Cultured Meat Market Analysis and Global Forecast 2024-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

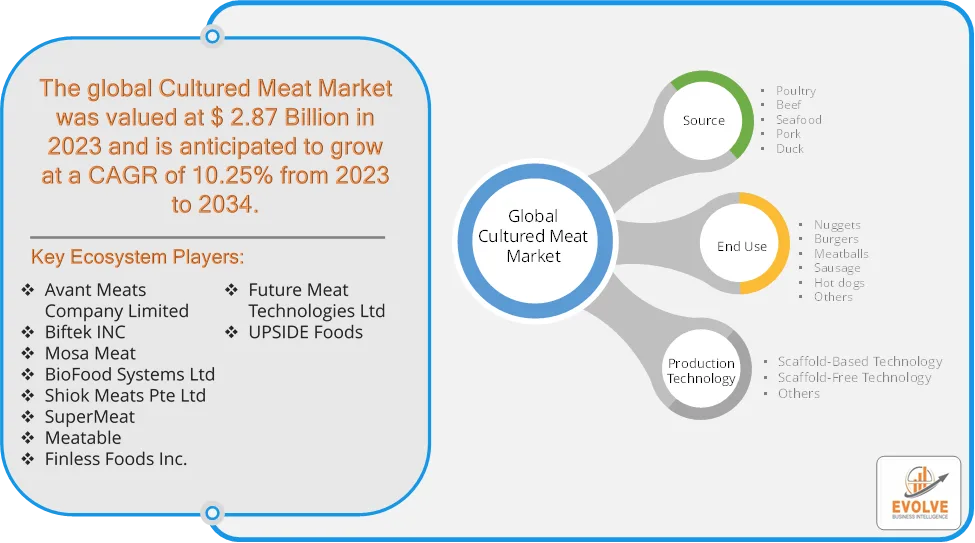

Cultured Meat Market Research Report: Information By Source (Poultry, Beef, Seafood, Pork, and Duck), By End Use (Nuggets, Burgers, Meatballs, Sausage, Hot dogs, and Others), By Production Technology (Scaffold-Based Technology, Scaffold-Free Technology, Others), and by Region — Forecast till 2034

Page: 129

Cultured Meat Market Overview

The Cultured Meat Market size accounted for USD 6.51 Billion in 2023 and is estimated to account for 7.21 Billion in 2024. The Market is expected to reach USD 13.85 Billion by 2034 growing at a compound annual growth rate (CAGR) of 10.25% from 2024 to 2034. The Cultured Meat Market is a rapidly growing segment of the alternative protein industry, driven by advancements in cellular agriculture, increasing concerns over sustainability, and the need for ethical meat production. Cultured meat, also known as lab-grown or cell-based meat, is produced by culturing animal cells in a controlled environment, eliminating the need for traditional livestock farming.

The cultured meat market is expected to witness exponential growth over the next decade as production costs decline and regulatory approvals expand. With increasing consumer awareness and technological advancements, cultured meat is set to revolutionize the global protein industry.

Global Cultured Meat Market Synopsis

Cultured Meat Market Dynamics

Cultured Meat Market Dynamics

The major factors that have impacted the growth of Cultured Meat Market are as follows:

Drivers:

Ø Growing Ethical Concerns & Animal Welfare

Increasing demand for cruelty-free meat due to ethical concerns over factory farming and animal slaughter. Cultured meat eliminates the need for mass animal farming, aligning with vegan, vegetarian, and flexitarian values. Innovations in cell culture techniques, bioreactors, and growth media are driving down production costs. Development of plant-based and animal-free growth mediums is making the process more sustainable and scalable and 3D bioprinting and tissue engineering technologies are improving texture and taste to match conventional meat.

Restraint:

- High Production Costs and Consumer Acceptance & Perception Issues

Cultured meat production is significantly more expensive than traditional meat due to the cost of growth media, bioreactors, and cell culture technology. Growth factors and serum-free media alternatives are still under development, which affects scalability. Many consumers are skeptical about lab-grown food, often associating it with unnatural or artificial production. Taste, texture, and appearance must match conventional meat to encourage adoption and religious and cultural dietary preferences (e.g., Halal, Kosher) may limit its appeal in certain markets.

Opportunity:

⮚ Cost Reduction & Technological Advancements

Innovations in cell culture media (e.g., plant-based or synthetic alternatives to fetal bovine serum) can significantly reduce production costs. Advances in bioreactor technology and 3D tissue engineering are improving scalability and efficiency and AI and automation can enhance cell growth processes, making production more efficient. Consumers are increasingly aware of climate change, deforestation, and ethical concerns related to meat production. Millennials and Gen Z are more open to alternative proteins, creating a ready market for cultured meat and rising interest in flexitarian, vegetarian, and vegan diets supports demand for sustainable meat options.

Cultured Meat Market Segment Overview

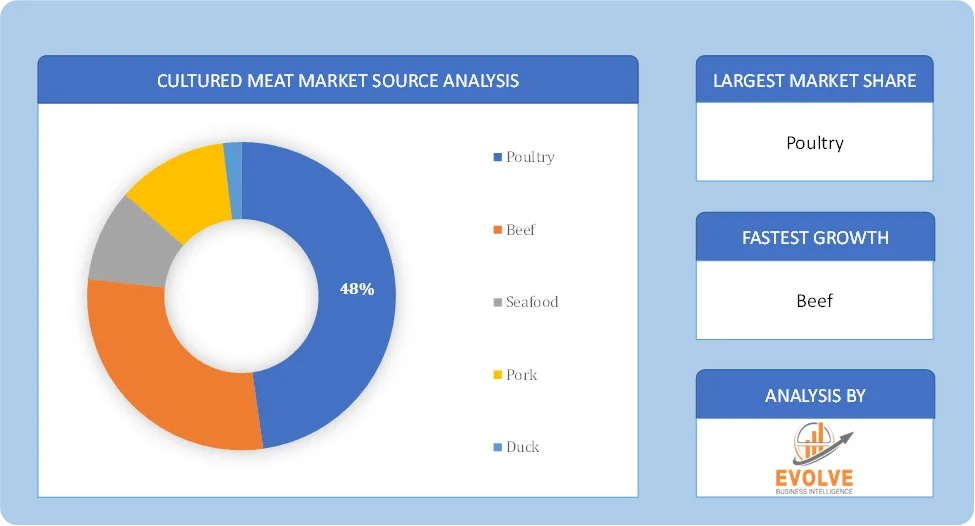

Based on Source, the market is segmented based on Poultry, Beef, Seafood, Pork, and Duck. The Poultry segment dominant the market. poultry is a key focus area for the cultured meat industry, as it is easier to produce than other types, such as beef and pork. The more straightforward cellular structure of poultry enables more efficient growth and development in lab settings, thus making it the first product to be commercially viable in the cultured meat sector.

By End Use

Based on End Use, the market segment has been divided into Nuggets, Burgers, Meatballs, Sausage, Hot dogs, and Others. The Burgers segment dominant the market. Due to rising consumer demand for ethical and sustainable beef substitutes, the cultured burger market is predicted to rise. Burgers made from cultured meat may help the meat business have a smaller negative impact on the environment.

By Production Technology

Based on Production Technology, the market segment has been divided into Scaffold-Based Technology, Scaffold-Free Technology, Others. The Scaffold-Based Technology segment dominant the market. scaffold-based technology is the most advanced and commercially viable method for producing complex, structured meats. This technology takes the growth of animal cells on a scaffold, mimics the extracellular matrix that supports tissue in living organisms, and thus allows the manufacture of high-quality, textured meat.

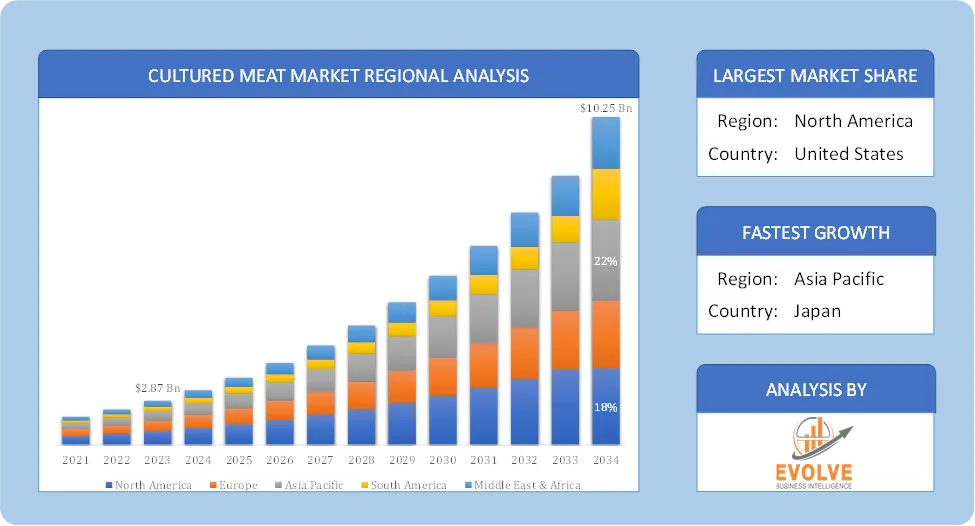

Global Cultured Meat Market Regional Analysis

Based on region, the global Cultured Meat Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Cultured Meat Market followed by the Asia-Pacific and Europe regions.

North America Cultured Meat Market

North America Cultured Meat Market

North America holds a dominant position in the Cultured Meat Market. North America is one of the leading regions in the cultured meat market, driven by strong R&D, government funding, and early regulatory approvals. The U.S. FDA and USDA have approved cultured meat products, making the U.S. a key market. There’s a growing awareness of alternative proteins and a relatively high level of consumer interest in sustainable food options and However, consumer acceptance still varies, and education is crucial.

Asia-Pacific Cultured Meat Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Cultured Meat Market industry. Asia-Pacific is expected to be a major growth market due to its large population and increasing demand for protein. Singapore is the first country to approve commercial sales of cultured meat. Food security is a significant concern in many parts of Asia, driving interest in alternative protein sources and there is a growing middle class that is increasingly interested in better food options.

Competitive Landscape

The global Cultured Meat Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Avant Meats Company Limited

- Biftek INC

- Mosa Meat

- BioFood Systems Ltd

- Shiok Meats Pte Ltd

- SuperMeat

- Meatable

- Finless Foods Inc.

- Future Meat Technologies Ltd

- UPSIDE Foods.

Scope of the Report

Global Cultured Meat Market, by Source

- Poultry

- Beef

- Seafood

- Pork

- Duck

Global Cultured Meat Market, by End Use

- Nuggets

- Burgers

- Meatballs

- Sausage

- Hot dogs

- Others

Global Cultured Meat Market, by Production Technology

- Scaffold-Based Technology

- Scaffold-Free Technology

- Others

Global Cultured Meat Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 10.25 Billion |

| CAGR (2024-2034) | 8.21% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Source, End Use, Production Technology |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Avant Meats Company Limited, Biftek INC, Mosa Meat, BioFood Systems Ltd, Shiok Meats Pte Ltd, SuperMeat, Meatable, Finless Foods Inc., Future Meat Technologies Ltd and UPSIDE Foods. |

| Key Market Opportunities | · Cost Reduction & Technological Advancements · Growing Consumer Demand for Sustainable & Ethical Protein |

| Key Market Drivers | · Growing Ethical Concerns & Animal Welfare |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Cultured Meat Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Cultured Meat Market historical market size for the year 2021, and forecast from 2023 to 2033

- Cultured Meat Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Cultured Meat Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Cultured Meat Market is 2021- 2033

What is the growth rate of the global Cultured Meat Market?

The global Cultured Meat Market is growing at a CAGR of 8.21% over the next 10 years

Which region has the highest growth rate in the market of Cultured Meat Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Cultured Meat Market?

North America holds the largest share in 2022

Who are the key players in the global Cultured Meat Market?

Avant Meats Company Limited, Biftek INC, Mosa Meat, BioFood Systems Ltd, Shiok Meats Pte Ltd, SuperMeat, Meatable, Finless Foods Inc., Future Meat Technologies Ltd and UPSIDE Foods. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Contents

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Source Segement – Market Opportunity Score

4.1.2. Production Technology Segment – Market Opportunity Score

4.1.3. End Use Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Cultured Meat Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Cultured Meat Market, By Source

7.1. Introduction

7.1.1. Poultry

7.1.2 Beef

7.1.3 Seafood

7.1.4 Pork

7.1.5 Duck

CHAPTER 8 Cultured Meat Market, By Production Technology

8.1. Introduction

8.1.1. Scaffold-Based Technology

8.1.2. Scaffold-Free Technology

8.1.3. Others

CHAPTER 9. Cultured Meat Market, By End Use

9.1. Introduction

9.1.1. Nuggets

9.1.2. Burgers

9.1.3. Meatballs

9.1.4. Sausage

9.1.5. Hot dogs

9.1.6. Beverages

9.1.7. Others

CHAPTER 10. Cultured Meat Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Source, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Production Technology, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. Avant Meats Company Limited

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. Biftek INC

13.3. Mosa Meat

13.4. BioFood Systems Ltd

13.5. Shiok Meats Pte Ltd

13.6. SuperMeat

13.7. Meatable

13.8. Finless Foods Inc.

13.9 Future Meat Technologies Ltd

13.10 UPSIDE Foods.

Connect To Analyst

Research Methodology