Clean Label Ingredients Market Analysis and Global Forecast 2021-2034

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

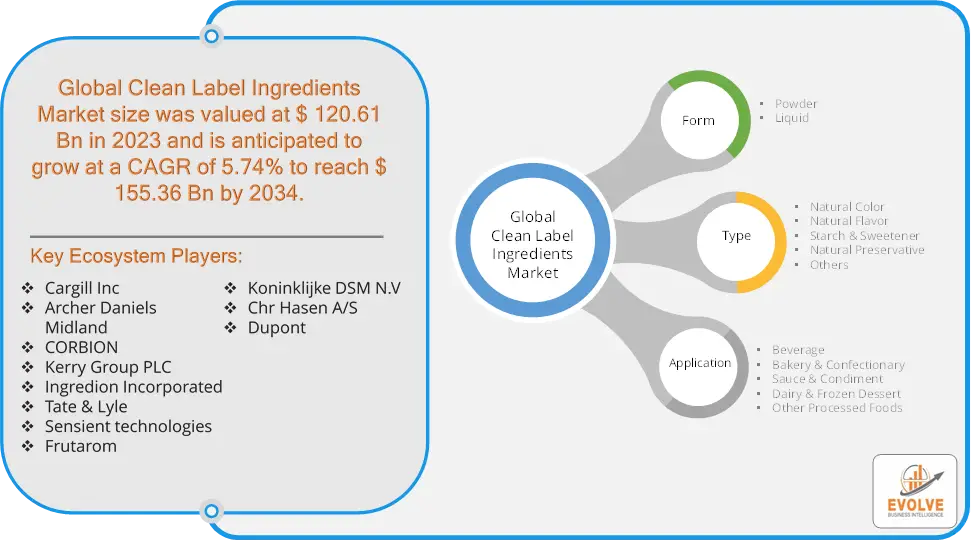

Clean Label Ingredients Market Research Report: By Type (Natural Color, Natural Flavor, Starch & Sweetener, Natural Preservative, Others), By Application (Beverage, Bakery & Confectionary, Sauce & Condiment, Dairy & Frozen Dessert, Other Processed Foods), By Form (Powder, Liquid), and by Region — Forecast till 2034

Page: 145

Clean Label Ingredients Market Overview

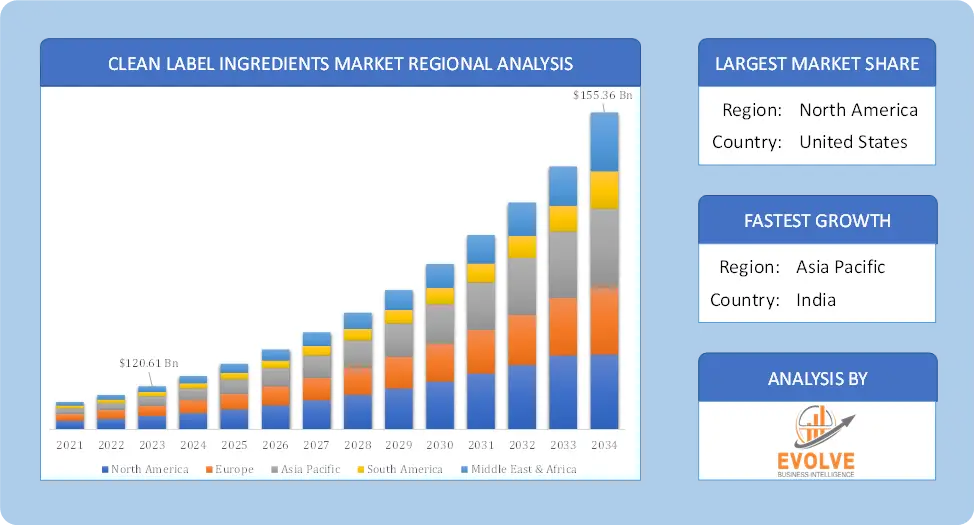

The Clean Label Ingredients Market Size is expected to reach USD 155.36 Billion by 2034. The Clean Label Ingredients Market industry size accounted for USD 120.61 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.74% from 2021 to 2034. The Clean Label Ingredients Market focuses on natural, transparent, and minimally processed ingredients that meet consumer demands for healthier and more sustainable food options. Clean label ingredients are free from artificial additives, preservatives, and allergens, emphasizing clarity in labeling and ingredient sourcing. This market includes a range of products like natural sweeteners, plant-based additives, and organic flavors. Key drivers include increasing health consciousness, demand for transparency, and regulatory pressures for cleaner ingredient formulations. The market caters to the food and beverage industry, with growth driven by rising consumer preference for clean and wholesome products.

Global Clean Label Ingredients Market Synopsis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the Clean Label Ingredients market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Global Clean Label Ingredients Market Dynamics

The major factors that have impacted the growth of Clean Label Ingredients are as follows:

Drivers:

⮚ Consumer Health Consciousness

There is a growing awareness among consumers about the health implications of artificial additives, preservatives, and processed ingredients. As people seek to improve their diet and overall well-being, they increasingly prefer products made with natural and minimally processed ingredients. This shift towards healthier eating habits drives the demand for clean label ingredients.

Restraint:

- Lack of Standardization

The clean label market lacks standardized definitions and criteria, which can create confusion and inconsistency in labeling practices. Without universally accepted standards, it can be difficult for consumers to fully understand what constitutes a clean label product, and manufacturers may face challenges in ensuring compliance and transparency.

Opportunity:

⮚ Innovation in Clean Label Technologies

Advances in technology and research offer opportunities to develop new clean label ingredients with enhanced functionality and performance. Innovations such as natural preservatives with extended shelf life, improved flavorings, and texturizers can help overcome current limitations of clean label ingredients. Investing in R&D to create more effective and versatile clean label options can differentiate brands and drive market growth.

Clean Label Ingredients Market Segment Overview

By Type

Based on the Type, the market is segmented based on Natural Color, Natural Flavor, Starch & Sweetener, Natural Preservative, Others. the Natural Flavor segment typically dominates due to the high demand for flavor enhancement in food and beverages while maintaining clean label standards. Consumers’ growing preference for natural and recognizable ingredients in their products drives the popularity and usage of natural flavors over other types.

By Application

Based on the Application, the market has been divided into Natural Color, Natural Flavor, Starch & Sweetener, Natural Preservative, Others. the Natural Flavor segment dominates due to its wide application in enhancing taste and aroma across various food and beverage products, meeting strong consumer demand for natural and flavorful options.

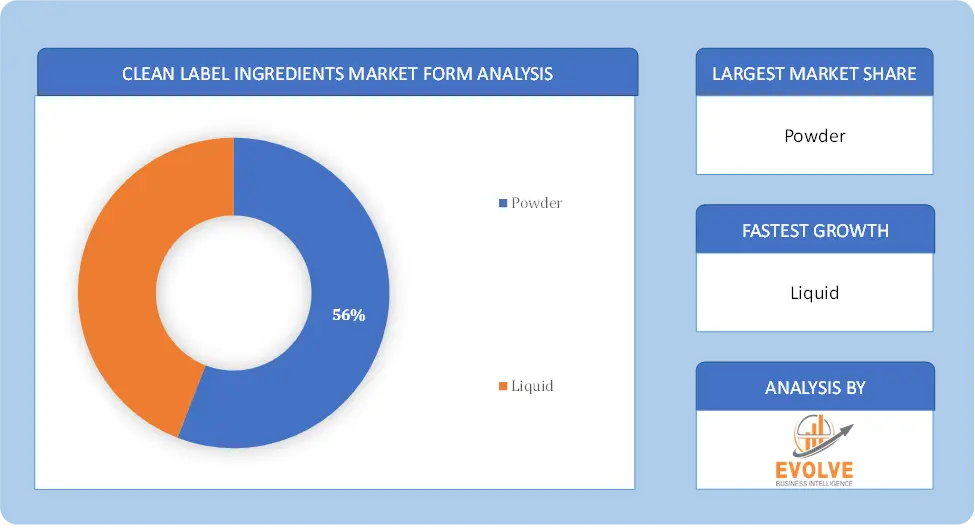

By Form

Based on Form, the market has been divided into Beverage, Bakery & Confectionary, Sauce & Condiment, Dairy & Frozen Dessert, Other Processed Foods. the Beverage segment dominates, driven by high consumer demand for natural and healthier options in drinks, which often require clean label ingredients to meet health and transparency expectations.

Based on Form, the market has been divided into Beverage, Bakery & Confectionary, Sauce & Condiment, Dairy & Frozen Dessert, Other Processed Foods. the Beverage segment dominates, driven by high consumer demand for natural and healthier options in drinks, which often require clean label ingredients to meet health and transparency expectations.

Global Clean Label Ingredients Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Clean Label Ingredients, followed by those in Asia-Pacific and Europe.

Clean Label Ingredients North America Market

Clean Label Ingredients North America Market

North America dominates the Clean Label Ingredients market due to several factors. Because there are more clean-label products in Europe than anywhere else, there is a higher demand for clean-label ingredients, which has led to the region having the most market share in the clean label ingredients industry.

Clean Label Ingredients Asia Pacific Market

The Asia-Pacific region has been witnessing remarkable growth in recent years. One of the clean-label ingredient marketplaces with the greatest rate of growth is the Asia-Pacific clean-label ingredient industry. Asia’s rapidly expanding market is primarily due to improving living standards for consumers. Consumers in the area are increasingly looking at the ingredient list before making a purchase. An increase in the market for convenience goods with clear labels is also helping the industry.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Cargill Inc, Archer Daniels Midland, CORBION, Kerry Group PLC, and Ingredion Incorporated are some of the leading players in the global Clean Label Ingredients Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Cargill Inc

- Archer Daniels Midland

- CORBION

- Kerry Group PLC

- Ingredion Incorporated

- Tate & Lyle, Sensient technologies

- Frutarom

- Koninklijke DSM N.V

- Chr Hasen A/S

Key development:

In April 2022 Cargill promoted a variety of plant-based lecithins to assist bakers in developing clean-mark and allergen-free products.

Scope of the Report

Global Clean Label Ingredients Market, by Type

- Natural Color

- Natural Flavor

- Starch & Sweetener

- Natural Preservative

- Others

Global Clean Label Ingredients Market, by Application

- Beverage

- Bakery & Confectionary

- Sauce & Condiment

- Dairy & Frozen Dessert

- Other Processed Foods

Global Clean Label Ingredients Market, by Form

- Powder

- Liquid

Global Clean Label Ingredients Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $155.36 Billion |

| CAGR | 5.74% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application, Form |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Cargill Inc, Archer Daniels Midland, CORBION, Kerry Group PLC, Ingredion Incorporated, Tate & Lyle, Sensient technologies, Frutarom, Koninklijke DSM N.V, Chr Hasen A/S, Dupont. |

| Key Market Opportunities | Companies have begun to invest significantly in R&D activities |

| Key Market Drivers | • Surveying customer behaviour and planning techniques with accuracy |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Clean Label Ingredients Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Clean Label Ingredients Market historical market size for the year 2022, and forecast from 2021 to 2034

- Clean Label Ingredients Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Clean Label Ingredients Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Clean Label Ingredients market is 2021- 2034

What are the 10 Years CAGR (2021 to 2034) of the global Clean Label Ingredients market?

The global Clean Label Ingredients market is growing at a CAGR of ~5.74% over the next 10 years

Which region has the highest growth rate in the market of Clean Label Ingredients?

Asia Pacific is expected to register the highest CAGR during 2021-2034

Which region accounted for the largest share of the market of Clean Label Ingredients?

Europe holds the largest share in 2023

Major Key Players in the Market of Stem Cell Manufacturers?

Cargill Inc, Archer Daniels Midland, CORBION, Kerry Group PLC, Ingredion Incorporated, Tate & Lyle, Sensient technologies, Frutarom, Koninklijke DSM N.V, Chr Hasen A/S, Dupont

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you deliver sections of a report?

Yes, we do provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope of The Study 2.1. Market Definition 2.2. Scope of The Study 2.2.1. Objectives of Report Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.2. Porter’s Five Forces Analysis 4.2.1. Threat of New Entrants 4.2.2. Bargaining Power of Buyers 4.2.3. Bargaining Power of Suppliers 4.2.4. Threat of Substitutes 4.2.5. Industry Rivalry 4.3. Impact of COVID-19 on Clean Label Ingredients Market 4.3.1. Impact on Market Size 4.3.2. End User Trend, Preferences and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players Strategy to Tackle Negative Impact 4.3.5. Opportunity Window Chapter 5. Market Dynamics 5.1. Introduction 5.2. DRO Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities Chapter 6. Global Clean Label Ingredients Market, By Type 6.1. Introduction 6.2. Natural Color 6.3. Natural Flavor 6.3. Starch & Sweetener 6.4. Natural Preservative 6.5. Others Chapter 7. Global Clean Label Ingredients Market, By Application 7.1. Introduction 7.2. Beverage 7.3. Bakery & Confectionary 7.4. Sauce & Condiment 7.5. Dairy & Frozen Dessert 7.6. Other Processed Foods Chapter 8. Global Clean Label Ingredients Market, By Form 8.1. Introduction 8.2. Powder 8.3. Liquid Chapter 9. Global Clean Label Ingredients Market, By Region 9.1. Introduction 9.2. North America 9.2.1. Introduction 9.2.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.3. Market Size and Forecast, By Country, 2020 - 2028 9.2.4. Market Size and Forecast, By Type, 2020 - 2028 9.2.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.6. Market Size and Forecast, By Form, 2020 – 2028 9.2.7. US 9.2.7.1. Introduction 9.2.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.2.7.4. Market Size and Forecast, By Application, 2020 – 2028 9.2.7.5. Market Size and Forecast, By Form, 2020 - 2028 9.2.8. Canada 9.2.8.1. Introduction 9.2.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.2.8.4. Market Size and Forecast, By Type, 2020 - 2028 9.2.8.5. Market Size and Forecast, By Application, 2020 – 2028 9.2.8.6. Market Size and Forecast, By Form, 2020 - 2028 9.3. Europe 9.3.1. Introduction 9.3.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.3. Market Size and Forecast, By Country, 2020 - 2028 9.3.4. Market Size and Forecast, By Type, 2020 - 2028 9.3.5. Market Size and Forecast, By Application, 2020 – 2028 9.3.6. Market Size and Forecast, By Form, 2020 – 2028 9.3.7. Germany 9.3.7.1. Introduction 9.3.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.7.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.7.5. Market Size and Forecast, By Form, 2020 - 2028 9.3.8. France 9.3.8.1. Introduction 9.3.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.8.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.8.5. Market Size and Forecast, By Form, 2020 - 2028 9.3.9. UK 9.3.9.1. Introduction 9.3.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.9.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.9.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.9.5. Market Size and Forecast, By Form, 2020 - 2028 9.3.10. Italy 9.3.10.1. Introduction 9.3.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.10.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.10.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.10.5. Market Size and Forecast, By Form, 2020 - 2028 9.3.11. Rest of Europe 9.3.11.1. Introduction 9.3.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.3.11.3. Market Size and Forecast, By Type, 2020 - 2028 9.3.11.4. Market Size and Forecast, By Application, 2020 – 2028 9.3.11.5. Market Size and Forecast, By Form, 2020 - 2028 9.4. Asia-Pacific 9.4.1. Introduction 9.4.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.3. Market Size and Forecast, By Country, 2020 - 2028 9.4.4. Market Size and Forecast, By Type, 2020 - 2028 9.4.5. Market Size and Forecast, By Application, 2020 – 2028 9.4.7. Market Size and Forecast, By Form, 2020 - 2028 9.4.8. China 9.4.8.1. Introduction 9.4.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.8.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.8.5. Market Size and Forecast, By Form, 2020 - 2028 9.4.9. India 9.4.9.1. Introduction 9.4.9.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.9.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.9.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.9.5. Market Size and Forecast, By Form, 2020 - 2028 9.4.10. Japan 9.4.10.1. Introduction 9.4.10.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.10.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.10.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.10.5. Market Size and Forecast, By Form, 2020 - 2028 9.4.11. South Korea 9.4.11.1. Introduction 9.4.11.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.11.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.11.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.11.5. Market Size and Forecast, By Form, 2020 - 2028 9.4.12. Rest of Asia-Pacific 9.4.11.1. Introduction 9.4.12.2. Driving Factors, Opportunity Analyzed and Key Trends 9.4.12.3. Market Size and Forecast, By Type, 2020 - 2028 9.4.12.4. Market Size and Forecast, By Application, 2020 – 2028 9.4.12.5. Market Size and Forecast, By Form, 2020 - 2028 9.5. Rest of The World (RoW) 9.5.1. Introduction 9.5.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.4. Market Size and Forecast, By Application, 2020 – 2028 9.5.5. Market Size and Forecast, By Form, 2020 - 2028 9.5.6. Market Size and Forecast, By Region, 2020 - 2028 9.5.7. South America 9.5.7.1. Introduction 9.5.7.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.7.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.7.4. Market Size and Forecast, By Application, 2020 – 2028 9.5.7.5. Market Size and Forecast, By Form, 2020 - 2028 9.5.8. Middle East & Africa 9.5.8.1. Introduction 9.5.8.2. Driving Factors, Opportunity Analyzed and Key Trends 9.5.8.3. Market Size and Forecast, By Type, 2020 - 2028 9.5.8.4. Market Size and Forecast, By Application, 2020 – 2028 9.5.8.5. Market Size and Forecast, By Form, 2020 - 2028 Chapter 10. Competitive Landscape 10.1. Introduction 10.2. Vendor Share Analysis, 2020/Key Players Positioning 2020 Chapter 11. Company Profiles 11.1. Cargill Inc 11.1.1. Business Overview 11.1.2. Financial Analysis 11.1.3. Product Portfolio 11.1.4. Recent Development and Strategies Adopted 11.1.5. SWOT Analysis 11.2. Archer Daniels Midland 11.2.1. Business Overview 11.2.2. Financial Analysis 11.2.3. Product Portfolio 11.2.4. Recent Development and Strategies Adopted 11.2.5. SWOT Analysis 11.3. Corbion 11.3.1. Business Overview 11.3.2. Financial Analysis 11.3.3. Product Portfolio 11.3.4. Recent Development and Strategies Adopted 11.3.5. SWOT Analysis 11.4. Kerry Group PLC 11.4.1. Business Overview 11.4.2. Financial Analysis 11.4.3. Product Portfolio 11.4.4. Recent Development and Strategies Adopted 11.4.5. SWOT Analysis 11.5. Ingredion Incorporated 11.5.1. Business Overview 11.5.2. Financial Analysis 11.5.3. Product Portfolio 11.5.4. Recent Development and Strategies Adopted 11.5.5. SWOT Analysis 11.6. Tate & Lyle, Sensient technologies 11.6.1. Business Overview 11.6.2. Financial Analysis 11.6.3. Product Portfolio 11.6.4. Recent Development and Strategies Adopted 11.6.5. SWOT Analysis 11.7. Frutarom 11.7.1. Business Overview 11.7.2. Financial Analysis 11.7.3. Product Portfolio 11.7.4. Recent Development and Strategies Adopted 11.7.5. SWOT Analysis 11.8. koninklijke DSM N.V 11.8.1. Business Overview 11.8.2. Financial Analysis 11.8.3. Product Portfolio 11.8.4. Recent Development and Strategies Adopted 11.8.5. SWOT Analysis 11.9. Chr Hasen A/S 11.9.1. Business Overview 11.9.2. Financial Analysis 11.9.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis 11.10. Dupont 11.10.1. Business Overview 11.10.2. Financial Analysis 11.10.3. Product Portfolio 11.9.4. Recent Development and Strategies Adopted 11.9.5. SWOT Analysis Chapter 12. Key Takeaways

Connect to Analyst

Research Methodology