Cross-border E-commerce Logistics Market Analysis and Global Forecast 2024-2034

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

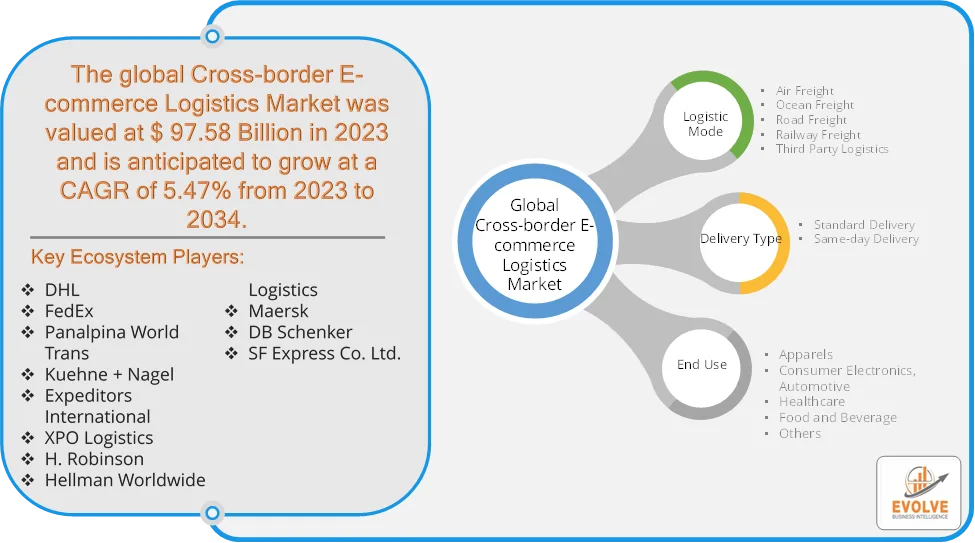

Cross-border E-commerce Logistics Market Research Report: Information By Logistics Mode (Air Freight, Ocean Freight, Road Freight, Railway Freight, Third Party Logistics), By Delivery Type (Standard Delivery, Same-day Delivery), End Use (Apparels, Consumer Electronics, Automotive, Healthcare, Food and Beverage, Others), and by Region — Forecast till 2034

Page: 165

Cross-border E-commerce Logistics Market Overview

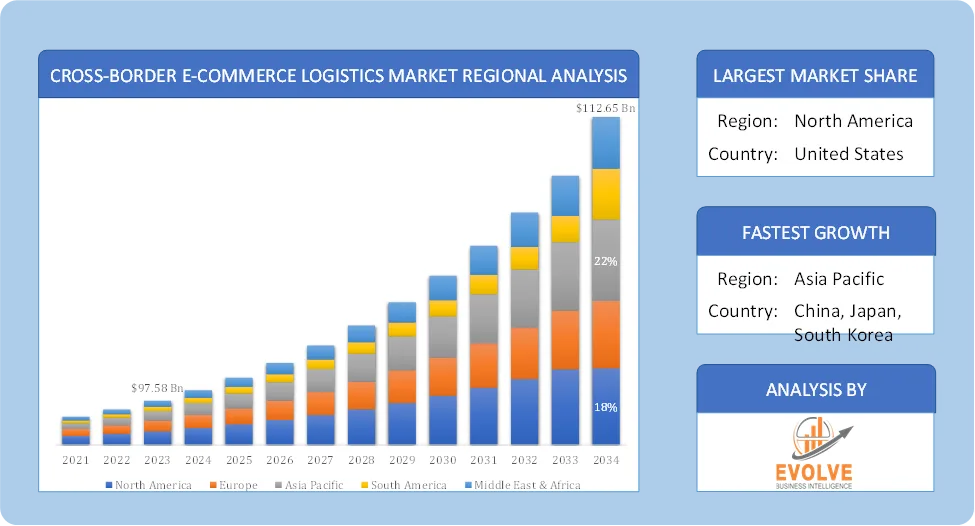

The Cross-border E-commerce Logistics Market size accounted for USD 97.58 Billion in 2023 and is estimated to account for 102.36 Billion in 2024. The Market is expected to reach USD 112.65 Billion by 2034 growing at a compound annual growth rate (CAGR) of 5.47% from 2024 to 2034. The cross-border e-commerce logistics market is experiencing significant growth, driven by the increasing popularity of online shopping and the desire of consumers to access a wider range of products from international markets. This necessitates sophisticated logistics networks to manage the complexities of international shipments, including transportation, warehousing, customs clearance, and last-mile delivery.

The cross-border e-commerce logistics market is dynamic and continues to evolve rapidly. Businesses that can effectively navigate the complexities and leverage emerging trends will be well-positioned to capitalize on the significant growth opportunities in this global marketplace.

Global Cross-border E-commerce Logistics Market Synopsis

Cross-border E-commerce Logistics Market Dynamics

Cross-border E-commerce Logistics Market Dynamics

The major factors that have impacted the growth of Cross-border E-commerce Logistics Market are as follows:

Drivers:

Ø Global Expansion of E-commerce

The rapid increase in online shopping worldwide has heightened the demand for efficient international logistics solutions. Consumers are increasingly purchasing products from overseas retailers, necessitating robust cross-border shipping and delivery services. Innovations such as blockchain technology, artificial intelligence (AI), and automation have enhanced supply chain efficiency and transparency. These technologies enable logistics providers to streamline operations, reduce costs, and improve delivery times. Enhancements in shipping options, such as faster air cargo services and efficient customs clearance procedures, have reduced delivery times and costs. These improvements make cross-border purchases more appealing to consumers and support the expansion of international e-commerce.

Restraint:

- High Logistics Costs and Infrastructure Limitations

International shipping often incurs higher expenses than domestic deliveries due to longer distances, multiple transportation modes, and additional fees like customs duties and value-added taxes (VAT). These costs can significantly impact e-commerce businesses’ profitability and lead to higher prices for consumers. Inadequate delivery infrastructure in certain regions can cause delays and inefficiencies in cross-border e-commerce logistics. Poor roads, limited connectivity, and congested ports or airports hinder the timely movement of goods, affecting customer satisfaction and increasing operational costs.

Opportunity:

⮚ Infrastructure Development

The integration of technologies such as blockchain, Internet of Things (IoT), and artificial intelligence (AI) is revolutionizing logistics operations. These innovations enhance supply chain transparency, improve tracking systems, and optimize delivery routes, leading to cost reductions and heightened customer satisfaction. Investments in logistics infrastructure, including warehouses, distribution centers, and transportation networks, are crucial to support the escalating demand in cross-border e-commerce.

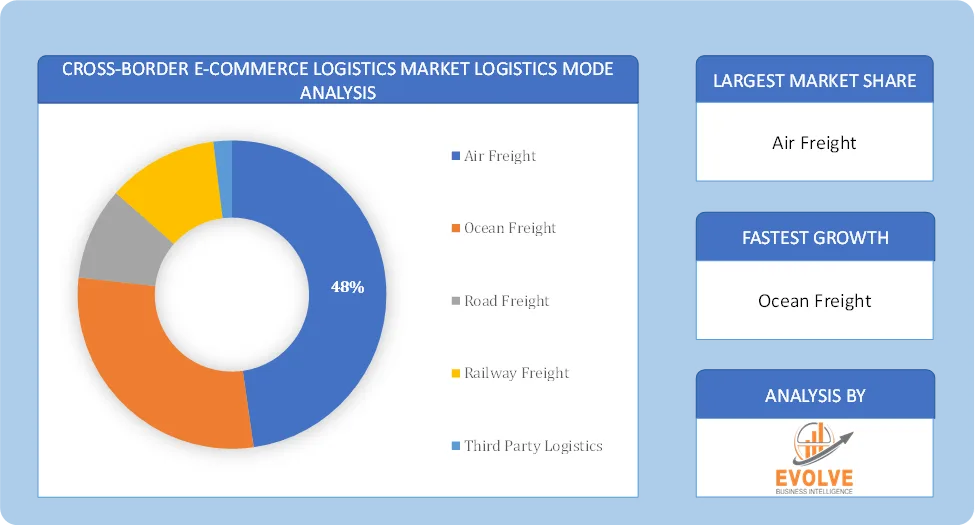

Cross-border E-commerce Logistics Market Segment Overview

Based on Logistics Mode, the market is segmented based on Air Freight, Ocean Freight, Road Freight, Railway Freight, Third Party Logistics. The Ocean Freight segment dominant the market. Ocean freight is generally more economical than air freight, making it suitable for shipping large volumes of goods where transit time is less critical. Freight forwarders are leveraging technology to optimize operations, offering value-added services like real-time tracking and inventory management to improve efficiency and customer satisfaction.

By Delivery Type

Based on Delivery Type, the market segment has been divided into Standard Delivery, Same-day Delivery. The Standard Delivery segment dominant the market. Standard delivery remains the most common option in cross-border e-commerce logistics, primarily due to its cost-effectiveness. The rise of online marketplaces has bolstered the standard delivery segment. Platforms like Amazon, Alibaba, and eBay have made it easier for sellers to reach international customers, who opt for standard delivery due to its affordability.

By End Use

Based on End Use, the market segment has been divided into Apparels, Consumer Electronics, Automotive, Healthcare, Food and Beverage, Others. The rapid spread of fashion trends across borders has fueled the demand for international apparel brands. Social media platforms and influencers play a significant role in promoting these trends, driving consumers to seek products from different parts of the world. Advanced technologies like AI and big data are enhancing the consumer shopping experience by offering personalized recommendations and seamless cross-border transactions.

Global Cross-border E-commerce Logistics Market Regional Analysis

Based on region, the global Cross-border E-commerce Logistics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Cross-border E-commerce Logistics Market followed by the Asia-Pacific and Europe regions.

North America Cross-border E-commerce Logistics Market

North America Cross-border E-commerce Logistics Market

North America holds a dominant position in the Cross-border E-commerce Logistics Market. The headquarters of global e-commerce giants like Amazon and eBay in North America contribute significantly to cross-border trade and logistics activities. The region boasts a well-established and advanced logistics infrastructure, facilitating efficient cross-border transportation and delivery and Consumers in North America often seek out unique or competitively priced products from overseas markets.

Asia-Pacific Cross-border E-commerce Logistics Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Cross-border E-commerce Logistics Market industry. China as the world’s largest e-commerce market, China is a major driver of cross-border logistics in the region, with significant import and export volumes and With a rapidly growing internet user base and increasing adoption of online shopping, India presents a substantial growth opportunity for cross-border e-commerce logistics. Growing economic prosperity, particularly in countries like China and India, increases consumers’ purchasing power and their willingness to buy international goods.

Competitive Landscape

The global Cross-border E-commerce Logistics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- DHL

- FedEx

- Panalpina World Trans

- Kuehne + Nagel

- Expeditors International

- XPO Logistics

- Robinson

- Hellman Worldwide Logistics

- Maersk

- DB Schenker

- SF Express Co. Ltd.

Scope of the Report

Global Cross-border E-commerce Logistics Market, by Logistics Mode

- Air Freight

- Ocean Freight

- Road Freight

- Railway Freight

- Third Party Logistics

Global Cross-border E-commerce Logistics Market, by Delivery Type

- Standard Delivery

- Same-day Delivery

Global Cross-border E-commerce Logistics Market, by End Use

- Apparels

- Consumer Electronics

- Automotive

- Healthcare

- Food and Beverage

- Others

Global Cross-border E-commerce Logistics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2034: USD 112.65 Billion |

| CAGR (2024-2034) | 5.47% |

| Base year | 2022 |

| Forecast Period | 2024-2034 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Logistics Mode, Delivery Type, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | DHL, FedEx, Panalpina World Trans, Kuehne + Nagel, Expeditors International, XPO Logistics, H. Robinson, Hellman Worldwide Logistics, Maersk, DB Schenker and SF Express Co. Ltd. |

| Key Market Opportunities | · Infrastructure Development |

| Key Market Drivers | · Global Expansion of E-commerce · Technological Advancements |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Cross-border E-commerce Logistics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Cross-border E-commerce Logistics Market historical market size for the year 2021, and forecast from 2023 to 2033

- Cross-border E-commerce Logistics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Cross-border E-commerce Logistics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Cross-border E-commerce Logistics Market is 2021- 2033

What is the growth rate of the global Cross-border E-commerce Logistics Market?

The global Cross-border E-commerce Logistics Market is growing at a CAGR of 5.47% over the next 10 years

Which region has the highest growth rate in the market of Cross-border E-commerce Logistics Market?

Asia Pacific is expected to register the highest CAGR during 2024-2034

Which region has the largest share of the global Cross-border E-commerce Logistics Market?

North America holds the largest share in 2022

Who are the key players in the global Cross-border E-commerce Logistics Market?

DHL, FedEx, Panalpina World Trans, Kuehne + Nagel, Expeditors International, XPO Logistics, H. Robinson, Hellman Worldwide Logistics, Maersk, DB Schenker and SF Express Co. Ltd. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary

CHAPTER 2. Scope of the Study

2.1. Market Definition

2.2. Market Scope & Segmentation

2.2.1. Objective of Report

CHAPTER 3. Evolve BI Methodology

3.1. Data Collection & Validation Approach

3.2. Market Size Estimation and Forecast

CHAPTER 4. Exclusive Analysis

4.1. Market Opportunity Score

4.1.1. Logistics Mode Segement – Market Opportunity Score

4.1.2. Delivery Type Segment – Market Opportunity Score

4.1.3. End Use Segment – Market Opportunity Score

4.2. Key Market Influencing Indicators

CHAPTER 5. Market Insights and Trends

5.1. Value Chain Analysis

5.1.1. Raw Material

5.1.2. Manufacturing Process

5.1.3. Distribution Channel

5.1.4. End User

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining Power of Buyers

5.2.2. Bargaining Power of Suppliers

5.2.3. Threat of New Entrant

5.2.4. Threat of Substitute

5.2.5. Industry Rivalry

5.3. COVID-19 Impact and Post COVID Scenario on Cross-border E-commerce Logistics Market Market

5.3.1. Impact of COVID-19

5.3.2. Government Support and Industry Revival Policies

5.3.3. Measures Taken by Companies to Mitigate Negative Impact

5.3.4. Post COVID Trend

CHAPTER 6. Market Dynamics

6.1. Introduction

6.2. Drivers

6.2.1. Driver 1

6.2.2. Driver 2

6.2.3. Driver 3

6.3. Restraints

6.3.1. Restraint 1

6.3.2. Restraint 2

6.4. Opportunity

6.4.1. Opportunity 1

CHAPTER 7. Cross-border E-commerce Logistics Market Market, By Logistics Mode

7.1. Introduction

7.1.1. Air Freight

7.1.2 Ocean Freight

7.1.3. Road Freight

7.1.4. Railway Freight

7.1.5. Third Party Logistics

CHAPTER 8 Cross-border E-commerce Logistics Market Market, By Delivery Type

8.1. Introduction

8.1.1. Standard Delivery

8.1.2. Same-day Delivery

CHAPTER 9. Cross-border E-commerce Logistics Market Market, By End Use

9.1. Introduction

9.1.1. Apparels

9.1.2. Consumer Electronics

9.1.3. Automotive

9.1.4. Healthcare

9.1.5. Food and Beverage

9.1.6. Others

CHAPTER 10. Cross-border E-commerce Logistics Market Market, By Region

10.1. Introduction

10.2. NORTH AMERICA

10.2.1. North America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.2.2. North America: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.2.3. North America: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.2.4. North America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.5. US

10.2.5.1. US: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.2.5.2. US: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.2.5.3. US: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.6. CANADA

10.2.6.1. Canada: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.2.6.2. Canada: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.2.6.3. Canada: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.2.7. MEXICO

10.2.7.1. Mexico: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.2.7.2. Mexico: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.2.7.3. Mexico: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3. Europe

10.3.1. Europe: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.3.2. Europe: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.3. Europe: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.4. Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.5. U.K.

10.3.5.1. U.K.: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.5.2. U.K.: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.5.3. U.K.: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.6. GERMANY

10.3.6.1. Germany: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.6.2. Germany: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.6.3. Germany: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.7. FRANCE

10.3.7.1. France: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.7.2. France: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.7.3. France: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.8. ITALY

10.3.8.1. Italy: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.8.2. Italy: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.8.3. Italy: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.9. SPAIN

10.3.9.1. Spain: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.9.2. Spain: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.9.3. Spain: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.10. BENELUX

10.3.10.1. BeNeLux: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.10.2. BeNeLux: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.10.3. BeNeLux: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.11. RUSSIA

10.3.11.1. Russia: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.11.2. Russia: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.11.3. Russia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.3.12. REST OF EUROPE

10.3.12.1. Rest of Europe: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.3.12.2. Rest of Europe: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.3.12.3. Rest of Europe: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4. Asia Pacific

10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.4.2. Asia Pacific: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.3. Asia Pacific: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.4. Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.5. CHINA

10.4.5.1. China: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.5.2. China: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.5.3. China: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.6. JAPAN

10.4.6.1. Japan: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.6.2. Japan: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.6.3. Japan: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.7. INDIA

10.4.7.1. India: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.7.2. India: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.7.3. India: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.8. SOUTH KOREA

10.4.8.1. South Korea: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.8.2. South Korea: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.8.3. South Korea: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.9. THAILAND

10.4.9.1. Thailand: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.9.2. Thailand: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.9.3. Thailand: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.10. INDONESIA

10.4.10.1. Indonesia: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.10.2. Indonesia: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.10.3. Indonesia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.11. MALAYSIA

10.4.11.1. Malaysia: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.11.2. Malaysia: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.11.3. Malaysia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.12. AUSTRALIA

10.4.12.1. Australia: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.12.2. Australia: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.12.3. Australia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.4.13. REST FO ASIA PACIFIC

10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5. South America

10.5.1. South America: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.5.2. South America: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.5.3. South America: Market Size and Forecast, By System, 2024 – 2034($ Million)

10.5.4. South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.5. BRAZIL

10.5.5.1. Brazil: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.5.5.2. Brazil: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.5.5.3. Brazil: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.6. ARGENTINA

10.5.6.1. Argentina: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.5.6.2. Argentina: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.5.6.3. Argentina: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.5.7. REST OF SOUTH AMERICA

10.5.7.1. Rest of South America: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.5.7.2. Rest of South America: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.5.7.3. Rest of South America: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6. Middle East & Africa

10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2024 – 2034($ Million)

10.6.2. Middle East & Africa: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.6.3. Middle East & Africa: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.6.4. Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.5. SAUDI ARABIA

10.6.5.1. Saudi Arabia: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.6.5.2. Saudi Arabia: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.6. UAE

10.6.6.1. UAE: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.6.6.2. UAE: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.6.6.3. UAE: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.7. EGYPT

10.6.7.1. Egypt: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.6.7.2. Egypt: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.6.7.3. Egypt: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.8. SOUTH AFRICA

10.6.8.1. South Africa: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.6.8.2. South Africa: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.6.8.3. South Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

10.6.9. REST OF MIDDLE EAST & AFRICA

10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Logistics Mode, 2024 – 2034($ Million)

10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Delivery Type, 2024 – 2034($ Million)

10.6.9.3.Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2024 – 2034($ Million)

CHAPTER 12. Competitive Landscape

12.1. Competitior Benchmarking 2023-

12.2. Market Share Analysis

12.3. Key Developments Analysis By Top 5 Companies

12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players

CHAPTER 13. Company Profiles

13.1. DHL

13.1.1. Hanon Systems

13.1.2. Financial Analysis

13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million

13.1.2.2. Geographic Revenue Mix, 2022 (% Share)

13.1.3. Product Portfolio

13.1.4. Recent Development and Strategies Adopted

13.1.5. SWOT Analysis

13.2. FedEx

13.3. Panalpina World Trans

13.4. Kuehne + Nagel

13.5. Expeditors International

13.6. XPO Logistics

13.7. H. Robinson

13.8. Hellman Worldwide Logistics

13.9 Maersk

13.10 DB Schenker

Connect to Analyst

Research Methodology