COVID-19 Sample Collection Kits Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

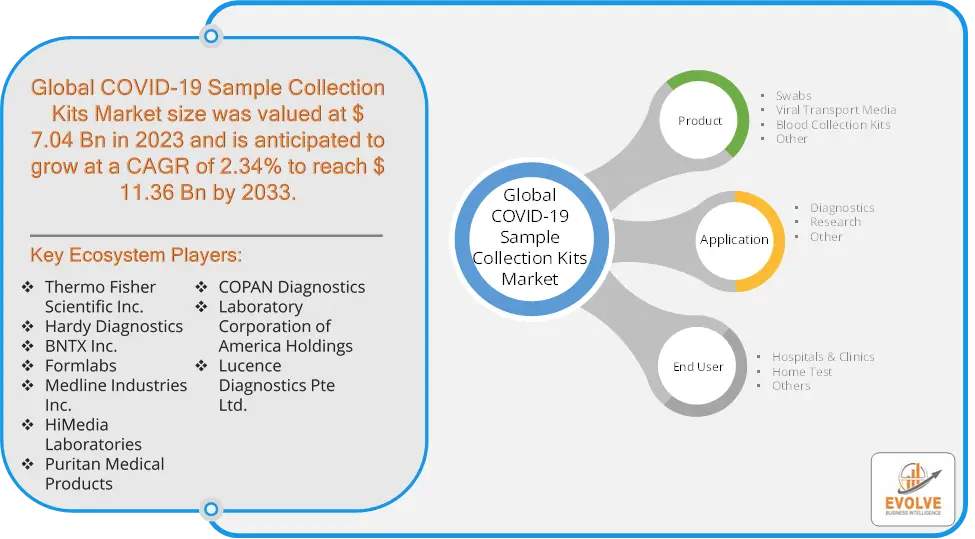

COVID-19 Sample Collection Kits Market Research Report: Information By Product Type (Swabs, Viral Transport Media, Blood Collection Kits, Other), By Application (Diagnostics, Research, Other), By End-Users (Hospitals & Clinics, Home Test, Others), and by Region — Forecast till 2033

Page: 165

COVID-19 Sample Collection Kits Market Overview

The COVID-19 Sample Collection Kits Market Size is expected to reach USD 11.36 Billion by 2033. The COVID-19 Sample Collection Kits Market industry size accounted for USD 7.04 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 2.34% from 2023 to 2033. The COVID-19 Sample Collection Kits Market refers to the segment of the healthcare and medical supplies industry that focuses on the production, distribution, and sales of kits used to collect biological samples for COVID-19 testing. These kits are essential for diagnosing and managing the spread of COVID-19 and typically include swabs, vials, transport media, and other necessary components for safely collecting and transporting samples, such as nasal or throat swabs, saliva, or blood, to testing laboratories.

The COVID-19 Sample Collection Kits Market has been critical in the global response to the pandemic, facilitating widespread testing and helping to inform public health decisions.

Global COVID-19 Sample Collection Kits Market Synopsis

The COVID-19 pandemic had a significant impact on the COVID-19 Sample Collection Kits Market. The pandemic created an unprecedented demand for COVID-19 testing, leading to a substantial increase in the production and distribution of sample collection kits. The pandemic drove the globalization of the sample collection kits market, with kits being distributed to both developed and developing regions. International collaborations and partnerships were formed to enhance the production capacity and distribution network. The initial phases of the pandemic saw disruptions in supply chains due to lockdowns and restrictions, affecting the availability of raw materials and components. The rapid scale-up of production and distribution posed logistical challenges, including transportation bottlenecks and regulatory hurdles. Innovations in packaging and storage solutions were developed to ensure the safe and effective transport of kits. Integration of digital technologies to streamline the testing process, such as automated sample processing and digital tracking systems, became more prevalent. The high demand for testing kits led to significant revenue growth for companies in this market. Rapid regulatory approvals were necessary to expedite the availability of testing kits, leading to streamlined processes for emergency use authorizations.

COVID-19 Sample Collection Kits Market Dynamics

The major factors that have impacted the growth of COVID-19 Sample Collection Kits Market are as follows:

Drivers:

- Technological Advancements

Development of less invasive and more efficient sample collection methods, such as saliva-based kits, has expanded market reach. Automated processing and integration with digital platforms have streamlined the testing process, making it more accessible and efficient. The emergence of new COVID-19 variants has sustained the need for ongoing testing and monitoring, driving demand for sample collection kits. Companies rapidly scaled up manufacturing capabilities to meet the heightened demand, increasing the availability of sample collection kits. Innovations in supply chain management have improved the efficiency and reliability of kit production and distribution.

Restraint:

- Perception of Cost and Pricing Pressures

The need for specialized materials and technologies can lead to increased production costs, affecting pricing and profitability. In regions with limited healthcare budgets, the cost of testing kits can be a barrier to widespread adoption. The rapid entry of multiple players into the market has increased competition, potentially leading to market saturation in some regions. Competitive pricing strategies may lead to reduced profit margins for manufacturers.

Opportunity:

⮚ Expansion of At-Home Testing

There is a growing demand for at-home testing kits due to their convenience and ease of use. Companies can capitalize on this trend by developing user-friendly kits that enable individuals to test themselves without visiting healthcare facilities. Integrating at-home testing kits with telehealth platforms can provide users with immediate access to healthcare professionals for guidance and result interpretation, enhancing the overall testing experience. Developing sustainable and biodegradable sample collection kits can appeal to environmentally conscious consumers and differentiate products in the market. Optimizing supply chain practices to reduce waste and improve efficiency can result in cost savings and a more sustainable business model.

COVID-19 Sample Collection Kits Market Segment Overview

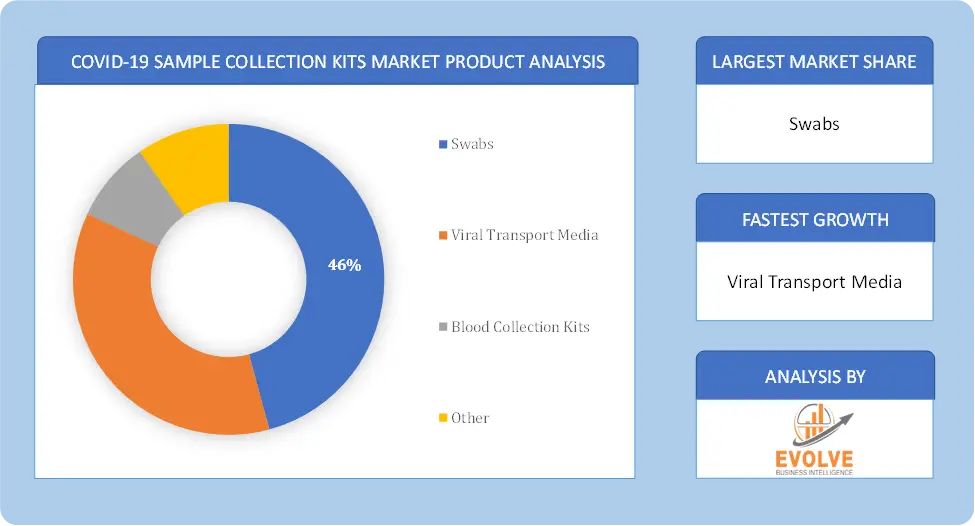

By Product Type

Based on Product Type, the market is segmented based on Swabs, Viral Transport Media, Blood Collection Kits and Other. The swabs segment dominated the market with the largest market. The market category for swabs COVID-19 sample kits accounted for the highest part of the overall market. This high percentage can be ascribed to the dependence on numerous diagnostic tools that have been approved, including nasopharyngeal swabs. The Centers for Disease Control and Prevention (CDC) state that samples can also be taken from the respiratory system if nasopharyngeal swabs are inadequate.

Based on Product Type, the market is segmented based on Swabs, Viral Transport Media, Blood Collection Kits and Other. The swabs segment dominated the market with the largest market. The market category for swabs COVID-19 sample kits accounted for the highest part of the overall market. This high percentage can be ascribed to the dependence on numerous diagnostic tools that have been approved, including nasopharyngeal swabs. The Centers for Disease Control and Prevention (CDC) state that samples can also be taken from the respiratory system if nasopharyngeal swabs are inadequate.

By Application

Based on Application, the market segment has been divided into Diagnostics, Research and Other. This Diagnostics segment is the fastest-growing segment. The COVID-19 sample collection kit permits samples collected from the patient’s nose using a designated self-collection kit that contains nasal swabs and saline. Such a high share is due to approvals for diagnostic tests by FDA for the COVID-19.

By End User

Based on End User, the market segment has been divided into Hospitals & Clinics, Home Test and Others. The hospitals and clinics segment dominant the sample collection kits. The exponential rise in hospitalization due to COVID-19 is primarily responsible for such market growth. As there is a global rise in COVID-19 cases, most hospitals are expanding their capabilities for the diagnosis of COVID-19. This has directly resulted in increased sample collection in the hospital settings through kits.

Global COVID-19 Sample Collection Kits Market Regional Analysis

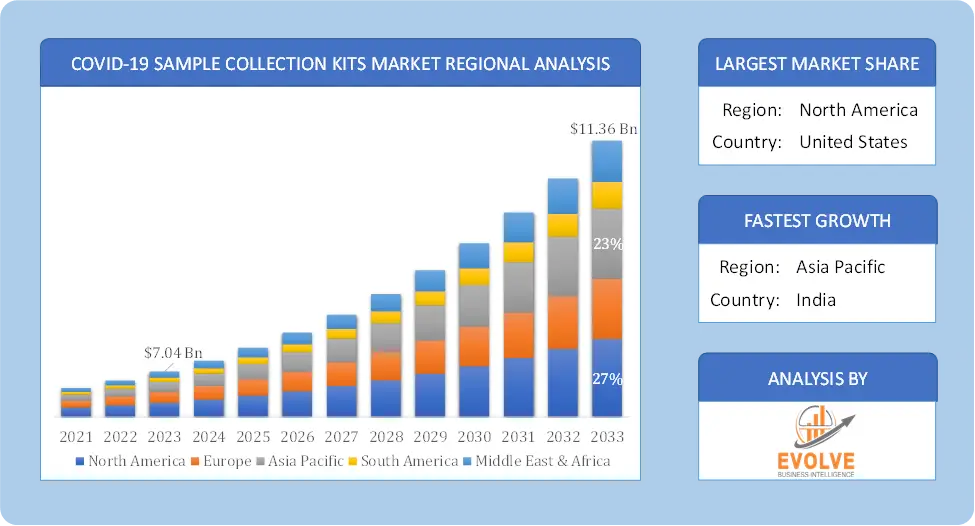

Based on region, the global COVID-19 Sample Collection Kits Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the COVID-19 Sample Collection Kits Market followed by the Asia-Pacific and Europe regions.

COVID-19 Sample Collection Kits North America Market

COVID-19 Sample Collection Kits North America Market

North America holds a dominant position in the COVID-19 Sample Collection Kits Market. North America has seen significant demand for COVID-19 sample collection kits due to widespread testing initiatives and government funding. The region has a robust healthcare infrastructure and a proactive approach to testing. The presence of major biotechnology and pharmaceutical companies in the U.S. has led to rapid innovation and development of advanced testing kits. There is a strong market for at-home testing kits, driven by consumer preference for convenience and accessibility.

COVID-19 Sample Collection Kits Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the COVID-19 Sample Collection Kits Market industry. Asia-Pacific has experienced rapid growth in the sample collection kits market due to large population sizes and high testing needs. Many countries in this region have boosted local manufacturing capabilities to meet domestic demand and reduce dependency on imports. Countries like China and South Korea have invested in technological advancements, leading to innovative testing solutions.

Competitive Landscape

The global COVID-19 Sample Collection Kits Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Thermo Fisher Scientific Inc.

- Hardy Diagnostics

- BNTX Inc.

- Formlabs

- Medline Industries Inc.

- HiMedia Laboratories

- Puritan Medical Products

- COPAN Diagnostics

- Laboratory Corporation of America Holdings

- Lucence Diagnostics Pte Ltd.

Key Development

In February 2022, In order to integrate their BD Veritor At-Home Covid-19 test directly into the ReturnSafe testing management system, Becton, Dickinson, and Company teamed up with ReturnSafe. Since test results can only be read on a smartphone, the BD Veritor At-Home Covid-19 test enables consumers to test without a supervisor at home while still giving accurate results.

In May 2021, As a potential tool to deal with new emergent variations, Vircell was developing new real-time PCR kits and serological testing.

Scope of the Report

Global COVID-19 Sample Collection Kits Market, by Product Type

- Swabs

- Viral Transport Media

- Blood Collection Kits

- Other

Global COVID-19 Sample Collection Kits Market, by Application

- Diagnostics

- Research

- Other

Global COVID-19 Sample Collection Kits Market, by End User

- Hospitals & Clinics

- Home Test

- Others

Global COVID-19 Sample Collection Kits Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $11.36 Billion |

| CAGR | 2.34% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Thermo Fisher Scientific Inc., Hardy Diagnostics, BNTX Inc., Formlabs, Medline Industries Inc., HiMedia Laboratories, Puritan Medical Products, COPAN Diagnostics, Laboratory Corporation of America Holdings and Lucence Diagnostics Pte Ltd |

| Key Market Opportunities | • Expansion of At-Home Testing • Focus on Sustainable Practices |

| Key Market Drivers | • Technological Advancements • Increased Production Capacity |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future COVID-19 Sample Collection Kits Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- COVID-19 Sample Collection Kits Market historical market size for the year 2021, and forecast from 2023 to 2033

- COVID-19 Sample Collection Kits Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global COVID-19 Sample Collection Kits Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global COVID-19 Sample Collection Kits Market is 2021- 2033

What is the growth rate of the global COVID-19 Sample Collection Kits Market?

The global COVID-19 Sample Collection Kits Market is growing at a CAGR of 2.34% over the next 10 years

Which region has the highest growth rate in the market of COVID-19 Sample Collection Kits Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global COVID-19 Sample Collection Kits Market?

North America holds the largest share in 2022

Who are the key players in the global COVID-19 Sample Collection Kits Market?

Thermo Fisher Scientific Inc., Hardy Diagnostics, BNTX Inc., Formlabs, Medline Industries Inc., HiMedia Laboratories, Puritan Medical Products, COPAN Diagnostics, Laboratory Corporation of America Holdings and Lucence Diagnostics Pte Ltd. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Type Segement – Market Opportunity Score 4.1.2. Application Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on COVID-19 Sample Collection Kits Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. COVID-19 Sample Collection Kits Market, By Product Type 7.1. Introduction 7.1.1. Swabs 7.1.2. Viral Transport Media 7.1.3. Blood Collection Kits 7.1.4. Other CHAPTER 8. COVID-19 Sample Collection Kits Market, By Application 8.1. Introduction 8.1.1. Diagnostics 8.1.2. Research 8.1.3 Other CHAPTER 9. COVID-19 Sample Collection Kits Market, By End User 9.1. Introduction 9.1.1. Hospitals & Clinics 9.1.2 Home Test 9.1.3 Others CHAPTER 10. COVID-19 Sample Collection Kits Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Application, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Thermo Fisher Scientific Inc. 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Hardy Diagnostics 13.3. BNTX Inc. 13.4. Formlabs 13.5. Medline Industries Inc. 13.6. HiMedia Laboratories 13.7. Puritan Medical Products 13.8. COPAN Diagnostics 13.9. Laboratory Corporation of America Holding 13.10. Lucence Diagnostics Pte Ltd

Connect to Analyst

Research Methodology

Our Most Viewed Report and gain instant expertise

Androgen Replacement Therapy Market Analysis and Global Forecast 2023-2033

COVID Testing Kit Market Analysis and Global Forecast 2023-2033

COVID Testing Kit Market Research Report: Information By Type (Rapid Test Kit, RT-PCR, Others), By Application (Hospitals, Clinics, Others), and by Region — Forecast till 2033

Page: 163Home health care products Market Analysis and Global Forecast 2023-2033

Home health care products Market Research Report: By Product (Testing, Screening and Monitoring Products, Blood Glucose Monitors, Blood Pressure Monitors, Pulse Oximeters, Peak Flow Meters, Heart Rate Monitors, Fetal Monitoring Devices, HIV Test Kits, Home Sleep Testing Devices, Others), By Service (Skilled Nursing Services, Rehabilitation Therapy Services, Hospice and Palliative Care Services, Unskilled Care Services, Respiratory Therapy Services, Infusion Therapy Services, Others), By Indication (Cardiovascular Disorders and Hypertension, and by Region — Forecast till 2033

Laxatives Market Analysis and Global Forecast 2023-2033

Medicinal Mushroom Extract Market Analysis and Global Forecast 2023-2033

Menstrual Cup market Analysis and Global Forecast 2022-2032

RTD Protein Beverages Market Analysis and Global Forecast 2023-2033

Telemedicine Market Analysis and Global Forecast 2023-2033

Press Release: https://evolvebi.com/the-telemedicine-market-is-estimated-to-record-a-cagr-of-around-29-2-during-the-forecast-period