COVID-19 Diagnostics Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

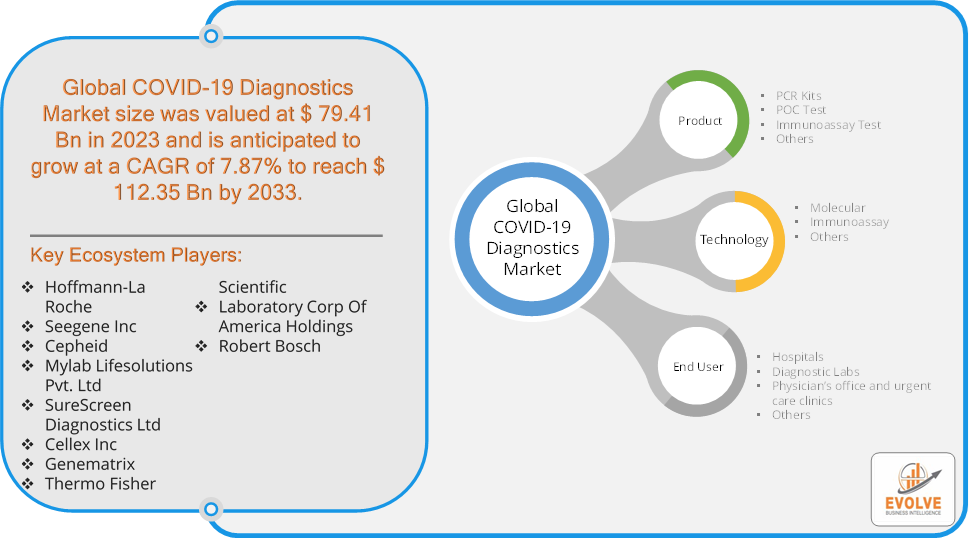

COVID-19 Diagnostics Market Research Report: Information By Product (PCR Kits, POC Test, Immunoassay Test, Others), By Technology (Molecular, Immunoassay, Others), By End-User (Hospitals, Diagnostic Labs, Physician’s office and urgent care clinics, Others), and by Region — Forecast till 2033

Page: 160

COVID-19 Diagnostics Market Overview

The COVID-19 Diagnostics Market Size is expected to reach USD 112.35 Billion by 2033. The COVID-19 Diagnostics Market industry size accounted for USD 79.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.87% from 2023 to 2033. The COVID-19 Diagnostics Market refers to the industry segment that focuses on the development, production, and distribution of tests and technologies used to detect the presence of the SARS-CoV-2 virus, which causes COVID-19. This market experienced rapid growth due to the urgent need for widespread testing during the COVID-19 pandemic.

The COVID-19 Diagnostics Market has played a critical role in controlling the pandemic by enabling widespread testing, facilitating timely medical interventions, and supporting public health measures. The market continues to evolve with the ongoing development of new testing technologies and strategies for managing infectious diseases.

Global COVID-19 Diagnostics Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic had a significant impact on the COVID-19 Diagnostics Market. The demand for diagnostic tests surged globally as countries sought to track and control the spread of the virus. This led to a rapid expansion of the COVID-19 Diagnostics Market, with companies increasing production capacities and scaling operations to meet the unprecedented demand. The urgency of the pandemic accelerated innovation in diagnostic technologies. New types of tests were developed, including rapid antigen tests and at-home testing kits. Advances in molecular testing, such as the development of highly sensitive and specific PCR assays, were also notable. The pandemic exposed vulnerabilities in global supply chains, leading to shortages of critical components such as reagents, swabs, and test kits. Companies had to innovate and collaborate to overcome these challenges and ensure a steady supply of diagnostic tests. The pandemic raised public awareness about the importance of diagnostic testing in controlling infectious diseases. This increased awareness is likely to have a lasting impact on how individuals and healthcare systems approach testing in the future. As vaccination rates increased and the pandemic progressed, the demand for COVID-19 diagnostics began to decline in some regions. This led to market saturation and a shift in focus toward developing tests for other infectious diseases or variants of concern.

COVID-19 Diagnostics Market Dynamics

The major factors that have impacted the growth of COVID-19 Diagnostics Market are as follows:

Drivers:

Ø Technological Advancements

Rapid advancements in diagnostic technologies, such as RT-PCR, rapid antigen tests, and at-home testing kits, drove market growth. These innovations improved the speed, accuracy, and convenience of testing, making it more accessible to a broader population. The global need for widespread testing to identify and control the spread of COVID-19 was a primary driver. Testing became essential for tracking infections, implementing public health measures, and making informed decisions about quarantine and isolation. The development of point-of-care and at-home testing options provided convenience and accessibility, driving market growth. These tests allowed individuals to self-test and obtain results quickly without visiting healthcare facilities.

Restraint:

- Perception of High Costs, Test Accuracy and Reliability

Concerns about the accuracy and reliability of certain tests, particularly rapid antigen tests, posed a challenge. False negatives and positives affected public confidence and complicated efforts to track and control the virus effectively. The cost of developing, producing, and distributing diagnostic tests was significant, and in some regions, the high price of testing limited accessibility for individuals and healthcare systems with budget constraints.

Opportunity:

⮚ Expansion of Testing Infrastructure

The pandemic highlighted the need for robust testing infrastructure, leading to opportunities for companies to invest in and expand laboratory facilities and point-of-care testing capabilities. This expansion can support not only COVID-19 diagnostics but also future testing needs for other infectious diseases. The integration of diagnostics with digital health platforms presents opportunities to enhance disease tracking and management. Companies can develop apps and platforms that allow individuals to report test results, access telemedicine services, and receive personalized health recommendations. The growth of telehealth services provides opportunities for diagnostics companies to integrate testing with remote healthcare solutions. This can enhance patient care by enabling timely diagnosis and treatment in remote or underserved areas.

COVID-19 Diagnostics Market Segment Overview

By Product

By Product

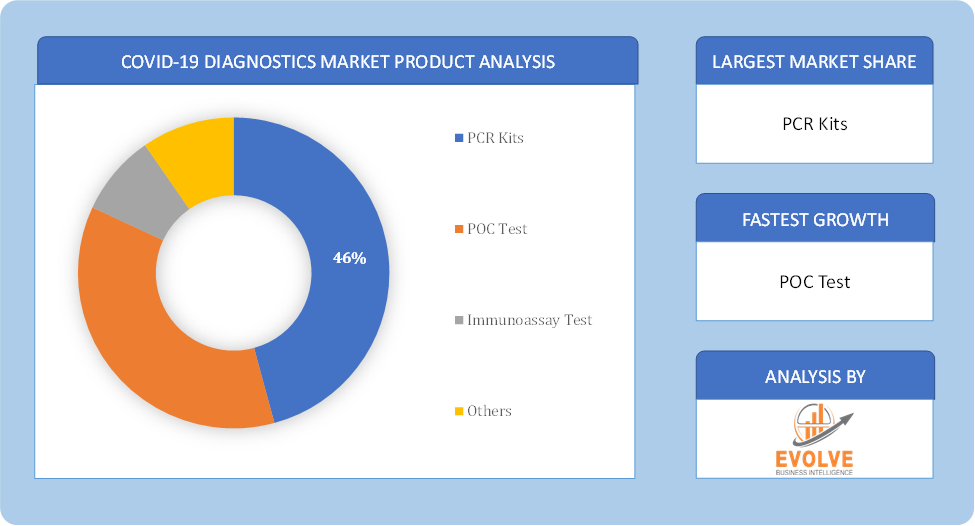

Based on Product, the market is segmented based on PCR Kits, POC Test, Immunoassay Testm and Others. As RT-PCR testing segment dominant the global COVID diagnostics market share. The market is witnessing an increasing uptake of PCR testing to deliver a reliable diagnosis in quick succession. Currently, the reverse transcription-polymerase chain reaction (RT-PCR Test) is a standard for diagnosing COVID-19. With the WHO recommending PCR testing as one of the reliable methods for COVID-19 test procedures, countries such as the US, Brazil, Russia, India, Germany, Italy, and Spain drive the demand for PCR kits the virus highly infects these regions.

By Technology

Based on Technology, the market segment has been divided into Molecular, Immunoassay and Others. The Molecular segment dominant the market. The share of molecular diagnostic test makers has increased drastically, with the WHO declaring RT-PCR as the standard test for COVID-19 diagnosis. This trend is followed in several developed, developing, and underdeveloped countries, thereby generating a high demand for molecular diagnostic testing.

By End User

Based on End User, the market segment has been divided into Hospitals, Diagnostic Labs, Physician’s office and urgent care clinics and Others. The Diagnostic Labs segment dominant the market. The diagnostic laboratories, which include standard and public health organizations, have played a significant role in detecting COVID-19. The demand for standalone laboratories is growing gradually owing to the prevalence of pandemic, epidemic conditions, or the outbreak of unexpected infectious diseases, requiring immediate diagnosis of the diseases for a large population in a shorter time.

Global COVID-19 Diagnostics Market Regional Analysis

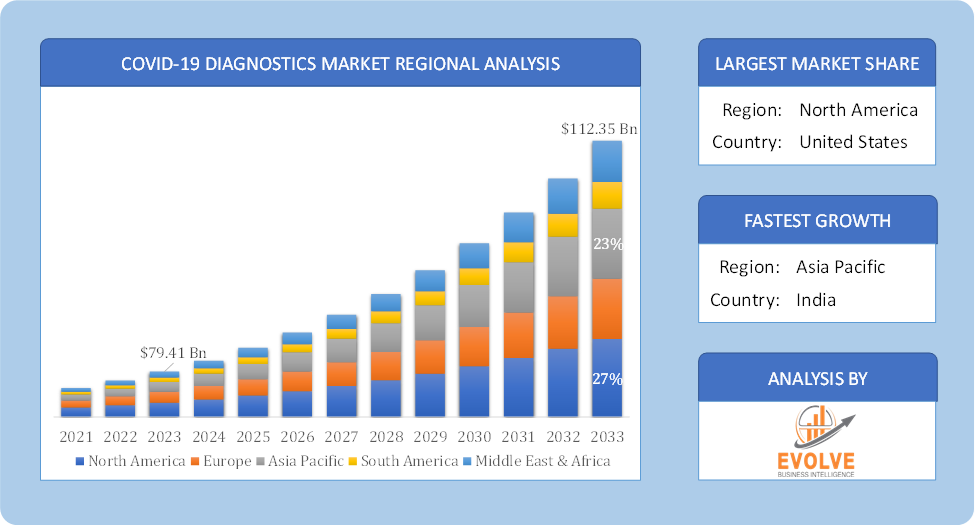

Based on region, the global COVID-19 Diagnostics Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the COVID-19 Diagnostics Market followed by the Asia-Pacific and Europe regions.

COVID-19 Diagnostics North America Market

COVID-19 Diagnostics North America Market

North America holds a dominant position in the COVID-19 Diagnostics Market. North America region has been one of the largest markets for COVID-19 diagnostics, due to factors like high testing rates, well-established healthcare systems, and government investment. The US in particular has a large and developed market for IVDs.

COVID-19 Diagnostics Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the COVID-19 Diagnostics Market industry. This region is expected to see significant growth in the COVID-19 diagnostics market in the coming years. This is due to factors such as a large and growing population base, increasing government investment in healthcare, and a rising middle class with more disposable income. Countries like China, Japan, and South Korea are at the forefront of this growth.

Competitive Landscape

The global COVID-19 Diagnostics Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Hoffmann-La Roche

- Seegene Inc

- Cepheid

- Mylab Lifesolutions Pvt. Ltd

- SureScreen Diagnostics Ltd

- Cellex Inc

- Genematrix

- Thermo Fisher Scientific

- Laboratory Corp Of America Holdings

- Robert Bosch

Key Development

In May 2022, Neuberg declared that it plans to double its labs and touchpoints over the next two years. This initiative is expected to expand the company’s capacity in lab testing.

In November 2021, Thermo Fisher Scientific, Inc. confirmed that its PCR kit, TaqPath COVID-19 CE-IVD RT-PCR Kit, and TaqPath COVID-19 Combo Kit can detect the Omicron variant. This confirmation was expected positively impacted the company’s growth.

Scope of the Report

Global COVID-19 Diagnostics Market, by Product

- PCR Kits

- POC Test

- Immunoassay Test

- Others

Global COVID-19 Diagnostics Market, by Technology

- Molecular

- Immunoassay

- Others

Global COVID-19 Diagnostics Market, by End User

- Hospitals

- Diagnostic Labs

- Physician’s office and urgent care clinics

- Others

Global COVID-19 Diagnostics Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 112.35 Billion |

| CAGR (2023-2033) | 7.87% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product, Technology, End User |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Hoffmann-La Roche, Seegene Inc, Cepheid, Mylab Lifesolutions Pvt. Ltd, SureScreen Diagnostics Ltd, Cellex Inc, Genematrix, Thermo Fisher Scientific, Laboratory Corp Of America Holdings and Robert Bosch. |

| Key Market Opportunities | · Expansion of Testing Infrastructure · Integration with Digital Health Platforms |

| Key Market Drivers | · Technological Advancements · Point-of-Care and At-Home Testing |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future COVID-19 Diagnostics Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- COVID-19 Diagnostics Market historical market size for the year 2021, and forecast from 2023 to 2033

- COVID-19 Diagnostics Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global COVID-19 Diagnostics Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global COVID-19 Diagnostics Market is 2021- 2033

What is the growth rate of the global COVID-19 Diagnostics Market?

The global COVID-19 Diagnostics Market is growing at a CAGR of 7.87% over the next 10 years

Which region has the highest growth rate in the market of COVID-19 Diagnostics Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global COVID-19 Diagnostics Market?

North America holds the largest share in 2022

Who are the key players in the global COVID-19 Diagnostics Market?

Hoffmann-La Roche, Seegene Inc, Cepheid, Mylab Lifesolutions Pvt. Ltd, SureScreen Diagnostics Ltd, Cellex Inc, Genematrix, Thermo Fisher Scientific, Laboratory Corp Of America Holdings and Robert Bosch are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Segement – Market Opportunity Score 4.1.2. Technology Segment – Market Opportunity Score 4.1.3. End User Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on COVID-19 Diagnostics Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. COVID-19 Diagnostics Market, By Product 7.1. Introduction 7.1.1. PCR Kits 7.1.2. POC Test 7.1.3. Immunoassay Test 7.1.4. Others CHAPTER 8. COVID-19 Diagnostics Market, By Technology 8.1. Introduction 8.1.1. Molecular 8.1.2. Immunoassay 8.1.3 Others CHAPTER 9. COVID-19 Diagnostics Market, By End User 9.1. Introduction 9.1.1. Hospitals 9.1.2 Diagnostic Labs 9.1.3 Physician’s office and urgent care clinics 9.1.4 Others CHAPTER 10. COVID-19 Diagnostics Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Technology, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End User, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Hoffmann-La Roche 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Seegene Inc 13.3. Cepheid 13.4. Mylab Lifesolutions Pvt. Ltd 13.5. SureScreen Diagnostics Ltd 13.6. Cellex Inc 13.7. Genematrix 13.8. Thermo Fisher Scientific 13.9. Laboratory Corp Of America Holdings 13.10. Robert Bosch

Connect to Analyst

Research Methodology

Our Most Viewed Report and gain instant expertise

Caffeine Market Analysis and Global Forecast 2023-2033

Desiccant Air Breathers market Analysis and Global Forecast 2023 – 2033

Desiccant Air Breathers Market Research Report: Information By Silica Content By Working Environment (Disposable Stationary Application, Limited Space Application, High Humidity / High Dust Application, Extreme Environment Application, High Vibration Application, Heavy Duty Application, Caustic Fumes/Gaseous Application)

Press Release :https://evolvebi.com/desiccant-air-breathers-market-is-estimated-to-record-a-cagr-of-around-5-58-during-the-forecast-period-2/

Emergency Medical Supplies Market Analysis and Global Forecast 2023-2033

Healthcare Analytics Market Analysis and Global Forecast 2023-2033

Healthcare Consulting Services Market Analysis and Global Forecast 2023-2033

Heart Rate Monitor Market Analysis and Global Forecast 2023-2033

Home health care products Market Analysis and Global Forecast 2023-2033

Home health care products Market Research Report: By Product (Testing, Screening and Monitoring Products, Blood Glucose Monitors, Blood Pressure Monitors, Pulse Oximeters, Peak Flow Meters, Heart Rate Monitors, Fetal Monitoring Devices, HIV Test Kits, Home Sleep Testing Devices, Others), By Service (Skilled Nursing Services, Rehabilitation Therapy Services, Hospice and Palliative Care Services, Unskilled Care Services, Respiratory Therapy Services, Infusion Therapy Services, Others), By Indication (Cardiovascular Disorders and Hypertension, and by Region — Forecast till 2033

COVID-19 Diagnostics North America Market

COVID-19 Diagnostics North America Market