Building panels Market Analysis and Global Forecast 2023-2033

€ 1,230.43 – € 4,886.30Price range: € 1,230.43 through € 4,886.30

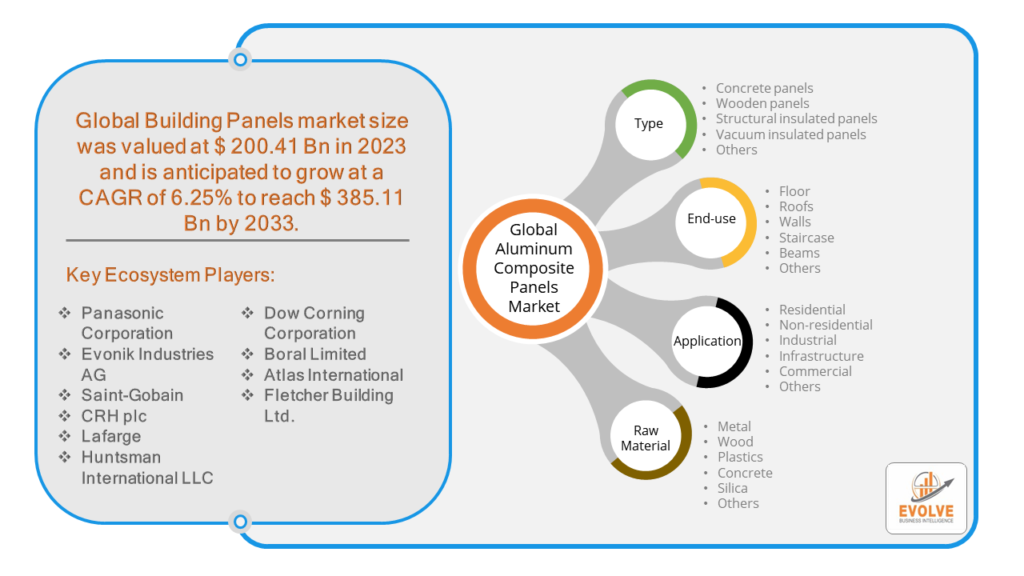

Building panels Market Research Report: By Type (Concrete panels, Wooden panels, Structural insulated panels, Vacuum insulated panels, Others, ), By End-use (Floor, Roofs, Walls, Staircase, Beams, Others), By Application (Residential, Non-residential, Industrial, Infrastructure, Commercial, Others), By Raw Material (Metal, Wood, Plastics, Concrete, Silica, Others), and by Region — Forecast till 2033.

Page: 118

Building panels Market Overview

Building panels Market Size is expected to reach USD 385.11 Billion by 2033. The Building panels industry size accounted for USD 200.41 Billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.25% from 2023 to 2033. Building panels are prefabricated building materials used to construct buildings’ exteriors and interiors, made from a variety of materials including concrete, wood, metal, and plastic. They offer advantages such as speed of construction, reduced labor costs, energy efficiency, and improved safety. The global building panels market is expected to grow due to factors such as the construction industry’s growth, urbanization, stringent building codes, and product innovations. The market is segmented by panel type, material type, application, and region. Key players include Nippon Steel & Sumitomo Metal Corporation, CRH plc, Lafarge, Evonik Industries AG, and Huntsman International LLC.

Global Building panels Market Synopsis

The Building panels market experienced a detrimental effect due to the Covid-19 pandemic. Building panel shortages or decreased demand are the results of supply chain disruptions brought on by the COVID-19 pandemic. Spending by consumers and businesses has decreased significantly as a result of the travel restrictions and social distancing measures, and this trend is expected to persist for some time. The epidemic has altered end-user trends and tastes, prompting manufacturers, developers, and service providers to implement diverse tactics aimed at stabilizing their businesses.

Global Building panels Market Dynamics

The major factors that have impacted the growth of Building panels are as follows:

Drivers:

⮚ Technological Advancements

Advancements in manufacturing technologies have led to the development of innovative building panel systems with enhanced strength, durability, and customization options. For instance, the use of advanced materials like fiber-reinforced polymers (FRP) or composite panels has expanded the applications of building panels in various structural designs and architectural styles. Additionally, the integration of digital design tools and automation in panel production processes has improved precision and quality control, driving the market growth further.

Restraint:

- Initial Cost and Investment

While building panels offer long-term cost savings through reduced labor and construction time, the initial investment required for manufacturing, transportation, and installation can be higher compared to traditional construction materials. Developers and builders may perceive the upfront cost of building panels as a barrier to adoption, particularly in markets where cost considerations outweigh long-term benefits. Overcoming this restraint involves demonstrating the overall value proposition of building panels in terms of lifecycle cost analysis, energy efficiency, and durability.

Opportunity:

⮚ Growing Demand for Sustainable Construction

There’s a rising demand for sustainable building materials and practices worldwide, fueled by increasing environmental awareness and regulatory initiatives. Building panels, especially those made from eco-friendly materials such as recycled wood, bamboo, or composite materials, are well-positioned to capitalize on this trend. Manufacturers can leverage the opportunity to develop innovative, environmentally friendly building panels that meet green building standards and contribute to sustainable development goals.

Building panels Market Segment Overview

By Type

Based on the Type, the market is segmented based on Concrete panels, Wooden panels, Structural insulated panels, Vacuum insulated panels and Others. The concrete panel segment will account for the major shares of the building panel materials market throughout the forecast period. Because structural-architectural concrete panels are highly engineered and provide a robust and durable wall surface, they are an affordable solution for construction projects. Because pre-stressed concrete panels are stronger than reinforced panels, they are frequently utilized for floors and roofs.

Based on the Type, the market is segmented based on Concrete panels, Wooden panels, Structural insulated panels, Vacuum insulated panels and Others. The concrete panel segment will account for the major shares of the building panel materials market throughout the forecast period. Because structural-architectural concrete panels are highly engineered and provide a robust and durable wall surface, they are an affordable solution for construction projects. Because pre-stressed concrete panels are stronger than reinforced panels, they are frequently utilized for floors and roofs.

By End-use

Based on End-use , the market has been divided into Floor, Roofs, Walls, Staircase, Beams and Others. The floors & roofs segment is the largest end-use segment due to the high demand for improved and high-quality floors and roof panels in buildings. The residential segment is projected to be the largest end-use segment in the structural insulated panels market, primarily due to favorable government policies and the increasing demand for energy-efficient buildings

By Application

Based on the Application, the market has been divided into Residential, Non-residential, Industrial, Infrastructure, Commercial and Others. According to this market research and analysis, the residential segment will account for the major shares of this market throughout the forecast period.

By Raw Material

Based on Raw Material, the market has been divided into Metal, Wood, Plastics, Concrete, Silica and Others. The concrete segment is expected to be the largest and fastest-growing material type in the market during the forecast period. The market is expanding in line with the construction industry’s growth trends, and building panels are more cost-effective than site-built construction, resulting in less material waste, reducing construction time delays, enabling worker safety, and being environmentally benign.

Global Building panels Market Regional Analysis

Based on region, the market has been divided into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The area of North America is anticipated to dominate the market for the usage of Blister Packaging, followed by those in Asia-Pacific and Europe.

Building panels North America Market

Building panels North America Market

The North American region holds a dominant position in the Building panels market. In 2019, North America held a dominant position in the market, contributing more than 38.0% of the worldwide revenue. Some of the main reasons for the market expansion in North America include the government’s attempts to create social infrastructure, the cold chain and logistics industries’ widespread development, and the rise in demand from the residential sector. In the upcoming years, growing awareness of the advantages of insulating building structures is anticipated to propel the market.

Building panels Asia Pacific Market

The Asia-Pacific region is witnessing rapid growth and emerging as a significant market for the Building panels industry. Because of the implementation of numerous green building standards and the rapid growth of the residential and commercial construction sectors, the Asia Pacific area is predicted to have the quickest rate of growth among all the other regional markets. Over the course of the projection period, a sizable CAGR is anticipated in the Middle East and Africa. Because to the arid climate and lack of rainfall, the majority of food goods in the region are imported from outside. The UAE has become the region’s center for food product import and trade.

Competitive Landscape

The competitive landscape includes key players (tier 1, tier 2, and local) having a presence across the globe. Companies such as Panasonic Corporation, Evonik Industries AG, Saint-Gobain, CRH plc, and Lafarge are some of the leading players in the global Building panels Industry. These players have adopted partnership, acquisition, expansion, and new product development, among others as their key strategies.

Key Market Players:

- Panasonic Corporation

- Evonik Industries AG

- Saint-Gobain

- CRH plc

- Lafarge

- Huntsman International LLC

- Dow Corning Corporation

- Boral Limited

- Atlas International

- Fletcher Building Ltd.

Key Development:

In September 2022, Panasonic Holdings Corporation published its “Annual Report 2022,” which is now available for viewing on its IR website. The report explains that under the new group structure launched in April 2022, the Company has started its medium- to long-term strategy with which it aims to achieve “an ideal society with affluence both in matter and mind.” The report also goes into how the Panasonic Group aims to enhance its competitiveness, to that end, from the viewpoints of both “strategy” and “operational capability,” and to create and increase its corporate value.

Scope of the Report

Global Building panels Market, by Type

- Concrete panels

- Wooden panels

- Structural insulated panels

- Vacuum insulated panels

- Others

Global Building panels Market, by End-use

- Floor

- Roofs

- Walls

- Staircase

- Beams

- Others

Global Building panels Market, by Application

- Residential

- Non-residential

- Industrial

- Infrastructure

- Commercial

- Others

Global Building panels Market, by Raw Material

- Metal

- Wood

- Plastics

- Concrete

- Silica

- Others

Global Building panels Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Benelux

- Nordic

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- Indonesia

- Austalia

- Malaysia

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

| Parameters | Indicators |

|---|---|

| Market Size | 2033: $385.11 Billion |

| CAGR | 6.25% CAGR (2023-2033) |

| Base year | 2022 |

| Forecast Period | 2023-2033 |

| Historical Data | 2021 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Key Segmentations | Type, End-use , Application, Raw Material |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, Middle East, Africa |

| Key Vendors | Panasonic Corporation, Evonik Industries AG, Saint-Gobain, CRH plc, Lafarge, Huntsman International LLC, Dow Corning Corporation, Boral Limited, Atlas International, Fletcher Building Ltd. |

| Key Market Opportunities | Increase in construction activities Increase in industrialization Rising urbanized population |

| Key Market Drivers | Surge in construction activities in the public utility segment Reduced power Less need of labor Reduced time consumption |

REPORT CONTENT BRIEF:

- High-level analysis of the current and future Building panels Industry trends and opportunities

- Detailed analysis of current market drivers, restraining factors, and opportunities analysis in the future

- Historical market size for the year 2021, and forecast from 2023 to 2033

- Building panels market share analysis for each segment

- Competitor analysis with a comprehensive insight into its product segment, financial strength, and strategies adopted.

- Identifies key strategies adopted by the key players including new product development, mergers and acquisitions, joint ventures, collaborations, and partnerships.

- To identify and understand the various factors involved in the global Building panels market affected by the pandemic

- To provide year-on-year growth from 2022 to 2033

- To provide short-term, long-term, and overall CAGR comparison from 2022 to 2033.

- Provide Total Addressable Market (TAM) for the Global Building panels Market.

Press Release

Global Pharmaceutical Manufacturing Market to Reach $1.38 Trillion by 2035 with 7.35% CAGR, New Research Shows

The Global Mammography Market Is Estimated To Record a CAGR of Around 10.29% During The Forecast Period

Glue Stick Market to Reach USD 2.35 Billion by 2034

Podiatry Service Market to Reach USD 11.88 Billion by 2034

Microfluidics Technology Market to Reach USD 32.58 Billion by 2034

Ferric Chloride Market to Reach USD 10.65 Billion by 2034

Family Practice EMR Software Market to Reach USD 21.52 Billion by 2034

Electric Hairbrush Market to Reach USD 15.95 Billion by 2034

Daily Bamboo Products Market to Reach USD 143.52 Billion by 2034

Cross-border E-commerce Logistics Market to Reach USD 112.65 Billion by 2034

Frequently Asked Questions (FAQ)

What is the study period of the Building Panels market?

The study period ranges from historical data in 2021 to forecasts for the years 2023 to 2033.

Which region has the highest growth rate in the Building Panels market?

The Asia-Pacific region is expected to witness the highest growth rate in the Building Panels market, driven by rapid urbanization, infrastructure development, and industrialization.

Which region has the largest share of the Building Panels market?

North America holds the largest share of the Building Panels market, attributed to factors such as government initiatives, growth in the residential sector, and the development of cold chain and logistics industries.

Who are the key players in the Building Panels market?

Key players in the Building Panels market include Panasonic Corporation, Evonik Industries AG, Saint-Gobain, CRH plc, Lafarge, Huntsman International LLC, Dow Corning Corporation, Boral Limited, Atlas International, and Fletcher Building Ltd., among others.

Do you offer Post Sale Support?

Yes, we offer 16 hours of analyst support to solve the queries

Do you sell particular sections of a report?

Yes, we provide regional as well as country-level reports. Other than this we also provide a sectional report. Please get in contact with our sales representatives.

Table of Content

CHAPTER 1. Executive Summary CHAPTER 2. Scope of the Study 2.1. Market Definition 2.2. Market Scope & Segmentation 2.2.1. Objective of Report CHAPTER 3. Evolve BI Methodology 3.1. Data Collection & Validation Approach 3.2. Market Size Estimation and Forecast CHAPTER 4. Exclusive Analysis 4.1. Market Opportunity Score 4.1.1. Product Type Segement – Market Opportunity Score 4.1.2. Function Segment – Market Opportunity Score 4.1.3. End-user Segment – Market Opportunity Score 4.2. Key Market Influencing Indicators CHAPTER 5. Market Insights and Trends 5.1. Value Chain Analysis 5.1.1. Raw Material 5.1.2. Manufacturing Process 5.1.3. Distribution Channel 5.1.4. End User 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Buyers 5.2.2. Bargaining Power of Suppliers 5.2.3. Threat of New Entrant 5.2.4. Threat of Substitute 5.2.5. Industry Rivalry 5.3. COVID-19 Impact and Post COVID Scenario on Advanced Glass market 5.3.1. Impact of COVID-19 5.3.2. Government Support and Industry Revival Policies 5.3.3. Measures Taken by Companies to Mitigate Negative Impact 5.3.4. Post COVID Trend CHAPTER 6. MArket Dynamics 6.1. Introduction 6.2. Drivers 6.2.1. Driver 1 6.2.2. Driver 2 6.2.3. Driver 3 6.3. Restraints 6.3.1. Restraint 1 6.3.2. Restraint 2 6.4. Opportunity 6.4.1. Opportunity 1 CHAPTER 7. Global Advanced Glass market, By Product Type 7.1. Introduction 7.1.1. Coated Glass 7.1.2. Laminated Glass 7.1.3. Toughened Glass 7.1.4. Ceramic Glass 7.1.5. Other CHAPTER 8. Global Advanced Glass market, By Function 8.1. Introduction 8.1.1. Safety & security 8.1.2. Solar Control 8.1.3. Optics & Lighting 8.1.4. High Performance 8.1.5. Other CHAPTER 9. Global Advanced Glass market, By End-user 9.1. Introduction 9.1.1. Building & Construction 9.1.2. Aerospace & Defense 9.1.3. Automotive 9.1.4 Electronics 9.1.5 Sports & Leisure 9.1.6 Others CHAPTER 10. Global Advanced Glass market, By Region 10.1. Introduction 10.2. NORTH AMERICA 10.2.1. North America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.2.2. North America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.3. North America: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.4. North America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.5. US 10.2.5.1. US: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.5.2. US: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.5.3. US: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.6. CANADA 10.2.6.1. Canada: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.6.2. Canada: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.6.3. Canada: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.2.7. MEXICO 10.2.7.1. Mexico: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.2.7.2. Mexico: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.2.7.3. Mexico: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3. Europe 10.3.1. Europe: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.3.2. Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.3. Europe: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.4. Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.5. U.K. 10.3.5.1. U.K.: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.5.2. U.K.: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.5.3. U.K.: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.6. GERMANY 10.3.6.1. Germany: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.6.2. Germany: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.6.3. Germany: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.7. FRANCE 10.3.7.1. France: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.7.2. France: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.7.3. France: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.8. ITALY 10.3.8.1. Italy: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.8.2. Italy: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.8.3. Italy: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.9. SPAIN 10.3.9.1. Spain: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.9.2. Spain: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.9.3. Spain: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.10. BENELUX 10.3.10.1. BeNeLux: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.10.2. BeNeLux: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.10.3. BeNeLux: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.11. RUSSIA 10.3.11.1. Russia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.11.2. Russia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.11.3. Russia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.3.12. REST OF EUROPE 10.3.12.1. Rest of Europe: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.3.12.2. Rest of Europe: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.3.12.3. Rest of Europe: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4. Asia Pacific 10.4.1. Asia Pacific: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.4.2. Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.3. Asia Pacific: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.4. Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.5. CHINA 10.4.5.1. China: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.5.2. China: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.5.3. China: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.6. JAPAN 10.4.6.1. Japan: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.6.2. Japan: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.6.3. Japan: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.7. INDIA 10.4.7.1. India: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.7.2. India: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.7.3. India: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.8. SOUTH KOREA 10.4.8.1. South Korea: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.8.2. South Korea: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.8.3. South Korea: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.9. THAILAND 10.4.9.1. Thailand: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.9.2. Thailand: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.9.3. Thailand: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.10. INDONESIA 10.4.10.1. Indonesia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.10.2. Indonesia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.10.3. Indonesia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.11. MALAYSIA 10.4.11.1. Malaysia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.11.2. Malaysia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.11.3. Malaysia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.12. AUSTRALIA 10.4.12.1. Australia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.12.2. Australia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.12.3. Australia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.4.13. REST FO ASIA PACIFIC 10.4.13.1. Rest fo Asia Pacific: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.4.13.2. Rest fo Asia Pacific: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.4.13.3. Rest fo Asia Pacific: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5. South America 10.5.1. South America: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.5.2. South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.3. South America: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.4. South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.5. BRAZIL 10.5.5.1. Brazil: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.5.2. Brazil: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.5.3. Brazil: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.6. ARGENTINA 10.5.6.1. Argentina: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.6.2. Argentina: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.6.3. Argentina: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.5.7. REST OF SOUTH AMERICA 10.5.7.1. Rest of South America: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.5.7.2. Rest of South America: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.5.7.3. Rest of South America: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6. Middle East & Africa 10.6.1. Middle East & Africa: Market Size and Forecast, By Country, 2023 – 2033 ($ Million) 10.6.2. Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.3. Middle East & Africa: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.4. Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.5. SAUDI ARABIA 10.6.5.1. Saudi Arabia: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.5.2. Saudi Arabia: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.5.3. Saudi Arabia: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.6. UAE 10.6.6.1. UAE: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.6.2. UAE: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.6.3. UAE: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.7. EGYPT 10.6.7.1. Egypt: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.7.2. Egypt: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.7.3. Egypt: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.8. SOUTH AFRICA 10.6.8.1. South Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.8.2. South Africa: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.8.3. South Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) 10.6.9. REST OF MIDDLE EAST & AFRICA 10.6.9.1. Rest of Middle East & Africa: Market Size and Forecast, By Product Type, 2023 – 2033 ($ Million) 10.6.9.2. Rest of Middle East & Africa: Market Size and Forecast, By Function, 2023 – 2033 ($ Million) 10.6.9.3. Rest of Middle East & Africa: Market Size and Forecast, By End-user, 2023 – 2033 ($ Million) CHAPTER 12. Competitive Landscape 12.1. Competitior Benchmarking 2023 12.2. Market Share Analysis 12.3. Key Developments Analysis By Top 5 Companies 12.4. Market Share Acquisition Strategies: Analysis of Key Approaches Employed by Top Players CHAPTER 13.Company Profiles 13.1. Advanced Glass & Mirror Inc. 13.1.1.Business Overview 13.1.2.Financial Analysis 13.1.2.1Business Segment Revenue, 2018, 2019, 2020, $ Million 13.1.2.2.Geographic Revenue Mix, 2020 (% Share) 13.1.3.Product Portfolio 13.1.4.Recent Development and Strategies Adopted 13.1.5.SWOT Analysis 13.2. Asahi Glass Co. 13.3. Corning Inc. 13.4. Fuyao Glass Industry Group Co. Ltd. 13.5. Huihua Glass Co. Limited 13.6. Koch Industries 13.7. Nippon Sheet Glass Co. Ltd. 13.8. Saint Gobain 13.9. Sisecam Group 13.10. Tyneside Safety Glass.

Connect to Analyst

Research Methodology