Chipless RFID Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

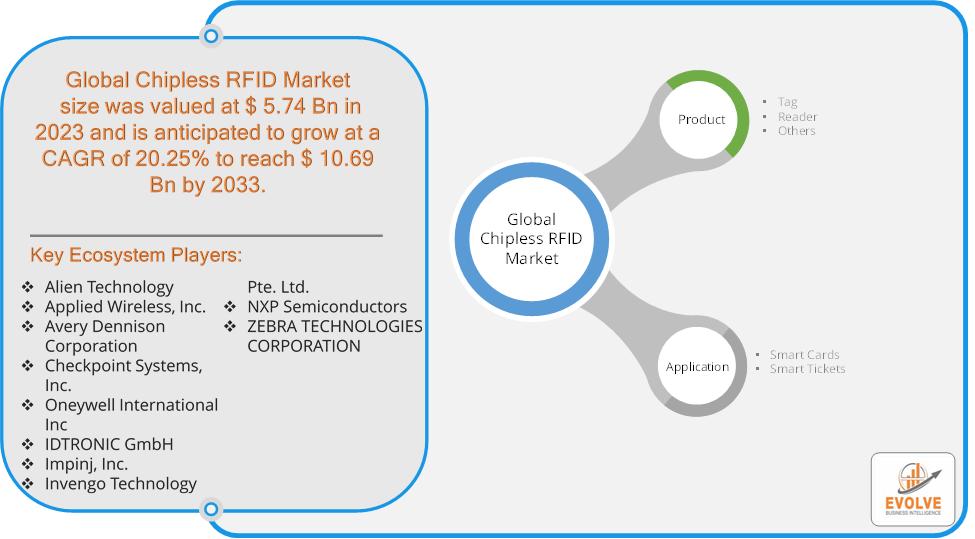

Chipless RFID Market Research Report: Information By Product Type (Tag, Reader), By Application (Smart Cards, Smart Tickets, Others), and by Region — Forecast till 2033.

Page: 171

Chipless RFID Market Overview

The Chipless RFID Market Size is expected to reach USD 10.69 Billion by 2033. The Chipless RFID industry size accounted for USD 5.74 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 20.25% from 2023 to 2033. The chipless RFID market encompasses the development and application of Radio Frequency Identification (RFID) systems that operate without an integrated circuit (chip). These systems use materials or patterns to encode data, making them potentially cheaper and more durable than traditional RFID tags. Applications of chipless RFID include asset tracking, inventory management, and anti-counterfeiting measures. Key advantages are reduced costs, longer lifespan, and better performance in harsh environments. However, challenges include lower data storage capacity and more complex signal processing requirements. The market is driven by advancements in materials science and increased demand for cost-effective RFID solutions.

Global Chipless RFID Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic has led to supply chain disruptions leading to supply shortages or lower demand in the chipless RFID market. The travel restrictions and social-distancing measures have resulted in a sharp drop in consumer and business spending and this pattern is to continue for some time. The end-user trend and preferences have changed due to the pandemic and have resulted in manufacturers, developers, and service providers adopting various strategies to stabilize the company.

Chipless RFID Market Dynamics

The major factors that have impacted the growth of Chipless RFID are as follows:

Drivers:

Ø Technological Advancements

Ongoing research and development in materials science and signal processing technologies are improving the performance and capabilities of chipless RFID systems. Innovations in tag design, printing techniques, and substrate materials are making these tags more efficient and versatile.

Restraint:

- Limited Data Storage Capacity

Chipless RFID tags typically have a lower data storage capacity compared to traditional RFID tags with integrated circuits. This limitation restricts the amount of information that can be encoded on each tag, potentially reducing their utility in applications requiring detailed data tracking.

Opportunity:

⮚ Growing demand for healthier food options

Advancements in materials science and printing technologies can lead to the development of more efficient and versatile chipless RFID tags. New materials and printing methods can enhance the performance, durability, and flexibility of these tags, expanding their applicability in various environments and use cases.

Chipless RFID Segment Overview

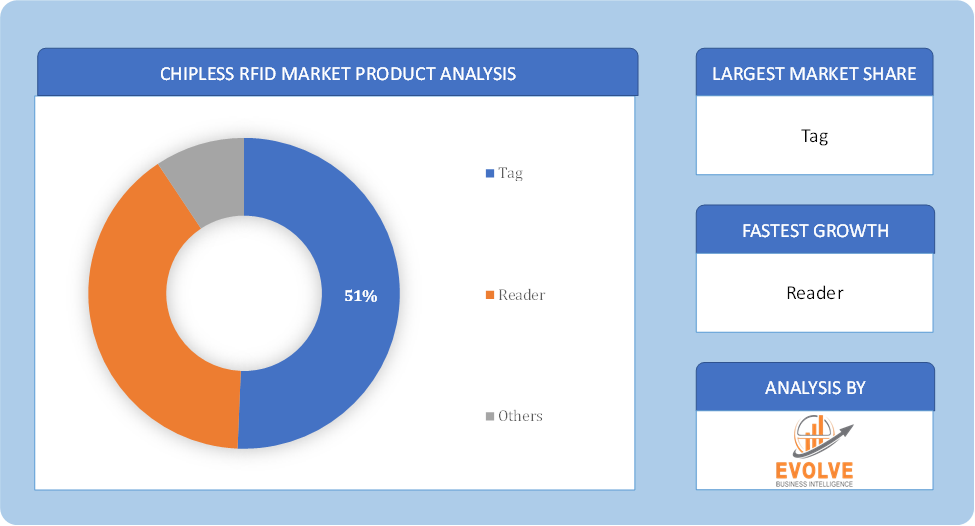

By Product

By Product

Based on Product, the market is segmented based on Tag, Reader. The Tag segment dominates the chipless RFID market, as tags are the primary components required for various applications such as asset tracking, inventory management, and anti-counterfeiting.

By Application

Based on Applications, the market has been divided into the Smart Cards, Smart Tickets, Others. The Smart Cards segment dominates the chipless RFID market, driven by its extensive use in secure access control, payment systems, and identification applications across various sectors.

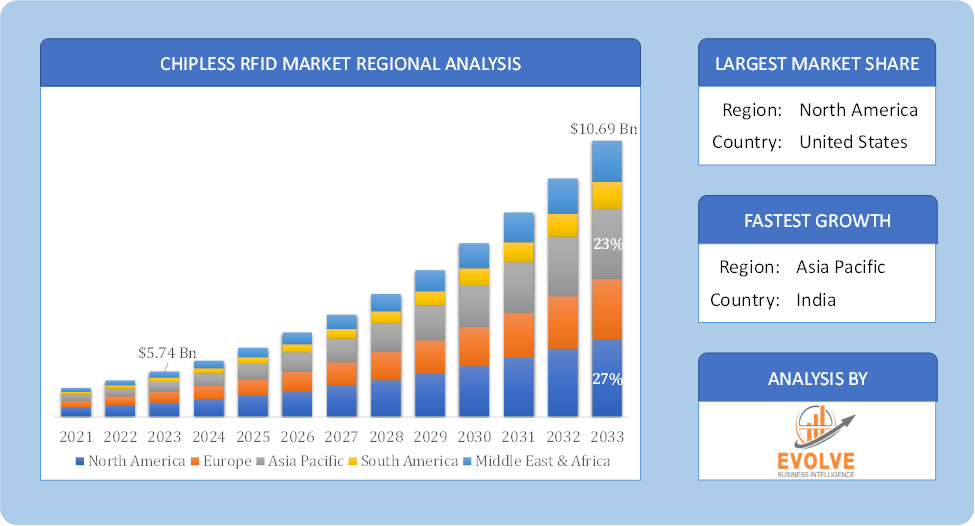

Global Chipless RFID Market Regional Analysis

Based on region, the global Chipless RFID market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Chipless RFID market followed by the Asia-Pacific and Europe regions.

Chipless RFID North America Market

Chipless RFID North America Market

North America holds a dominant position in the Chipless RFID Market. In North America, the chipless RFID market is experiencing significant growth due to the region’s advanced technological infrastructure and high adoption rate of innovative solutions across industries such as retail, healthcare, and logistics. The demand for efficient supply chain management, anti-counterfeiting measures, and enhanced asset tracking systems drives market expansion. Additionally, increasing investment in IoT integration and the presence of key market players contribute to the robust development of chipless RFID technology in the region.

Chipless RFID Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Chipless RFID industry. The chipless RFID market in the Asia-Pacific region is growing rapidly, driven by the expanding industrial and retail sectors, particularly in countries like China, Japan, and India. Increasing adoption of advanced tracking and inventory management solutions, coupled with rising investments in IoT and smart technologies, fuels market growth. The region’s large manufacturing base and supply chain networks further boost demand for cost-effective and efficient RFID solutions. Additionally, supportive government initiatives and policies promoting technology adoption contribute to the market’s expansion in Asia-Pacific.

Competitive Landscape

The global Chipless RFID market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Alien Technology

- Applied Wireless, Inc.

- Avery Dennison Corporation

- Checkpoint Systems, Inc.

- Oneywell International Inc

- IDTRONIC GmbH

- Impinj, Inc.

- Invengo Technology Pte. Ltd.

- NXP Semiconductors

- ZEBRA TECHNOLOGIES CORPORATION.

Key Development

In September 2022, In September 2022, Zebra Technologies Corporation faced significant supply chain challenges, particularly due to persistent component shortages and the transition to a new North American distribution center. Despite these hurdles, Zebra continued to see solid customer demand and a strong order pipeline, although some large customer projects were deferred, impacting product shipments and sales for the quarter

Scope of the Report

Global Chipless RFID Market, by Product

- Tag

- Reader

- Others

Global Chipless RFID Market, by Application

- Smart Cards

- Smart Tickets

Global Chipless RFID Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 10.69 Billion |

| CAGR (2023-2033) | 20.25% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Product Type, Application |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Alien Technology, Applied Wireless, Inc., Avery Dennison Corporation, Checkpoint Systems, Inc., Oneywell International Inc, IDTRONIC GmbH, Impinj, Inc., Invengo Technology Pte. Ltd., NXP Semiconductors, ZEBRA TECHNOLOGIES CORPORATION. |

| Key Market Opportunities | · The rise of e-commerce |

| Key Market Drivers | · Technological Advancements · Increasing Urbanization |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Chipless RFID market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Chipless RFID market historical market size for the year 2021, and forecast from 2023 to 2033

- Chipless RFID market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Chipless RFID market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Chipless RFID market is 2021- 2033

What is the growth rate of the global Chipless RFID market?

The global Chipless RFID market is growing at a CAGR of 20.25% over the next 10 years

Which region has the highest growth rate in the market of Frozen Food?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Chipless RFID market?

North America holds the largest share in 2022

Who are the key players in the global Chipless RFID market?

Alien Technology, Applied Wireless, Inc., Avery Dennison Corporation, Checkpoint Systems, Inc., Oneywell International Inc, IDTRONIC GmbH, Impinj, Inc., Invengo Technology Pte. Ltd., NXP Semiconductors, and ZEBRA TECHNOLOGIES CORPORATION. are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

Chapter 1. Executive Summary Chapter 2. Scope Of The Study 2.1. Market Definition 2.2. Scope Of The Study 2.2.1. Objectives of Report 2.2.2. Limitations 2.3. Market Structure Chapter 3. Evolve BI Methodology Chapter 4. Market Insights and Trends 4.1. Supply/ Value Chain Analysis 4.1.1. Raw Applications Providers 4.1.2. Manufacturing Process 4.1.3. Distributors/Retailers 4.1.4. End-Use Industry 4.2. Porter’s Five Forces Analysis 4.2.1. Threat Of New Entrants 4.2.2. Bargaining Power Of Buyers 4.2.3. Bargaining Power Of Suppliers 4.2.4. Threat Of Substitutes 4.2.5. Industry Rivalry 4.3. Impact Of COVID-19 on the Chipless RFID Market 4.3.1. Impact on Market Size 4.3.2. End-Use Industry Trend, Preferences, and Budget Impact 4.3.3. Regulatory Framework/Government Policies 4.3.4. Key Players' Strategy to Tackle Negative Impact 4.3.5. Opportunity Window 4.4. Technology Overview 12.28. Macro factor 4.6. Micro Factor 4.7. Demand Supply Gap Analysis of the Chipless RFID Market 4.8. Import Analysis of the Chipless RFID Market 4.9. Export Analysis of the Chipless RFID Market Chapter 5. Market Dynamics 5.1. Introduction 5.2. DROC Analysis 5.2.1. Drivers 5.2.2. Restraints 5.2.3. Opportunities 5.2.4. Challenges 5.3. Patent Analysis 5.4. Industry Roadmap 5.5. Parent/Peer Market Analysis Chapter 6. Global Chipless RFID Market, By Product Type 6.1. Introduction 6.2. Tag 6.3. Reader 6.3. Others Chapter 7. Global Chipless RFID Market, By Application 7.1. Introduction 7.2. Smart Cards 7.3. Smart Tickets Chapter 8. Global Chipless RFID Market, By Region 8.1. Introduction 8.2. North America 8.2.1. Introduction 8.2.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.3. Market Size and Forecast, By Country, 2023-2033 8.2.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.5. Market Size and Forecast, By Application, 2023-2033 8.2.6. US 8.2.6.1. Introduction 8.2.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.2.6.4. Market Size and Forecast, By Application, 2023-2033 8.2.7. Canada 8.2.7.1. Introduction 8.2.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.2.7.4. Market Size and Forecast, By Product Type, 2023-2033 8.2.7.5. Market Size and Forecast, By Application, 2023-2033 8.3. Europe 8.3.1. Introduction 8.3.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.3. Market Size and Forecast, By Country, 2023-2033 8.3.4. Market Size and Forecast, By Product Type, 2023-2033 8.3.5. Market Size and Forecast, By Application, 2023-2033 8.3.6. Germany 8.3.6.1. Introduction 8.3.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.6.4. Market Size and Forecast, By Application, 2023-2033 8.3.7. France 8.3.7.1. Introduction 8.3.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.7.4. Market Size and Forecast, By Application, 2023-2033 8.3.8. UK 8.3.8.1. Introduction 8.3.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.8.4. Market Size and Forecast, By Application, 2023-2033 8.3.9. Italy 8.3.9.1. Introduction 8.3.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.9.4. Market Size and Forecast, By Application, 2023-2033 8.3.11. Rest Of Europe 8.3.11.1. Introduction 8.3.11.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.3.11.3. Market Size and Forecast, By Product Type, 2023-2033 8.3.11.4. Market Size and Forecast, By Application, 2023-2033 8.4. Asia-Pacific 8.4.1. Introduction 8.4.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.3. Market Size and Forecast, By Country, 2023-2033 8.4.4. Market Size and Forecast, By Product Type, 2023-2033 8.12.28. Market Size and Forecast, By Application, 2023-2033 8.4.6. China 8.4.6.1. Introduction 8.4.6.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.6.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.6.4. Market Size and Forecast, By Application, 2023-2033 8.4.7. India 8.4.7.1. Introduction 8.4.7.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.7.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.7.4. Market Size and Forecast, By Application, 2023-2033 8.4.8. Japan 8.4.8.1. Introduction 8.4.8.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.8.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.8.4. Market Size and Forecast, By Application, 2023-2033 8.4.9. South Korea 8.4.9.1. Introduction 8.4.9.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.9.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.9.4. Market Size and Forecast, By Application, 2023-2033 8.4.10. Rest Of Asia-Pacific 8.4.10.1. Introduction 8.4.10.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.4.10.3. Market Size and Forecast, By Product Type, 2023-2033 8.4.10.4. Market Size and Forecast, By Application, 2023-2033 8.5. Rest Of The World (RoW) 8.5.1. Introduction 8.5.2. Driving Factors, Opportunity Analyzed, and Key Trends 8.5.3. Market Size and Forecast, By Product Type, 2023-2033 8.5.4. Market Size and Forecast, By Application, 2023-2033 Chapter 9. Company Landscape 9.1. Introduction 9.2. Vendor Share Analysis 9.3. Key Development Analysis 9.4. Competitor Dashboard Chapter 10. Company Profiles 10.1. Alien Technology 10.1.1. Business Overview 10.1.2. Government & Defense Analysis 10.1.2.1. Government & Defense – Existing/Funding 10.1.3. Product Portfolio 10.1.4. Recent Development and Strategies Adopted 10.1.5. SWOT Analysis 10.2. Applied Wireless, Inc. 10.2.1. Business Overview 10.2.2. Government & Defense Analysis 10.2.2.1. Government & Defense – Existing/Funding 10.2.3. Product Portfolio 10.2.4. Recent Development and Strategies Adopted 10.2.5. SWOT Analysis 10.3. Avery Dennison Corporation 10.3.1. Business Overview 10.3.2. Government & Defense Analysis 10.3.2.1. Government & Defense – Existing/Funding 10.3.3. Product Portfolio 10.3.4. Recent Development and Strategies Adopted 10.3.5. SWOT Analysis 10.4. Checkpoint Systems, Inc. 10.4.1. Business Overview 10.4.2. Government & Defense Analysis 10.4.2.1. Government & Defense – Existing/Funding 10.4.3. Product Portfolio 10.4.4. Recent Development and Strategies Adopted 10.12.28. SWOT Analysis 10.5. Oneywell International Inc 10.5.1. Business Overview 10.5.2. Government & Defense Analysis 10.5.2.1. Government & Defense – Existing/Funding 10.5.3. Product Portfolio 10.5.4. Recent Development and Strategies Adopted 10.5.5. SWOT Analysis 10.6. IDTRONIC GmbH 10.6.1. Business Overview 10.6.2. Government & Defense Analysis 10.6.2.1. Government & Defense – Existing/Funding 10.6.3. Product Portfolio 10.6.4. Recent Development and Strategies Adopted 10.6.5. SWOT Analysis 10.7. Impinj, Inc. 10.7.1. Business Overview 10.7.2. Government & Defense Analysis 10.7.2.1. Government & Defense – Existing/Funding 10.7.3. Product Portfolio 10.7.4. Recent Development and Strategies Adopted 10.7.5. SWOT Analysis 10.8 Invengo Technology Pte. Ltd. 10.8.1. Business Overview 10.8.2. Government & Defense Analysis 10.8.2.1. Government & Defense – Existing/Funding 10.8.3. Product Portfolio 10.8.4. Recent Development and Strategies Adopted 10.8.5. SWOT Analysis 10.9 NXP Semiconductors 10.9.1. Business Overview 10.9.2. Government & Defense Analysis 10.9.2.1. Government & Defense – Existing/Funding 10.9.3. Product Portfolio 10.9.4. Recent Development and Strategies Adopted 10.9.5. SWOT Analysis 10.10. ZEBRA TECHNOLOGIES CORPORATION. 10.10.1. Business Overview 10.10.2. Government & Defense Analysis 10.10.2.1. Government & Defense – Existing/Funding 10.10.3. Product Portfolio 10.10.4. Recent Development and Strategies Adopted 10.10.5. SWOT Analysis

Connect to Analyst

Research Methodology

Chipless RFID North America Market

Chipless RFID North America Market