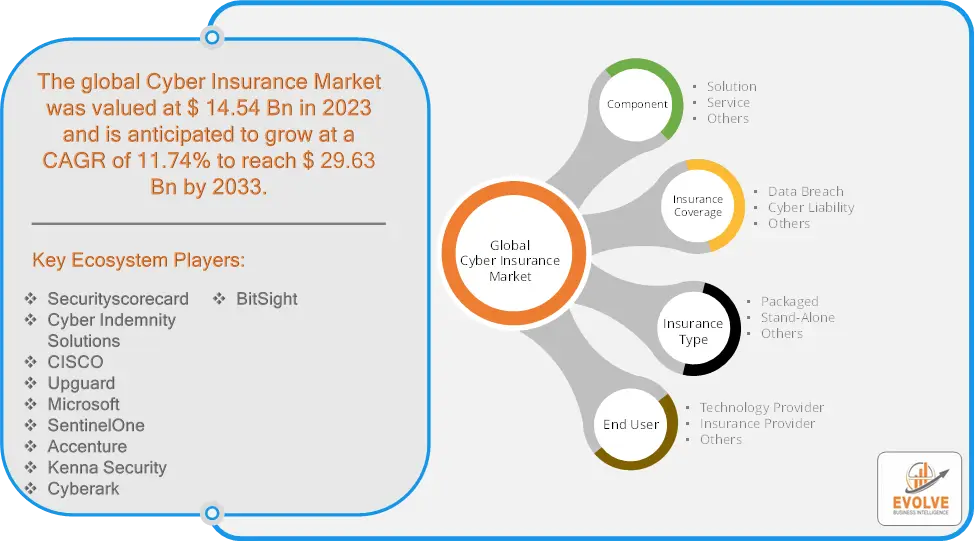

Cyber Insurance Market Research Report: Information By Component (Solution, Service, Others), By Insurance Coverage (Data Breach, Cyber Liability, Others), By Insurance Type (Packaged, Stand-Alone, Others), By End-User (Technology Provider, Insurance Provider, Others), and by Region — Forecast till 2033

Page: 171

Cyber Insurance Market Overview

The Cyber Insurance Market Size is expected to reach USD 29.63 Billion by 2033. The Cyber Insurance Market industry size accounted for USD 14.54 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.74% from 2023 to 2033. The Cyber Insurance Market refers to the sector within the insurance industry that offers products designed to protect businesses and individuals against the financial risks associated with cyberattacks and data breaches. The cyber insurance market has been growing rapidly as the frequency and sophistication of cyberattacks increase, along with rising awareness of the potential financial impacts.

Insurers in this market often provide risk assessment services, helping clients identify vulnerabilities and implement measures to reduce their risk profile. The market is driven by factors such as increasing digitalization, evolving regulatory landscapes, and the need for businesses to protect themselves against potentially devastating cyber incidents.

Global Cyber Insurance Market Synopsis

The COVID-19 pandemic had a significant impact on the Cyber Insurance Market. The shift to remote work during the pandemic increased the exposure to cyber risks, as employees accessed company systems from home networks, which are often less secure. This heightened awareness of vulnerabilities and drove demand for cyber insurance policies to mitigate these risks. The pandemic accelerated digital transformation across various industries, increasing reliance on digital platforms and cloud services. As companies expanded their digital footprint, they recognized the need for cyber insurance to protect against potential cyber threats. The pandemic highlighted the need for innovative cyber insurance products tailored to specific risks, such as coverage for remote work-related vulnerabilities or protection against emerging threats like supply chain attacks. The pandemic raised awareness among businesses of all sizes about the importance of cybersecurity, leading to a broader market for cyber insurance. This increased awareness presents an opportunity for insurers to educate potential clients about the benefits of cyber insurance.

Cyber Insurance Market Dynamics

The major factors that have impacted the growth of Cyber Insurance Market are as follows:

Drivers:

Ø Technological Advancements

Advances in technology enable insurers to offer more sophisticated and customized cyber insurance products, including risk assessment tools and incident response services. These innovations enhance the value proposition of cyber insurance. As businesses undergo digital transformation, they rely more heavily on digital platforms and cloud-based services, which increases their vulnerability to cyber threats. This digital shift underscores the need for cyber insurance to protect digital assets and operations. The rise of remote work, accelerated by the COVID-19 pandemic, has exposed organizations to new cybersecurity risks, as employees access corporate networks from potentially insecure home environments. This shift has increased the demand for cyber insurance policies tailored to remote work scenarios.

Restraint:

- Perception of High Premium Costs and Evolving Cyber Threats

The complexity of assessing cyber risks and the increasing frequency of claims have led to higher premiums, which can be prohibitive for small and medium-sized enterprises (SMEs) looking to purchase cyber insurance. Cyber threats are constantly evolving, with new attack vectors emerging regularly. Insurers must continuously update their coverage offerings to address these changes, which can be challenging and resource-intensive.

Opportunity:

⮚ Integration with Cybersecurity Services

Insurers can offer cyber insurance in conjunction with cybersecurity services, such as threat detection, incident response planning, and vulnerability assessments. This integrated approach provides added value to clients and enhances overall risk management. Leveraging artificial intelligence (AI) and data analytics for risk assessment, fraud detection, and claims management can improve the efficiency and accuracy of cyber insurance offerings. These technologies can enhance underwriting processes and better predict potential losses.

Cyber Insurance Market Segment Overview

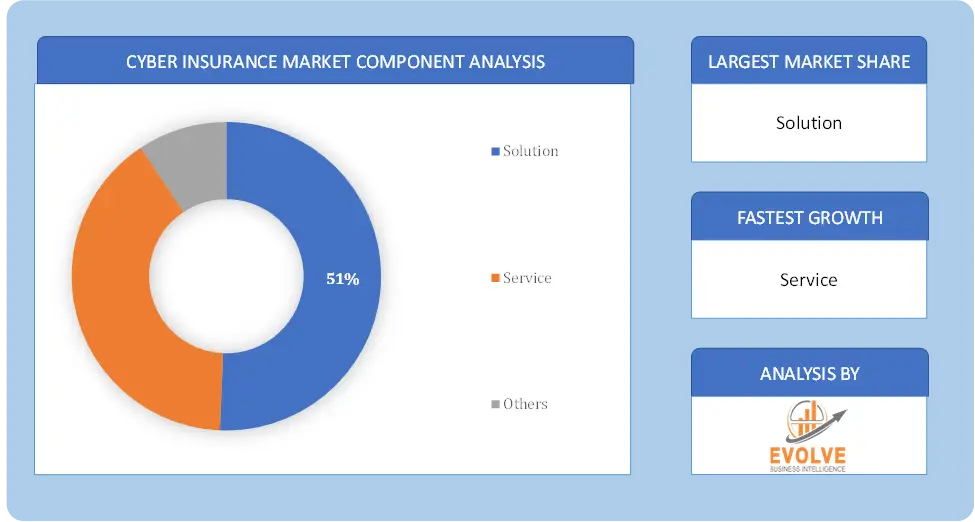

By Component

Based on Component, the market is segmented based on Solution, Service and Others. The services segment dominant the market The attributed to its vital role in assessing and managing cyber risks for organizations. Insurance providers offer comprehensive risk assessment services that assist businesses in identifying vulnerabilities, evaluating threats, and implementing effective risk mitigation strategies. This proactive approach to risk management is highly valued by organizations seeking robust protection against cyber threats, ensuring optimal data protection.

Based on Component, the market is segmented based on Solution, Service and Others. The services segment dominant the market The attributed to its vital role in assessing and managing cyber risks for organizations. Insurance providers offer comprehensive risk assessment services that assist businesses in identifying vulnerabilities, evaluating threats, and implementing effective risk mitigation strategies. This proactive approach to risk management is highly valued by organizations seeking robust protection against cyber threats, ensuring optimal data protection.

By Insurance Coverage

Based on Insurance Coverage, the market segment has been divided into Data Breach, Cyber Liability and Others. The data breach segment dominant the cyber insurance market. This can be attributed to the fact that organizations now have legal responsibility to secure and handle sensitive data as a result of strict data protection laws such as, general data protection regulation (GDPR), and central consumer protecting authority (CCPA). Organizations can comply with these regulatory standards with the use of cyber insurance market policies that cover cyber breach insurance data.

By Insurance Type

Based on Insurance Type, the market segment has been divided into Packaged, Stand-Alone and Others. This Stand-Alone segment dominant the market. Standalone cyber insurance policies are tailored specifically to address the complex nature of cyber threats, providing comprehensive protection against a wide range of cyber incidents such as data breaches, cyber theft, and ransomware attacks. These policies are highly customizable, allowing businesses to adjust coverages based on their specific risk exposures and security needs.

By End User

Based on End User, the market segment has been divided into Technology Provider, Insurance Provider and Others. The Insurance Provider segment dominant the market.

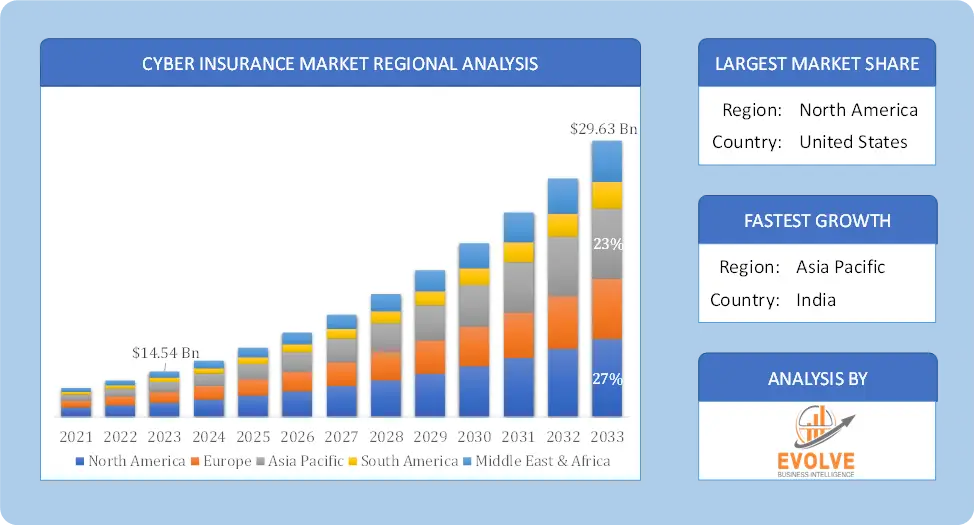

Global Cyber Insurance Market Regional Analysis

Based on region, the global Cyber Insurance Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Cyber Insurance Market followed by the Asia-Pacific and Europe regions.

Cyber Insurance North America Market

Cyber Insurance North America Market

North America holds a dominant position in the Cyber Insurance Market. North America, particularly the United States, is the largest market for cyber insurance. This is due to its high level of digital infrastructure, advanced technology adoption, and stringent data protection regulations. The presence of numerous tech companies, high frequency of cyberattacks, and regulatory requirements such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) drive demand.

Cyber Insurance Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Cyber Insurance Market industry. The Asia-Pacific region is rapidly expanding due to increasing digitalization, especially in countries like China, India, Japan, and South Korea. The rise in digital infrastructure, growing e-commerce, and increasing cyber threats are major factors and the market is still developing, and there are varying levels of regulatory frameworks and awareness across countries. This creates a fragmented market landscape.

Competitive Landscape

The global Cyber Insurance Market is highly competitive, with numerous players offering a wide range of solution. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Securityscorecard

- Cyber Indemnity Solutions

- CISCO

- Upguard

- Microsoft

- SentinelOne

- Accenture

- Kenna Security

- Cyberark

- BitSight

Key Development

In March 2024, HSB, a specialty insurer owned by Munich Re, has lately revealed its intention to offer insurance coverage for clients affected by cyber attacks related to automobiles, as stated in a press statement released by the firm.

In March 2023, An alliance was formed between F-Secure and Allianz Partners in order to produce an all-encompassing cyber security suite that integrates insurance, protection, and prevention. The suite was provided by F-Secure, Allianz, and their respective partners. The recently formed collaborative alliance provided an all-encompassing assortment of insurance policies pertaining to cyber security and cyber care. It included parental control, browsing and banking protection, protection against virus and malware, and ID monitoring.

Scope of the Report

Global Cyber Insurance Market, by Component

- Solution

- Service

- Others

Global Cyber Insurance Market, by Insurance Coverage

- Data Breach

- Cyber Liability

- Others

Global Cyber Insurance Market, by Insurance Type

- Packaged

- Stand-Alone

- Others

Global Cyber Insurance Market, by End User

- Technology Provider

- Insurance Provider

- Others

Global Cyber Insurance Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $29.63 Billion |

| CAGR | 11.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Component, Insurance Coverage, Insurance Type, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Securityscorecard, Cyber Indemnity Solutions, CISCO, Upguard, Microsoft, SentinelOne, Accenture, Kenna Security, Cyberark and BitSight |

| Key Market Opportunities | • Integration with Cybersecurity Services • Utilizing AI and Data Analytics |

| Key Market Drivers | • Technological Advancements • Digital Transformation |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Cyber Insurance Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Cyber Insurance Market historical market size for the year 2021, and forecast from 2023 to 2033

- Cyber Insurance Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Cyber Insurance Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Cyber Insurance Market is 2021- 2033

What is the growth rate of the global Cyber Insurance Market?

The global Cyber Insurance Market is growing at a CAGR of 11.74% over the next 10 years

Which region has the highest growth rate in the market of Cyber Insurance Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Cyber Insurance Market?

North America holds the largest share in 2022

Who are the key players in the global Cyber Insurance Market?

Securityscorecard, Cyber Indemnity Solutions, CISCO, Upguard, Microsoft, SentinelOne, Accenture, Kenna Security, Cyberark and BitSight are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Cyber Insurance Market 4.3.1. Impact on Market Size 4.3.2. End-User Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Cyber Insurance Market, By Component 6.1. Introduction 6.2. Solution 6.3. Service 6.4. Others Chapter 7. Global Cyber Insurance Market, By Insurance Coverage 7.1. Introduction 7.2. Data breach 7.3. Cyber liability 7.4. Others Chapter 8. Global Cyber Insurance Market, By Insurance Type 8.1. Introduction 8.2. Packaged 8.3. Stand-Alone 8.4. Others Chapter 9. Global Cyber Insurance Market, By End-User 9.1. Introduction 9.2. Technology provider 9.3. Insurance provider 9.4. Others Chapter 10. Global Cyber Insurance Market, By Region 10.1. Introduction 10.2. North America 10.2.1. Introduction 10.2.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.3. Market Size and Forecast, By Country, 2020 - 2028 10.2.4. Market Size and Forecast, By Component, 2020 - 2028 10.2.5. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.2.6. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.2.7. Market Size and Forecast, By End-User, 2020 - 2028 10.2.8. US 10.2.8.1. Introduction 10.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.2.8.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.2.8.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.2.8.6. Market Size and Forecast, By End-User, 2020 - 2028 10.2.9. Canada 10.2.9.1. Introduction 10.2.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.2.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.2.9.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.2.9.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.2.9.6. Market Size and Forecast, By End-User, 2020 - 2028 10.3. Europe 10.3.1. Introduction 10.3.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.3. Market Size and Forecast, By Country, 2020 - 2028 10.3.4. Market Size and Forecast, By Component, 2020 - 2028 10.3.5. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.3.6. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.3.7. Market Size and Forecast, By End-User, 2020 - 2028 10.3.8. Germany 10.3.8.1. Introduction 10.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.8.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.3.8.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.3.8.6. Market Size and Forecast, By End-User, 2020 - 2028 10.3.9. France 10.3.9.1. Introduction 10.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.9.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.3.9.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.3.9.6. Market Size and Forecast, By End-User, 2020 - 2028 10.3.10. UK 10.3.10.1. Introduction 10.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.10.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.10.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.3.10.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.3.10.6. Market Size and Forecast, By End-User, 2020 - 2028 10.3.11. Italy 10.3.11.1. Introduction 10.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.11.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.11.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.3.11.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.3.11.6. Market Size and Forecast, By End-User, 2020 - 2028 10.3.12. Rest Of Europe 10.3.12.1. Introduction 10.3.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.3.12.3. Market Size and Forecast, By Component, 2020 - 2028 10.3.12.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.3.12.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.3.12.6. Market Size and Forecast, By End-User, 2020 - 2028 10.4. Asia-Pacific 10.4.1. Introduction 10.4.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.3. Market Size and Forecast, By Country, 2020 - 2028 10.4.4. Market Size and Forecast, By Component, 2020 - 2028 10.4.5. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.4.6. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.4.7. Market Size and Forecast, By End-User, 2020 - 2028 10.4.8. China 10.4.8.1. Introduction 10.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.8.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.4.8.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.4.8.6. Market Size and Forecast, By End-User, 2020 - 2028 10.4.9. India 10.4.9.1. Introduction 10.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.9.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.4.9.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.4.9.6. Market Size and Forecast, By End-User, 2020 - 2028 10.4.10. Japan 10.4.10.1. Introduction 10.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.10.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.10.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.4.10.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.4.10.6. Market Size and Forecast, By End-User, 2020 - 2028 10.4.11. South Korea 10.4.11.1. Introduction 10.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.11.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.11.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.4.11.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.4.11.6. Market Size and Forecast, By End-User, 2020 - 2028 10.4.12. Rest Of Asia-Pacific 10.4.12.1. Introduction 10.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 10.4.12.3. Market Size and Forecast, By Component, 2020 - 2028 10.4.12.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.4.12.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.4.12.6. Market Size and Forecast, By End-User, 2020 - 2028 10.5. Rest Of The World (RoW) 10.5.1. Introduction 10.5.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.3. Market Size and Forecast, By Component, 2020 - 2028 10.5.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.5.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.5.6. Market Size and Forecast, By End-User, 2020 - 2028 10.5.7. Market Size and Forecast, By Region, 2020 - 2028 10.5.8. South America 10.5.8.1. Introduction 10.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.8.3. Market Size and Forecast, By Component, 2020 - 2028 10.5.8.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.5.8.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.5.8.6. Market Size and Forecast, By End-User, 2020 - 2028 10.5.9. Middle East & Africa 10.5.9.1. Introduction 10.5.9.2. Driving Factors, Opportunity Analyzed and Key Trends 10.5.9.3. Market Size and Forecast, By Component, 2020 - 2028 10.5.9.4. Market Size and Forecast, By Insurance Coverage, 2020 - 2028 10.5.9.5. Market Size and Forecast, By Insurance Type, 2020 - 2028 10.5.9.6. Market Size and Forecast, By End-User, 2020 - 2028 Chapter 11. Competitive Landscape 11.1. Introduction 11.2. Vendor Share Analysis, 2020/Key Players Positioning, 2020 Chapter 12. Company Profiles 12.1. Securityscorecard 12.1.1. Business Overview 12.1.2. Financial Analysis 12.1.3. Product Portfolio 12.1.4. Recent Development and Strategies Adopted 12.1.5. SWOT Analysis 12.2. Cyber Indemnity Solutions 12.2.1. Business Overview 12.2.2. Financial Analysis 12.2.3. Product Portfolio 12.2.4. Recent Development and Strategies Adopted 12.2.5. SWOT Analysis 12.3. CISCO 12.3.1. Business Overview 12.3.2. Financial Analysis 12.3.3. Product Portfolio 12.3.4. Recent Development and Strategies Adopted 12.3.5. SWOT Analysis 12.4. Upguard 12.4.1. Business Overview 12.4.2. Financial Analysis 12.4.3. Product Portfolio 12.4.4. Recent Development and Strategies Adopted 12.4.5. SWOT Analysis 12.5. Microsoft 12.5.1. Business Overview 12.5.2. Financial Analysis 12.5.3. Product Portfolio 12.5.4. Recent Development and Strategies Adopted 12.5.5. SWOT Analysis 12.6. Sentinelone 12.6.1. Business Overview 12.6.2. Financial Analysis 12.6.3. Product Portfolio 12.6.4. Recent Development and Strategies Adopted 12.6.5. SWOT Analysis 12.7. Accenture 12.7.1. Business Overview 12.7.2. Financial Analysis 12.7.3. Product Portfolio 12.7.4. Recent Development and Strategies Adopted 12.7.5. SWOT Analysis 12.8. Kenna Security 12.8.1. Business Overview 12.8.2. Financial Analysis 12.8.3. Product Portfolio 12.8.4. Recent Development and Strategies Adopted 12.8.5. SWOT Analysis 12.9. Cyberark 12.9.1. Business Overview 12.9.2. Financial Analysis 12.9.3. Product Portfolio 12.9.4. Recent Development and Strategies Adopted 12.9.5. SWOT Analysis 12.10. Bitsight 12.10.1. Business Overview 12.10.2. Financial Analysis 12.10.3. Product Portfolio 12.10.4. Recent Development and Strategies Adopted 12.10.5. SWOT Analysis Chapter 13. Key Takeaways

Connect to Analyst

Research Methodology