Ceramic Tiles Market Analysis and Global Forecast 2023-2033

$ 1,390.00 – $ 5,520.00Price range: $ 1,390.00 through $ 5,520.00

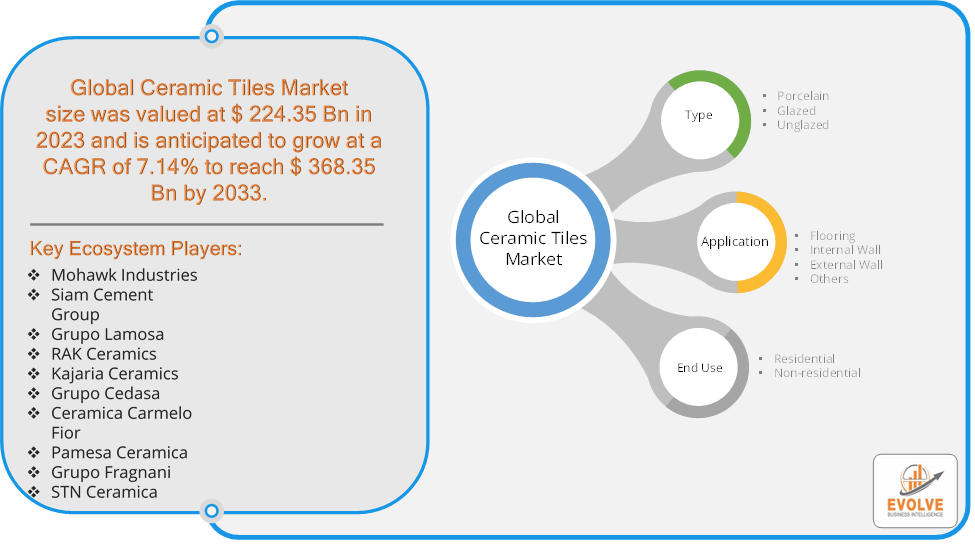

Ceramic Tiles Market Research Report: Information By Type (Porcelain, Glazed, Unglazed), By Application (Flooring, Internal Wall, External Wall, Others), By End-Use (Residential, Non-residential), and by Region — Forecast till 2033

Page: 168

Ceramic Tiles Market Overview

The Ceramic Tiles Market Size is expected to reach USD 368.35 Billion by 2033. The Ceramic Tiles Market industry size accounted for USD 224.35 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.14% from 2023 to 2033. The Ceramic Tiles Market refers to the global industry involved in the production, distribution, and sale of ceramic tiles, which are widely used in residential, commercial, and industrial applications for flooring, wall coverings, and decorative purposes. This market encompasses a variety of ceramic tile types, including glazed, unglazed, porcelain, and terracotta tiles, each offering different aesthetic, durability, and performance characteristics.

The Ceramic Tiles Market is expected to continue growing due to ongoing construction activities, increasing consumer spending on home improvement, and advancements in tile technology that expand their applications and aesthetic possibilities.

Global Ceramic Tiles Market Synopsis

COVID-19 Impact Analysis

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the Ceramic Tiles Market. Lockdowns and restrictions led to the closure of manufacturing plants and disruptions in the supply chain, causing delays in production and delivery of raw materials. Reduced availability of raw materials and logistical challenges increased production costs. The pandemic caused a slowdown in construction activities due to labor shortages, halted projects, and reduced investment, leading to decreased demand for ceramic tiles. Economic downturns and uncertainty reduced consumer spending on home renovation and new construction projects. With more people staying at home, there was a surge in DIY home improvement projects, leading to increased demand for ceramic tiles for renovations. The pandemic accelerated the adoption of e-commerce and online sales channels, allowing manufacturers and retailers to reach customers directly. Growing emphasis on sustainable practices and eco-friendly products in response to heightened awareness of environmental issues.

Ceramic Tiles Market Dynamics

The major factors that have impacted the growth of Ceramic Tiles Market are as follows:

Drivers:

Ø Technological Advancements

Technological advancements in tile manufacturing, such as digital printing and inkjet technology, have improved the quality, design, and functionality of ceramic tiles. Development of new tile products, such as large-format tiles, thin tiles, and anti-slip tiles, cater to specific market needs and applications, driving market growth. Ceramic tiles offer a vast array of designs, colors, textures, and patterns, catering to diverse consumer preferences and interior design trends. Advanced manufacturing technologies enable customization of ceramic tiles, allowing for unique and personalized designs, which attract consumers looking to enhance the aesthetic appeal of their spaces. Rising disposable income, particularly in developing economies, has increased consumer spending on home improvement and renovation projects, boosting the demand for ceramic tiles.

Restraint:

- Perception of High Production Costs and Logistical Challenges

The manufacturing process of ceramic tiles is energy-intensive, involving high temperatures for firing and glazing, which increases production costs. Fluctuations in the prices of raw materials, such as clay, feldspar, and silica, can impact the overall cost structure and profitability of manufacturers. Disruptions in the supply chain, such as delays in the transportation of raw materials and finished products, can affect production schedules and delivery timelines. Changes in trade policies, tariffs, and import/export regulations can impact the global distribution of ceramic tiles, affecting market dynamics.

Opportunity:

⮚ Sustainable and Eco-Friendly Products

Growing awareness and demand for environmentally sustainable building materials present an opportunity for manufacturers to develop and market eco-friendly ceramic tiles made from recycled materials and sustainable production processes. Obtaining green certifications such as LEED can enhance the appeal of ceramic tiles to environmentally conscious consumers and builders. Incorporating smart technology into ceramic tiles, such as temperature control, lighting, and energy monitoring, can create innovative products that appeal to tech-savvy consumers and commercial spaces. The integration of the Internet of Things (IoT) can lead to the development of smart home applications, enhancing the functionality and appeal of ceramic tiles.

Ceramic Tiles Market Segment Overview

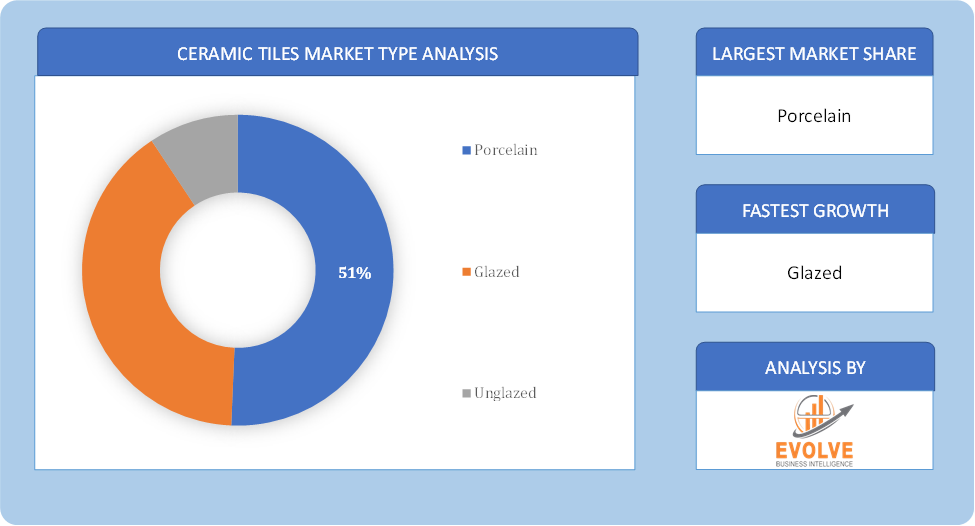

By Type

By Type

Based on Type, the market is segmented based on Porcelain, Glazed and Unglazed. The porcelain tiles segment dominant the ceramic tiles market. Porcelain tiles are known for their exceptional durability, making them highly resistant to scratches, stains, and moisture. This characteristic makes them ideal for high-traffic areas and outdoor applications. Additionally, porcelain tiles offer a wide range of design options, including realistic replication of natural stone and wood textures.

By Application

Based on Application, the market segment has been divided into Flooring, Internal Wall, External Wall and Others. The floor tiles segment dominant the market. Floor tiles are widely used in both residential and commercial spaces, making them highly in demand. The durability and strength of ceramic floor tiles make them ideal for high-traffic areas, ensuring longevity and resistance to wear and tear. Additionally, floor tiles offer a wide range of design options, allowing for customization and enhancing the aesthetic appeal of the space.

By End Use

Based on End Use, the market segment has been divided into Residential and Non-residential. The Residential segment dominate the market. The growth of this sector is driven by factors such as the rise in new constructions, housing renovation and remodeling activities, and higher disposable income levels. Ceramic tiles are widely favored in residential settings due to their durability and easy maintenance, making them the ideal choice for areas including kitchens, bathrooms, living rooms, dining spaces, and bedrooms.

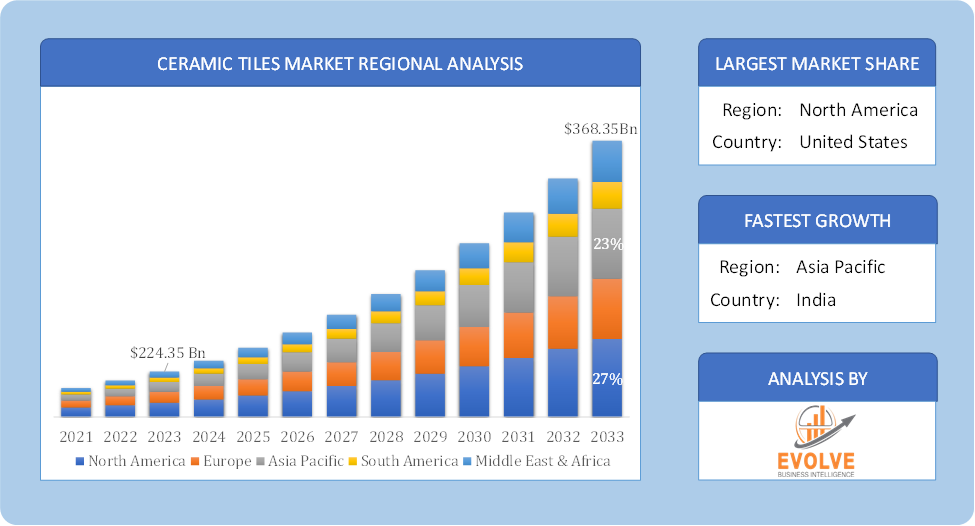

Global Ceramic Tiles Market Regional Analysis

Based on region, the global Ceramic Tiles Market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America is projected to dominate the use of the Ceramic Tiles Market followed by the Asia-Pacific and Europe regions.

Ceramic Tiles North America Market

Ceramic Tiles North America Market

North America holds a dominant position in the Ceramic Tiles Market. North America is a mature market with stable demand for ceramic tiles, supported by renovation projects in residential and commercial sectors. Preference for high-quality, durable tiles with advanced features such as antimicrobial properties and energy efficiency. Adoption of digital printing technology and innovation in tile designs to meet diverse consumer preferences.

Ceramic Tiles Asia-Pacific Market

The Asia-Pacific region has indeed emerged as the fastest-growing market for the Ceramic Tiles Market industry. Asia-Pacific is the largest market for ceramic tiles, driven by rapid urbanization, infrastructure development, and increasing disposable incomes in countries like China, India, and Southeast Asian nations. The region is a major hub for ceramic tile manufacturing, with China being the largest producer and exporter globally. Preference for affordable and durable tiles, as well as growing interest in aesthetically appealing designs and digital printing technologies.

Competitive Landscape

The global Ceramic Tiles Market is highly competitive, with numerous players offering a wide range of software solutions. The competitive landscape is characterized by the presence of established companies, as well as emerging startups and niche players. To increase their market position and attract a wide consumer base, the businesses are employing various strategies, such as product launches, and strategic alliances.

Prominent Players:

- Mohawk Industries

- Siam Cement Group

- Grupo Lamosa

- RAK Ceramics

- Kajaria Ceramics

- Grupo Cedasa

- Ceramica Carmelo Fior

- Pamesa Ceramica

- Grupo Fragnani

- STN Ceramica

Key Development

In June 2022, Mohawk Industries entered into an agreement to acquire the Vitromex ceramic tile business from Grupo Industrial Saltillo (GIS) for approximately USD 293 million. Vitromex, established in 1967, operates four manufacturing plants in Mexico. This expanded presence will enhance the company’s client base, manufacturing efficiencies, and logistical capabilities in conjunction with Mohawk’s existing operations.

In August 2021, Grupo Lamosa announced the acquisition of Grupo Roca’s tile division. Grupo Roca, a premium ceramic tile company, operates not only in Spain but also in the Americas. This strategic move signifies a significant step in the company’s growth and diversification strategy. It will reinforce the company’s position in the Americas, including entry into the Brazilian market and increased presence in the US, while also expanding its footprint in Europe.

Scope of the Report

Global Ceramic Tiles Market, by Type

- Porcelain

- Glazed

- Unglazed

Global Ceramic Tiles Market, by Application

- Flooring

- Internal Wall

- External Wall

- Others

Global Ceramic Tiles Market, by End Use

- Residential

- Non-residential

Global Ceramic Tiles Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: USD 368.35 Billion |

| CAGR (2023-2033) | 7.14% |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 (2017 to 2020 On Demand) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, Application, End Use |

| Geographies Covered | North America, Europe, Asia-Pacific, South America, Middle East, Africa |

| Key Vendors | Mohawk Industries, Siam Cement Group, Grupo Lamosa, RAK Ceramics, Kajaria Ceramics, Grupo Cedasa, Ceramica Carmelo Fior, Pamesa Ceramica, Grupo Fragnani and STN Ceramica. |

| Key Market Opportunities | · Sustainable and Eco-Friendly Products · Integration of Smart Technology |

| Key Market Drivers | · Technological Advancements · Aesthetic Appeal and Design Flexibility |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Ceramic Tiles Market trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities in the future

- Ceramic Tiles Market historical market size for the year 2021, and forecast from 2023 to 2033

- Ceramic Tiles Market share analysis at each product level

- Competitor analysis with detailed insight into its product segment, Government & Defense strength, and strategies adopted.

- Identifies key strategies adopted including product launches and developments, mergers and acquisitions, joint ventures, collaborations, and partnerships as well as funding taken and investment done, among others.

- To identify and understand the various factors involved in the global Ceramic Tiles Market affected by the pandemic

- To provide a detailed insight into the major companies operating in the market. The profiling will include the Government & Defense health of the company’s past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Frequently Asked Questions (FAQ)

What is the study period of this market?

The study period of the global Ceramic Tiles Market is 2021- 2033

What is the growth rate of the global Ceramic Tiles Market?

The global Ceramic Tiles Market is growing at a CAGR of 4.41% over the next 10 years

Which region has the highest growth rate in the market of Ceramic Tiles Market?

Asia Pacific is expected to register the highest CAGR during 2023-2033

Which region has the largest share of the global Ceramic Tiles Market?

North America holds the largest share in 2022

Who are the key players in the global Ceramic Tiles Market?

Mohawk Industries, Siam Cement Group, Grupo Lamosa, RAK Ceramics, Kajaria Ceramics, Grupo Cedasa, Ceramica Carmelo Fior, Pamesa Ceramica, Grupo Fragnani and STN Ceramica are the major companies operating in the market.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Type Segement – Market Opportunity Score 4.1.2. Applications Segment – Market Opportunity Score 4.1.3. End Use Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Ceramic Tiles Market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. Market Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Ceramic Tiles Market, By Type 7.1. Introduction 7.1.1. Porcelain 7.1.2. Glazed 7.1.3. Unglazed CHAPTER 8 Ceramic Tiles Market, By Applications 8.1. Introduction 8.1.1. Flooring 8.1.2. Internal Wall 8.1.3. External Wall 8.1.4. Others CHAPTER 9. Ceramic Tiles Market, By End Use 9.1. Introduction 9.1.1. Residential 9.1.2 Non-residential CHAPTER 10. Ceramic Tiles Market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Typess, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Applications, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End Use, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13. Company Profiles 13.1. Mohawk Industries 13.1.1. Hanon Systems 13.1.2. Financial Analysis 13.1.2.1. Business Segment Revenue, 2020, 2021, 2022, $ Million 13.1.2.2. Geographic Revenue Mix, 2022 (% Share) 13.1.3. Product Portfolio 13.1.4. Recent Development and Strategies Adopted 13.1.5. SWOT Analysis 13.2. Siam Cement Group 13.3. Grupo Lamosa 13.4. RAK Ceramics 13.5. Kajaria Ceramics 13.6. Grupo Cedasa 13.7. Ceramica Carmelo Fior 13.8. Pamesa Ceramica 13.9 Grupo Fragnani 13.10 STN Ceramica

Connect to Analyst

Research Methodology

Ceramic Tiles North America Market

Ceramic Tiles North America Market